by Dave Senf

December 2019

Note: All data except for Minnesota’s PMI have been seasonally adjusted. See the feature article in the Minnesota Employment Review, May 2010, for more information on the Minnesota Index.

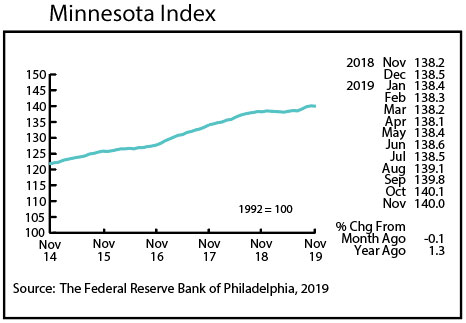

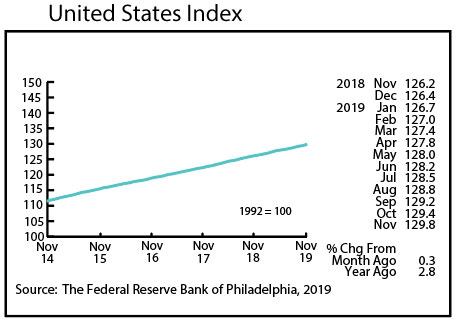

The Minnesota Index, after climbing over the previous three months, slipped slightly in November, declining 0.1 percent. November’s retreat was the result of an uptick in the unemployment rate, a decline in average weekly manufacturing hours, and a dip in wage and salary employment. The U.S. index increased 0.3 percent for the second time in three months. Minnesota’s index, after outpacing the U.S. index from August through October, lagged the national index in November.

November’s reading was 1.3 percent higher than a year ago, while the U.S. annual gain was 2.8 percent. Economic activity slowed in Minnesota in November after three months of solid growth. Minnesota was one of 10 states reporting a decline in their index in November.

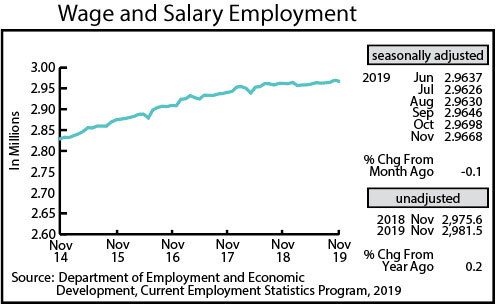

Adjusted Wage and Salary Employment dropped by 3,000 jobs in November, and October’s job expansion was revised down by 2,200 jobs. All of the job loss was in the private sector with job cutbacks the highest in Construction, Manufacturing, and Educational and Health Services. The Construction workforce drop was the largest in 20 months while the Manufacturing job cutbacks were the highest in over 10 years. Strong hiring in Leisure and Hospitality only partially offset job losses in the other sectors.

Over-the-year job growth for the state, using unadjusted job numbers, fell to 0.2 percent in November while the U.S. job gain was 1.6 percent. Through the first 11 months of the year Minnesota’s over-the-year job growth averages out to 0.3 while the U.S. job growth averages out to 1.6 percent.

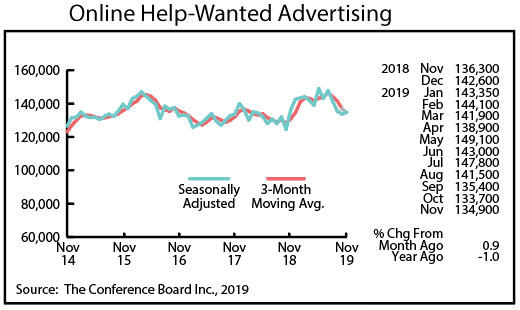

After declining for three months in a row, Online Help-Wanted Ads ticked up slightly in November, increasing 0.9 percent while national job postings rose 2.3 percent. Minnesota’s share of nationwide online job postings remained at 2.6 percent which still tops the 2.0 percent share of national wage and salary employment that Minnesota holds. Labor demand has continued to remain solid based on online help-wanted ad levels.

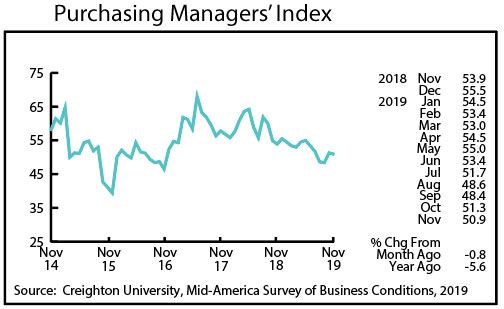

Minnesota’s Purchasing Managers’ Index (PMI), after a slight uptick in October, dipped in November to 50.9. The index has slipped in five of the last six months. The other two comparable indices also declined with the Mid-America Business Index retreating to 48.6 and the Institute of Supply Management’s national PMI dropping to 48.1. Manufacturing in Minnesota and nationally continue to face slow global growth and trade war headwinds.

