by Nick Dobbins

July 2020

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.

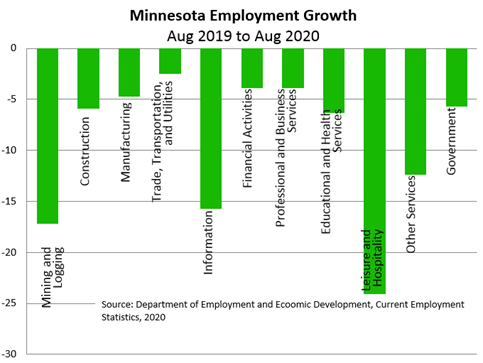

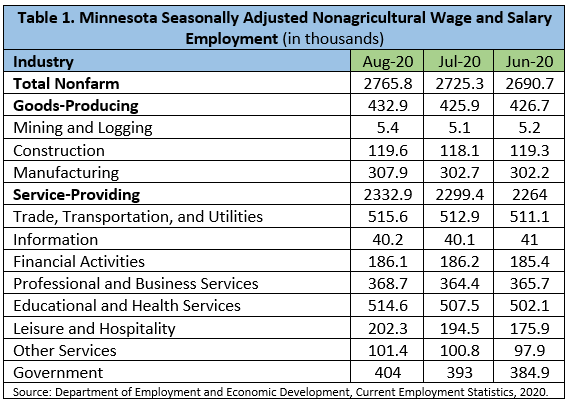

Total nonfarm employment was up by 32,500 in July on a seasonally adjusted basis. Service providers drove most of the growth, adding 32,100 jobs, while their counterparts in goods production added 400 jobs. Over the year employment in the state was down by 256,062 (8.5%), an improvement over June’s 9.4% decrease. Service providers lost 226,227 jobs (9%) while goods producers lost 29,835 (6.2%).

Employment in Mining and Logging was down by 100 (1.9%) in July. The supersector has not seen a seasonally-adjusted monthly increase since January. Over the year Mining and Logging employment was down by 1,429 (20.6%), slightly worse growth than June’s 19.9% decrease.

Construction employment was off by 400 (0.3%) in July on a seasonally adjusted basis. This was the second consecutive month of declines for the supersector, which lost 2,200 jobs in June. Over the year Construction employers lost 8,336 jobs (5.9%). All three published component sectors saw negative growth, led by Heavy and Civil Engineering Construction, which was down by 6,260 jobs or 6.9%.

Employment in Manufacturing was up by 900 (0.3%) in July. The addition of 1,400 jobs (1.3%) in Non-Durable Goods Manufacturing more than offset the loss of 500 jobs (0.3%) in their Durable Goods counterparts. Annually the supersector lost 20,070 jobs (6.1%), maintaining June’s over-the-year job loss. Durable Goods manufacturers lost 15,616 jobs (7.4%), and Non-Durable Goods manufacturers lost 4,454 (3.8%).

Trade, Transportation, and Utilities added 2,300 jobs in July (0.5%). It was the third consecutive month of seasonally adjusted growth for the supersector. Retail Trade was up 1,200 (0.4%), and Transportation, Warehousing, and Utilities added 3,000 (3%), while Wholesale Trade employers shed 1,900 jobs (1.5%). Over the year, Trade, Transportation, and Utilities lost 15,709 jobs (3%). Despite the loss, it was the best proportional over-the-year growth of any supersector in the state, buoyed by the relatively modest 0.6% decline in Retail Trade, which marks a significant improvement over April’s 11.5% decline.

Employment in Information was down by 900 (2.2%) in July. Over the year Information employers lost 7,398 jobs (15.6%). While much of the loss can likely be attributed to fallout from the ongoing pandemic, employment in the supersector has also been on a steady decline for more than a decade.

Financial Activities employment was up by 1,000 (0.5%) in July, as both component sectors posted positive monthly growth. Real Estate and Rental and Leasing added 700 jobs (2.4%) while Finance and Insurance added 300 (0.2%). Annually Financial Activities employers lost 7,616 jobs (3.9%). Finance and Insurance was down 1,559 (1%), and Real Estate and Rental and Leasing was off by 6,057 (16.4%).

Professional and Business Services lost 900 jobs (0.2%) in July, with all of those losses coming in Professional, Scientific, and Technical Services (down 2,700 or 1.7%). Management of Companies was up 1,200 (1.4%), and Administrative and Support and Waste Management and Remediation Services added 600 (0.5%). Over the year the supersector lost 18,426 jobs (4.7%), with all three major components posting similar declines. While Administrative and Support and Waste Management and Remediation Services outperformed the other two sectors, down just 3.1% (4,299 jobs), the important Employment Services component was off by 10% (5,751 jobs).

Employment in Educational and Health Services was up by 4,400 (0.9%) in July. Health Care and Social Assistance added 3,700 jobs (0.8%), and Educational Services added 600 (0.5%). On an annual basis Educational and Health Services lost 39,766 jobs (7.3%). While most of the actual losses came from Health Care and Social Assistance (down 35,504 or 7.3%), proportional declines in Educational Services were similar, as the sector was down 7.1% (4,262 jobs).

Leisure and Hospitality employment was up 17,200 (9.8%) in July. It was the largest proportional monthly growth from the supersector that has been the hardest hit by effects of the ongoing pandemic. Arts, Entertainment, and Recreation was up by 4,900 (20.4%), and Accommodation and Food Services was up 12,300 (8.1%). Leisure and Hospitality still posted the worst over-the-year job loss, down by 29.2% (86,132) from July of 2019, although that is a marked improvement from June’s 34.8% loss. Arts, Entertainment, and Recreation was down 21,875 (39.7%) while Accommodation and Food Services was off by 64,257 (26.7%).

Other Services employment was up by 2,800 (2.9%) in July. The increase followed growth of 12.1% in June and 6.1% in May as employment continued to move back towards pre-pandemic levels. Over the year the supersector lost 15,527 jobs (13.3%). While all three component sectors shed jobs, the largest declines in both real and proportional terms continued to be in Personal and Laundry Services, which was down by 9,416 jobs or 32.5%.

Government employers added 6,200 jobs (1.6%) in July. All three levels of government posted positive monthly growth. Local government led the way in both real and proportional terms, adding 4,800 jobs or 1.9%. Annually Government employers lost 35,653 jobs (8.8%). Most of those declines came at the local level, where employers shed 32,885 jobs or 11.8%. Federal Government employers actually added jobs on the year, up 567 or 1.8%.