by Carson Gorecki and Cameron Macht

December 2024

In addition to the statewide long-term projections produced every two years, DEED also creates more detailed employment forecasts for the six planning regions in Minnesota. Each region has its own population and labor force trends, unique industry mixes, and past employment trends that impact future employment growth. This article compares regional industry and occupational employment trends, highlighting both shared trajectories as well as areas of divergence. Based on the factors listed above and others, Central Minnesota and the Twin Cities Metro Area are poised for higher-than-average growth. Southeast and Northwest Minnesota are expected to grow slightly below the state average and Northeast and Southwest Minnesota are projected to grow relatively slower over the next decade.

Every two years, DEED's Labor Market Information Office produces employment projections of where industries and occupations are expected to be a decade from now. Factors considered in these projections include trends in past employment, unemployment, labor force, population, productivity and demand, among others. In addition to statewide projections, DEED also creates more detailed employment forecasts for the six planning regions in Minnesota. Each region has its own population and labor force trends and unique industry mix that impact future employment growth.

Statewide, Minnesota is projected to add over 144,500 jobs over the ten-year period ending in 2032, representing a gain of +4.6%. Two of the six regions, Central Minnesota and the seven-county Twin Cities Metro area, are expected to see growth above the state average. Southeast Minnesota's growth is forecasted to be similar to the state's; while Northwest, Northeast and Southwest Minnesota are all expected to grow more slowly (see Table 1).

| Table 1. Minnesota Employment Projections by Region, 2022-2032 | |||||||

|---|---|---|---|---|---|---|---|

| Area Name | Estimate

Year Employment, 2022 |

Projected

Year Employment, 2032 |

Projected

Percent Change, 2022-2032 |

Projected

Numeric Change, 2022-2032 |

Labor Force

Exit Openings, 2022-2032 |

Occupational

Transfer Openings, 2022-2032 |

Total

Hires, 2022-2032 |

| Minnesota | 3,135,681 | 3,280,273 | +4.6% | +144,592 | +1,531,700 | +1,913,823 | +3,590,115 |

| Central Minnesota | 315,929 | 332,231 | +5.2% | +16,302 | +160,516 | +198,606 | +375,424 |

| Twin Cities Metro | 1,927,280 | 2,022,157 | +4.9% | +94,877 | +921,025 | +1,165,418 | +2,181,320 |

| Southeast Minnesota | 270,975 | 283,255 | +4.5% | +12,280 | +134,631 | +163,022 | +309,933 |

| Northwest Minnesota | 265,321 | 275,647 | +3.9% | +10,326 | +135,428 | +166,881 | +312,635 |

| Northeast Minnesota | 153,945 | 159,102 | +3.3% | +5,157 | +77,963 | +95,406 | +178,526 |

| Southwest Minnesota | 202,214 | 207,878 | +2.8% | +5,664 | +102,272 | +125,638 | +233,574 |

| Source: Minnesota Employment Outlook | |||||||

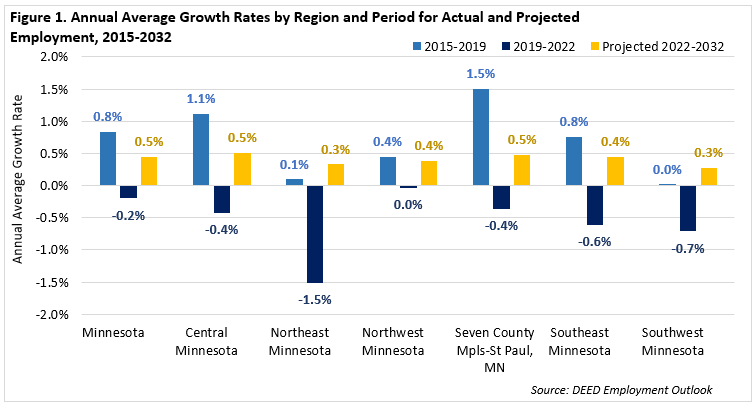

For each of the six planning regions, projected average annual employment growth rates are expected to increase from the declines experienced from 2019 to 2022 due to the Pandemic Recession (see Figure 1, the dark blue bars).

In most regions, these new projected growth rates are near, but slightly below, those of the period leading into the pandemic (see Figure 1, comparing the light blue and yellow bars). Northeast and Southwest Minnesota are the two exceptions, with average projected growth now expected to outpace the pre-pandemic period. Part of this can be explained by the relatively large employment declines seen in these regions from 2019 to 2022. Recoveries in these regions have been more drawn out, carrying into the current projections period.

