by Cameron Macht

June 2023

Southwest Minnesota's economy stands at a critical juncture as it navigates an aging population, declining labor force, and changing industry trends. By embracing proactive strategies, the region can overcome these challenges and position itself for long-term success. Diversification, workforce development, and leveraging manufacturing and agricultural strengths are key pillars in ensuring a resilient and robust economy. With a focus on fostering innovation, Southwest Minnesota has the potential to not only achieve short-term recovery but also thrive in a long-term economic evolution.

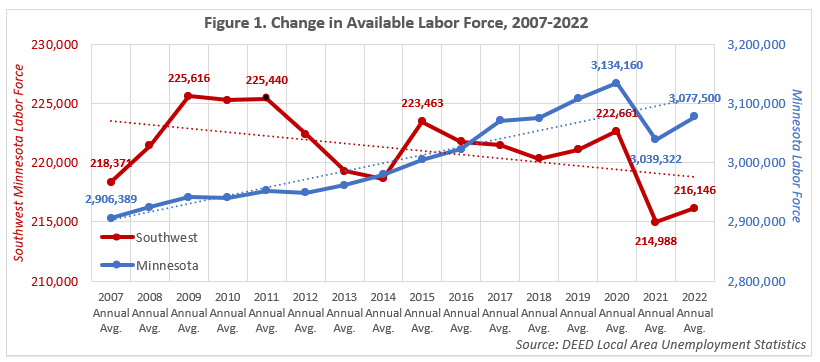

According to DEED's Local Area Unemployment Statistics program, Southwest Minnesota had an average of about 216,150 available workers in 2022. While that was a gain of about 1,150 workers compared to 2021, it represents the second smallest annual average number of workers on record going back to 2000. After peaking with just over 225,000 workers during the Great Recession from 2009 through 2011, the region had already started experiencing the long-term labor force declines brought about by an aging population over the past decade, before stabilizing around 220,000 to 222,000 workers as the economy expanded from 2015 to 2020.

The Pandemic Recession accelerated Southwest's labor force decline, cutting more than 7,500 workers from 2020 to 2021, with the region still down about 6,500 workers in 2022 despite a small reversal. Among the six planning regions in the state, Southwest Minnesota has seen the largest labor force exodus from 2020 to 2022, back to just 97.1% of pre-pandemic levels, with Northwest closest to its 2020 labor force level at 99.6%.

Over a 10-year period, Southwest is one of only two regions that has fewer workers now, down -1.4% compared to 2013. Northeast Minnesota, which also has an older population, is down -1.9% over the decade. In contrast, the state's labor force is up 3.9% overall, with the fastest gains in Central (+4.1%) and the Twin Cities (+5.5%). While Minnesota's labor force growth has slowed, the trend line is still pointing upward. Southwest had been growing in the 1990s and early 2000s, but that changed in 2011 before the significant drop in 2020 (see Figure 1).

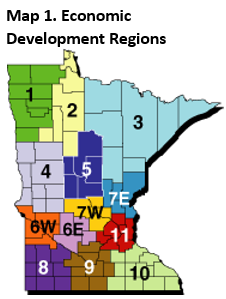

The Southwest Minnesota planning region is made up of 23 counties and three Economic Development Regions (EDRs), and it's important to note that there are significant differences across them (see Map 1). All three EDRs lost workers due to the Pandemic Recession, with Region 6W – Upper Minnesota Valley showing the fastest decline in the region and among the 13 EDRs in the state at -4.7%. Likewise, Region 6W also had the largest percent decline over the past 10 years, dropping -6.4% from 2013 to 2022. Region 8 – Southwest and Region 9 – South Central both declined about -2.5% from 2020 to 2022, but that created a -2.1% loss for Region 8 over the 10 year period, whereas Region 9's labor force was flat.

