by Nick Dobbins

November 2017

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

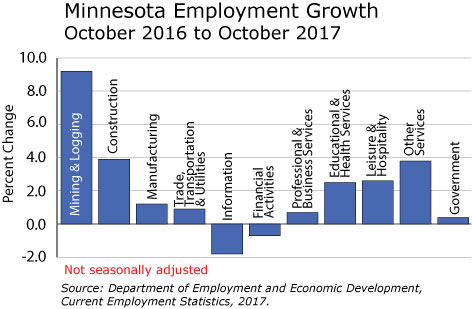

Minnesota lost 4,500 jobs (0.2 percent) in October on a seasonally adjusted basis. This continued a recent trend of alternating gains and losses - September employment was up 6,600, August was down 5,800. Losses were concentrated in the private sector, as public sector employers added 500 jobs (0.1 percent). Goods Producers were off by 0.4 percent (1,800 jobs) largely from a big decline in Construction employment, while Service Providers were off slightly, down 0.1 percent (2,700 jobs). Annually Minnesota employers added 41,372 jobs (1.4 percent), with growth spread across industry groups. Private sector employers added 39,487 jobs (1.6 percent), and public sector employers added 1,885 (0.4 percent). Goods Producers added 9,482 jobs (2.1 percent), and Service Providers added 31,890 (1.3 percent). The state has had annual employment growth of greater than 1 percent in every month since July of 2016.

Mining and Logging employment was off slightly in October on a seasonally adjusted basis, losing 100 jobs (1.4 percent). Despite the decline, the supersector has seen more months with growth than losses in 2017, including the addition of 400 jobs in March. Over the year, Mining and Logging employers added 615 jobs (9.2 percent). The supersector has had significant annual growth for every month in 2017.

Employment in the Construction industry was down sharply on the month, off by 2,300 jobs (1.9 percent). The seasonally adjusted losses may be attributable to the unseasonable fall weather, including a much wetter than usual October. This marked four consecutive months of job losses in the supersector, although the previous three months’ losses combined totaled a comparatively small 1,600. Annually Construction employers added 4,893 jobs (3.9 percent), which kept the industry well ahead of the total employment growth of 1.4 percent. Construction’s job growth came primarily from Specialty Trade Contractors which added 4,956 jobs (6.2 percent).

Employment in the Manufacturing supersector was up by 600 (0.2 percent) in October. Durable Goods Manufacturers added 500 jobs (0.2 percent), and Non-Durable Goods Manufacturers added 100 (0.1 percent). Annually Manufacturing added 3,974 jobs (1.2 percent). Durable Goods added 2,322 jobs (1.1 percent), as it continued its recent climb out of over-the-year losses with five consecutive months of job gains and two consecutive months of greater than 1 percent growth. Non-Durable Goods remained up on the year as well, adding 1,652 jobs (1.4 percent).

Trade, Transportation, and Utilities employment was down by 1,600 (0.3 percent) in October. Transportation, Warehousing, and Utilities lost 1,400 jobs (1.4 percent), while Wholesale Trade lost 800 (0.6 percent). Retail Trade had 0.2 percent growth, adding 600 jobs. Annually the supersector added 4,881 jobs (0.9 percent). Both trade components showed positive growth, with Retail adding 5,284 jobs (1.8 percent) and Wholesale adding 1,011 (0.8 percent). Transportation, Warehousing, and Utilities lost jobs, however, off by 1,414 (1.4 percent). The decline in this sector is somewhat noteworthy, as the industry group dipped into negative over-the-year growth for the first time in more than six years in September, when it was off by 0.3 percent. The over-the-year decline coincides with a large employment spike in the sector roughly a year ago.

Employment in the Information supersector was up by 400 (0.8 percent) in October. September growth was also revised up, if only slightly, from a loss of 3.3 percent to a loss of 3.1 percent. Annually Information employment was off by 904 jobs (1.8 percent). Publishing Industries (except Internet) lost 839 jobs (4.4 percent) and Telecommunications lost 184 (1.5 percent).

