by Nick Dobbins

May 2021

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.

| (In Thousands) | |||

|---|---|---|---|

| Industry | Apr-21 | Mar-21 | Feb-21 |

| Total Nonfarm | 2815.3 | 2804 | 2783.6 |

| Goods-Producing | 442.2 | 440.9 | 430.8 |

| Mining and Logging | 6.3 | 6.2 | 6.2 |

| Construction | 126.6 | 125.5 | 117 |

| Manufacturing | 309.3 | 309.2 | 307.6 |

| Service-Providing | 2373.1 | 2363.1 | 2352.8 |

| Trade, Transportation, and Utilities | 511.2 | 508.7 | 505.2 |

| Information | 40 | 40.2 | 40.3 |

| Financial Activities | 192.1 | 193.3 | 194.1 |

| Professional and Business Services | 365.3 | 360.5 | 355.7 |

| Educational and Health Services | 536.3 | 539.3 | 540.8 |

| Leisure and Hospitality | 217.5 | 214.4 | 210 |

| Other Services | 101.7 | 100.9 | 100.4 |

| Government | 409 | 405.8 | 406.3 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2021. | |||

Employment in Minnesota was up by 11,300, or 0.4% in April on a seasonally adjusted basis. Service providers added 10,000 jobs (0.4%) while goods producers added 1,300 jobs (0.4%).

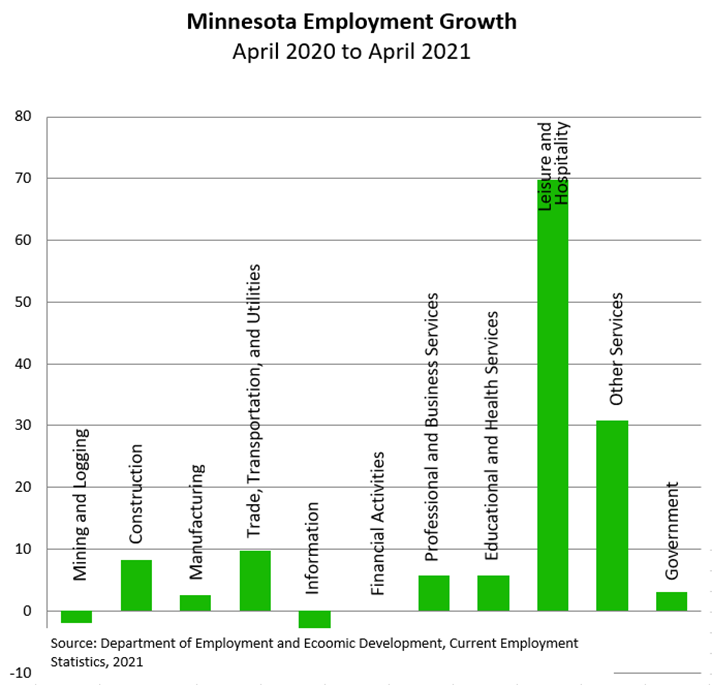

On an annual basis employers in the state added 230,463 jobs (9%), after being down 5.8% in March. The sudden flip from negative to positive growth was caused by our being exactly one year out from the earliest and lowest point of the COVID-19-related declines in the market. Because over-the-year marks for the next year will be comparisons to a uniquely pandemic-weakened labor market, analysis of annual growth will require more nuance than usual.

Employment in Mining and Logging was up 1.6% or 100 jobs in April, on a seasonally adjusted basis. Employment settled at 6,300 total jobs, matching its highest level since March of 2020.

Annually employment in the supersector was down 118 jobs or 1.9%. It was one of only two supersectors to post negative over-the-year growth exactly one year out from the worst effects of the COVID-19 virus on the labor market. However, the immediate effects of the pandemic were less severe in Mining and Logging in April 2020 than they were for most of the market, with the larger employment declines coming in May of 2020.

Construction employment was up 1,100 or 0.9% in April after posting 7.3% over-the-month growth in March.

Over the year the supersector added 9,073 jobs, or 8.3%. It was also the only supersector in the state where April 2021 employment exceeded pre-COVID-19 employment from March 2020. However, since weather can play a large role in spring employment growth in Construction, it's likely too soon to say the supersector has fully recovered.