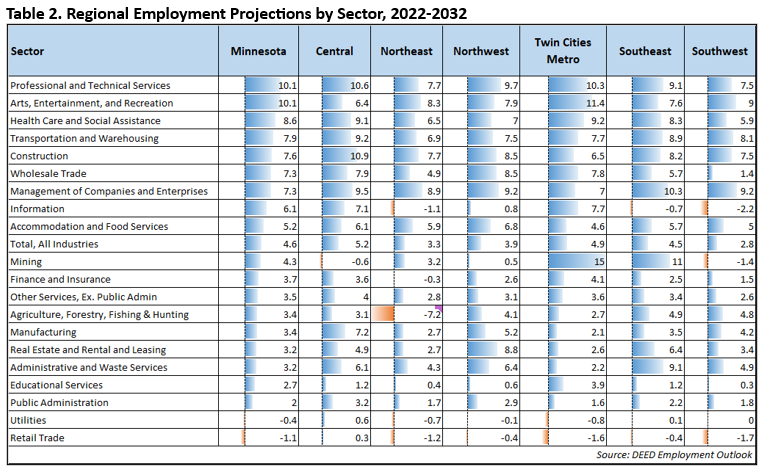

As mentioned, our projections are created for both detailed industries and occupations. Overall projection trends played a large role in determining relative outcomes, but the unique industry mix of each region also created some differences. By percent change, the fastest growing sectors statewide were Professional, Scientific & Technical Services and Arts, Entertainment & Recreation, both tied at 10.1%. Health Care & Social Assistance and Transportation & Warehousing took up the third and fourth spots at 8.6% and 7.9%, respectively.

By region, there was a lot more variety to the rankings. Despite the statewide lead, Professional, Scientific & Technical Services ranked 1st only in Northwest, though the lowest Professional, Scientific & Technical Services ranking was 4th in Southwest, while Arts, Entertainment & Recreation wasn't 1st in any region, and fell as low as 9th in Central (see Table 2).

Reflecting the expansion of corporate headquarters, Management of Companies held the top or second spots in Northeast, Northwest, Southeast and Southwest regions, but was 7th statewide. This is because the overall Management of Companies footprint outside of the Twin Cities is relatively small, with only about 9,200 jobs in Greater Minnesota, which was only 11% of sector jobs in the state in 2022.

The opposite is true for the Mining sector. While it is expected to be the fastest growing sector in the Twin Cities Metro, it only accounted for 650 jobs in the region in 2022, or about 11.6% of the statewide total. Instead, over 70% of Mining jobs are located in Northeast Minnesota, where the sector is expected to grow roughly in line with the regional average rate of 3.3%. Finally, underlining the diversity of the sector by geography, Mining is projected to be the only sector to see a decline in Central, though that would be a loss of fewer than 5 jobs. Small sectors and industries like this are more likely to show larger percent gains or losses, but still reflect relatively small absolute employment changes.

At the bottom end of the projected change spectrum by region, there is slightly more agreement. Retail Trade is projected to be the fastest declining sector in five out of six regions and the slowest growing in Central. This trend of sluggish Retail Trade growth echoes the growing influence of e-commerce and automation on the sector, as there is less emphasis on brick-and-mortar locations and employers manage with fewer employees (i.e. Cashiers). Utilities is also commonly projected to be one of the slowest growing sectors in several regions, and did not rank higher than 17th out of 20 in any region.

Other than Retail Trade and Mining, the only other sectors to rank lowest in projected percent change were Agriculture, Forestry, Fishing & Hunting in Northeast and Information in Southeast and Southwest. Agriculture, Forestry, Fishing & Hunting is a relatively small sector in Northeast Minnesota and a forecasted decline of fewer than 100 jobs in Forestry & Logging is mostly responsible for the projected 7.2% decline.

Likewise, Information is a sector that has seen long-term employment declines across much of the state over the past two decades. However, it's high concentration in the Twin Cities Metro (75% of statewide jobs), means that any growth there will likely outweigh declines in other regions where Information has a much smaller share of total employment. As a result, only Mining rankings varied more across regions.

Beyond industries, occupational projections also provide a critical glimpse into the future workforce needs of each region. By analyzing trends in employment, growth rates, labor force exits and transfer openings at the occupational level, these projections can help workforce development professionals and local educational institutions align programs with anticipated labor market demands.

