by Anthony Schaffhauser

June 2023

While Northwest Minnesota's supply of labor is constrained by an aging population, this trend has been in play since 2011 when the Baby Boomer generation began reaching the traditional retirement age of 65. The pandemic impacts on the labor force added to these labor force challenges, but as the pandemic recovery is nearly complete it is the unprecedentedly strong demand for goods and services in the Northwest that is driving extremely tight labor markets, wage growth, industry sector trends, and occupational demand.

Local Area Unemployment Statistics (LAUS) became available at the regional level in 1990, and Northwest Minnesota set an initial record low unemployment rate of 2.7% in October 1999. That record stood until it dipped to 2.5% in September 2018 as the labor market got extremely hot gaining steam in the prolonged recovery from the Great Recession. Then, in October 2021 as the economy came roaring back from the pandemic emergency, while supply chains and labor markets were reeling, the unemployment rate inched down to a new record low of 2.4%. Demand for workers continued to increase and Northwest set a new all-time record low of 2.0% in September 2022. What's more, Traverse County and Stevens County tied for the record low unemployment rate of any Northwest county, hitting a miniscule 1.3% in September 2022 (Traverse) and October 2022 (Stevens).

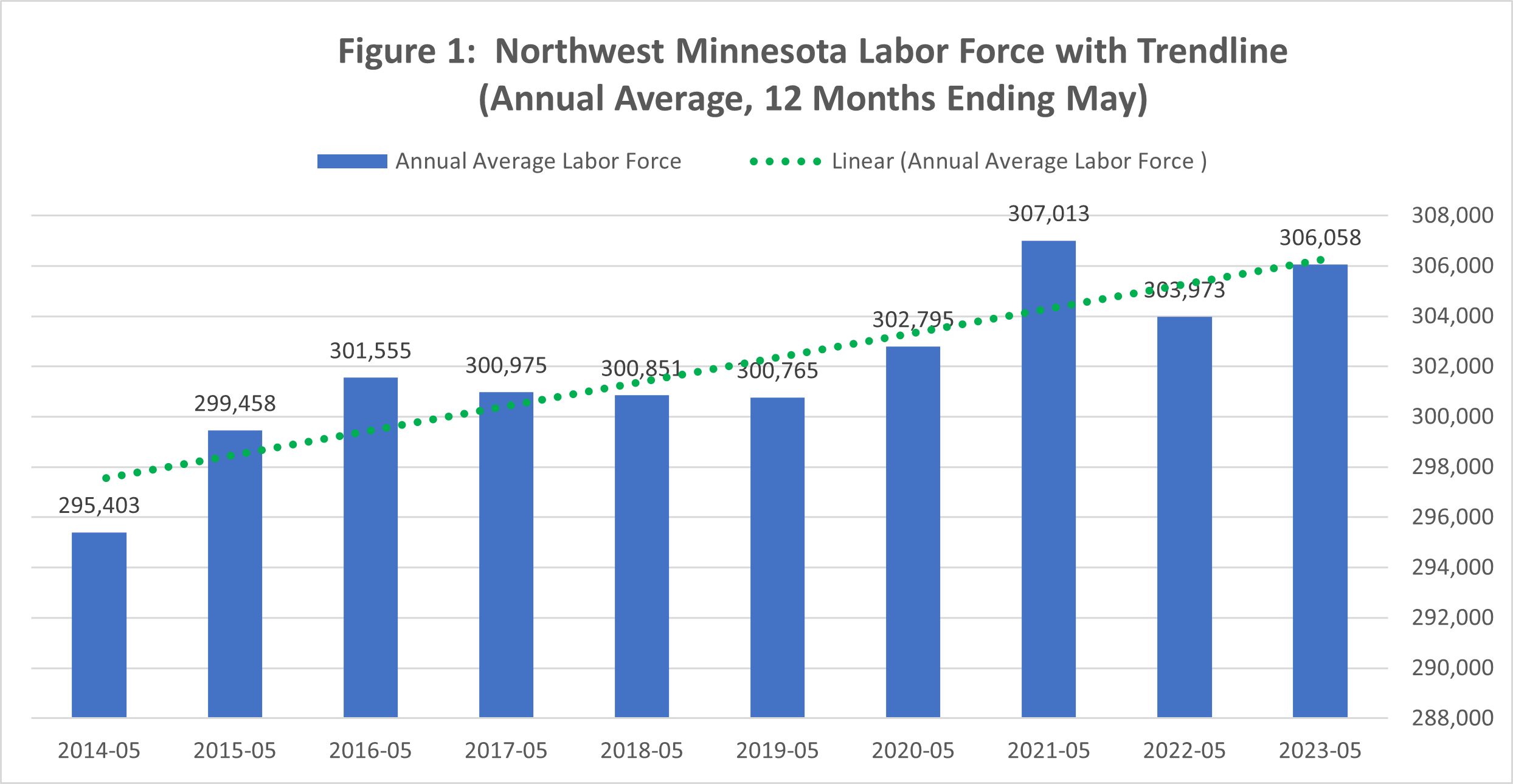

The labor market is an interaction between supply and demand. As Northwest Minnesota job vacancies soared to a new record high of 20,409 in 2022, beating the previous record set in 2021, there were an estimated 2.5 job vacancies for each unemployed worker. Even if every unemployed worker were an immediate fit for an available job, 60% of open positions would still be unfilled. While the supply of labor was constrained by the pandemic, the Northwest's labor force has grown over the past decade. (See Figure 1.)