Employment in Manufacturing was mostly flat in April as the supersector added 100 jobs or 0.0%. Durable Goods Manufacturing was up by 800 (0.4%), but that growth was tempered by the loss of 700 jobs (0.6%) in Non-Durable Goods Manufacturing.

On an annual basis Minnesota manufacturers added 7,739 jobs or 2.6%. Non-Durable Goods drove most of the growth, adding 5,519 jobs (5.3%), while their counterparts in Durable Goods Manufacturing added 2,220 jobs (1.1%).

Trade, Transportation, and Utilities employment was up by 0.5% or 2,500 jobs in April. The growth came entirely in Retail Trade, which was up 2,600 jobs or 0.9%. Wholesale Trade lost 100 jobs (0.1%), and Transportation, Warehousing, and Utilities employment was flat.

On an annual basis the supersector added 44,909 jobs (9.8%), slightly outpacing the state's overall growth of 9%. Retail Trade was the primary driver of the growth, adding 41,782 jobs (17.7%) over the year. Wholesale Trade added 2,419 jobs (2%), and Transportation, Warehousing and Utilities employment was up 708 (0.7%).

Information employment was down 200 or 0.5% over the month in April.

Over the year the supersector lost 1,932 jobs or 4.6%. It was one of only two supersectors to lose jobs on the year, and unlike Mining and Logging, is unlikely to see improvement on that number in May as it showed immediate employment declines when COVID-19 first hit in April 2020. The negative over-the-year growth in this supersector is more likely from struggles that long predate the recent pandemic.

Employment in Financial Activities was down 1,200 (0.6%) over the month in April as both component sectors lost jobs.

Over the year the supersector added just 81 jobs (0%). The relatively small growth is not entirely surprising, as employment in Financial Activities was less impacted by the onset of COVID-19 one year ago than many other industry groups, reaching a low over-the-year change of -1.5% in June of 2020.

Professional and Business Services employment was up 4,800 (1.3%) over the month in April. Administrative and Support and Waste Management and Remediation Services added 3,300 jobs (2.7%), and Professional, Scientific, and Technical Services added 1,700 (1.1%), while Management of Companies and Enterprises lost 200 jobs (0.2%).

Over the year the supersector added 19,603 jobs (5.7%). Administrative and Support and Waste Management and Remediation Services added 14,779 jobs (13.9%) buoyed by the addition of 8,683 jobs (20.6%) in Employment Services. Professional, Scientific, and Technical Services added 4,220 jobs (2.8%), and Management of Companies and Enterprises added 604 jobs (0.7%).

Employment in Educational and Health Services was down 3,000 (0.6%) in April, with 0.6% declines in both component sectors as Health Care and Social Assistance lost 2,600 jobs, and Educational Services lost 400.

Over the year the supersector added 28,988 jobs (5.7%). Educational Services employment was up 11.1% (7,416 jobs), while Health Care and Social Assistance added 4.9% (21,572 jobs).

Leisure and Hospitality employment was up by 1.4% (3,100 jobs) in April. It was the largest proportional increase of any supersector in the state on the month, which is likely at least in part from employment in this supersector being hit hardest by the COVID-19 fallout and as such has the most ground to make up in recovery.

Over the year the supersector added 85,731 jobs or 69.8%, also the largest yearly growth in the state. Employment in the supersector is still over 50,000 less than it was in pre-COVID-19 early-2020, suggesting there is still a lot of ground left to recover.

Other Services employment was up by 800 (0.8%) in April, after having added 500 jobs in March.

On the year the supersector added 23,965 jobs or 30.8%. Like Leisure and Hospitality, it dramatically outpaced overall employment growth since April 2020 because it lost so many jobs as part of the reaction to the COVID-19 crisis. Likewise, it also has more room to grow before it reaches pre-COVID-19 levels, as employment is still more than 10,000 lower than it was in March of 2020.

Employment in Government was up 3,200 (0.8%) in April. All that growth came from Local Government employers, who added 3,400 jobs (1.2%). Both State and Federal level employers lost 100 jobs (0.1% and 0.3%, respectively).

Over the year Government employers added 12,423 jobs or 3.1%. State Government lost 2,337 jobs (2.3%), while Local employers added 14,682 jobs (5.5%), and Federal employers added 78 jobs (0.3%).