by Cameron Macht

June 2024

Economic recovery continued in Southwest Minnesota, as the 23-county region welcomed more than 1,600 additional workers to the labor force over the past year, and nearly 1,200 net new jobs from 2022 to 2023. The region's unemployment rate ended 2023 at 2.9%, which is the second lowest annual rate recorded in the region going all the way back to 1990, slightly above the all-time low set last year in 2022 at 2.5%.

That is the equivalent of only about 6,250 unemployed workers in a labor force of just over 217,725 people, reflecting a tight labor market. With an estimate of around 9,600 job vacancies posted in 2023, Southwest still had less than one jobseeker available for every job opening, making it difficult for employers to find the workers they need. However, the recent growth in the labor force was making conditions better, both for employers and jobseekers.

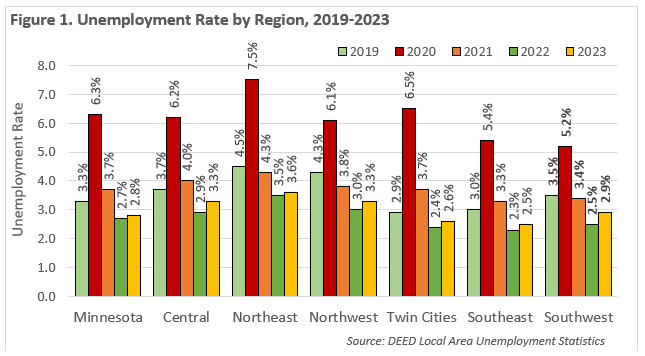

While employers were not able to grow as fast as they would have liked to if they could have hired more workers, that is also a distinguishing feature of Southwest Minnesota's economy. The region does not have the same peaks or suffer the same valleys as other regions. Of the six planning regions in the state, Southwest suffered the smallest numeric and percentage employment drop from 2019 to 2020 in the Pandemic Recession. The region also reported the lowest unemployment peak in 2020 and had the smallest rise in rates from 2019 to 2020 (see Figure 1).

While Southwest Minnesota's economy did not suffer as badly during the Pandemic Recession, it also has not recovered as quickly. In 2023, there were an average of just under 173,000 jobs at nearly 13,000 employer establishments spread across the 23 counties, with a total payroll of nearly $9.1 billion. Manufacturing is still the largest employing industry in the region, providing more than 31,275 jobs – accounting for 18% of total employment. That was the highest concentration of the six regions in the state, and about 7% above the statewide share of Manufacturing employment. Average wages were more than $10,000 higher in Manufacturing than across the total of all industries.

The next largest industry is Health Care & Social Assistance, with 29,905 jobs at 1,730 establishments. This includes nearly 9,800 jobs at Nursing & Residential Care Facilities, almost 8,200 jobs at Hospitals, about 6,700 jobs at Ambulatory Health Care Services and 5,300 jobs in Social Assistance. Health Care & Social Assistance had the most job vacancies in the region in 2023, accounting for just under 18% of total openings.

With more than 19,000 jobs, Retail Trade is the third largest employing industry in Southwest but tends to offer lower wages and more part-time hours. Retail Trade has 11.1% of total employment in the region, but Retail openings were 15% of total vacancies in 2023. Southwest also had a high concentration of employment in Educational Services, with 15,605 jobs at 239 institutions. This primarily includes Elementary & Secondary Schools, which had about 11,700 jobs, as well as Junior Colleges and Universities, which provided about 3,325 jobs in 2023.