The Northwest's labor force peaked at over 321,000 people in June 2020 as many began seeking work during the low point of the pandemic recession because their spouses or significant others, parents, and siblings were suddenly unemployed. Note that the labor force is an estimate of the civilian population age 16 and over who are either working or actively seeking work and available to take a job. The average annual labor force for 12 months ending May 2023 is more than 1% larger than in the 12 months ending May 2020 and 3.6% larger than in May 2014. Labor force growth has slowed, though, and this has been happening over the past three decades (see Figure 7 on the Northwest Regional Profile.) Instead, the job market has tightened while the labor force has continued to grow, but more slowly than it has in the past few decades. Note the green trendline in Figure 1. This implies that increasing demand for goods and services, rather than decreasing supply of labor, is the primary driver of the record-tight labor market.

The pandemic recovery was characterized by unevenness as initially goods producing industries captured an increasing share of consumer income while many services were unavailable, particularly Accommodation & Food Services and Arts, Entertainment & Recreation, as well as a large swath of in-person Retail Trade. Even through 2022, total employment is not quite back to 2019 levels, and it is the services side of the economy that is lagging (see Table 1).

| Table 1. Northwest Minnesota Industry Employment Statistics, 2022 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| NAICS Industry Title | Average Number of Firms | Average Number of Jobs | Total Payroll ($1,000s) | Average Annual Wage | 2021-2022 | 2019-2022 | |||

| Change in Jobs | Percent Change | Change in Jobs | Percent Change | ||||||

| Total, All Industries | 18,086 | 221,564 | $10,943,971 | $49,394 | 3,273 | 1.5% | -1,671 | -0.7% | |

| Agriculture, Forestry, Fish & Hunt | 954 | 5,412 | $280,184 | $51,771 | 185 | 3.5% | 124 | 2.3% | |

| Mining | 44 | 216 | $14,421 | $66,763 | 8 | 3.8% | 6 | 2.9% | |

| Construction | 2,361 | 12,507 | $806,999 | $64,524 | -967 | -7.2% | 1,137 | 10.0% | |

| Manufacturing | 829 | 29,870 | $1,832,509 | $61,349 | 971 | 3.4% | 392 | 1.3% | |

| Utilities | 69 | 1,238 | $124,163 | $100,293 | -6 | -0.5% | -45 | -3.5% | |

| Wholesale Trade | 641 | 11,876 | $772,916 | $65,082 | 367 | 3.2% | 726 | 6.5% | |

| Retail Trade | 2,286 | 27,914 | $920,572 | $32,979 | 722 | 2.7% | 70 | 0.3% | |

| Transportation & Warehousing | 887 | 5,954 | $309,535 | $51,988 | -225 | -3.6% | -163 | -2.7% | |