The Southwest Minnesota planning region is made up of 23 counties and three Economic Development Regions (EDRs), and it's important to note that there are significant differences across them (see Map 1). All three EDRs lost workers due to the Pandemic Recession, with Region 6W – Upper Minnesota Valley showing the fastest decline in the region and among the 13 EDRs in the state at -4.7%. Likewise, Region 6W also had the largest percent decline over the past 10 years, dropping -6.4% from 2013 to 2022. Region 8 – Southwest and Region 9 – South Central both declined about -2.5% from 2020 to 2022, but that created a -2.1% loss for Region 8 over the 10 year period, whereas Region 9's labor force was flat.

Just seven of the 23 counties in the region saw labor force growth since 2013, led by Blue Earth and Nicollet, which make up the Mankato-North Mankato metropolitan statistical area (MSA). Watonwan and Le Sueur County in Region 9 also saw long-term growth, despite losing more than 2% since 2020. In Region 8, Cottonwood County, which is home to Windom, saw the largest percentage increase over the decade, and also the biggest gain since 2020. The two southwestern-most counties in the state, Rock and Nobles, both added workers as well. All five counties in Region 6W saw declines from 2013 (see Table 1).

| Table 1. Labor Force Trends by County, 2013-2022 | |||||

|---|---|---|---|---|---|

| - | Number of Workers | 3-Year 2020-2022 Percent Change | 10-Year 2013-2022 Percent Change | ||

