by Erik White

July 2019

One of the fastest growing industries in Northeast Minnesota is the Professional, Scientific, and Technical Services industry which includes many in-demand occupations. These jobs often have higher educational requirements, along with higher wages, and the ability of the industry to sustain and grow will depend largely on the retention and attraction of college graduates to the Arrowhead region.

With 562 business establishments employing 4,226 workers, the Professional, Scientific, and Technical Services sector in Northeast Minnesota is vital to the region's economy. While it constitutes only 2.9 percent of total employment in the region, the sector employs more than the often discussed Mining sector. It is high-paying as well, providing an average annual wage of $63,336, more than $18,000 over the average annual wage for Total, All Industries in the 7-County Arrowhead region.

The Professional, Scientific, and Technical Services industry sector is composed of nine sub-sectors that vary widely in employment and wages in Northeast Minnesota. The largest sub-sector by employment is Architectural, Engineering, and Related Services with 1,307 jobs and actually has a location quotient greater than 1.0 (see Table 1) indicating a more concentrated industry in the region than the state as a whole. A reason for this cluster is the unique natural resources in the region such as timber and iron ore which provide demand for engineering services in the area, especially as it relates to the natural environment. The next largest subsector is Computer Systems Design and Related Services (690 jobs) followed by Accounting, Tax Preparation, Bookkeeping, and Payroll (544 jobs), Other Professional, Scientific and Technical Services (485 jobs), and Legal Services (462 jobs).

While the overall sector has gained more than 200 jobs in the past five years, this fact masks some of the changes that are occurring in the Professional, Scientific, and Technical Services industry. For example, the Computer Systems Design and Related Services subsector has added 133 jobs in the past five years, an increase of 23.9 percent. Architectural, Engineering, and Related Services is another subsector that has experienced considerable job growth, as it has increased employment by 9.6 percent with the addition of 114 jobs during the past five years. The Legal Services subsector has decreased in employment by 100, a 17.8 percent decrease, and the Management, Scientific, and Technical Consulting employment dropped by 15.7 percent with the loss of 37 jobs since 2013. Despite the growth of the industry, fundamental shifts are occurring as it responds to the region's demands for professional services (see Table 1).

| Table 1. Professional, Scientific, and Technical Services Employment Statistics, Northeast Minnesota | ||||||

|---|---|---|---|---|---|---|

| NAICS | Industry | 2018 | 2013-2018 | |||

| Number of Employees | Average Annual Wage | Location Quotient | Numeric Change | Percent Change | ||

| 0 | Total, All Industries | 143,598 | $45,136 | 1.0 | 3,277 | 2.3% |

| 54 | Professional, Scientific, and Technical Services | 4,226 | $63,336 | 0.5 | 204 | 5.1% |

| 5411 | Legal Services | 462 | $62,140 | 0.5 | -100 | -17.8% |

| 5412 | Accounting, Tax Preparation, Bookkeeping, and Payroll | 544 | $59,488 | 0.7 | 5 | 0.9% |

| 5413 | Architectural, Engineering, and Related Services | 1,307 | $73,268 | 1.1 | 114 | 9.6% |

| 5414 | Specialized Design Services | 30 | $32,708 | 0.3 | -3 | -9.1% |

| 5415 | Computer Systems Design and Related Services | 690 | $65,052 | 0.4 | 133 | 23.9% |

| 5416 | Management, Scientific, and Technical Consulting | 199 | $79,404 | 0.1 | -37 | -15.7% |

| 5417 | Scientific Research and Development Services | 313 | $67,236 | 0.8 | 30 | 10.6% |

| 5418 | Advertising and Related Services | 193 | $52,000 | 0.3 | 1 | 0.5% |

| 5419 | Other Professional, Scientific, and Technical Services | 485 | $37,752 | 0.6 | 43 | 9.7% |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | ||||||

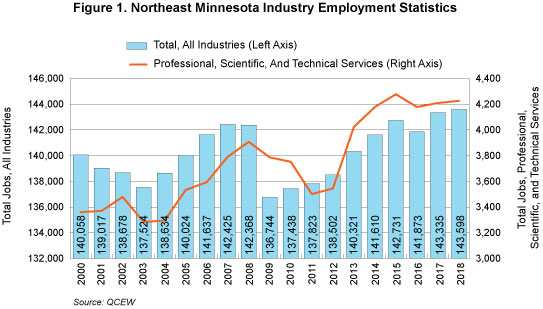

The Professional, Scientific, and Technical Services industry has increased rapidly in the region since 2000 with a growth rate of 25.8 percent (866 jobs), about 10 times greater than the rate of growth for all jobs in the region during the same time frame. The trend of employment in the Professional, Scientific, and Technical Services sector follows closely the overall employment picture in the region in that it was impacted by the recession of 2008-2009 and has regained all employment and then some. The industry bottomed out in 2011 with 3,501 jobs but has added 725 jobs since, a 20.7 percent increase, and has recaptured jobs lost from its high-water mark prior to the recession as well as increased employment by 319 jobs by 2018 (see Figure 1).

