by Dave Senf

March 2021

Job growth in 2021 is expected to be robust in Minnesota as more people are vaccinated and as dining, recreation and other opportunities expand while official restrictions continue to be eased and people resume more activities. In fact, the state is forecasted to add roughly 123,000 jobs between the fourth quarters of 2020 and 2021. Still, because of the deep economic damage caused by the pandemic, a return to full pre-pandemic employment is not expected to take place until late 2022.

Minnesota’s job recovery from the pandemic has been shaped by the track of COVID-19 cases. As virus cases ebbed and surged over the past year individuals responded by social distancing and changing spending habits. Business and other restrictions were likewise issued and eased as virus cases spiked and retreated.

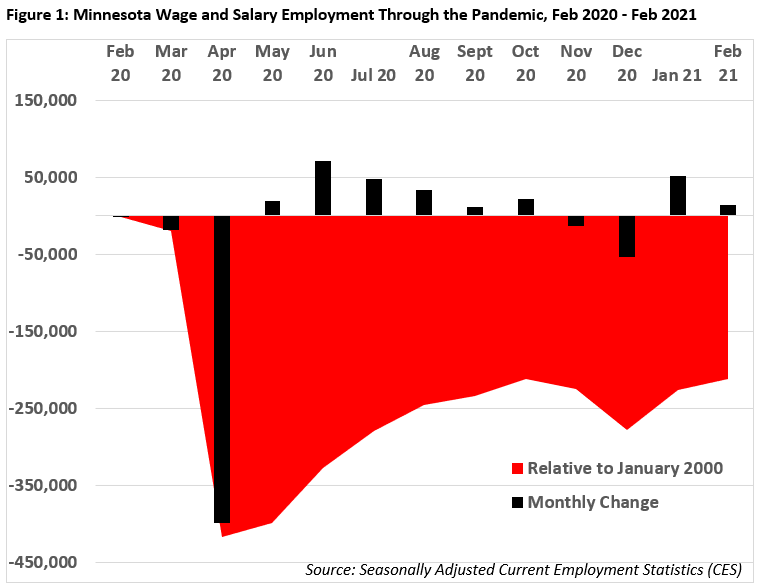

Following an unprecedented number of jobs lost in April 2020, jobs began to bounce back in May when the initial stay-in-place order and business restrictions were eased,. Job growth then continued for six straight months as businesses ramped back up operations and people became comfortable with the health and safety measures in place.

By October the state had recovered 47% of pandemic-related job loss, but hospitalization and death rates soared in November leading to another round of business restrictions and social gathering limitations. Two months of job losses closed out 2020 before the virus spike began to recede. The state’s COVID-19 situation has improved significantly since the beginning of 2021: business restrictions have been eased and jobs are again being added. As of February, however, the state has still recovered only 47% of jobs lost during the initial weeks of the pandemic (see Figure 1).

As the past year has shown, Minnesota’s short-term jobs forecast is linked to the trajectory of the coronavirus and to a lesser degree by federal relief spending. Both factors are looking highly favorable right now with the recent passage of another round of fiscal stimulus, the American Rescue Plan Act, and as the vaccination rollout gains speed. Expectations for U.S. GDP growth this year have continuously been upgraded with most forecasters now expecting GDP growth to be the fastest since the 1980s. Typically, a rise in GDP leads to a decline in unemployment.

Robust GDP growth is expected to be propelled by strong growth in consumer spending, equipment investment, residential construction, and government consumption and gross investment. High savings, pent-up household demand, another round of stimulus checks and falling unemployment as job growth accelerates will boost consumer spending. The upbeat outlook is tempered by the possibility of virus variants generating another COVID-19 case spike. An uptick in cases is also possible before widespread immunity is achieved through vaccinations.

The upbeat job forecast between the fourth quarters of 2020 and 2021 is based on U.S. GDP growth topping 5% and gradually falling or steady COVID-19 infections rates in Minnesota as the vaccination rate nears herd immunity level later in the year. Given these assumptions, Minnesota’s job growth will accelerate throughout 2021 as the U.S. economy builds momentum and business restrictions are downgraded. The state is forecasted to add roughly 123,000 jobs, or grow 4.4%, between the fourth quarters of 2020 and 2021.1

The 4.4% increase averages out to a gain of 12,000 jobs a month compared to the 20,000 monthly job gain averaged since last May. A 4.4% job gain this year would put 2021 into the top 10 as far as annual job growth in Minnesota (data goes back to 1950) and be the highest since 1984, another point when we were emerging from a deep recession. By the end of 2021 Minnesota is expected to have recovered roughly 77% of jobs lost from the pandemic. Employment is not expected to top the pre-pandemic peak until late 2022.

