by Nick Dobbins

February 2017

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

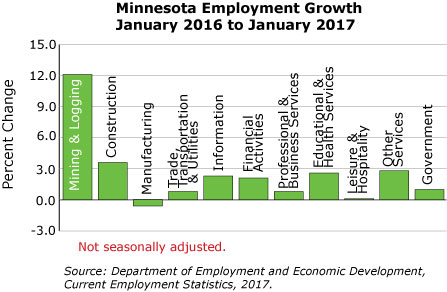

Minnesota lost 8,300 jobs (0.3 percent) in January on a seasonally adjusted basis. However, this decline is from December’s estimated 2,921,400 jobs, which was revised up from the original preliminary 2,919,300 in recent year-end re-estimation. January’s losses were spread among industry groups: Service Providers were off by 5,800 jobs (0.2 percent), and Goods Producers were down 2,500 (0.6 percent). Private sector employers shed 5,600 jobs (0.2 percent), while public sector employers lost 2,700 (0.6 percent). Over the year, Minnesota added 35,136 jobs (1.2 percent). Most of those jobs came from service providing industries, as private service providers added 28,380 jobs (1.4 percent), and Government employers added 4,413 jobs (1 percent). Goods Producers also grew over the year, although by a more modest 2,343 jobs (0.6 percent).

Employment in the Mining and Logging supersector was flat in January, holding at a seasonally adjusted 6,400 jobs. However, this is a significant upward revision from the 5,600 jobs that preliminary estimates showed at the end of 2016. Over the year, Mining and Logging added 662 jobs (12.1 percent). This is a dramatic change from December’s 2.1 percent over-the-year decline and marks the first annual increase since the summer of 2015, as the steep declines in employment first showed up a little over a year ago.

Employment in the Construction supersector was down in January, shedding 900 jobs (0.8 percent) on a seasonally adjusted basis after adding 3,500 in November and 1,400 in December. Annually, the Construction supersector added 3,492 jobs (3.6 percent). While employment in Construction of Buildings actually declined by 969 (4.1 percent), growth in the other major component sectors more than made up for the loss. Specialty Trade Contractors added 3,832 jobs (6 percent) while Heavy and Civil Engineering Construction added 629 (6.6 percent).

Minnesota Manufacturers lost 1,600 jobs (0.5 percent) in January on a seasonally adjusted basis. Durable Goods Manufacturers drove the decline, shedding 2,400 jobs (1.2 percent) while their Non-Durable Goods counterparts added 800 jobs (0.7 percent). The monthly changes mirror the larger trends in the component sectors. Over the year, Durable Goods Manufacturers lost 3,445 jobs (1.7 percent), with losses spread among industry groups, while Non-Durable Goods Manufacturers added 1,634 jobs (1.4 percent). The end result is a net annual decline of 1,811 (0.6 percent) in Manufacturing. This represented the second consecutive month of over-the-year job losses in the supersector.

Employment in Trade, Transportation, and Utilities was down by 4,100 (0.8 percent) in January. All three component sectors shed jobs, with Transportation, Warehousing, and Utilities leading the way with a decline of 2,100 (2 percent). Wholesale Trade lost 600 jobs, and Retail Trade lost 1,400, both of which represented a decline of 0.5 percent. Annually, the supersector added 4,222 jobs (0.8 percent), with all of those gains coming in Retail Trade (up 4,604 or 1.6 percent), with more than half of those new jobs coming from Food and Beverage Stores (up 2,410 or 4.6 percent). Wholesale Trade lost 312 jobs (0.2 percent), and Transportation, Warehousing, and Utilities lost 70 (0.1 percent).

The Information supersector added 200 jobs (0.4 percent) in January on a seasonally adjusted basis. Annually, the supersector added 1,176 jobs (2.3 percent). This is a significant turnaround for the supersector, which has showed over-the-year job growth in only one month since 2013 – in October of 2016 the supersector showed 0.2 percent growth.

