Industrial Analysis

by Nick Dobbins

June 2020

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

Overview

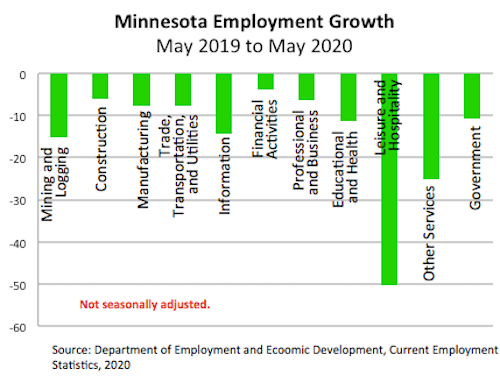

Employment in Minnesota was up by 9,800 jobs (0.4 percent) in May on a seasonally adjusted basis. The relatively small increase suggested that while employment losses stabilized a bit since April, large-scale improvement in the labor market had yet to begin. The monthly growth came entirely in the private sector (up 27,500 or 1.3 percent), as public sector employers lost 17,700 jobs (4.4 percent). Over the year the state lost 393,101 jobs (13.1 percent), which was roughly in line with April’s over-the-year estimates. Service providers shed 359,075 jobs (14.1 percent), while goods producers lost 34,026 jobs (7.4 percent).

Mining and Logging

Employment in Mining and Logging was off by 12.3 percent (800 jobs) in May on a seasonally adjusted basis. It was the largest proportional monthly decrease of any supersector in the state, likely driven at least in part by several high-profile closures in the mining industry. Over the year, Mining and Logging employment was down by 15.3 percent (1,023 jobs) after seeing just a 0.6 percent decline in April. As the larger labor market appeared to stabilize somewhat in May, the declines here illustrated some lagging effects that have crept into parts of the market that weren’t as immediately affected by COVID-19 containment strategies but are seeing second-wave declines from decreased demand.

Construction

Construction employment was up by 7,100 jobs (6.2 percent) in May. It was the first month of seasonally-adjusted growth for the supersector in 2020 and followed a decline of 8.5 percent in April, suggesting some stabilization and growth in the industry. Annually Construction employers lost 7,845 jobs (5.9 percent), a marked improvement from April’s 10.3 percent over-the-year job loss. Specialty Trade Contractors lost 5,351 jobs (6.3 percent), and Construction of Buildings was off by 2,155 jobs (7.5 percent), although subsector Residential Building Construction was up by 2.3 percent over April of 2019, suggesting that the declines in that sector came primarily in Commercial and Other Non-residential Building Construction.

Manufacturing

Manufacturers lost 1,200 jobs (0.4 percent) in May, with Durable and Non-Durable Goods component sectors off by 0.4 percent (800 and 400 jobs, respectively). Over the year the supersector lost 25,158 jobs (7.8 percent). Durable Goods Manufacturers lost 18,608 jobs (8.9 percent), and Non-Durable Goods Manufacturers lost 6,550 (5.7 percent).

Trade, Transportation, and Utilities

Employment in Trade, Transportation, and Utilities was up by 2,400 (0.5 percent) in May. Retail Trade, likely buoyed by the mid-month easing of COVID containment requirements, led the growth by adding 10,300 jobs (4 percent). Those gains were tempered by declines of 4,600 jobs (3.7 percent) and 3,300 jobs (3.2 percent) in Wholesale Trade and Transportation, Warehousing, and Utilities, respectively. On the year the supersector lost 41,550 jobs (7.8 percent), a slight improvement over April’s 8.4 percent decline. As was the case over the month, Retail Trade improved from a decline of 11.5 percent in April to a loss of 8 percent in May, but the other two component sectors saw slightly worse annual performance.

Information

Information employment was off by 1,700 jobs (4.1 percent) in May, one of the larger proportional declines in the state. Over the year the supersector lost 6,763 jobs (14.4 percent), slightly worse than the overall 13.1 percent annual decline.