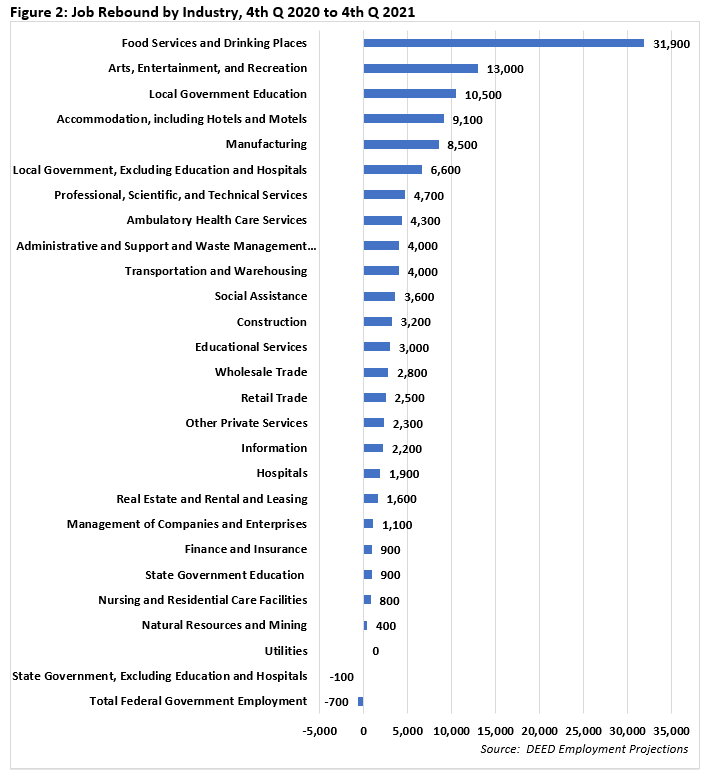

Job growth for the most part will continue to be concentrated in industries that were hardest hit by the pandemic (see Figure 2). Job gains are expected to be highest in: Food Services and Drinking Places; Arts, Entertainment and Recreation; Local Government Education; and Accommodations. These face-to-face industries were the most disrupted by the pandemic and will bounce back robustly as the state turns the corner in its battle with the virus and spending on dining out, travel, tourism, recreation, sporting events and live arts performances begins to rebound. Employment in most direct consumer-facing industries, however, will still be in the 85 to 90% range of pre-pandemic payroll numbers. The jump in Local Government Education employment (public elementary and secondary schools) is based on students returning to the classrooms full-time in the fall.

Job growth in industries less effected over the past year will be in line with annual growth experienced prior to the pandemic. Finance and Insurance will boost payrolls slightly and while Utilities payroll numbers will continue to inch down as they have since 2014.

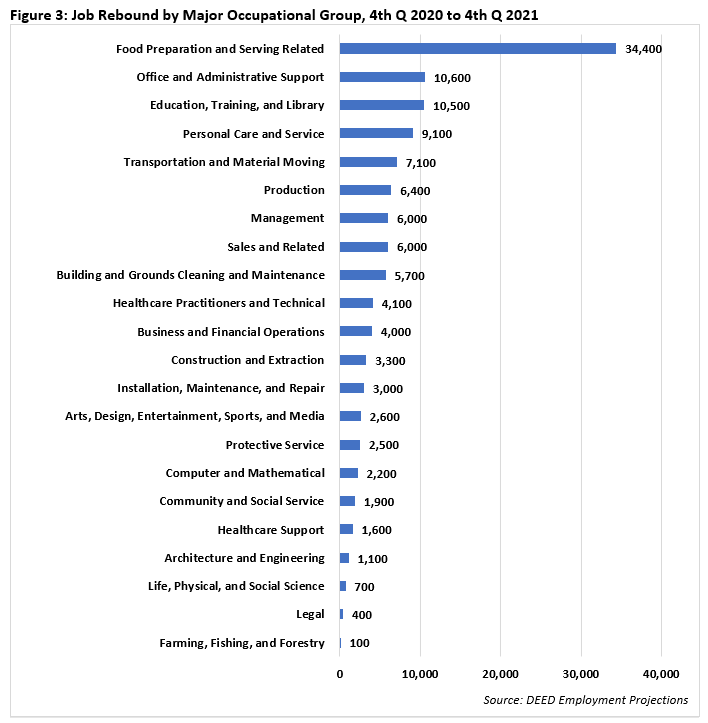

Occupations concentrated in face-to-face interaction industries as well as occupations that are widely spread across all industries are expected to expand payrolls the most. Food Preparation and Serving related occupations and Education, Training, and Library positions are examples of face-to-face occupations that are expected to see hiring ramp up. Increased demand for Office and Administrative Support staff and Transportation and Material Moving staff are examples of the numerous employment opportunities expected to be generated by strong growth across most industries.

The concentration of job growth in hard hit industries such as Food Services and Drinking Places and Accommodations suggests that the job rebound will benefit Minnesota’s Black, Indigenous and People of Color (BIPOC) workers as these are industries with a higher share of BIPOC workers. Overall, BIPOC workers make up a higher share of the workforces in industries that tend to have a high degree of face-to-face interactions. Despite the job gains expected in these industries over the next 12-months, job recovery in Minnesota’s BIPOC communities will trail the overall job recovery since these industries are still expected to remain below pre-pandemic job numbers into 2022.

Job growth in 2021 is expected to be robust in Minnesota as vaccination rates swell and business restrictions are continue to be lifted. As we have painfully experienced, the job rebound wasn’t the fast V-shape rebound that was initially hoped for due to the continued impacts of the pandemic. Job market damage in Minnesota has been deep and has lasted long enough that even after a solid job bounce this year, complete recovery will take through 2022.

1This forecast starts with the February 2021 baseline forecast of IHS Markit, the economic consulting firm that the state utilizes in budget forecasting. Prior to the unprecedented pandemic-induced employment plunge last April DEED provided over-the-year job forecast quarterly based on statistical models. Some of the models, in particular for industries with the most dramatic job loss, are not reliable given the wide swing in various economic indicators during the pandemic. The IHS Markit baseline forecast has been customized to Minnesota based on the judgement of labor market analysts at DEED by comparing recent labor market trends in Minnesota to nationwide trends.