by Oriane Casale and Luke Greiner

December 2022

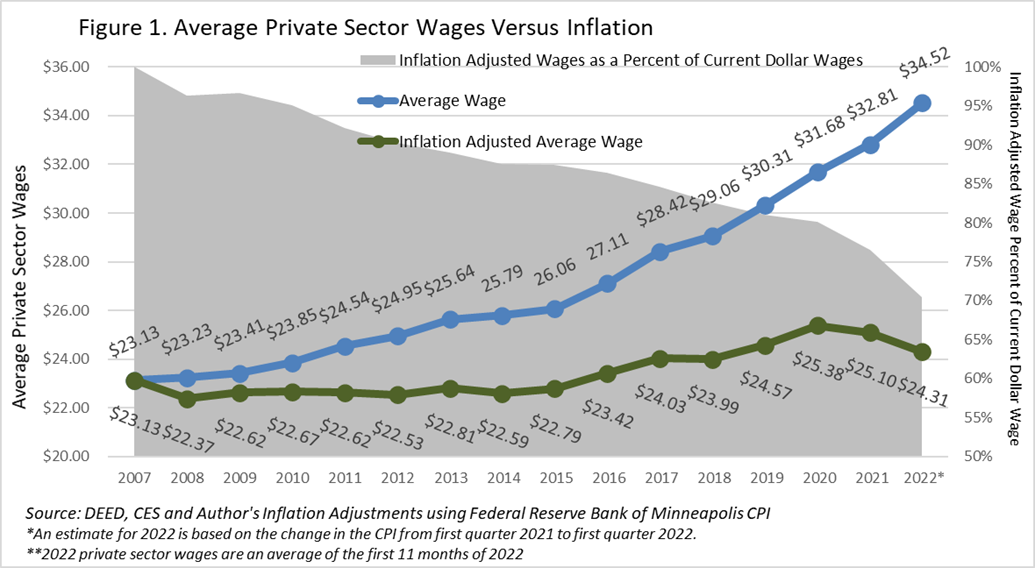

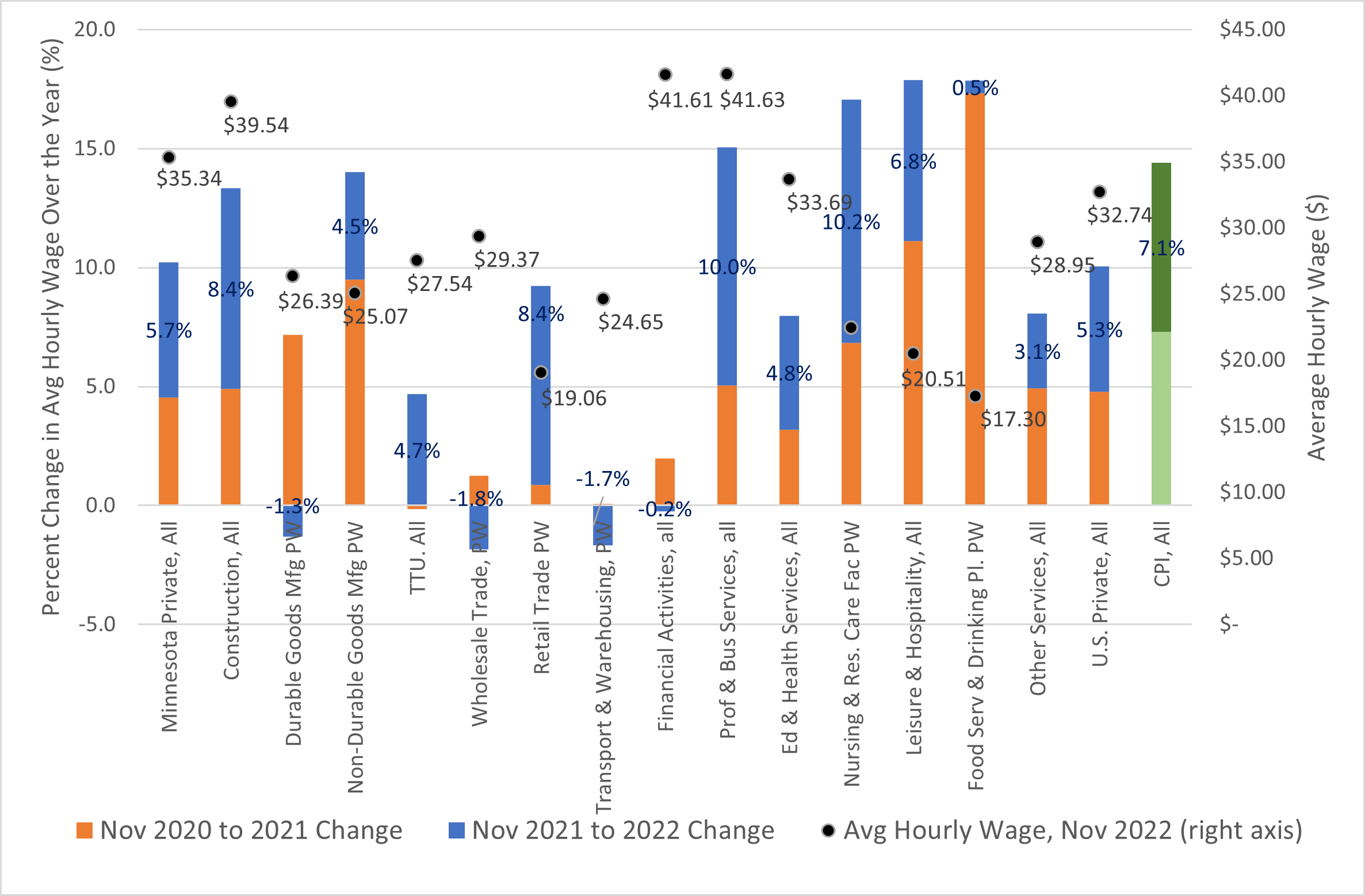

Total private sector wages have been increasing faster than at any time in the history of the Current Employment Statistics (CES) data series going back to 2006. Over-the-year in November 2022, they increased 5.7% in Minnesota. Despite this, they are falling short of inflation, which increased 7.1% nationwide (CPI, all consumers, U.S.) over the same period.

While inflation growth is beginning to show signs of slowing, wage growth, both in Minnesota and nationwide, has continued ramping up over the last few months. Moreover, wages are growing at an even faster clip in some industry sectors, particularly those struggling to build back staffing levels after the Pandemic Recession. This article reviews wage growth in Minnesota and the U.S. with comparisons between industries and across states, where available.

With an average hourly private sector wage of $32.81 in 2021, Minnesota ranked eighth highest among the states (excluding Washington DC) for four of the last five years, 2021, 2020, 2018 and 2017. This ranking is up from a fairly consistent 10th place between 2007 and 2015. We've moved into eighth place by pulling ahead of Colorado, Arkansas, Utah, Virginia, and Hawaii, all of which placed in 8th, 9th or 10th place at some point between 2007 and 2016.

Minnesota has seen very high wage growth, at 5.7% over the year in November 2022. But even with that high wage growth, we ranked only 24th fastest among the states in November. Over two years, November 2020 to November 2022, our wage growth was 10.2%, putting us in 26th place among the states for strongest wage growth over the period.

Minnesota's wage growth fell short of inflation growth over the last two years, which was at 7.1% in November 2022 over the year, down from 9.1% in June 2022. Over two years, 2020 to 2022, inflation was 14.4% in November, the highest it's been since the early 1980s.

Unlike many economic theories and concepts, both wages and inflation make a very big and immediate difference at the household level. Items that are purchased weekly like gas and groceries or monthly like rent or utilities are a constant reminder of how far paychecks stretch as costs rise.

In the last five years inflation has pushed prices 20% higher while overall average private sector wages inched forward 21% resulting in only 1% growth in real wages since 2017. However, the past two years has reversed a 15-year upward trend in real wage growth with the most recent year showing the largest decline in real wage growth. Real wage decline in 2021 and 2022 pushed wages down to 2018 levels after adjusting for inflation. With continued high inflation heading into 2023 it's possible that we'll see continued loss in workers' real wages as illustrated by the inflation adjusted average wage on Figure 1.

