Finance & Insurance Ecosystem

Minnesota's robust economy is supported by strong and diversified finance and insurance industries. From credit unions, banking services, and health insurance, Minnesota companies offer the whole spectrum of financial and insurance services.

Overview

Financial and insurance industries employed 153,739 people in Minnesota in 2022 and include commercial banking, credit unions, real estate credit, investment advice and insurance, among other activities. These industries are nearly 20 percent more concentrated in the state than in the U.S., according to the state's location quotient (1.18). There are 10,590 finances and insurance locations here.

Source: Lightcast

Below are the largest financial and insurance companies headquartered or operating in Minnesota by number of workers:

- Ameriprise Financial (Investment Advice): 5,920

- Wells Fargo Home Mortgage (Real Estate Credit): 3,750

- Blue Cross & Blue Shield of Minnesota (Insurance Agencies And Brokerages): 3,500

- Travelers (Insurance Agencies And Brokerages): 2,000

- U.S. Bank (Commercial Banking): 3,860

- Minnesota Life Insurance (Insurance Agencies And Brokerages): 2,400

- Allianz Life Insurance-North America (Insurance Agencies And Brokerages): 2,000

- Royal Bank of Canada (Investment Advice): 2,000

- Securian Financial Group (Investment Advice): 2,000

- UnitedHealth Group (Insurance Agencies And Brokerages): 2,000

- Federated Insurance (Insurance Agencies And Brokerages): 1,520

- Medica Holding (Insurance Agencies And Brokerages): 1,300

- Long Term Care Insurance Advisors (Insurance Agencies And Brokerages): 1,000

- Huntington Bank (Formerly TCF Bank, Commercial Banking): 1,000

- Thrivent Financial for Lutherans (Insurance Agencies And Brokerages): 1,000

Source: Data Axle, Reference Solutions, Travelers website

Insured Banking Institutions

According to the Federal Deposit Insurance Corporation, the 255 insured institutions operating or headquartered in the state have assets of $122.6 billion. The largest by revenue are:

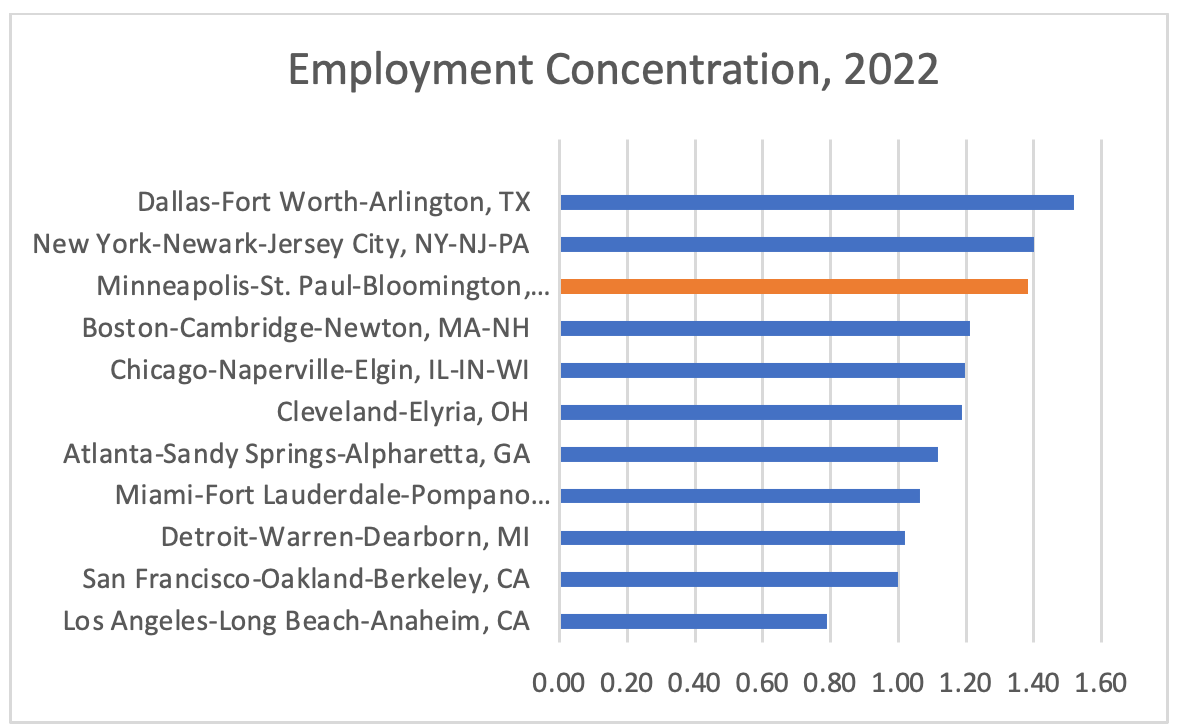

Employment Concentration

Among large metropolitan areas, Minneapolis-St. Paul has one of the highest concentrations of people employed in finance and insurance industries, as measured by location quotients.