So, what kind of jobs are there in the Professional, Scientific, and Technical Services industry sector? Using DEED's Occupational Staffing Patterns matrix, we can see which occupations make up this particular industry. Accountants, lawyers, and office clerks are the top three occupations in the sector, but computer related occupations are growing quickly as employment opportunities expand. Meanwhile, management analysts, civil engineers, architects, mechanical engineers, and architectural and civil drafters constitute occupations in the region's dominant subsector of Architectural, Engineering, and Related Services.

Many of the occupations in the sector are showing strong current demand in the region based on DEED's Occupations in Demand dataset. Accountants, office clerks, computer system analysts, customer service representatives, bookkeeping and auditing clerks, civil engineers, network and computer system administrators, and secretaries and administrative assistants all have five star rankings for their current demand indicators, representing favorable current demand conditions. Along with strong demand, most occupations in the Professional, Scientific, and Technical Services industry have higher median hourly wages than the $18.57 median hourly wage for all occupations in Northeast Minnesota. However, with the higher wages come greater educational requirements with over half of the occupations requiring a Bachelor's degree or greater (see Table 2).

| Table 2. Occupations in Northeast Minnesota | ||||||

|---|---|---|---|---|---|---|

| Occupation Title | Estimated Regional Employment | Median Hourly Wage | Current Demand Indicator | Typical Educational Requirement | ||

| Total, All Occupations | 144,430 | $18.57 | N/A | N/A | ||

| Accountants and Auditors | 840 | $29.69 | ★ ★ ★ ★ ★ | Bachelor's degree | ||

| Lawyers | 300 | $39.04 | ★ ★ ★ | Doctoral or prof. degree | ||

| Office Clerks, General | 3,120 | $16.81 | ★ ★ ★ ★ ★ | High school or equivalent | ||

| Software Developers, Applications | 320 | $36.78 | ★ ★ ★ ★ | Bachelor's degree | ||

| Computer Systems Analysts | 300 | $36.25 | ★ ★ ★ ★ ★ | Bachelor's degree | ||

| Computer Programmers | 90 | $33.03 | ★ ★ ★ ★ | Bachelor's degree | ||

| General and Operations Managers | 2,230 | $36.92 | N/A | N/A | ||

| Sales Representatives, Services, All Other | 610 | $25.14 | N/A | N/A | ||

| Management Analysts | 150 | $32.44 | ★ ★ ★ ★ | Bachelor's degree | ||

| Market Research Analysts | 320 | $25.89 | ★ ★ ★ ★ | Bachelor's degree | ||

| Paralegals and Legal Assistants | 90 | $24.30 | ★ ★ | Associate's degree | ||

| Customer Service Representatives | 1,970 | $15.91 | ★ ★ ★ ★ ★ | High school or equivalent | ||

| Bookkeeping, Accounting, and Auditing Clerks | 1,560 | $17.73 | ★ ★ ★ ★ ★ | High school or equivalent | ||

| Computer User Support Specialists | 290 | $24.75 | ★ ★ ★ ★ | Associate's degree | ||

| Legal Secretaries | 150 | $20.79 | ★ ★ ★ | High school or equivalent | ||

| Computer and Information Systems Managers | 140 | $49.89 | ★ ★ ★ ★ | Bachelor's degree | ||

| Civil Engineers | 320 | $42.19 | ★ ★ ★ ★ ★ | Bachelor's degree | ||

| Network and Computer Systems Administrators | 270 | $35.25 | ★ ★ ★ ★ ★ | Bachelor's degree | ||

| Secretaries and Administrative Assistants | 1,550 | $18.24 | ★ ★ ★ ★ ★ | High school or equivalent | ||

| Veterinary Technologists and Technicians | 90 | $16.92 | ★ | Associate's degree | ||