The region has just over 12,050 jobs in Accommodation & Food Services, including about 9,400 jobs at Restaurants, about 1,050 jobs at Drinking Places, and over 900 jobs at Hotels & Motels . Other important industries in Southwest include Public Administration, Construction, Wholesale Trade, Transportation & Warehousing, Finance & Insurance, Other Services, and Agriculture, Forestry, Fishing & Hunting (see Table 1).

| Table 1. Southwest Minnesota Industry Employment Statistics | Quarterly Census of Employment & Wages 2023 Annual Data | Job Vacancy Survey 2023 Annual Data | ||||

|---|---|---|---|---|---|---|

| NAICS Industry Title | Number of Firms | Number of Jobs | Total Payroll | Avg. Annual Wage | Number of Job Vacancies | Job Vacancy Rate |

| Total, All Industries | 12,929 | 172,921 | $9,090,562,731 | $52,571 | 9,546 | 5.5% |

| Manufacturing | 623 | 31,276 | $1,985,617,351 | $63,487 | 964 | 2.9% |

| Health Care & Social Assistance | 1,730 | 29,905 | $1,572,365,143 | $52,579 | 1,718 | 5.9% |

| Retail Trade | 1,438 | 19,151 | $608,781,425 | $31,788 | 1,469 | 7.3% |

| Educational Services | 239 | 15,605 | $783,806,104 | $50,228 | 789 | 4.7% |

| Accommodation & Food Services | 874 | 12,058 | $218,402,813 | $18,113 | 967 | 8.2% |

| Public Administration | 579 | 10,247 | $547,585,078 | $53,439 | 447 | 4.4% |

| Construction | 1,567 | 8,157 | $551,444,572 | $67,604 | 822 | 10.2% |

| Wholesale Trade | 644 | 7,738 | $623,259,751 | $80,545 | 391 | 5.2% |

| Transportation & Warehousing | 785 | 6,931 | $347,405,412 | $50,123 | 328 | 4.7% |

| Finance & Insurance | 698 | 5,885 | $456,309,895 | $77,538 | 187 | 3.2% |

| Agriculture, Forestry, Fish & Hunting | 733 | 5,173 | $268,352,377 | $51,876 | 110 | 2.1% |

| Other Services | 1,114 | 5,022 | $174,435,624 | $34,734 | 369 | 7.6% |

| Professional & Technical Services | 627 | 3,906 | $281,244,892 | $72,003 | 275 | 7.4% |

| Admin. Support & Waste Mgmt. Svcs. | 411 | 3,880 | $186,022,767 | $47,944 | 366 | 13.0% |

| Information | 198 | 2,042 | $126,493,510 | $61,946 | 27 | 1.3% |

| Arts, Entertainment, & Recreation | 242 | 1,986 | $44,204,928 | $22,258 | 160 | 8.0% |

| Real Estate & Rental & Leasing | 275 | 1,409 | $51,451,695 | $36,516 | 7 | 0.5% |

| Management of Companies | 53 | 1,403 | $151,922,469 | $108,284 | 118 | 7.5% |

| Utilities | 76 | 924 | $95,131,778 | $102,956 | 23 | 2.6% |

| Mining | 24 | 218 | $16,325,147 | $74,886 | - | - |

| Source: DEED Quarterly Census of Employment & Wages, Job Vacancy Survey | ||||||

With a total gain of nearly 1,200 jobs, 15 of the 20 main industry sectors added jobs in Southwest Minnesota over the past year, led by huge gains in Health Care & Social Assistance, Accommodation & Food Services, Wholesale Trade, Public Administration and Construction.

In contrast, the region's largest industry suffered the largest job loss, as Manufacturers cut 827 jobs over the year following three years of growth coming out of the Pandemic Recession. Almost all of this year's loss and the previous gain occurred in the Food Manufacturing subsector, which grew from 11,260 jobs in 2020 to 12,022 jobs in 2022, then back down to 11,331 jobs in 2023. One of the most distinguishing subsectors in the region is Machinery Manufacturing, which added over 525 jobs since 2020 to rise to nearly 3,675 jobs in 2023. Other key subsectors in the region include Printing & Related Support Activities, Fabricated Metal Product Manufacturing, and Electrical Equipment, Appliance & Component Manufacturing, which all have more than 2,000 jobs.