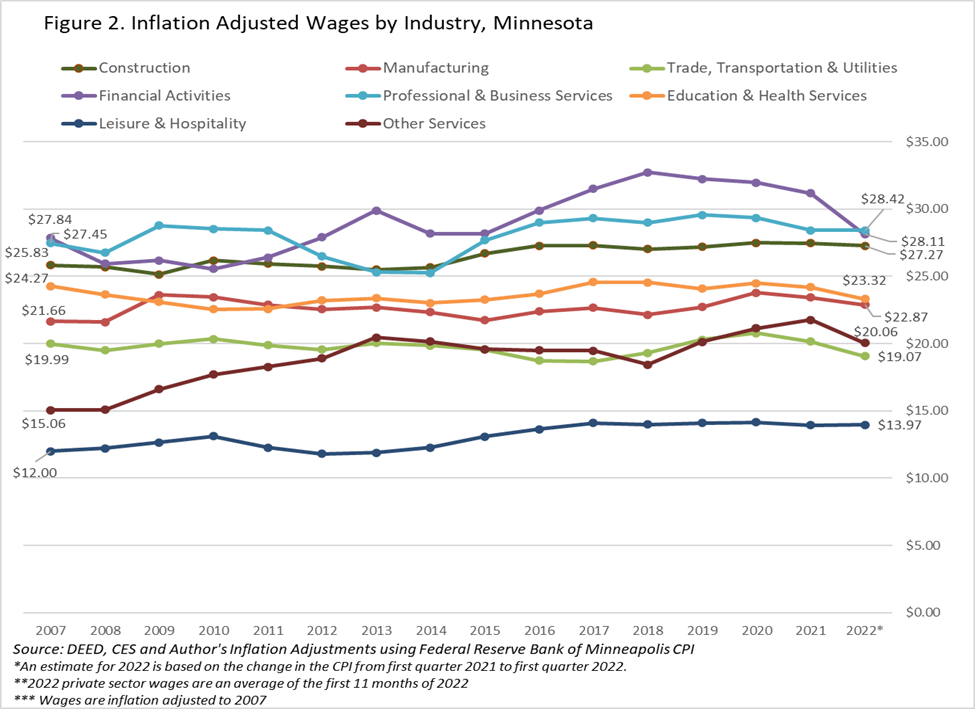

Not all sectors in Minnesota are seeing the same growth in wages, with some sectors keeping up with inflation and most lagging far behind. Figure 2 displays most of the industry sectors that we track in Minnesota in the national Current Employment Statistics (CES) survey. Not all states track the same industries so rankings are not available for all of these industries, but are provided where available.

Annual data illustrates how real wages for most industry sectors had been growing and outpacing inflation for the past 15 years. Financial Activities had the highest average real wage growth during the previous decade before beginning to fall in 2019 and eventually sliding below the Professional & Business Services sector in 2022. The wages in Figure 2 are inflation adjusted to 2007. This graph shows how workers in most sectors have made small gains over the years with the largest real wage growth occurring in the lower paying Leisure & Hospitality and Other Services sectors. While employers have been ramping up wages for years, workers have barely experienced enough increase to outpace inflation.

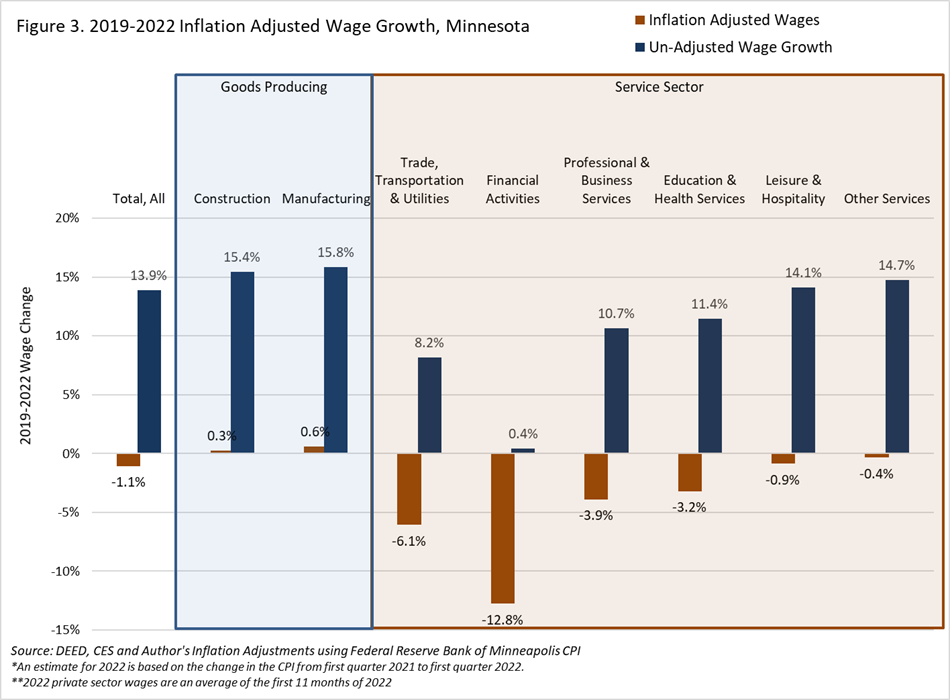

Figure 3 focuses on wage growth from 2019-2022 because this tumultuous period saw the fastest unadjusted wage growth and inflation. Two major industry sectors, both goods producing, managed to increase average wages faster than inflation from 2019-2022: Construction and Manufacturing. Even for those industries that managed real wage growth over the period, it was meager, with each growing less than 1%. The largest decline in real wage growth occurred in the Financial Services sector, down almost 13% in the past three years. Trade Transportation & Utilities also saw a substantial 6.1% decline.