The Financial Activities supersector lost 100 jobs (0.1 percent) in January. A decline of 300 (0.9 percent) in Real Estate and Rental and Leasing was enough to bury the small 200 job (0.1 percent) growth in Finance and Insurance. Over the year, the supersector added 3,591 jobs (2.1 percent). Finance and Insurance added 3,395 jobs (2.4 percent), accounting for the lion’s share of the supersectors growth, with components Credit Intermediation and Insurance Carrier and Related Activities each showing 2.7 percent annual growth (1,682 and 1,569 jobs, respectively). Real Estate and Rental and Leasing, the other major component, added 196 jobs (0.6 percent).

Professional and Business Services lost 3,200 jobs (0.9 percent) in January. All three component sectors shed employment. Management of Companies and Enterprises led the way with a decline of 1,600 jobs (2 percent) while Professional, Scientific, and Technical Services lost 1,200 (0.8 percent), and Administrative and Support and Waste Management and Remediation Services lost 400 (0.3 percent). Annually, the supersector added 2,710 jobs (0.8 percent). Professional, Scientific, and Technical Services added 366 jobs (0.2 percent), Management of Companies and Enterprises added 1,381 (1.8 percent), and Administrative and Support and Waste Management and Remediation Services added 963 (0.8 percent).

Educational and Health Services lost 700 jobs (0.1 percent) in January. Health Care and Social Assistance shed 800 jobs (0.2 percent), while Educational Services added 100 (0.1 percent). Annually, the supersector added 13,247 jobs (2.6 percent). Health Care and Social Assistance added 12,809 jobs (2.9 percent). Ambulatory Health Services had the fastest growth among component groups, adding 5,611 or 3.8 percent. Growth in Educational Services was much slower than its counterpart in the supersector, as the sector added 438 jobs or 0.7 percent.

Leisure and Hospitality added 3,300 jobs (1.3 percent) in January on a seasonally adjusted basis. Arts, Entertainment, and Recreation added 2,500 jobs (6.3 percent) while Accommodation and Food Services showed more modest growth, adding 800 jobs or 0.4 percent. Annually, the supersector added 263 jobs (0.1 percent). Arts, Entertainment, and Recreation added 144 jobs (0.4 percent), while Accommodation and Food Services added 119 (0.1 percent).

Employment in the Other Services supersector was up by 1,500 (1.3 percent) in January. Over the year, Other Services added 3,171 jobs (2.8 percent). All three component industry groups grew, with Repair and Maintenance adding 638 jobs (3 percent), Personal and Laundry Services adding 1,301 (4.6 percent), and Religious, Grantmaking, Civic, Professional, and Similar Organizations adding 1,232 (1.9 percent).

Government employers lost 2,700 jobs (0.6 percent) in January. Local Government was the big weight on the group, losing 2,300 jobs (0.8 percent). Annually, public sector employment grew by 4,413 (1 percent). State employers lost 1,649 jobs (1.7 percent), while Local and Federal employment both grew (by 5,294 or 1.8 percent and by 768 or 2.4 percent, respectively).

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | Jan-17 | Dec-16 | Nov-16 |

| Total Nonfarm | 2,913.1 | 2,921.4 | 2,915.6 |

| Goods-Producing | 440.7 | 443.2 | 442.3 |

| Mining and Logging | 6.4 | 6.4 | 6.5 |

| Construction | 118.0 | 118.9 | 117.5 |

| Manufacturing | 316.3 | 317.9 | 318.3 |

| Service-Providing | 2,472.4 | 2,478.2 | 2,473.3 |

| Trade, Transportation, and Utilities | 531.5 | 535.6 | 534.9 |

| Information | 51.1 | 50.9 | 50.9 |

| Financial Activities | 177.4 | 177.5 | 177.0 |

| Professional and Business Services | 372.6 | 375.8 | 374.2 |

| Educational and Health | 530.5 | 531.2 | 529.0 |

| Leisure and Hospitality | 264.9 | 261.6 | 262.4 |

| Other Services | 117.4 | 115.9 | 116.2 |

| Government | 427.0 | 429.7 | 428.7 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2017. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.