Though 15 industries added jobs in the past year, only three industries have fully recovered all the jobs lost during the Pandemic Recession: Public Administration, Professional & Technical Services, and Wholesale Trade are all up slightly compared to their 2019 employment levels. Even if not all the way back, though, several other industries are within one percent of their pre-pandemic job counts, including Manufacturing, Retail Trade, Finance & Insurance, and Other Services. The industry that remains furthest behind its 2019 employment level is Mining, which has cut almost one-third of its workforce (see Table 2).

| Table 2. Southwest Minnesota Industry Employment Statistics | 2023 | 2022-2023 | 2020-2023 | 2019-2023 | |||

|---|---|---|---|---|---|---|---|

| NAICS Industry Title | Number of Jobs | Change in Jobs | Percent Change | Change in Jobs | Percent Change | Change in Jobs | Percent Change |

| Total, All Industries | 172,921 | +1,198 | +0.7% | +5,734 | +3.4% | -3,683 | -2.1% |

| Manufacturing | 31,276 | -827 | -2.6% | +1,211 | +4.0% | -71 | -0.2% |

| Health Care & Social Assistance | 29,905 | +688 | +2.4% | -140 | -0.5% | -1,664 | -5.3% |

| Retail Trade | 19,151 | -158 | -0.8% | +705 | +3.8% | -19 | -0.1% |

| Educational Services | 15,605 | +88 | +0.6% | +655 | +4.4% | -493 | -3.1% |

| Accommodation & Food Services | 12,058 | +336 | +2.9% | +1,960 | +19.4% | -193 | -1.6% |

| Public Administration | 10,247 | +275 | +2.8% | +442 | +4.5% | +179 | +1.8% |

| Construction | 8,157 | +219 | +2.8% | +236 | +3.0% | -133 | -1.6% |

| Wholesale Trade | 7,738 | +276 | +3.7% | +203 | +2.7% | +12 | +0.2% |

| Transportation & Warehousing | 6,931 | +19 | +0.3% | -191 | -2.7% | -348 | -4.8% |

| Finance & Insurance | 5,885 | -18 | -0.3% | -322 | -5.2% | -7 | -0.1% |

| Agriculture, Forestry, Fish & Hunting | 5,173 | +26 | +0.5% | -377 | -6.8% | -219 | -4.1% |

| Other Services | 5,022 | +49 | +1.0% | +561 | +12.6% | -11 | -0.2% |

| Professional & Technical Services | 3,906 | +166 | +4.4% | +342 | +9.6% | +91 | +2.4% |

| Admin. Support & Waste Mgmt. Svcs. | 3,880 | -11 | -0.3% | +347 | +9.8% | -159 | -3.9% |

| Information | 2,042 | +11 | +0.5% | -157 | -7.1% | -455 | -18.2% |

| Arts, Entertainment, & Recreation | 1,986 | +24 | +1.2% | +276 | +16.1% | -28 | -1.4% |

| Real Estate & Rental & Leasing | 1,409 | +37 | +2.7% | +91 | +6.9% | -18 | -1.3% |

| Management of Companies | 1,403 | -37 | -2.6% | -65 | -4.4% | -24 | -1.7% |

| Utilities | 924 | +24 | +2.7% | -11 | -1.2% | -24 | -2.5% |

| Mining | 218 | +8 | +3.8% | -34 | -13.5% | -101 | -31.7% |

| Source: DEED Quarterly Census of Employment & Wages | |||||||

Continuing growth in the region will depend on labor force availability. As noted earlier, Southwest Minnesota added over 1,600 new workers from 2022 to 2023 but was still down more than 3,600 workers compared to 2019, prior to the pandemic. Long-term labor force projections suggest that the region may lose another 1,950 workers over the next decade, based on population projections by age group from the Minnesota State Demographic Center and current labor force participation rates by age group from the Census Bureau's American Community Survey (see Table 3).