In November, wage growth in Construction, all workers, was beating inflation at 8.4% over the year. The average hourly wage in this industry for all workers, including management and supervisory staff, was $39.54 per hour. Construction wage growth was somewhat slower in 2021 but picked up in the spring of 2022, peaking at 11% over-the-year growth in October. Among the 43 states with monthly estimates for this industry, Minnesota's growth ranked 12th. Despite this strong wage growth, Construction has been struggling to add jobs in Minnesota. Over the year, Construction is one of just two industries to see a decline, losing almost 600 jobs or 0.5% of employment in November.

Overall, Minnesota's Manufacturing sector pays an average hourly wage of $25.85 for production workers (nonmanagerial/supervisory), ranking 14th highest. Wages were up 8.6% over two years in November, ranking us in 30th place for wage growth, but less than 1% in November over the year, pushing Minnesota's ranking down to 42nd among the states by this measure.

Wages have been growing faster in Non-Durable Goods than in Durable Goods Manufacturing since spring 2021. Some of this strong wage growth in Non-Durable Goods may be related to the difficulty of recruiting and retaining workers in this sector, which was hit hard by COVID-19 infections prior to vaccinations being widely available in 2020 and early 2021. Durable Goods has the advantage of have a higher average hourly wage than Non-Durable Goods. Over the year in November, employment in both Durable and Non-Durable Goods grew at a fast clip, with Non-Durable Goods up 4% and Durable Goods up 5.2% over the year, both surpassing national job growth in Manufacturing, which was at 3.3%.

In Non-Durable Goods Manufacturing, average hourly wages, at $25.07 for production workers in November, rose 4.5%, the slowest growth this year for this sector in Minnesota. But over two years wages were up 14%, hovering just below inflation. Compared to other states, Minnesota's Non-Durable Manufacturing wage growth ranked 18th of 33 states over the year in November 2022 and 13th over two years.

Durable Goods Manufacturing saw average hourly wages, at $26.39 for production workers in November, stall out and then decline over the last three months. In November 2022, wages were down 1.3%, or 35 cents an hour from November 2021, putting Minnesota in 35th place among the 38 states that publish this measure. Over two years, they were up 5.9%, providing a slightly better ranking at 29th.

Trade, Transportation & Utilities is a diverse sector with a range of wage growth trajectories. Wholesale Trade average hourly wages for production workers, at $29.37 per hour in November, were down 1.8% over the year and 0.6% over two years. The sector did see over-the-year wage growth during the first 5 months of the year but has since seen flat or declining wages. Part of the reason for the decline may be strong wage growth during the second half of 2021, with November 2021's 1.3% growth being an anomaly. Out of the 14 states that publish this measure, Minnesota ranked 12th, with only three other states showing a decline over the year and one other showing a decline over two years. Despite this, the sector continues to add jobs, up 2.3% or 2,855 jobs.

Retail Trade wages for production workers, at $19.06 in November 2022, grew at a very fast clip throughout 2021, averaging 7.2% over the year. However, growth slowed in 2022, down to only 1.8% in May. Every month since May, wage growth has ticked up, at 8.4% in November over the year, and 9.2% over two years. Among the other 13 states that report this measure, Minnesota ranked second for November over-the-year growth and eight for two-year growth.

Transportation & Warehousing has seen slow or declining growth in production worker wages since the middle of 2021, following strong growth in the first half of 2021 and an average growth rate of 4.9% over the year in 2021. At $24.65 per hour in November, production worker wages were down 1.7% over the year and down 1.6% over two years. No comparisons are available to other states, but nationwide wages grew at a very fast clip all year, up 12.1% in November. Moreover, nationwide production worker wage growth beat inflation growth all year in this industry.

Financial Activities employment has been on the decline in Minnesota for three years, down 1% in 2020 and 0.9% in 2021. It saw job declines in 5 of the last 11 months (in 2022), with November 2022 flat compared to October. Wages fell 0.2% over the year in November 2022, but over two years they increased 1.7%. Compared to 39 other states, Minnesota's Financial Activities average hourly wage ranked 10th at $41.61 in November 2022. But our negative wage growth over the year put us in 26th place in November and 24th place over two years.