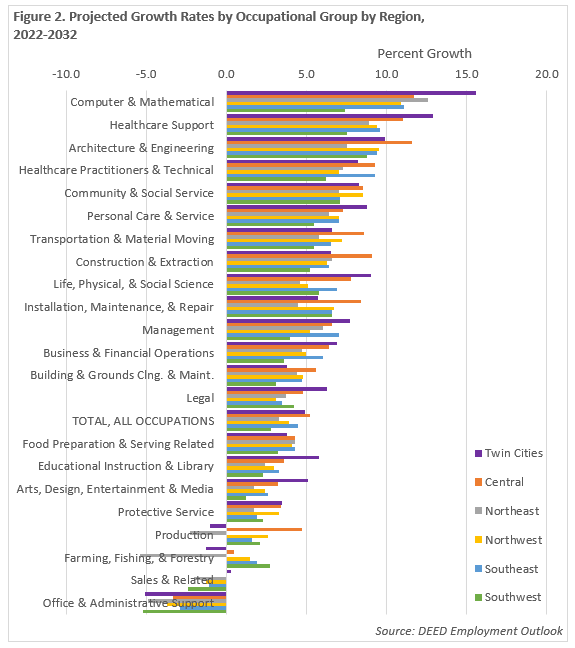

Like industries, several occupational groups are expected to see above average growth across all regions over the decade. Most notably, Computer & Mathematical occupations are projected to add thousands of new jobs in the state, and ranked first in five of the six planning regions, with the exception being Southwest where it ranks as the third-fastest group. However, over 85% of these jobs are currently employed in the Twin Cities metro area, and nearly 90% of the projected growth through 2032 is expected to be located there as well.

Similarly, Healthcare Support and Healthcare Practitioners will see rapid growth across all regions. Ranking as the second fastest growing group in four of the six regions and third fastest in the other two, Healthcare Support occupations including jobs like Home Health and Personal Care Aides, Nursing Assistants, Medical Assistants and Dental Assistants are projected to experience significant hiring demand over the next 10 years. Healthcare Practitioners rank among the top six fastest growing occupation groups in all six regions, covering jobs including Registered Nurses (RNs), Licensed Practical Nurses (LPNs), Pharmacists, Nurse Practitioners and Dental Hygienists. These jobs are more spread across the state, with the Twin Cities having around 58% of total employment in the state; and with Greater Minnesota expected to account for around 40% of total job growth through 2032.

Other occupational groups that are projected to enjoy well above average growth in every region include Architecture & Engineering, Community & Social Service, Personal Care & Service, Transportation & Material Moving and Construction & Extraction. In contrast, only a couple occupational groups are expected to decline across the state, with the biggest losses forecasted for Office & Administrative Support occupations, such as Secretaries & Administrative Assistants, Customer Service Representatives, Office Clerks, Bookkeeping Clerks and Bank Tellers, among others. Sales & Related is the other group expecting to suffer notable cuts, especially for Cashiers, Retail Salespersons and Telemarketers. Some regions may also see reductions for Production and Farming, Fishing & Forestry occupations (see Figure 2).

Projected to be the fastest growing region overall, Central Minnesota is expected to see swift growth in several occupational groups, led by Computer & Mathematical, Architectural & Engineering, Healthcare Practitioners & Technical and Construction & Extraction. The largest number of new jobs are projected in Transportation & Warehousing, Healthcare Support, Construction & Extraction and Healthcare Practitioners & Technical occupations. At a more detailed level, the jobs with the most new projected positions include General & Operations Managers, Construction Laborers, Registered Nurses, Restaurant Cooks and Fast Food & Counter Workers.

As noted above, two-thirds of new job growth in the state is projected to occur in the Twin Cities metro area. This will lead to rapidly rising demand for Computer & Mathematical, Healthcare Support, Architecture & Engineering and Personal Care & Service occupations. Four occupational groups are projected to add more than 11,500 net new jobs each through 2032: Healthcare Support, Computer & Mathematical, Management and Business & Financial Operations. The largest number of jobs will be gained for Software Developers, General & Operations Managers, Market Research Analysts & Marketing Specialists, Industrial Engineers, Financial Managers, Management Analysts and Registered Nurses.

At 4.5%, Southeast is projected to be the third-fastest growing region in the state through 2032. But at 11.1%, Computer & Mathematical occupations are expected to expand more than twice as fast in the region, and three other occupational groups are also projected to grow more than 9.0%: Healthcare Support, Architecture & Engineering, and Healthcare Practitioners & Technical occupations. Well known for its high concentration of employment in Health Care, the largest number of new jobs is projected in Healthcare Practitioners and Healthcare Support, followed by Transportation & Material Moving and Management occupations. This includes Nurse Practitioners, Registered Nurses, Physician Assistants, Medical Assistants and General & Operations Managers.

Computer & Mathematical occupations are expected to pace gains in Northwest Minnesota, followed by strong growth in Architecture & Engineering and Healthcare Support occupations. Just five of the 22 major occupational groups are projected to account for well over half of the new job growth in the region over the decade: Transportation & Material Moving, Healthcare Support, Healthcare Practitioners, Management and Construction & Extraction. Demand is high for high-turnover occupations like Stockers & Order Fillers, Restaurant Cooks, Construction Laborers, Freight, Stock & Material Movers and Heavy & Tractor-Trailer Truck Drivers.