Financial Activities

Financial Activities employment was down by 400 jobs (0.2 percent) in May with losses in both component sectors. On the year Financial Activities employers lost 7,069 jobs (3.7 percent), the most modest proportional over-the-year decline of any supersector in the state.

Professional and Business Services

Professional and Business Services employment was up by 2,200 (0.6 percent) in May, with growth in two of the three component sectors. Management of Companies and Enterprises lost 1,100 jobs or 1.3 percent. Annually the supersector lost 24,155 jobs (6.3 percent). Declines were sharpest in the Administrative and Support and Waste Management and Remediation Services component, which lost 15,473 jobs (11.2 percent), primarily from the loss of 15,394 jobs (25.3 percent) in Employment Services.

Educational and Health Services

Educational and Health Services employers added 2,600 jobs (0.5 percent) in May. Health Care and Social Assistance employment was up by 3,100 (0.7 percent), but Educational Services lost 500 jobs (0.9 percent). Over the year the supersector lost 62,609 jobs or 11.3 percent, just slightly better than April’s 11.7 percent decline. Health Care and Social Assistance was down 47,721 (9.9 percent), and Educational Services was down 14,888 (20.6 percent).

Leisure and Hospitality

Leisure and Hospitality added 13,800 jobs (11.1 percent) in May, after losing 57,700 jobs in April. It had the highest monthly growth of any supersector in the state, although that growth came on the heels of the largest monthly loss in April. The supersector still had the worst over-the-year growth rate in the state, down by 50.2 percent (141,731 jobs) from May of 2019. While this feasibly indicates some stabilization in our hardest-hit supersector, employment remains well below historical levels, suggesting what may be a long road back to normalcy.

Other Services

Employment in Other Services was up by 3,500 jobs (4.3 percent) in May, after losing 30,700 jobs in April. On the year employment in the supersector was off by 25.1 percent, the second largest decline in the state. While all three component sectors lost jobs, the largest declines came in Personal and Laundry Services, which was off by 17,024 jobs or 59.2 percent. Relaxed restrictions on hair salons, fitness centers, and other personal care services went into effect in early June, which may foster some improvement in the industry group in next month’s estimates.

Government

Government employers lost 17,700 jobs (4.4 percent) in May. The declines were driven by the loss of 16,300 jobs (6.1 percent) at the Local Government level. State employers shed 1,300 jobs (1.3 percent), and Federal employers lost 100 jobs (0.3 percent). Over the year Government employment was off by 46,439 jobs (10.7 percent), a worsening of conditions from April, when annual employment was off by 6.1 percent. The annual decline was primarily at the Local level, where employers lost 41,277 jobs (13.8 percent). Local Government Educational Services employment was off by 10.4 percent from 6.1 percent in April, while Non-Educational Services was down 17.2 percent, 10.2 percent in April. Some of this worsening may be explained by seasonal changes, as government employment typically shifts towards recreational services such as park maintenance and staffing as summer starts, and those areas are more likely to be affected by COVID containment measures.

| Industry | May-20 | Apr-20 | Mar-20 |

|---|---|---|---|

| Total Nonfarm | 2,599.6 | 2,589.8 | 2,949.8 |

| Goods-Producing | 426.1 | 421.0 | 453.4 |

| Mining and Logging | 5.7 | 6.5 | 6.6 |

| Construction | 121.6 | 114.5 | 125.1 |

| Manufacturing | 298.8 | 300.0 | 321.7 |

| Service-Providing | 2,173.5 | 2,168.8 | 2,496.4 |

| Trade, Transportation and Utilities | 490.8 | 488.4 | 526.6 |

| Information | 40.0 | 41.7 | 45.3 |

| Financial Activities | 186.4 | 186.8 | 190.5 |

| Professional and Business Services | 360.3 | 358.1 | 380.7 |

| Education and Health Services | 489.6 | 487.0 | 544.7 |

| Leisure and Hospitality | 137.9 | 124.1 | 269.2 |

| Other Services | 85.8 | 82.3 | 113.0 |

| Government | 382.7 | 400.4 | 426.4 |

| Source: Department of Employment and Economic Development, current Employment Statistics, 2020. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.