Much of the projected decline is related to the region's fading reliance on the Baby Boom generation, who will be between 71 and 89 years of age by the year 2035, and mostly out of the labor force. Generation X, which will be between 55 and 70 years of age in 2035, is much smaller, leading to a projected decline of nearly 6,250 fewer workers from 55 to 74 years of age in 2035. The region is also expected to lose nearly 1,775 workers between 25 and 44 years of age as Millennials move up the population pyramid.

However, Southwest Minnesota is expected to gain nearly 1,500 workers from 16 to 24 years of age, and by 2035, Generation Z would be the largest cohort in the labor force if current participation rates hold steady. The region would have just over 65,000 Generation Z workers and just under 65,000 Millennials, compared to 38,000 Generation X and about 8,200 Baby Boomers. There would also be almost 29,500 young workers from Generation Alpha already in the workforce.

| Table 3. Southwest Minnesota Labor Force Projections, 2025-2035 | ||||

|---|---|---|---|---|

| Age | 2025 Labor Force Projection | 2035 Labor Force Projection | Projected Change 2025-2035 | |

| Numeric | Percent | |||

| 16 to 19 years | 13,651 | 13,117 | -534 | -3.9% |

| 20 to 24 years | 25,158 | 27,169 | +2,011 | +8.0% |

| 25 to 44 years | 79,757 | 77,979 | -1,777 | -2.2% |

| 45 to 54 years | 37,247 | 41,229 | +3,982 | +10.7% |

| 55 to 64 years | 34,932 | 30,838 | -4,094 | -11.7% |

| 65 to 74 years | 14,267 | 12,132 | -2,135 | -15.0% |

| 75 years & over | 2,747 | 3,344 | +598 | +21.8% |

| Total Labor Force | 207,759 | 205,808 | -1,951 | -0.9% |

| Source: calculated from Minnesota State Demographic Center population projections and 2018-2022 American Community Survey 5-Year Estimates | ||||

Despite the constraints from an aging white population that is rapidly reaching retirement age, Southwest Minnesota's labor force has been growing increasingly racially diverse over time. About 90 percent of the region's workforce reported White alone as their race, even as the number of white labor force participants declined by more than 17,500 people over the past decade. In contrast, the number of Black, Indigenous, and People of Color (BIPOC) increased by nearly 12,000 workers from 2012 to 2022.

The number of workers reporting as Two or More Races quadrupled in just 10 years, rising to more than 7,300 workers in 2022, now accounting for 3.5% of the labor force, up from just 0.7% in 2012. There are also now 5,930 workers of Some Other Race, a 125% increase since 2012. Some of the growth in these race groups may be a result of people gaining a better understanding of the available categories and starting to identify their race more accurately. This may also be reflected in the decline in the white population.

The largest group in the region other than White Alone can be of any race, as the region has more than 14,900 workers of Hispanic or Latino origin. That was a gain of more than 5,500 workers over the past decade, and Hispanic or Latinos now account for 7.0% of the region's total workforce. That was 1.6% more than the statewide share (5.4%) and was the highest among the six planning regions in the state.

The region also had about 3,900 workers each identifying as Black or African American and Asian or Other Pacific Islander, both equaling 1.8% of the overall workforce. The smallest number of workers were American Indian or Alaska Native, with just under 1,100 workers in 2022 after rising by 21.5% over the last 10 years.

The region's overall labor force participation rate was 66.9%, and it has been declining over time due to the aging of the population. However, participation rates were close to 77% for the three largest and fastest growing BIPOC groups – with Hispanic or Latinos at 77.4%, Two or More Races at 76.8%, and workers of Some Other Race at 76.6% (see Table 4).