| 2022 Annual Avg. | 2020 Annual Avg. | 2013 Annual Avg. | |||

| Region 6W | 22,120 | 23,214 | 23,629 | -4.7% | -6.4% |

| Swift Co. | 4,805 | 4,923 | 4,900 | -2.4% | -1.9% |

| Big Stone Co. | 2,399 | 2,564 | 2,560 | -6.4% | -6.3% |

| Chippewa Co. | 6,480 | 6,824 | 6,953 | -5.0% | -6.8% |

| Lac qui Parle Co. | 3,400 | 3,548 | 3,670 | -4.2% | -7.4% |

| Yellow Medicine Co. | 5,036 | 5,355 | 5,546 | -6.0% | -9.2% |

| Region 8 | 63,539 | 65,199 | 64,901 | -2.5% | -2.1% |

| Cottonwood Co. | 6,664 | 6,396 | 5,763 | +4.2% | +15.6% |

| Rock Co. | 6,010 | 5,889 | 5,631 | +2.1% | +6.7% |

| Nobles Co. | 11,087 | 11,710 | 11,071 | -5.3% | +0.1% |

| Pipestone Co. | 4,662 | 4,729 | 4,693 | -1.4% | -0.7% |

| Murray Co. | 4,654 | 4,898 | 4,842 | -5.0% | -3.9% |

| Lyon Co. | 14,421 | 14,721 | 15,295 | -2.0% | -5.7% |

| Redwood Co. | 7,596 | 7,840 | 8,059 | -3.1% | -5.7% |

| Lincoln Co. | 3,029 | 3,162 | 3,313 | -4.2% | -8.6% |

| Jackson Co. | 5,416 | 5,854 | 6,234 | -7.5% | -13.1% |

| Region 9 | 130,487 | 134,248 | 130,744 | -2.8% | -0.2% |

| Watonwan Co. | 6,520 | 6,721 | 6,186 | -3.0% | +5.4% |

| Nicollet Co. | 20,648 | 21,021 | 19,732 | -1.8% | +4.6% |

| Blue Earth Co. | 40,267 | 40,969 | 38,655 | -1.7% | +4.2% |

| Le Sueur Co. | 15,898 | 16,264 | 15,517 | -2.3% | +2.5% |

| Sibley Co. | 8,078 | 8,379 | 8,329 | -3.6% | -3.0% |

| Brown Co. | 13,773 | 14,353 | 14,539 | -4.0% | -5.3% |

| Faribault Co. | 7,067 | 7,183 | 7,503 | -1.6% | -5.8% |

| Martin Co. | 9,618 | 10,137 | 10,346 | -5.1% | -7.0% |

| Waseca Co. | 8,618 | 9,221 | 9,937 | -6.5% | -13.3% |

| Source: DEED Local Area Unemployment Statistics | |||||

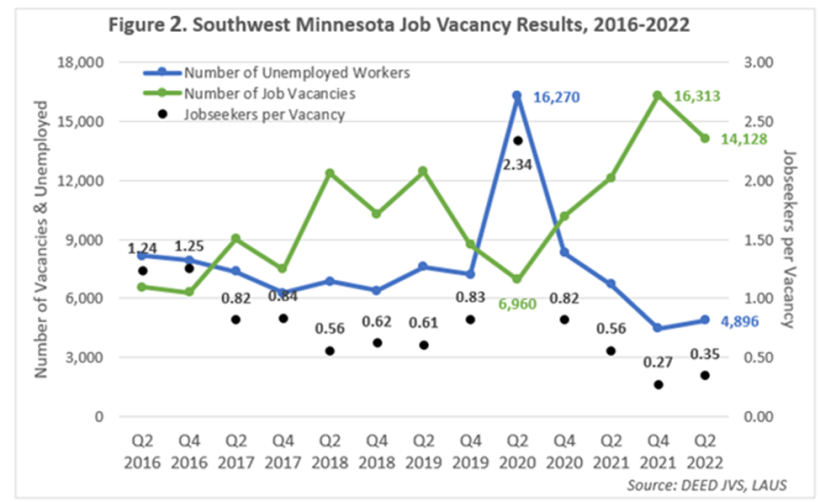

While the region has been regaining jobs since the Pandemic Recession in 2020, the lack of available workers is affecting the region's economic recovery. With just over 14,000 job vacancies in 2022, employers in Southwest Minnesota reported the second highest number of openings on record, after setting the high mark in the fourth quarter of the prior year. In contrast, there were an average of less than 4,900 unemployed workers in the region during 2022, meaning there were just 0.3 jobseekers available for every vacancy. Employers in the region have gotten used to an environment where jobs have outnumbered jobseekers starting in 2017, with the exception being the outset of the pandemic in 2020 (see Figure 2).

One quarter of the job vacancies in the region were in Health Care & Social Assistance, and another one-fifth were in Manufacturing. Combined, those two industries accounted for almost half of all vacancies in the region in 2022. Health Care & Social Assistance had nearly 3,600 vacancies in 2022, which was down from the record high of almost 6,000 in fourth quarter 2021, but was still more than double the average across the past 10 years. Surpassing 3,000 vacancies for the first time ever, demand for workers in Manufacturing is at an all-time high in the region.

Overall, just 31% of the vacancies in Southwest Minnesota required college, meaning the other two-thirds can be started without a degree. Likewise, about one-third of current postings required at least one year of prior work experience, showing that employers have lowered requirements in an attempt to draw in more workers.

Wage offers have also been increasing to attract jobseekers, rising to $16.55 in 2022. That was up by more than a dollar from the second quarter of 2021, when the median wage offer just topped $15. Employers have raised wages across the board, but especially for lower-skilled, lower-paying positions that are hard to fill.

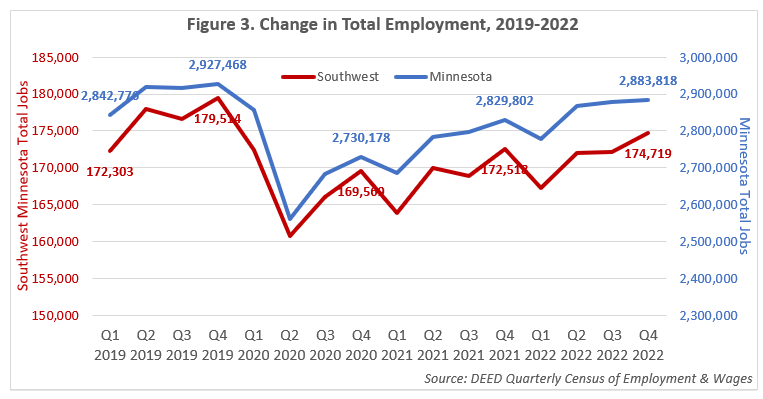

According to Current Employment Statistics, the Mankato-North Mankato MSA matched its pre-pandemic employment level in February of 2023, and has since continued adding more jobs. But the Southwest region as a whole is still down about 4,795 jobs, or -2.7% comparing the fourth quarter of 2022 with the fourth quarter of 2019, right before the Pandemic Recession. The region is a little behind the state, with a slower recovery constrained by labor force availability (see Figure 3).