| Information | 307 | 2,585 | $148,483 | $57,440 | 33 | 1.3% | -15 | -0.6% | |

| Finance & Insurance | 859 | 5,867 | $418,495 | $71,330 | -1 | 0.0% | -94 | -1.6% | |

| Real Estate & Rental & Leasing | 485 | 1,519 | $66,454 | $43,749 | -8 | -0.5% | 9 | 0.6% | |

| Professional & Technical Services | 897 | 4,563 | $291,178 | $63,813 | -126 | -2.7% | -188 | -4.0% | |

| Management of Companies | 65 | 570 | $61,232 | $107,425 | -11 | -1.9% | -125 | -18.0% | |

| Admin. Support & Waste Mgmt. Svcs. | 716 | 4,027 | $158,038 | $39,245 | -88 | -2.1% | -48 | -1.2% | |

| Educational Services | 410 | 22,072 | $1,076,811 | $48,786 | 750 | 3.5% | -611 | -2.7% | |

| Health Care & Social Assistance | 1,868 | 38,260 | $2,081,955 | $54,416 | -236 | -0.6% | -925 | -2.4% | |

| Arts, Entertainment, & Recreation | 421 | 3,544 | $79,894 | $22,544 | 346 | 10.8% | 5 | 0.1% | |

| Accommodation & Food Services | 1,616 | 21,458 | $460,638 | $21,467 | 1,225 | 6.1% | -836 | -3.7% | |

| Other Services | 1,649 | 6,780 | $194,361 | $28,667 | 262 | 4.0% | 49 | 0.7% | |

| Public Administration | 725 | 15,328 | $845,134 | $55,137 | 71 | 0.5% | -1,138 | -6.9% | |

| Source: DEED Quarterly Census of Employment & Wages (QCEW) program | |||||||||

Every industry in the goods-producing industry sector has more jobs than prior to the pandemic. (Following the North American Industry Classification System (NAICS), these goods producing sectors are: Agriculture, Forestry, Fishing, & Hunting, Mining, Construction, and Manufacturing.) However, the Total, All Industries is still down 0.7%. It is notable that the private sector was down by a mere 140 jobs or less than 0.1%, consistent with the fact that there is little public sector employment in goods production.

The two services-providing sectors with the largest gains in employment are Wholesale Trade and Retail Trade, which merchandise to end consumers. Note that Wholesale Trade also supplies Manufacturing with durable and non-durable goods to feed supply chains and maintain equipment. The other service sector that grew from pre-pandemic levels is named Other Services (a catch-all that includes everything from automotive repair to hair salons to churches) and it had the fifth fastest growth from 2019 as vaccines allowed people to go places and interact.

The services side of Northwest Minnesota's economy is held back the most by the Public Administration and Healthcare & Social Assistance sectors. Public Administration was closely examined statewide by my colleague, Dave Senf. Northwest Minnesota's Public Administration employment is significantly impacted by tribal government employment declines, which in many cases include casino gaming. As noted in the same blog cited above, "Nearly all these jobs were lost in local government..." And, "Health Care employment is facing some serious hiring and retention challenges." Furthermore, these health care workforce challenges are even more severe in Northwest Minnesota.

Like health care, employment in Accommodation & Food Services and Educational Services is no doubt constrained more by a lack of workers than by a lack of jobs, as these sectors' above-average job vacancy rates bear out. Thus, the services sectors also experienced a resurgence in demand, but unfilled job vacancies left many of these services industries below pre-pandemic employment.

With 20,409 job vacancies in 2022, and employment just 1,671 jobs below 2019, there is no doubt that it is a lack of workers, not a lack of jobs that is keeping Northwest Minnesota from exceeding 2022 employment levels. This underscores why Minnesota's Job Vacancy Survey (JVS) is so important. Many industries have not returned to pre-pandemic employment levels, but this is due to a lack of workers, not a lack of jobs. JVS is the only source we have that gages occupational demand for unfilled vacancies. The industry job trends do not reflect unfilled demand, and therefore neither do the occupational projections, which are almost entirely based on industry employment trends (and a bit on macro-economic assumptions such as factoring in the occasional occurrence of a recession).

