by Luke Greiner

May 2021

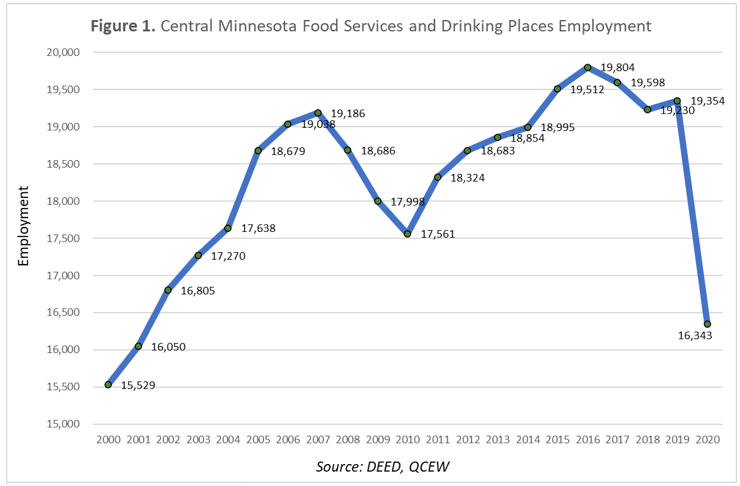

In 2019 Central Minnesota was home to 1,106 Food Services and Drinking Place establishments that provided the region with more than 19,350 jobs. After dipping during the Great Recession, long-term trends of expansions and growing employment in the sector showed that it took the region six long years to recover the 1,625 jobs lost from that turbulent period. But the downturn of the Great Recession was easily eclipsed in the past year as the industry shed almost twice as many jobs (3,011 jobs) in a third of the time. Employment in 2020 averaged 16,343 jobs, the lowest level since 2001 (Figure 1).

The target of numerous executive orders that placed operational limits, the industry suffered both from a drop in consumer demand for services and government policies in 2020. As the state has begun emerging from the constrictions of the pandemic, Food Services and Drinking Places have been given a refreshed appreciation, and demand has soared in 2021 for their services. Restrictive policies have been removed and the labor market is in a bit of a scrambled omelet situation as labor is being redistributed throughout the economy. Workers from all corners of the economy were laid off, but especially at Food Services and Drinking Places, and now the competition to bring workers back is in full swing.

Occupations in the food services sector have long been some of the lowest paying, and the industry's heavy reliance on new labor entrants (high school students/graduates) coupled with high turnover rates have been the normal operating rhythm for most establishments for decades. Of course, "normal" has been redefined, and this industry sector will look different in the near future than it did in the recent past.

| NAICS | Industry Title | Employment | Establishments | Avg. Annual Wage | Total Payroll |

|---|---|---|---|---|---|

| 0 | Total, All Industries | 263,167 | 18,526 | $48,464 | $12,762,451,297 |

| 722 | Food Services and Drinking Places | 16,343 | 1,100 | $16,484 | $269,993,793 |

| 7223 | Special Food Services | 337 | 65 | $23,036 | $7,644,766 |

| 7224 | Drinking Places (Alcoholic Beverages) | 951 | 138 | $15,704 | $15,016,318 |

| 7225 | Restaurants | 15,056 | 897 | $16,432 | $247,332,709 |

| Source: DEED QCEW | |||||

The average annual wage in the Food Services and Drinking Places industry was just $16,484, which was 80th of 82 subsectors in the Central region and about a third of the average wage across all industries.