Southwest is the only region where Manufacturing is still the largest employing industry, with just over 32,000 jobs at 634 establishments. It was the largest growing industry as well, adding jobs even during the Pandemic Recession. In contrast, Health Care & Social Assistance lost jobs in 2020 and has continued to hemorrhage jobs in the region, losing even more in 2021 and 2022. Retail Trade is the third largest industry and like Manufacturing, actually grew during the Pandemic Recession (see Table 2).

| Table 2. Southwest Minnesota Employment Trends by Industry, 2019-2022 | |||||||

|---|---|---|---|---|---|---|---|

| - | 2022 Annual Average Data | Avg. Annual Wage | Change in Jobs | ||||

| Industry Title | Number of Firms | Number of Jobs | Total Payroll | 2019-2022 | 2020-2022 | 2021-2022 | |

| Total, All Industries | 12,805 | 171,543 | $8,748,745,410 | $51,000 | -2.9% | +2.6% | +1.6% |

| Manufacturing | 634 | 32,109 | $1,988,894,729 | $61,942 | +2.4% | +6.8% | +3.4% |

| Health Care & Social Assistance | 1,651 | 29,207 | $1,501,260,598 | $51,401 | -7.5% | -2.8% | -0.4% |

| Retail Trade | 1,438 | 19,312 | $597,436,280 | $30,936 | +0.7% | +4.7% | +2.2% |

| Educational Services | 236 | 15,472 | $767,765,880 | $49,623 | -3.9% | +3.5% | +2.1% |

| Accommodation & Food Services | 848 | 11,670 | $199,777,681 | $17,119 | -4.7% | +15.6% | +4.5% |

| Public Administration | 587 | 9,942 | $510,279,861 | $51,326 | -1.3% | +1.4% | +1.3% |

| Construction | 1,562 | 7,924 | $501,659,032 | $63,309 | -4.4% | 0.0% | +0.5% |

| Wholesale Trade | 649 | 7,451 | $581,360,263 | $78,024 | -3.6% | -1.1% | +2.8% |

| Transportation & Warehousing | 780 | 6,913 | $339,621,099 | $49,128 | -5.0% | -2.9% | -1.1% |

| Finance & Insurance | 714 | 5,902 | $444,554,667 | $75,323 | +0.2% | -4.9% | -1.5% |

| Agriculture, Forestry, Fishing & Hunting | 718 | 5,133 | $256,172,885 | $49,907 | -4.8% | -7.5% | -3.7% |

| Other Services | 1,096 | 4,963 | $165,263,680 | $33,299 | -1.4% | +11.3% | +3.1% |

| Admin. Support & Waste Mgmt. Svcs. | 408 | 3,890 | $179,150,029 | $46,054 | -3.7% | +10.1% | +4.9% |

| Professional, Scientific & Technical Svcs. | 608 | 3,738 | $259,707,182 | $69,478 | -2.0% | +4.9% | +3.4% |

| Information | 201 | 2,031 | $118,868,800 | $58,527 | -18.7% | -7.6% | -1.1% |

| Arts, Entertainment, & Recreation | 246 | 1,960 | $41,222,218 | $21,032 | -2.7% | +14.6% | +6.7% |

| Management of Companies | 53 | 1,440 | $143,256,993 | $99,484 | +0.9% | -1.9% | -2.4% |

| Real Estate & Rental & Leasing | 278 | 1,372 | $48,273,286 | $35,185 | -3.9% | +4.1% | +5.2% |