Table 2 lists the specific occupations that have the highest number of vacancies, while also having above average vacancy rates and higher median wage offers than for all vacancies in Northwest Minnesota. More succinctly, this table highlights the Northwest occupations with high demand and high wage offers. Note that job vacancy rate is the number of vacancies relative to the number of filled jobs. Thus, these occupations are in high demand in terms of the number of openings, but also relative to the size of the occupation.

| Table 2: Northwest Minnesota Job Vacancies and Median Wage Offers for Selected Occupations | |||||

|---|---|---|---|---|---|

| SOC Code | SOC Title | Job Vacancies | 2022 Vacancy Rate | Change from 2019 | Median Wage Offer |

| 00-0000 | Total, All Occupations | 20409 | 9.3 | 3.5 | $17.06 |

| 29-1141 | Registered Nurses | 487 | 10.5 | 3.5 | $31.89 |

| 53-3032 | Heavy and Tractor-Trailer Truck Drivers | 346 | 10.0 | 3.2 | $18.86 |

| 53-3051 | Bus Drivers, School | 284 | 26.3 | NA | $17.85 |

| 29-2061 | Licensed Practical Nurses | 271 | 17.5 | 3.2 | $19.74 |

| 49-9071 | Maintenance and Repair Workers, General | 262 | 11.0 | 9.4 | $17.48 |

| 53-3052 | Bus Drivers, Transit and Intercity | 247 | 72.7 | NA | $21.13 |

| 51-3022 | Meat, Poultry, and Fish Cutters and Trimmers | 240 | 51.1 | NA | $17.07 |

| 49-3023 | Automotive Service Technicians and Mechanics | 206 | 16.5 | 11.6 | $22.30 |

| 25-3031 | Substitute Teachers, Short-Term | 162 | 21.1 | NA | $20.50 |

| 25-2052 | Special Education Teachers, Kindergarten and Elementary | 149 | 36.4 | 32.9 | $23.10 |

| 21-1093 | Social and Human Service Assistants | 145 | 12.0 | 9.8 | $18.07 |

| 51-4041 | Machinists | 131 | 11.4 | 9.4 | $25.76 |

| 51-9111 | Packaging and Filling Machine Operators and Tenders | 110 | 13.1 | 12 | $20.52 |

| 25-2011 | Preschool Teachers, Except Special Education | 104 | 12.9 | 9.2 | $21.87 |

| 53-7051 | Industrial Truck and Tractor Operators | 100 | 14.9 | -12.3 | $17.29 |

| 53-3031 | Driver/Sales Workers | 98 | 19.1 | 6.7 | $19.50 |

| 25-2058 | Special Education Teachers, Secondary School | 82 | 21.5 | NA | $22.78 |

| 51-9198 | Helpers--Production Workers | 77 | 38.6 | NA | $18.46 |

| 25-2022 | Middle School Teachers, Except Special and Career | 76 | 13.4 | NA | $23.58 |

| 29-1127 | Speech-Language Pathologists | 61 | 27.9 | 24.7 | $36.19 |

| 31-9092 | Medical Assistants | 59 | 13.0 | 11.7 | $18.37 |

| 19-3033 | Clinical and Counseling Psychologists | 57 | 114.0 | NA | $31.52 |

| 29-1215 | Family Medicine Physicians | 50 | 19.4 | NA | $55.27 |

| 33-3012 | Correctional Officers and Jailers | 48 | 9.6 | 8.8 | $21.36 |

| 21-1023 | Mental Health and Substance Abuse Social Workers | 47 | 21.4 | -20 | $28.18 |

| 51-9124 | Coating, Painting, and Spraying Machine Setters | 46 | 10.0 | NA | $18.57 |

| 11-2022 | Sales Managers | 45 | 9.5 | NA | $31.99 |

| 25-3021 | Self-Enrichment Teachers | 43 | 13.4 | NA | $17.47 |

| 11-9151 | Social and Community Service Managers | 41 | 9.6 | 8.8 | $27.71 |

| 25-2032 | Career/Technical Education Teachers, Secondary | 40 | 44.2 | 42.2 | $23.03 |

