by Dave Senf

April 2020

Signs of Minnesota’s stay-at-home order to minimize the human health crisis arising from COVID-19 are everywhere from closed retail store, darkened eating and drinking establishments, and empty hotels to the vacant sports arenas, theaters, and music venues. The economic carnage from the abrupt freezing of major segments of the economy were, however, only vaguely visible in March’s total nonfarm employment numbers and in the unemployment rate. Real-time (daily or weekly) statistics measuring the economic fallout are hard to find simply because the data collection system isn’t set up to provide daily or weekly data, the main hurdle being that more timely data collection would be expensive.

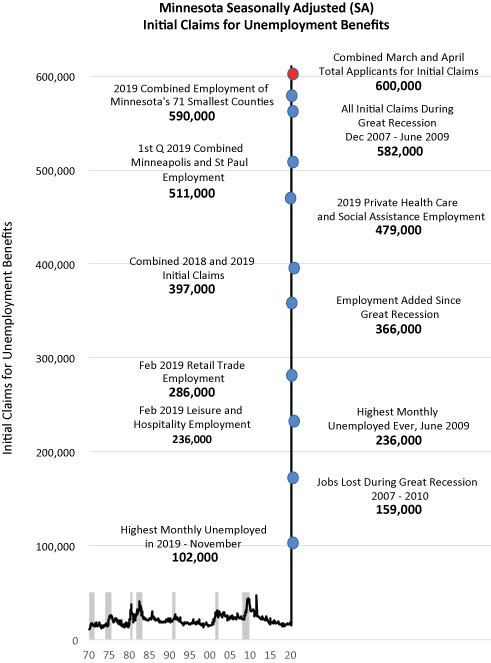

About the only real-time economic data providing insight into how sharply and abruptly the state’s labor market deteriorated since the onset of the pandemic in mid-March have been the explosion in first-time filings for unemployment benefits. As businesses closed or curtailed activity, layoffs skyrocketed, and jobless claims soared to never imagined levels.1 Final numbers aren’t completely tallied yet, but the combined March and April total for initial claims may top a crushing 600,000. The graph below attempts to bring some perspective to the astonishing avalanche of jobless claims filed in March and April.

The 600,000 initial claims represent about 20 percent of the 2.9 million jobs covered by unemployment insurance in the state in February. Total U.S. jobless claims over the same period will probably reach 29 million, also about 20 percent of the nation’s 142 million covered jobs. Initial claims as a percent of employment in Minnesota were running ahead of the national percent through early April first from “shutter business” orders occurring earlier in Minnesota than in many states and secondly to Minnesota’s unemployment insurance system’s processing claims more efficiently than was the case in at least half of the other states. Some states still had huge backlogs of unprocessed applications for unemployment in late April. Initial claims in Minnesota appear to have peaked during the three-week period ending the second week in April.

Minnesota’s previous record-high month for first-time jobless benefits was in July 2011 when the state government shut down for 20 days, and its workforce collected unemployment checks for a couple of weeks. Look closely at the bottom of the chart to see the normal level of monthly initial claims over the last six decades. The six-decade average through February was 21,000 claims a month. The level of initial claims in March and April are roughly 14 times the historical monthly average. Jobless claims over the 19-month Great Recession (December 2007 to June 2009), when combined, add up to 582,000. The March-April total exceeds the Great Recession total as well as all covered employment in Minneapolis and St. Paul.

The previously unimaginable initial claims level and implied job loss in March and April tops the combined covered employment of Minnesota’s 71 smallest counties (Minnesota has 87 counties). The state’s largest sector in terms of employment is Health Care and Social Assistance, which had annual average employment of 479,000 last year. The tidal wave of initial claims is expected to recede in May, but most of the initial claims will continue to show up in unemployment insurance statistics as continuing claims. Continuing claims, at least through the summer, will follow the initial claims track reaching previously unthinkable levels.

The rise and peak of continuing claims, however, will probably fall short of the initial claims track as business restrictions are gradually being lifted and as the Small Business Administration’s Payroll Protection Program (PPP) comes online. Minnesota businesses captured a disproportionately high share of the first round of PPP loans that, if used by business as intended, will move unemployed workers off unemployment and back onto the business’s payrolls. Businesses using the PPP are supposed to use 75 percent of their PPP loan over an eight-week period to pay their payroll expenses if they want the loan to turn into a grant. In theory the PPP in Minnesota could move several hundreds of thousands of workers off unemployment and back on their employer’s payrolls.

The best scenario for the rest of 2020 is that social distancing controls the spread of the coronavirus and the unbelievable explosion in initial claims and ongoing continuing claims will turn into sharp, rapid, never-seen-before declines, indicating that the job loss has turned into job growth, and the labor market has started to rebound from the economic devastation related to fighting the coronavirus.

Source: All data are available using DEED’s Data Tool. Data tools used for this article include Current Employment Statistics (CES), LAUS (Local Area Unemployment Statistics), Quarterly Census of Employment and Wages (QCEW), and Unemployment Insurance Statistics.

1Daily, weekly, and initial claims tallies.