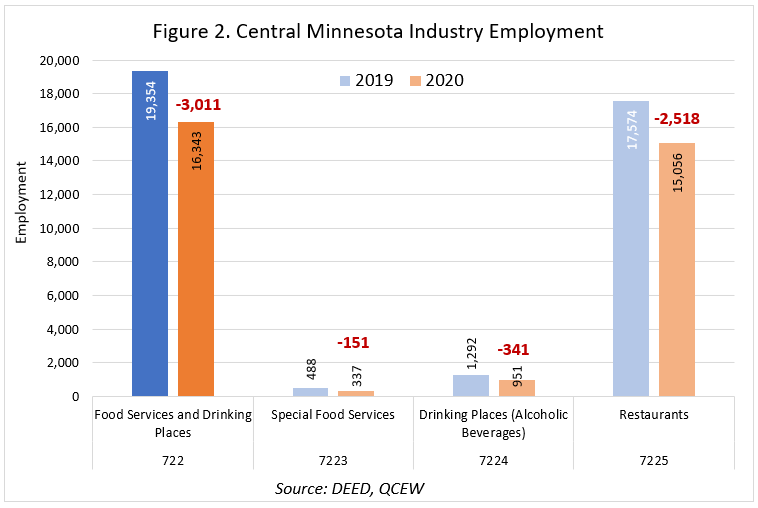

Restaurants are easily the largest component of Food Services and Drinking Places (NAICS 722) industry, accounting for 92% of the sector's employment in 2020 with 897 establishments providing 15,056 jobs. Bars (Drinking Places) maintained just under 1,000 jobs at 138 establishments, and Special Food Services, which includes caterers, food service contractors, and mobile food services, accounted for 337 jobs (Table 1).

Of the six planning regions in the state, Central Minnesota's Food Services and Drinking Places sector managed to shed the smallest share of jobs, but there is little to celebrate as employers in the sector averaged a 15.6% loss from 3,011 fewer jobs in 2020 compared to the year prior. The largest decline in the industry was in the Twin Cities, where employers cut 26.2% of jobs and followed by Northeast Minnesota with a year-over-year decline of 21.3%. There is no way to separate part-time from full-time jobs in the Quarterly Census of Employment and Wages dataset, meaning reductions in hours are not reflected in Figure 2, just the net loss of jobs over the year.

In percentage terms the employment decline was largest in the Special Food Services subsector which saw a 31% decline as demand for catering services and mobile food services dried up. Drinking Places employment dropped by a steep-26.4% and restaurant employment fell by 14.3%.

However, using numeric job loss instead of percentages shows restaurants shed more than 2,500 jobs, accounting for 84% of all jobs lost at the Food Services and Drinking Places sector. Drinking Places shed 341 jobs and Special Food Services, which saw the largest percent decline, saw the smallest numeric loss (151 jobs).

The Food Services and Drinking Places industry saw a net loss of only six establishments in 2020, as many appeared to be closed only temporarily rather than permanently. Drinking Places were off by seven establishments whereas one new Specialty Food Services establishment opened. Restaurants actually managed to average the same number of establishments in 2020 as it did in 2019, which is especially good news since the average number of jobs per restaurant establishments is about twice as high as establishments in the overall economy.

Analyzing age demographic data from DEED's Quarterly Employment Demographics provides additional insight into the changing labor market in Food Services and Drinking Places. For this article the average of the first three quarters is used since the fourth quarter data for 2020 are not yet published.

The largest shift of workers in the region from 2019 to 2020 was found in the oldest two age cohorts. The share of jobs held by workers 65 years and older dropped by 6.6% while the share held by workers 55-64 years increased by 6.7%. This might not be apparent at first glance, however, since both cohorts combined make up less than 9% of total jobs in the industry. Most of the employment is held by younger workers, including almost a third that are teenagers. Possibly the result of the lack of other options, the share of jobs held by teenagers in the Food Services and Drinking Places employment grew 4.1% from 2019 to 2020. This was offset by larger relative losses in workers aged 20-54 years.

The median hourly wage for the first three quarters grew for every age cohort from 2019 to 2020 in the Food Services and Drinking Places sector, albeit at a slower rate than wage growth for the broader economy. The average median hourly wage in the sector was $12.09 in the first three quarters of 2020, compared to $11.68 a year prior. Central Minnesota's employers had an average median wage growth of 8.4% in the first three quarters of 2020 compared to the first three quarters of 2019, but Food Services and Drinking Places managed less than half that rate at just 3.6% growth. The largest average median wage growth was for workers 55 years and older, potentially a reflection of lower compensated older workers leaving employment with higher skilled and higher paid older workers remaining in the industry. No cohort managed to surpass an average median wage of $15 per hour, with teenagers having the lowest median wage of less than $11 per hour.