| 27-1026 | Merchandise Displayers and Window Trimmers | 40 | 24.8 | 16.5 | $17.51 |

| 29-2034 | Radiologic Technologists and Technicians | 38 | 10.5 | 0.5 | $24.05 |

| 25-2057 | Special Education Teachers, Middle School | 35 | 29.0 | NA | $22.23 |

| 13-2020 | Property Appraisers and Assessors | 33 | 19.6 | NA | $23.11 |

| Source: DEED Job Vacancy Survey | |||||

These job vacancy data demonstrate their worth in illuminating a region's occupational demand. Recall from Table 1 that Health Care & Social Assistance industry employment is down 236 jobs from 2021 to 2022. However, Registered Nurses (RNs) and Licensed Practical Nurses (LPNs) are two of the top four in terms of job vacancies, and six of these 34 selected high demand jobs are health care occupations (SOCs begin with 29 or 31), while Social & Human Services Assistants and Social & Community Service Managers also both make this exclusive list. What's more, job vacancy rates for all the selected Health Care & Social Assistance occupations are higher in 2022 than 2019, yet industry employment is down 925 jobs from 2019. Similarly, seven of these 34 high-demand, high-wage occupations are educational occupations (SOCs beginning with 25) and all that have comparable data for 2019 have double digit increases in vacancy rates. Yet, employment in the Educational Services industry sector is down 611 jobs since 2019.

These data are also an important input for the Occupations in Demand Tool that informs job seekers of the occupations with the best job prospects, as well as informing education administrators of the need for career and occupational programs. A lack of up-to-date occupational demand data could mean a lack of good career and workforce development decisions.

Rest assured, there have not been mass alien abductions. The region's pre-existing workforce challenges were exacerbated by the pandemic, as illustrated by Quarterly Workforce Indicators (QWI) employment by age and sex.

The employment by age and sex differences are striking, particularly the drop for females aged 22 to 64 and the gain for the youngest and oldest workers . . . . it is only among youth and seniors where females outpace males in employment growth. Every other age group saw declines in female employment since 2020. . . . This is consistent with state and national research that points to caregiving as one of the main drivers of decreased labor force participation. Regarding child care in particular, the second and third largest percentage employment drops are for females aged 22 to 34, which is the age range most likely to have infants and young children. Males in this age range also have the largest drops, likely also driven by child care demands.

According to QCEW data, the Northwest's Child & Day Care Services industry employment increased from 653 to 692 jobs – a gain of 39 jobs or 6% – from 2019 to 2022. However, most child care operations in the region are licensed as family child care where the owner provides care rather than having employees, as with facilities licensed as child care centers. The total child care capacity of the region has declined significantly due to a decrease in these family child care facilities (see Table 3).

| Table 3: Northwest Minnesota Child Care Providers and Capacity | |||||

|---|---|---|---|---|---|

| School Year | Child Care Centers | Family Child Care | Total | ||

| Number | Capacity | Number | Capacity | Capacity | |

| 2021 to 2022 School Year | 70 | 4,507 | 1,089 | 13,109 | 17,616 |

| 2019 to 2020 School Year | 60 | 3,973 | 1,204 | 14,572 | 18,545 |

| Change | 10 | 534 | -115 | -1,463 | -929 |

|

Source: Minnesota Dept. of Human Services Data Tabulated by First Children's Finance Minnesota. Rural Child Care. |

|||||

However, caring for aging parents and grandchildren may have had an even larger impact. This is potentially demonstrated by the largest percentage drop in jobs held being for females aged 55 to 64. While this may appear to be an impact from early retirement, it is remarkable that females in this age group had a 21 times greater percentage drop than males. This only makes sense considering that females in this age group are much more likely to be caring for a parent (and/or grandkids) than males. No doubt, the precipitous 12.2% decline in the region's Nursing & Residential Care Facilities employment from 2018 to 2022 means that many had given up working to care for elderly family members.

Along with caregiving, increased retirements have also contributed to the pandemic-related workforce challenges. However, most people retire eventually, so an early retirement has a limited-time impact. For example, the impact of a person retiring three years early due to the pandemic is already passed or soon to pass. What's encouraging is that the increase in job holders over age 65 suggests that unlike for the U.S., seniors transitioning from retirement back to work, what I call "unretirement", are helping to ease pandemic-related workforce challenges in the Northwest.