| Table 4. Southwest Minnesota Labor Force Characteristics by Race, 2022 | 2022 Labor Force | 2022 Labor Force Partic. Rate | 2012 Labor Force | Change from 2012-2022 | |

|---|---|---|---|---|---|

| Number | Percent | ||||

| White Alone | 190,274 | 66.4% | 207,819 | -17,545 | -8.4% |

| Black or African American Alone | 3,878 | 66.1% | 2,121 | +1,757 | +82.8% |

| American Indian or Alaska Native Alone | 1,086 | 58.5% | 894 | +192 | +21.5% |

| Asian or Pacific Islander Alone | 3,900 | 66.3% | 3,087 | +813 | +26.3% |

| Some Other Race Alone | 5,930 | 76.6% | 2,635 | +3,295 | +125.0% |

| Two or More Races | 7,332 | 76.8% | 1,553 | +5,779 | +372.1% |

| Hispanic or Latino (of any race) | 14,901 | 77.4% | 9,355 | +5,546 | +59.3% |

| TOTAL | 212,400 | 66.9% | 218,109 | -5,709 | -2.6% |

| Source: 2018-2022 American Community Survey 5-Year Estimates | |||||

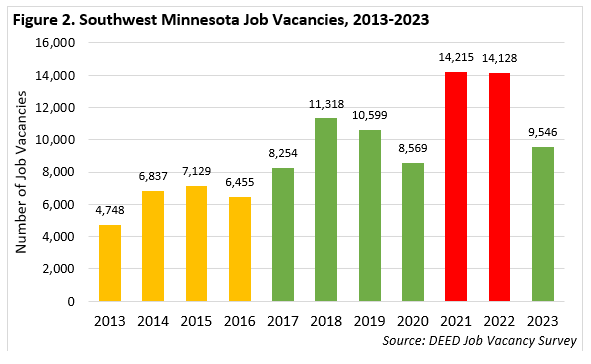

BIPOC workers have been critical to the region's economic expansion, filling open jobs across the economy. But even the rapid growth of several racial and ethnic groups with high labor force participation i has not been enough to keep pace with the number of job openings posted by employers in the region. Vacancies outstripped available jobseekers starting in 2017 – meaning that there were more job vacancies posted in the region than unemployed workers actively seeking jobs – and began piling up each year until 2020, when the Pandemic Recession disrupted everything.

With the resultant decline in labor force running against the economic recovery in 2021 and 2022, vacancies reached record levels in the region and the state, before finally returning to pre-pandemic levels in 2023. Employers reported just over 9,500 openings in 2023, which as noted earlier in the article, still means there are more vacancies than unemployed workers, but the gap is narrowing. The region still has a very tight labor market, but employers are enjoying a larger labor pool as they slow their hiring demand (see Figure 2).

The last year was filled with mostly positive economic and labor market data for Southwest Minnesota. The region gained workers, added jobs, and saw welcome moderation in the jobseeker-per-vacancy ratio. Demand for workers remains relatively high and the unemployment rate remains relatively low, but the region does not experience the same peaks and valleys that other regions face.

The region's distinguishing industries remain mostly healthy, with 15 of 20 main sectors picking up jobs over the past year. Significant gains were observed in Health Care & Social Assistance, Accommodation & Food Services, Wholesale Trade, Public Administration, and Construction. However, the region's largest industry, Manufacturing, experienced a substantial job loss, primarily in Food Manufacturing. While some subsectors like Machinery Manufacturing saw growth, overall, Manufacturing lost 827 jobs following several years of post-pandemic recovery.

Continued growth in Southwest Minnesota relies on labor force availability, which faces challenges due to demographic shifts. While the region saw some growth in workers between 2022 and 2023, it still lags behind pre-pandemic levels, with projections suggesting further declines over the next decade, particularly among older generations like Baby Boomers. However, there's a potential uptick in younger workers, notably from Generation Z.

Despite an aging white population, the region's workforce is diversifying, with significant increases in BIPOC representation, particularly among Hispanic or Latino workers, who now comprise 7.0% of the total workforce. However, overall labor force participation rates are declining, though remain higher among BIPOC groups, highlighting the need for strategies to address these demographic shifts.