by Nick Dobbins

September 2017

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

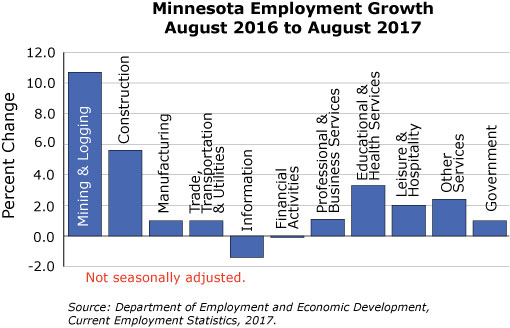

Minnesota lost 6,600 jobs (0.2 percent) in August on a seasonally adjusted basis. The decline gave back some of the nearly 12,000 jobs the state had gained in June and July. The losses were concentrated entirely among private service providing sectors which shed 7,800 jobs (0.4 percent) while good producers and the public sector both added employment. Over the year Minnesota added 49,695 jobs (1.7 percent). While this represented a decrease in over-the-year growth from the previous few months, it still compared favorably to growth rates in recent years. August's annual growth was shared among goods producers and service providers, as well as between the private and public sectors, as most industry groups saw job growth on the year, the exceptions being the Information and Financial Activities supersectors, which had combined annual losses of less than 1,000 jobs.

Employment in the Mining and Logging supersector was flat in August, holding at 6,900 seasonally adjusted jobs. This was the second straight month of flat growth in the supersector. Employment has been static in Mining and Logging since March, and it has not varied from its current level by more than 100 jobs since February's 6,600 job estimate. Over the year the supersector added 720 jobs (10.7 percent). This is a decline from July's 11.8 percent over-the-year growth, and we should expect the number to continue to drop in the coming months as the fallout from the closing and re-opening of large employers in the supersector in recent years begins to fade.

Employment in Construction was off slightly in August, losing 400 jobs (0.3 percent). The supersector lost 1,300 jobs, seasonally adjusted, over July and August. Annually Construction employment was up by 7,247 (5.6 percent). That growth remained concentrated primarily in Specialty Trade Contractors, which added 7,073 jobs (8.6 percent) on the strength of 5,213 jobs in the component Building Equipment Contractors sector. Construction of Buildings lost 495 jobs (1.8 percent) on the year, while Heavy and Civil Engineering Construction added 669 (3.3 percent). The last time the Construction supersector showed over-the-year job losses was in December.

The Manufacturing supersector added 800 jobs (0.2 percent) on a seasonally adjusted basis in August. That marked three consecutive months of growth for the supersector. The August growth was split between the component sectors, as Durable Goods Manufacturing added 200 jobs (0.1 percent), and Non-Durable Goods Manufacturing added 600 (0.5 percent). Over the year Manufacturers added 3,084 jobs (1 percent). Durable Goods Manufacturers added 259 jobs (0.1 percent) while Non-Durable Goods added 2,825 (2.4 percent).

Trade, Transportation, and Utilities employment was up by 3,200 (0.6 percent) in August. It was the strongest month for the supersector since February, and helped halt a slide that had seen job losses of 1,500 in the previous two months and 4,500 since February's high-water mark. August's growth was broad-based, coming from Transportation, Warehousing, and Utilities (up 1,500 or 1.4 percent), Wholesale Trade (up 1,500, 1.1 percent) and, to a lesser extent, Retail Trade (up 200, 0.1 percent). Annually the supersector added 5,538 jobs (1 percent), with growth in all three component sectors.

Employment in the Information supersector was up by 500 (1 percent) in August. It was the second straight month of growth. Annually Information employers lost 744 jobs (1.4 percent). Although it had shown over-the-year growth in recent months, the supersector returned to the job losses that have been common in recent year. Information employment peaked and began its current slow but steady decline near the turn of the century.

Financial Activities employment was up by 200 (0.1 percent) in August. It was only the second time in 2017 that the supersector posted employment gains. The growth came from Finance and Insurance, which added 300 jobs (0.2 percent) while Real Estate and Rental and Leasing lost 100 (0.3 percent). Annually the supersector lost 213 jobs (0.1 percent), making it only the second supersector, in addition to Information, to post over-the-year job losses. While Finance and Insurance employment was stronger, adding 1,468 jobs (1 percent), Real Estate and Rental and Leasing employment dropped sharply, losing 1,547 jobs (5.6 percent).

Professional and Business Services added 800 jobs (0.2 percent) in August. Administrative and Support and Waste Management and Remediation Services added 1,700 jobs (1.2 percent), and Management of Companies and Enterprises added 900 (1.1 percent) while Professional, Scientific, and Technical Services lost 1,800 jobs (1.1 percent). Annually the supersector added 4,263 jobs (1.1 percent). That gain came primarily from Administrative and Support and Waste Management and Remediation Services, which added 5,492 jobs (3.9 percent), with component Employment Services chipping in 3,667 of that gain (a 6.1 percent over-the-year change).

Educational and Health Services employment was down in August, off by 5,300 (1 percent) from July's estimate. Both Educational Services (down 2,200 or 3.2 percent) and Health Care and Social Assistance (down 3,100 or 0.7 percent) posted negative growth. Over the year the supersector added 17,280 jobs (3.3 percent). While it remained the single largest contributor of new jobs to the state, the proportional growth came down slightly from recent months, and may be settling into more modest growth after posting over-the-year changes of 4.3, 5.6, and 4.4 percent, respectively, in the prior three months.

The Leisure and Hospitality supersector lost 6,400 jobs (2.3 percent) in August. While the decline was relatively large, it came on the heels of five consecutive months of seasonally adjusted growth, including the similarly large addition of 5,700 jobs (2.1 percent) in July. This suggests that the decline may have been something of a correction to earlier outsized growth. Annually the supersector added 5,628 jobs (2 percent). Arts, Entertainment, and Recreation added 1,911 jobs (3.8 percent), and Accommodation and Food Services added 3,717 (1.6 percent).

Other Services employment was off by 800 (0.7 percent) in August. Annually the supersector added 2,852 jobs (2.4 percent). Most of the growth came from Religious, Grantmaking, Civic, Professional, and Similar Organizations, which added 1,955 jobs (3 percent), although all three component sectors contributed to the gains.

Government employment was up by 800 (0.2 percent) in August. State Government added 1,100 jobs (1.1 percent), but both Federal and Local employers lost a small amount of employment. Annually Government employers added 4,040 jobs (1 percent) with growth in all three branches.

| Industry | August 2017 | July 2017 | June 2017 |

|---|---|---|---|

| Total Nonfarm | 2,948.1 | 2,954.7 | 2,952.1 |

| Goods-Producing | 449.5 | 449.1 | 449.8 |

| Mining and Logging | 6.9 | 6.9 | 6.9 |

| Construction | 121.7 | 122.1 | 123.0 |

| Manufacturing | 320.9 | 320.1 | 319.9 |

| Service-Providing | 2,498.6 | 2,505.6 | 2,502.3 |

| Trade, Transportation, and Utilities | 539.0 | 535.8 | 536.8 |

| Information | 51.4 | 50.9 | 50.7 |

| Financial Activities | 175.5 | 175.3 | 176.6 |

| Professional and Business Services | 376.2 | 375.4 | 377.8 |

| Educational and Health Services | 540.9 | 546.2 | 542.8 |

| Leisure and Hospitality | 267.6 | 274.0 | 271.5 |

| Other Services | 119.1 | 119.9 | 119.6 |

| Government | 428.9 | 428.1 | 426.5 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2017. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.