Decreased immigration has also had an impact on the Northwest's workforce, and this was exacerbated by pandemic restrictions on international travel. I estimated that restoring immigration to 2015 levels would reverse 75% of the Northwest's pandemic labor force decline over the next eight years. International immigration to Minnesota and the region has been declining since 2015 and took a sharp pandemic plunge in 2020 and 2021.

Perhaps the workforce impact most directly attributable to the pandemic is debilitation due to long COVID. While a lack of data makes precise estimation impossible, a Brookings institute study of the existing studies estimated a 1.8% full-time-equivalent workforce decrease from those not able to return to work or decreasing the number of hours they are able to work. In Northwest Minnesota, this would amount to nearly 5,500 workers based on 2022's average labor force.

To round out the discussion of pandemic workforce impacts, we should not lose sight of the fact that the pandemic caused huge disruptions that are having prolonged impacts. Supply chain issues are still rippling. Sweatpants and loungewear inventory became out of stock in the stay home, stay safe phase, and then dress shirts and beauty accessories went from surplus to shortage as vaccines allowed people to go out. I still do not see the same selection of grocery items at my store as pre-pandemic. (Where are those spicy pickles I love so much?!?!) Analogously, workers are still adjusting. Many jobs have changed, and not everyone could go back to the same job. For many, returning to work means new child care and transportation arrangements are needed.

In any case, the long-term, immutable cause of Northwest Minnesota's workforce challenge is the aging Baby Boomer generation. I estimate that over 60% of the Northwest's slowed labor force growth from 2020 to 2030 was "baked in" prior to the pandemic due to aging demographics, with the remaining roughly 40% induced by the pandemic. Those who study our region's demographic and labor force trends have been talking about the tightening labor markets due to the aging population for over a decade. The supply of workers was set to decline as the Baby Boomers aged, and Northwest Minnesota's labor market has an outsized share of Boomers. According to generational definitions, Boomers were aged 56 to 74 in 2020, and about 26.3% of Northwest Minnesota's labor force was aged 55 to 74 in 2020, compared to 22.5% statewide and 21.5% for the entire U.S.

As a result, Northwest Minnesota's labor force was already projected to shrink by 5,850 workers, or -2%, from 2020 to 2030 based on population projections and 2019 labor force participation rates by age. Based on pre-pandemic trends, the region was expected to experience an average annual loss of 585 workers. Compounding this long-term labor force trend is the fact that retirees still demand services, and to a lesser extent goods, adding to the demand for labor but not to the supply.

While the saying is "demographics is destiny," human creativity, ingenuity, and teamwork can meet the challenges. Leaders should be encouraged to implement innovative workforce solutions because the long-term nature of the demographic-induced labor force challenge means that any success will pay off for years to come. The region is quickly recognizing where the opportunities are to meet increasing demand. In fact, Northwest Minnesota was recently covered by the National Public Radio economics radio show Marketplace to provide insight to the rest of the nation on how companies can address post-pandemic tight labor markets.

Within challenges lie opportunities. One such opportunity is for technology and automation to eliminate the tedious and physically taxing tasks of jobs. One typically thinks of manufacturing plants and warehouses, but the possibilities are expanding. For example, medical clinical laboratory work has been made much more efficient with technology and automation.

Nonetheless, there are always going to be many tasks where the human touch is essential. For these it is imperative to develop the workforce, particularly youth that are likely to stay in the region. Many Black, Indigenous and People of Color (BIPOC) residents of Northwest have much higher unemployment rates than white residents. It is imperative to make Northwest's communities highly attractive places to live for diverse populations, both so workers stay and so that more workers move in. Child care and housing are a top concern of business leaders in Northwest communities.

The Northwest has some distinct advantages. Wages have been increasing beyond inflation in the Northwest, and the region has the second lowest cost of living of the six planning regions in the state. For those who like a rural landscape, and the change of seasons, Northwest Minnesota offers some great career opportunities.