| Utilities | 77 | 900 | $89,735,991 | $99,707 | -5.1% | -3.7% | -1.6% |

| Mining | 23 | 210 | $14,484,256 | $68,973 | -34.2% | -16.7% | -5.0% |

| Source: DEED Quarterly Census of Employment & Wages | |||||||

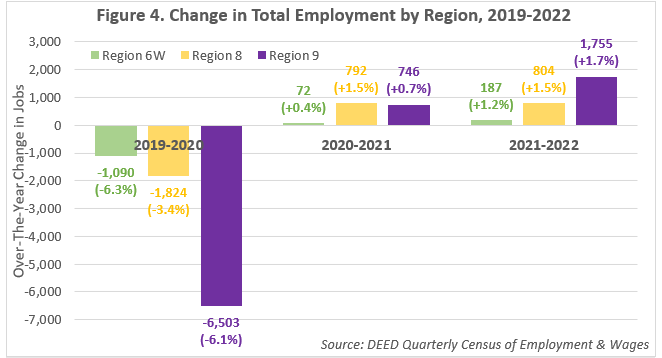

Region 9 – South Central saw the fastest growth in the past year, regaining 1,755 jobs from 2021 to 2022, though it is still down just over 4,000 jobs compared to pre-pandemic levels. That's because Region 9 saw the fastest decline from 2019 to 2020, cutting more than 6,500 jobs over the year. In 2022, Region 9 was back to 102,120 jobs at just under 7,100 establishments. Two industries gained more than 200 jobs in the region from 2019 to 2022 - Retail Trade and Finance & Insurance - but those gains were overwhelmed by big declines in Health Care & Social Assistance, Manufacturing, and Educational Services.

Region 8 – Southwest is closest to full recovery, reaching 99.6% of its 2019 employment level by the end of 2022, with 53,005 jobs at 4,103 establishments. Region 8 was more insulated due to its strength in Manufacturing, which added over 1,400 jobs since 2019 despite the Pandemic Recession. Region 8 also saw gains in Agriculture, Forestry, Fishing & Hunting, Utilities, Other Services, Arts, Entertainment & Recreation, and Professional & Technical Services. Those gains offset losses in Health Care & Social Assistance, Accommodation & Food Services, Wholesale Trade, and Administrative Support & Waste Management Services.

Finally, Region 6W – Upper Minnesota Valley has the most ground to make up from 2019, still down 831 jobs from 2019 to 16,417 jobs at 1,604 establishments in 2022. Over a third of that decline occurred in Health Care & Social Assistance, which is down more than 300 jobs from 2019 to 2022. Only two industries – Transportation & Warehousing and Real Estate, Rental & Leasing – reported more jobs now than in 2019. Region 6W has the smallest number of jobs and has seen the biggest percent decline over the period.

Southwest Minnesota's economy has long been shaped by an aging population and labor force, which led to accelerated declines during the pandemic that have not been recovered. The declining labor force necessitates a proactive approach to workforce development. To address the shortage of skilled workers, it is crucial to invest in educational programs that align with the evolving needs of industries including Manufacturing and Health Care & Social Assistance. Collaborations between educational institutions, including high schools, and local businesses can facilitate the development of specialized training programs, apprenticeships, and internships. Additionally, efforts to attract and retain young professionals and entrepreneurs should be undertaken to replenish the workforce and foster innovation.

With a high concentration of employment in the manufacturing sector, the region faces both challenges and opportunities in maintaining economic growth and adapting to changing times. The region's manufacturing expertise and infrastructure can be leveraged to capitalize on emerging industries. For instance, cutting-edge technologies like automation and robotics can enhance productivity and competitiveness. Additionally, partnerships between manufacturers, educational institutions, and government entities can facilitate research and development, leading to product innovation and increased market presence.

The challenges faced by Southwest Minnesota's economy extend beyond industry dynamics. The region must also prioritize community development and quality of life to attract and retain a skilled workforce. Investments in infrastructure, including transportation, health care facilities, and improved broadband access, are essential for supporting economic growth. Furthermore, initiatives to promote cultural amenities and enhance recreational opportunities can contribute to a vibrant and attractive living environment for both residents and businesses.