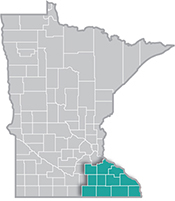

Southeast Minnesota is a health care and agricultural powerhouse. The region is home to the renowned Mayo Clinic and some of the world's most recognized food companies and brands.

Southeast Minnesota is a health care and agricultural powerhouse. The region is home to the renowned Mayo Clinic and some of the world's most recognized food companies and brands.

Advanced manufacturing is especially strong here, with machinery, chemicals, and electronics among the top products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

In recent years, much has been said about the aging workforce in various industries. However, few sectors have experienced as dramatic a shift as the Construction industry, particularly when it comes to young workers. A dive into employment data from 2005 to 2023 reveals a trend that was exacerbated by the housing market downturn and the subsequent 2008 recession, though recent years have shown signs of recovery.

| Table 1. Young Workers in Construction in Southeast Minnesota, 2005-2023 | |||||

|---|---|---|---|---|---|

| Year | Total Number of Construction Jobs | Number of Young Workers (14-24 years) | Young Workers Percent of Total Jobs | Change from Previous Year | Percent Change from Previous Year |

| 2005 | 10,168 | 1,762 | 17.3% | - | - |

| 2006 | 10,326 | 1,628 | 15.8% | -134 | -7.6% |

| 2007 | 9,940 | 1,387 | 14.0% | -241 | -14.8% |

| 2008 | 9,555 | 1,156 | 12.1% | -231 | -16.7% |

| 2009 | 8,553 | 876 | 10.2% | -280 | -24.2% |

| 2010 | 8,074 | 747 | 9.2% | -129 | -14.7% |

| 2011 | 8,367 | 761 | 9.1% | +14 | +1.9% |

| 2012 | 8,491 | 776 | 9.1% | +15 | +2.0% |

| 2013 | 8,774 | 838 | 9.5% | +62 | +8.0% |

| 2014 | 9,232 | 987 | 10.7% | +149 | +17.8% |

| 2015 | 9,410 | 989 | 10.5% | +2 | +0.2% |

| 2016 | 9,903 | 1,064 | 10.7% | +75 | +7.6% |

| 2017 | 10,116 | 1,154 | 11.4% | +90 | +8.5% |

| 2018 | 10,449 | 1,218 | 11.7% | +64 | +5.5% |

| 2019 | 10,831 | 1,328 | 12.3% | +110 | +9.0% |

| 2020 | 10,781 | 1,429 | 13.3% | +101 | +7.6% |

| 2021 | 10,552 | 1,392 | 13.2% | -37 | -2.6% |

| 2022 | 10,824 | 1,510 | 13.9% | +118 | +8.5% |

| 2023 | 11,131 | 1,616 | 14.5% | +106 | +7.0% |

| Source: Quarterly Workforce Indicators | |||||

Interestingly, the decline of young workers in Construction began before the official onset of the 2008 financial crisis, aligning with the early signs of a cooling housing market. While economic indicators may not have signaled a recession until 2008, the Construction industry was already feeling the effects. From 2005 to 2006, the number of workers aged 14 to 24 in Construction dropped by 7.6%. The following year saw an even steeper decline of 14.8%. When the recession officially hit in 2008, it dramatically accelerated the existing trend. Between 2007 and 2008, the Construction industry saw a 16.7% decrease in young workers, followed by another 24.2% drop in 2009.

After the recession, young workers in Construction began a gradual but steady recovery. While 2010 still saw a 14.7% drop, it marked the end of the sharp declines. From 2011 onwards, the number of young workers began to increase consistently. The years 2011 and 2012 saw small increases of 1.9% and 2.0%, followed by larger increases of 8.0% and 17.8% in 2013 and 2014. After a minimal increase of 0.2% in 2015, the industry experienced consistent growth ranging from 5.5% to 9.0% annually from 2016 to 2020. There was a slight decrease of 2.6% in 2021 due to the pandemic, but growth resumed in 2022 and 2023.

Despite this recovery, by 2023, the number of young workers (1,616) was still 8.3% lower than in 2005 (1,762). However, an interesting trend emerges when considering young workers as a percentage of total employment in the Construction industry. In 2005, young workers made up 17.3% of the total construction workforce. This percentage declined sharply during the Great Recession, reaching a low of 9.1% in 2011 and 2012. Since then, there has been a steady increase in the proportion of young workers. By 2023, young workers comprised 14.5% of the total Construction workforce, the highest percentage since 2007. This increase is particularly noteworthy given that total employment in the Construction industry has also been rising, from a low of 8,074 jobs in 2010 to 11,131 jobs in 2023. This suggests that the Construction industry in Southeast Minnesota has been increasingly successful in attracting and retaining young workers, even as the overall industry has expanded.

This trend is similar to, but more pronounced than, the change seen across all industries, where young workers decreased from 16.7% to 14.7% of the total workforce over the same period. The concentration of middle-aged workers (25 to 54 years) in Construction has seen a slight reduction, from 70.9% in 2005 to 65.8% in 2023. This change is a bit more stable compared to all industries, where this age group declined from 66.7% to 60.5%.

The most striking difference is in the older age groups. In Construction, workers aged 55 to 64 years increased from 9.4% to 15.0% of the workforce, while those 65 and older grew from 2.3% to 4.7%. Across all industries, the increase was even more dramatic, with the 55- to 64- year- old age group growing from 12.7% to 17.5%, and the 65 and over group doubling from 3.9% to 7.2% of the workforce.

As the Construction industry continues to evolve, finding ways to balance the experience of older workers with the new skills of younger employees will be crucial for its long-term sustainability and growth. Recent trends show promise, with the proportion of young workers increasing even as total employment has grown. This success provides a positive foundation for the future of the Construction industry in Southeast Minnesota.