Not surprisingly, the Food Services and Drinking Places sector is home to mostly part-time jobs where the average median hours worked in the first three quarters of 2020 was just 142 compared to 395 for the overall regional economy. Also not surprisingly, in the first and second quarter of 2020 workers found shorter shifts, with hours reduced slightly in the broad regional economy as well as at Food Services and Drinking Places. But as demand began to increase in the third quarter of 2020 the number of hours worked spiked higher than is typical. The fluctuation was more dramatic in Food Services and Drinking Places industry. Hours were nearly constant in the first quarter of 2020, but the second quarter saw median hours fall by 26% from the previous year, and then in the third quarter hours rebounded to a level higher than in 2019. Contrary to the wage increase, however, the rebound was not experienced by workers 55 years or older. Instead, their median hours worked declined substantially even in the third quarter of last year compared to the prior year.

Conversations with employers and workers in the Food Services and Drinking Places suggests a continuation of trends that are just beginning to appear in the data. Although the fourth quarter 2020 Job Vacancy Survey found a decline in Food Preparation and Serving Related openings, over 1,500 openings were reported. With a labor market that continues to tighten through the first half of 2021, it is probable that Restaurants will continue hiring teenagers, boosting their share of jobs in the sector. Many employers will also likely keep raising wages to attract and retain workers, although that may in turn contribute to inflationary pressure. But with restaurants and bars struggling to hire more workers, what employees they do have are frequently working more hours to make up for being short-staffed.

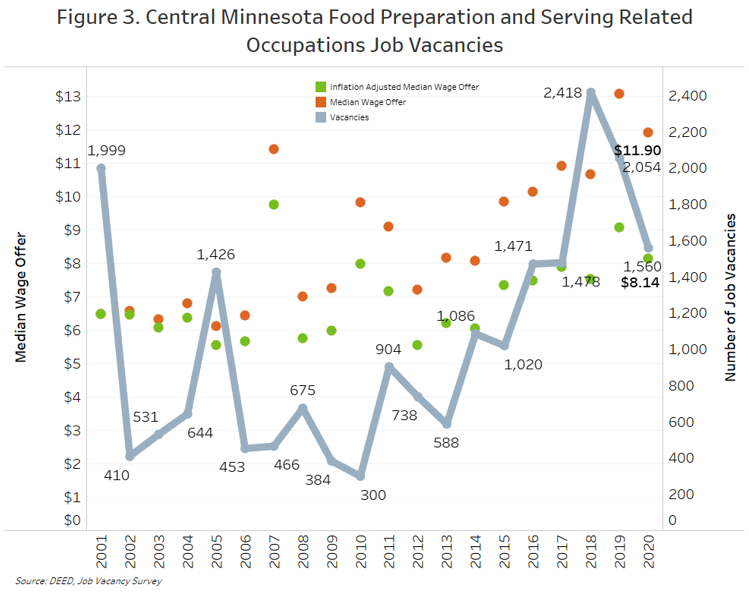

Median wage offers for Food Prep and Serving Related workers have been on the rise over the past two decades, and they have even outpaced inflation, resulting in real wage growth illustrated by the green inflation adjusted wage markers in Figure 3. The broad occupational category had a median wage offer of $11.90, but wage offers ranged from $10 for short order cooks to $12.71 for bartenders. Although no Food Preparation and Serving Related Occupation had starting wages over $13/hour, tips can boost wages significantly higher. But it might not be enough for workers on the fence to decide to return to the food industry.

It appears that the events of the past year and a half have changed workers' perception of employment in the industry, and modest increases in starting wages might need to be complimented by other types of benefits to lure new workers or retain current ones. Most Food Services and Drinking Place jobs cannot be worked remotely and the flexibility that the sector offers might seem less beneficial compared to working from home in a different industry. One aspect of hiring that is likely to help the industry rebound is the low barrier of entry: 78% of Food Prep and Serving Related openings had no educational requirements in the fourth quarter of 2020, with the remaining openings requiring a high school diploma. The industry can train in new labor force entrants at a scale that most other industries can't. So while seasoned food service workers might be eyeing other employment options, a large segment of the labor force (new labor force entrants) has few other options and will likely continue to seek employment in the Food Services and Drinking Places industry.