Growth is more measured in Northeast, with a 3.3% growth rate leading to an estimate of just over 5,000 net new jobs. At 12.6%, Computer & Mathematical occupations are the fastest growing group, though that growth would equate to only about 300 net new jobs, accounting for less than 6% of total job growth in the region. In contrast, Healthcare Practitioners and Healthcare Support occupations are expected to account for about one-third of total job gains. This includes Registered Nurses, Nurse Practitioners, Medical & Health Services Managers, Substance Abuse & Mental Health Counselors and Medical Assistants.

Finally, Southwest is expected to be the slowest growing region at 2.8%, which would be almost 5,700 new jobs. Architecture & Engineering, Healthcare Support, Computer & Mathematical, Community & Social Service and Installation, Maintenance & Repair occupations are projected to be the fastest growing in Southwest; but Transportation & Material Moving will likely add the most net new jobs. One in every four new jobs is expected to be added in Healthcare Support or Healthcare Practitioners.

These projections not only highlight growth trends but also reveal opportunities in occupations with significant openings due to retirements or career changes. In fact, new jobs are the smallest slice of total openings, with Labor Force Exits and Occupational Transfers accounting for about 96% of projected total openings in the state.

At a regional level, new jobs are projected to make up 4.3% of total hires in both the Twin Cities and Central Minnesota, and only 2.4% of total hires in Northeast Minnesota. This reflects both the slower projected growth, and also each region's labor force demographics. With a larger portion of the workforce in the oldest age groups, Northeast Minnesota has the highest projected incidence of Labor Force Exits, followed closely by Southwest (see Table 3).

| Table 3. Employment Projections, Components of Total Hires by Region, 2022-2032 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Region | Projected

Employment, 2032 |

New Jobs,

2022-2032 |

Percent

of Total Hires |

Labor Force

Exits, 2022-2032 |

Percent

of Total Hires |

Occupational

Transfers, 2022-2032 |

Percent

of Total Hires |

Total Hires,

2022-2032 |

| Twin Cities | 2,022,157 | +94,877 | 4.3% | +921,025 | 42.2% | +1,165,418 | 53.4% | +2,181,320 |

| Central | 332,231 | +16,302 | 4.3% | +160,516 | 42.8% | +198,606 | 52.9% | +375,424 |

| Southeast | 283,255 | +12,280 | 4.0% | +134,631 | 43.4% | +163,022 | 52.6% | +309,933 |

| Northwest | 275,647 | +10,326 | 3.3% | +135,428 | 43.3% | +166,881 | 53.4% | +312,635 |

| Northeast | 207,878 | +5,664 | 2.4% | +102,272 | 43.8% | +125,638 | 53.8% | +233,574 |

| Southwest | 159,102 | +5,157 | 2.9% | +77,963 | 43.7% | +95,406 | 53.4% | +178,526 |

| Minnesota | 3,280,273 | +144,592 | 4.0% | +1,531,700 | 42.7% | +1,913,823 | 53.3% | +3,590,115 |

| Source: DEED Employment Projections | ||||||||

Table 3 clearly shows that demand to fill existing jobs far outpaces new job growth and will require hundreds of thousands of workers to continue their career progression. This demand stems largely from the natural dynamics of the labor market, including retirements, career transitions and individuals exiting the workforce for personal reasons. As a result, maintaining the existing workforce infrastructure will require not only a consistent influx of new workers but also significant efforts to upskill and reskill current employees to meet evolving industry needs.

This trend underscores the importance of investing in education, training programs and career development pathways that align with both current market demands and future economic shifts. It also reflects broader societal challenges, such as ensuring equitable access to training opportunities and addressing regional disparities in workforce readiness. Ultimately, this ongoing cycle of filling existing roles serves as a reminder that sustaining economic stability is as much about maintaining the present workforce as it is about innovating for the future.

Minnesota's employment projections present a wide range of opportunities and challenges, shaped by regional economic characteristics and demographic trends. Regions like the Twin Cities Metro and Central Minnesota are poised for significant growth, driven by their dynamic industry bases and younger populations. In contrast, slower growth in Northeast and Southwest Minnesota reflects an aging workforce and slower economic recovery, though these regions still show potential in emerging and locally significant industries.

Addressing labor force exits remains critical across the state. These exits, coupled with occupational transfers, account for the vast majority of job openings, underscoring the importance of preparing the next generation of workers. Through focused training programs, education investments and regional economic development, Minnesota can continue to adapt to its evolving labor market and sustain growth across all regions.