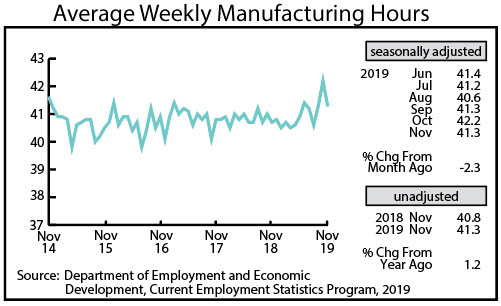

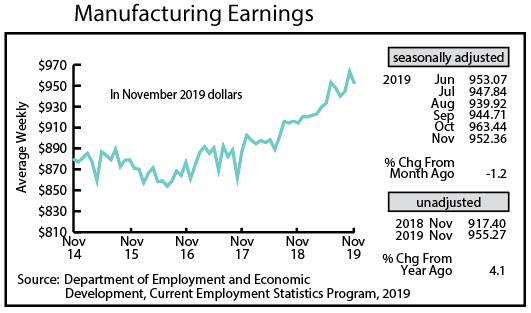

Adjusted average weekly Manufacturing Hours, after spiking the previous two months, stumbled in November, dropping to 41.3 hours. The shorter factory workweek was more in tune with the low PMI index. Average weekly Manufacturing Earnings, adjusted for inflation and seasonality, also fell in November. Factory paychecks shrank by 1.2 percent from October’s record-high to $952.36. Real Manufacturing earnings, adjusted for inflation and seasonally, were still up a very strong 4.2 percent from last November.

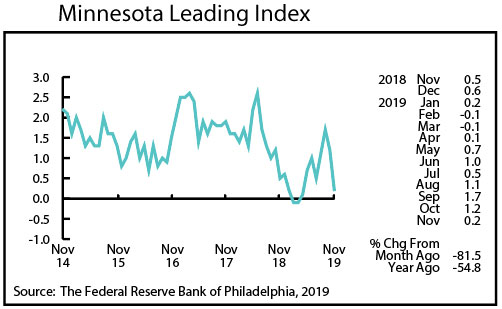

The Minnesota Leading Index retreated significantly in November, falling to 0.2. The 37-year monthly average is 1.4, so November’s reading suggest that Minnesota’s economic growth over the next six months will fall way below the long-term average. The state’s leading index for November ranked 40th among the states, just below Alaska and slightly ahead of Iowa. Once again the big question is whether Minnesota’s labor shortage is restricting how fast Minnesota’s economy can expand or are other factors involved.

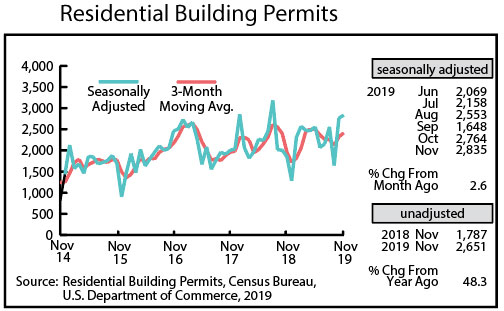

Residential Building Permits, after surging in October, inched up to 2,835 in November. That is the highest level since August 2018 and 34 percent higher than the long-term monthly average of 2,114. Minnesota home building permits accounted for 2.5 percent of all U.S. home building permits issued in November compared to the 2.2 percent level through the first 11 months of the year.

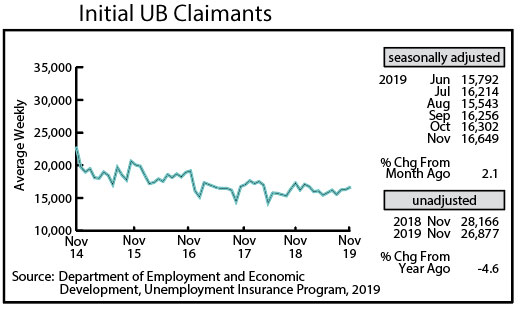

Seasonally Adjusted Initial Claims for Unemployment Benefits (UB) rose for the third straight month to 16,649. November’s claims level was the highest since February but remain very low historically. Another record-low initial claim level will be set in 2019 after adjusting for employment size. Monthly initial claims have averaged 20,995 a month since 1970, but wage and salary employment has increased from 1.3 million in 1970 to 2.9 million in 2019. After adjusting for employment, monthly initial claims have averaged 977 initial claims per 100,000 jobs since 1970. The average for 2019 will be roughly 547 claims per 100,000 jobs or 44 percent below the 49-year average. This will be the third year in a row in which initial claims have set a record low.