| Architects | 40 | $30.86 | ★ ★ ★ | Bachelor's degree | ||

| Mechanical Engineers | 310 | $35.54 | ★ ★ ★ ★ | Bachelor's degree | ||

| Architectural and Civil Drafters | 80 | $22.70 | ★ | Associate's degree | ||

| Source: DEED's OES and OID data | ||||||

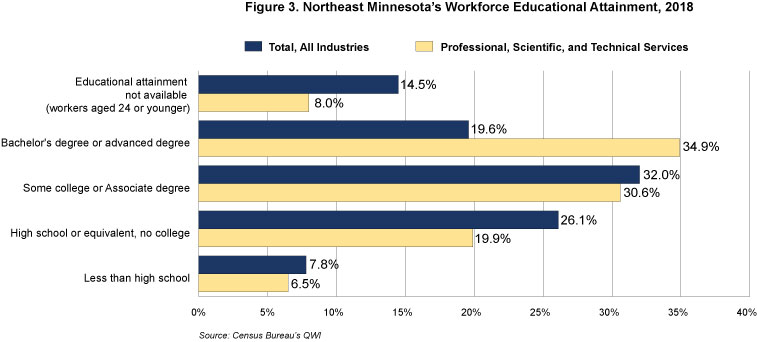

Age demographics of the Professional, Scientific, and Technical Services industry show a younger workforce than that found in the economy as a whole in Northeast Minnesota. 27.7 percent of employees are 25 to 34 years of age compared to just 20.2 percent for all industries, and the same trend follows for those that are 35 to 44 years. However, it has the same concentration of workers who are 65 years and older, indicating that the individual sector is not immune to the challenges of replacing a retiring workforce that threatens the regional economy as a whole. For the youngest of workers, those 24 years and younger, only 8.0 percent of employees belong to this age demographic compared to 14.5 percent for all industries, indicating the importance of advanced education to the Professional, Scientific, and Technical Services industry since those youngest workers have yet to earn their degrees and enter the field (see Figure 2).

Other demographic data from the Quarterly Workforce Indicator programs show an industry that is nearly equal in representation when it comes to gender with 49.5 percent of the workforce identifying itself as female. When it comes to race, the Professional, Scientific, and Technical Services industry in Northeast Minnesota is 94.2 percent white, a greater percentage than the 92.8 percent that reported as white for all industries in the region. However, diversity has increased in the industry since 2000, when 97.4 percent of workers were white alone. Lastly, over a third of the workforce has a Bachelor's degree or advanced degree, compared to just 19.6 percent of the total workforce in the region (see Figure 3).

With education an important factor in employment in the Professional, Scientific, and Technical Services industry, the state's colleges and universities play an important role in providing the future workforce to this industry. According to DEED's Graduate Employment Outcome (GEO) data program, instructional programs such as architecture and related services, communication, journalism and related, computer and information sciences, engineering, engineering technologies and engineering-related fields, natural resources and conservation, physical sciences, legal professions, and social sciences are majors that tend to lead to employment in the Professional, Scientific, and Technical Services. Combined, these education offerings graduated more than 12,700 students in graduation year 2015-2016 in the state of Minnesota, a significant pool of potential employees. While not all of these graduates will make the move to the Arrowhead region nor work in the Professional, Scientific, and Technical Services industry, we estimate that roughly 1,000 graduates from the years 2013-2016 became employed in the region.

Closer to home in Northeast Minnesota, the University of Minnesota-Duluth, the College of St. Scholastica, and the region's community and technical colleges help to produce the next generation of professional and technical workers by offering relevant curriculum. Local colleges and universities tend to place their graduates in the region and are an important pipeline to the regional industry. However, local graduates are being recruited outside the area for employment opportunities where wages tend to be higher, especially in the 7-County Metro Area, where there's a strong concentration of Professional, Scientific, and Technical industries.

Keeping local graduates is just one of the ways that the industry is maintaining employment. Other measures will be needed, including attracting professionals to Northeast Minnesota, to ensure the continued growth of the industry. Northforce1 is one local initiative that is taking on the challenges of recruiting and retaining by connecting local employers and potential job-seekers with a constantly updating job board and mentorship program where talent can be linked with regional opportunity. Efforts like this are imperative for the Professional, Scientific, and Technical industry, especially considering the projected growth of employment. The industry is expected to gain over 500 jobs by 2026, making it the fastest growing industry in the region with a 13.3 percent growth of employment based on DEED's Employment Outlook.

1Northforce. APEX and the Northspan Group.