Source: Lightcast

Fortune Companies

Our Fortune 1000 companies in 2023 show the strength of our financial system.

- UnitedHealth Group (Rank 5th): The company has revenues of $324.2 billion. It is the largest health insurance company in the country.

- U.S. Bancorp (Rank 149th): Is the fifth largest banking institution in the country with revenues of $27.4 billion.

- Ameriprise Financial (Rank 289th): Is the seventh largest diversified financials company in the country and the largest in the Midwest.

- Thrivent Financial for Lutherans (Rank 412th): Offers financial products and services including life insurance, mutual funds, money management, brokerage services, retirement planning and more. The company has $9.3 billion in revenues and is among the top life and health insurance companies in the country.

- Securian Financial Group (Rank 567th): The company provides insurance, investment and retirement solutions. The company has $6.2 billion in revenues in 2022.

- Federated Mutual Insurance (Rank 912th): Is a direct writer of property and casualty insurance products. The company has approximately 2,600 employees and operates in 47 states. Insurance services include commercial property, general liability, workers compensation, environmental liability and life/disability, among others.

Source: Fortune 500, companies' websites.

FinTech

The financial technology sector, or FinTech, is transforming how banks and other financial institutions do business. While there is no universal definition of FinTech companies, they are businesses that use technology to develop financial products and services that are more user-friendly, secure, efficient and automated than in the past.

Examples of Fintech companies headquartered or operating in Minnesota:

- Apruve: Offers a B2B credit automation platform that manages and finances credit programs for suppliers and their business customers. Headquartered in Minnesota.

- Surest (Formerly Bind): Provides on-demand health insurance platform for individuals and employers. Headquartered in Minnesota.

- Branch: Manages an app-based platform for earned wages loans. Headquartered in Minnesota.

- Ceridian: Offers global human capital management technology serving more than 50 countries. Headquartered in Minnesota.

- ClickSWITCH: Provides technology for financial institutions that simplifies the process of bringing on new account holders and efficiently switching their recurring payments. Headquartered in Minnesota.

- New Era Technology (Formerly Comm-Works): Provides customizable IT integration services to multi-site organizations.

- Daily Pay: Offers an on-demand pay platform. Headquartered in Minnesota.

- Deluxe Corporation: Manufactures high security checks and provides web services and fraud protection. Headquartered in Minnesota.

- Digital River: Provides global e-commerce, payments and marketing services. Headquartered in Minnesota.

- FICO: Provides predictive analytics to help businesses automate, improve and connect decisions across organizational silos and customer lifecycles.

- GenEQTY: Offers AI-driven analytics designed for SMB data. Headquartered in Minnesota.

- MoneyGram: Provides payment processing services with more than 500 employees in Minnesota.

- Nomics: Operates as a crypto-asset market data company. Headquartered in Minnesota.

- Sezzle: Offers bank authentication technology with time tested ACH to enable Instant ACH transactions. Headquartered in Minnesota.

- Thomson Reuters: Provides innovative technology to deliver critical information to decision makers in the financial, legal, tax and accounting, scientific, healthcare and media markets.

- Total Expert: Manages automation platforms for financial institutions. Headquartered in Minnesota.

- Upsie: Offers affordable, reliable warranties for electronic devices. Headquartered in Minnesota.

Source: Companies' websites.

Industry Support

Minnesota Bankers Association (MBA): A leader for Minnesota bankers, representing 95% of Minnesota chartered banks and savings and loans. MBA provides webinars, training, and leadership development, among other services.

Minnesota Association for Financial Professionals: Provides education opportunities, continuing education credits, network and collaboration with colleagues and regular monthly meetings.

Risk Management Association, Minnesota Chapter: A professional banking association that helps institutions identify and manage the impacts of credit risk, operational risk, and market risk on their businesses and customers. They provide education, research, networking, and leadership opportunities.

Minnesota Technology Association: Supports high-tech companies in the state, including FinTech.

Big I Minnesota: The organization has a membership of over 725 insurance agencies, including branches, and 6,500 insurance professionals in Minnesota.

Minnesota FinTech Collective: Represents local offices of several corporations in finance, insurance, and regulation in partnership with local startups, accelerators, and members of the local entrepreneurial community.

University of Minnesota FinTech Boot Camp: Provides training in finance, fundamental programming, data analysis, and modern tools in cryptocurrency and blockchain.

OnRamp Insurance: An accelerator supported by Allianz and Securian Financial, investing in insur-tech startups who participate in the concierge accelerator program in Minneapolis-St. Paul. Each startup receives a cash investment of $100K, office space and access to gener8tor's global network of mentors and investors.

Launch Minnesota: A statewide collaborative effort to accelerate the growth of startups and amplify Minnesota as a national leader in innovation.