Employment in Professional & Business Services grew 3% in 2021 and 6.1% in November 2022 over the year. Wages for all workers in the sector (including managerial and supervisor) increased 10% over the year in November and 1.4% over the year in 2021. Wage growth has been very strong all year in this industry, ranging from 7% to 10.3%. Minnesota's average hourly wage for all workers in the sector was $41.63 in November, ranking 8th among all states. Moreover, November over-the-year wage growth ranked 15th among all 50 states and 14th over two years in Minnesota. Unfortunately, no other wage detail on this sector is available for Minnesota, so it is not clear which industries are driving this growth.

Education & Health Services has seen over-the-year job growth since the middle of 2022 after struggling to recall and hire workers following the Pandemic Recession. Wage growth in this industry tends to be more stable than in other sectors because of union contracts and public funding sources that often don't allow for quick responses to shifting labor market conditions. The sector saw wage growth for all workers of 3.4% over the year in 2021 and 4.8% over the year in November 2022, revealing steady growth that is well below inflation. Compared to 47 other states, Minnesota's average hourly wage for all workers ranked 9th at $33.69 in November. Wage growth over the year in November ranked 23rd and 40th over two years.

In Minnesota, Ambulatory Health Care wages, at $36.32 for production workers, grew 4.4% in November over the year but fell 4.4% one year prior, and 1% on average in 2021. Employment in this industry grew 2.3% in 2021 and is on track to grow 1% over the year in 2022.

In contrast Nursing & Residential Care Facilities wages, at $22.44 per hour on average for production workers, grew 10.2% in November over the year, after growing 6.2% over the year the prior November but only 1.8% on average in 2021. Wage growth was negative through the first half of 2021, turned around during the second half of 2021, picking up speed throughout the rest of the year and remaining above 10% through November 2022. This industry had been unable to recruit and retain enough workers to show any over-the-year job growth for nearly three years, with employment down 2% in 2020 and 3.4% in 2021. In fact, the industry did not see any over-the-year job growth until September 2022 when it added 246 workers. By November, over-the-year job growth was at 2% with the addition of 1,960 workers.

Leisure & Hospitality has seen strong employment growth since April 2021 when employment started to rebound after COVID-19 vaccinations became widely available in Minnesota and pandemic restrictions were lifted. Growth in 2021 was 10.8% and remained high at 7.4% over the year in November 2022. Wages for all workers in the sector have mirrored employment trends, up 6.8% over the year in November and 10.4% over two years. Wage growth was negative until June 2021, but rose to 13% over the year in May 2022 and has since slowed somewhat. Compared to other states, Minnesota's November over-the-year job growth ranks only 33rd, and 36th over two years. At $20.51 per hour, it ranked 18th in November.

Food Service & Drinking Places saw very strong employment growth starting in April 2021, but it tapered to 3.4% by November 2022. Wage growth mirrored employment growth at 0.5% over the year in November and 17.8% over two years for production workers. With these increases, average wages for production workers are now $17.30 per hour, cracking $15 per hour in May 2021 and continuing their upward trajectory through 2022. The average hourly wage measure for this industry is available in only two other states, Hawaii and Indiana. Among the three, Minnesota has the slowest wage growth, both this year and over two years in November, with a wage that falls between the two. These measures are unavailable nationally.

Other Services has seen fairly steady job growth since April 2021, now at 3.4% over the year in November. Wage growth for all employees was 3.1% over the year in November and 8.1% over two years. Among the 30 states that report wages for this sector, Minnesota's wage growth ranked 27th in November over the year and 14th over two years, with the wage, at $29.32 per hour, also coming in 18th.

Although wages have been growing at an unprecedented rate over the last three years, they have continued to fall short of inflation growth, resulting in falling real wages in many industries in Minnesota and across the county. Overall, Minnesota has high wages, ranking in the top quintile among states. But wage growth over the period has not been as strong, ranking Minnesota close to the middle of the pack, at 24th in November.

Workers in Construction and Manufacturing have made small real wage gains over the last three years while workers in all other industries have seen their real wages, after adjusting for inflation, decline since 2019. Workers in Financial Activities, Trade, Transportation & Utilities, Professional & Business Services and Education & Health Services have seen the largest drop in real wages. Over a shorter timeline, just the last two years, 2020 to 2022, workers in Construction, Professional & Business Services and Leisure & Hospitality have seen wages grow faster than inflation. If wages continue strong growth throughout 2023, they may be able to make up ground against inflation as it begins to slow.