Contact Amanda O'Connell, Labor Market Analyst, at amanda.oconnell@state.mn.us.

10/21/2024 3:29:16 PM

Amanda O'Connell

In recent years, much has been said about the aging workforce in various industries. However, few sectors have experienced as dramatic a shift as the Construction industry, particularly when it comes to young workers. A dive into employment data from 2005 to 2023 reveals a trend that was exacerbated by the housing market downturn and the subsequent 2008 recession, though recent years have shown signs of recovery.

| Table 1. Young Workers in Construction in Southeast Minnesota, 2005-2023 | |||||

|---|---|---|---|---|---|

| Year | Total Number of Construction Jobs | Number of Young Workers (14-24 years) | Young Workers Percent of Total Jobs | Change from Previous Year | Percent Change from Previous Year |

| 2005 | 10,168 | 1,762 | 17.3% | - | - |

| 2006 | 10,326 | 1,628 | 15.8% | -134 | -7.6% |

| 2007 | 9,940 | 1,387 | 14.0% | -241 | -14.8% |

| 2008 | 9,555 | 1,156 | 12.1% | -231 | -16.7% |

| 2009 | 8,553 | 876 | 10.2% | -280 | -24.2% |

| 2010 | 8,074 | 747 | 9.2% | -129 | -14.7% |

| 2011 | 8,367 | 761 | 9.1% | +14 | +1.9% |

| 2012 | 8,491 | 776 | 9.1% | +15 | +2.0% |

| 2013 | 8,774 | 838 | 9.5% | +62 | +8.0% |

| 2014 | 9,232 | 987 | 10.7% | +149 | +17.8% |

| 2015 | 9,410 | 989 | 10.5% | +2 | +0.2% |

| 2016 | 9,903 | 1,064 | 10.7% | +75 | +7.6% |

| 2017 | 10,116 | 1,154 | 11.4% | +90 | +8.5% |

| 2018 | 10,449 | 1,218 | 11.7% | +64 | +5.5% |

| 2019 | 10,831 | 1,328 | 12.3% | +110 | +9.0% |

| 2020 | 10,781 | 1,429 | 13.3% | +101 | +7.6% |

| 2021 | 10,552 | 1,392 | 13.2% | -37 | -2.6% |

| 2022 | 10,824 | 1,510 | 13.9% | +118 | +8.5% |

| 2023 | 11,131 | 1,616 | 14.5% | +106 | +7.0% |

| Source: Quarterly Workforce Indicators | |||||

Interestingly, the decline of young workers in Construction began before the official onset of the 2008 financial crisis, aligning with the early signs of a cooling housing market. While economic indicators may not have signaled a recession until 2008, the Construction industry was already feeling the effects. From 2005 to 2006, the number of workers aged 14 to 24 in Construction dropped by 7.6%. The following year saw an even steeper decline of 14.8%. When the recession officially hit in 2008, it dramatically accelerated the existing trend. Between 2007 and 2008, the Construction industry saw a 16.7% decrease in young workers, followed by another 24.2% drop in 2009.

After the recession, young workers in Construction began a gradual but steady recovery. While 2010 still saw a 14.7% drop, it marked the end of the sharp declines. From 2011 onwards, the number of young workers began to increase consistently. The years 2011 and 2012 saw small increases of 1.9% and 2.0%, followed by larger increases of 8.0% and 17.8% in 2013 and 2014. After a minimal increase of 0.2% in 2015, the industry experienced consistent growth ranging from 5.5% to 9.0% annually from 2016 to 2020. There was a slight decrease of 2.6% in 2021 due to the pandemic, but growth resumed in 2022 and 2023.

Despite this recovery, by 2023, the number of young workers (1,616) was still 8.3% lower than in 2005 (1,762). However, an interesting trend emerges when considering young workers as a percentage of total employment in the Construction industry. In 2005, young workers made up 17.3% of the total construction workforce. This percentage declined sharply during the Great Recession, reaching a low of 9.1% in 2011 and 2012. Since then, there has been a steady increase in the proportion of young workers. By 2023, young workers comprised 14.5% of the total Construction workforce, the highest percentage since 2007. This increase is particularly noteworthy given that total employment in the Construction industry has also been rising, from a low of 8,074 jobs in 2010 to 11,131 jobs in 2023. This suggests that the Construction industry in Southeast Minnesota has been increasingly successful in attracting and retaining young workers, even as the overall industry has expanded.

This trend is similar to, but more pronounced than, the change seen across all industries, where young workers decreased from 16.7% to 14.7% of the total workforce over the same period. The concentration of middle-aged workers (25 to 54 years) in Construction has seen a slight reduction, from 70.9% in 2005 to 65.8% in 2023. This change is a bit more stable compared to all industries, where this age group declined from 66.7% to 60.5%.

The most striking difference is in the older age groups. In Construction, workers aged 55 to 64 years increased from 9.4% to 15.0% of the workforce, while those 65 and older grew from 2.3% to 4.7%. Across all industries, the increase was even more dramatic, with the 55- to 64- year- old age group growing from 12.7% to 17.5%, and the 65 and over group doubling from 3.9% to 7.2% of the workforce.

As the Construction industry continues to evolve, finding ways to balance the experience of older workers with the new skills of younger employees will be crucial for its long-term sustainability and growth. Recent trends show promise, with the proportion of young workers increasing even as total employment has grown. This success provides a positive foundation for the future of the Construction industry in Southeast Minnesota.

Contact Amanda O'Connell, Labor Market Analyst, at amanda.oconnell@state.mn.us.