Financial Activities employers shed 500 jobs (0.3 percent) in October. The losses came entirely from Real Estate and Rental and Leasing (off 1.5 percent) as employment in Finance and Insurance was flat. Annually the supersector lost 1,215 jobs (0.7 percent). Finance and Insurance continued its growth, up 1,499 (1.1 percent), while Real Estate and Rental and Leasing lost 2,714 (7.7 percent). The sector continues to dig itself deeper into negative growth.

Professional and Business Services employment was largely flat in October, off by 100 jobs or 0.0 percent. Management of Companies and Enterprises added 1,100 jobs (1.4 percent), while Professional, Scientific, and Technical Services was off by 0.5 percent,and Administrative and Support and Waste Management and Remediation Services was off 0.3 percent. Annually the supersector added 2,670 jobs (0.7 percent). Professional, Scientific, and Technical Services lost 4,395 jobs (2.8 percent), which was made up for by gains of 3,022 (3.9 percent) and 4,043 (2.8 percent) in Management of Companies and Administrative and Support and Waste Management and Remediation Services, respectively. Employment Services, a component of Administrative and Support which is seen as something of a bellwether for larger employment trends, was especially noteworthy. After showing worrisome over-the-year declines for most of 2016 and early 2017, employment grew throughout the summer and reached an all-time high of 69,092 in October, an over-the-year change of 7.7 percent.

Educational and Health Services employment was off by 2,400 (0.4 percent) in October as both component sectors shed jobs. Educational Services lost 900 (1.4 percent) while Health Care and Social Assistance lost 1,500 (0.3 percent). It accounted for 18.2 percent of the state’s total employment in October. On an annual basis the supersector added 13,380 jobs (2.5 percent). It remained one of the state’s strongest areas of employment growth. The supersector's over-the-year growth came entirely from the Health Care and Social Assistance sector (up 17,936 or 3.9 percent) as Educational Services shed jobs on the year.

Leisure and Hospitality employers added 1,400 jobs (0.5 percent) in October. The growth came on the heels of two straight months of losses. It also capped an odd summer that saw the largest seasonally adjusted increase (2.1 percent in June) and decline (2.0 percent in August) in the series’ more than 20-year history, as seasonal patterns bucked traditional trends. Annually employment in Leisure and Hospitality was up by 6,776 (2.6 percent). Arts, Entertainment, and Recreation added 3,050 jobs (7.9 percent), and Accommodation and Food Services added 3,726 (1.7 percent).

Other Services employment was down by 400 (0.3 percent) in October. The supersector has alternated gains and losses every month since June. Annually Other Services added 4,417 jobs (3.8 percent). All three component sectors grew on the year, with Repair and Maintenance showing the largest proportional change (up 6.6 percent) and Religious, Grantmaking, Civic, Professional, and Similar Organizations adding the most jobs (2,456).

Government employers added 500 jobs (0.1 percent) in October, with all three levels of government growing slightly. Annually Government employers added 1,885 jobs (0.4 percent). Local Government added 2,477 jobs (0.8 percent), while State Government shed 876 jobs (0.8 percent).

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | October 2017 | September 2017 | August 2017 |

| Total Nonfarm | 2,951.0 | 2,955.5 | 2,948.9 |

| Goods-Producing | 448.5 | 450.3 | 449.6 |

| Mining and Logging | 7.0 | 7.1 | 6.9 |

| Construction | 119.1 | 121.4 | 121.7 |

| Manufacturing | 322.4 | 321.8 | 321.0 |

| Service-Providing | 2,502.5 | 2,505.2 | 2,499.3 |

| Trade, Transportation, and Utilities | 539.2 | 540.8 | 538.4 |

| Information | 50.2 | 49.8 | 51.4 |

| Financial Activities | 175.8 | 176.3 | 175.6 |

| Professional and Business Services | 378.9 | 379.0 | 376.9 |

| Educational and Health | 538.8 | 541.2 | 540.6 |

| Leisure and Hospitality | 268.3 | 266.9 | 268.4 |

| Other Services | 120.2 | 120.6 | 119.1 |

| Government | 431.1 | 430.6 | 428.9 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2017. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.