by Nick Dobbins

December 2019

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

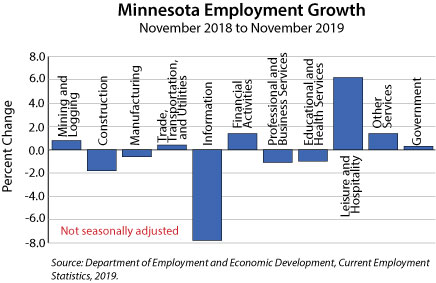

Total Nonfarm employment was off by 3,000 (0.1 percent) in November on a seasonally adjusted basis. The loss came entirely from goods producers, which shed 7,600 jobs or 1.7 percent, while service providers added 4,600 (0.2 percent). Over the year Minnesota employers added 5,911 jobs (0.2 percent). Goods producers lost 4,236 jobs (0.9 percent), but that loss was overcome by the addition of 10,147 jobs (0.4 percent) among service providers. The private sector added 4,451 jobs (0.2 percent) while the public sector added 1,460 (0.3 percent).

Mining and Logging employment was down by 100 (1.5 percent) in November. It was the first month with non-static employment levels in the supersector since March. On the year Mining and Logging employers added 50 jobs (0.8 percent).

Employment in Construction was down sharply in November as employers shed 4,900 jobs or 3.8 percent, the largest real and proportional decline of any supersector in the state. It was the fourth consecutive month of flat or negative growth in Construction following a strong spring and summer. Over the year Construction employment was down by 2,296 or 1.8 percent. It was their first month of over-the-year job losses since April of 2018, suggesting an especially inhospitable fall for the highly seasonal supersector. Annual declines were driven primarily by the loss of 1,691 jobs (9.9 percent) in Heavy and Civil Engineering Construction.

Manufacturers lost 2,600 jobs (0.8 percent) in November, with declines coming in both Durable and Non-Durable Goods Manufacturing. The supersector had added 2,300 jobs over the previous two months. Manufacturing employment was also down annually as the supersector lost 1,990 jobs (0.6 percent). Over-the-year declines came entirely from Durable Goods Manufacturers, which shed 3,652 jobs (1.8 percent). Their counterparts in Non-Durable Goods Manufacturing added 1,662 jobs (1.4 percent) despite the loss of 315 jobs (0.7 percent) in the important Food Manufacturing component sector. November’s over-the-year job loss in the supersector came on the heels of 0.3 percent annual growth in October.

Employment in Trade, Transportation, and Utilities was stable in November as employers added 300 jobs (0.1 percent). Transportation, Warehousing, and Utilities was up by 400 (0.4 percent) while Retail Trade employment was off by 100 (0.0 percent), and Wholesale Trade was flat. Over the year the supersector added 2,326 jobs (0.4 percent). Retail Trade drove the growth, up 1,854 (0.6 percent), while Wholesale Trade added 500 jobs (0.4 percent), and Transportation, Warehousing, and Utilities lost 78 (0.1 percent).

Information employers lost 100 jobs (0.2 percent) in November. The supersector has experienced negative growth in three consecutive months. Annually Information employment was down by 3,830 (7.8 percent). The supersector continued its years-long decline and has lost jobs on an annual basis every month for more than two years

Financial Activities employment was up by 300 (0.2 percent) in November. Finance and Insurance employers added 1,100 jobs (0.7 percent), but that growth was counterbalanced by a loss of 800 (2.3 percent) in Real Estate and Rental and Leasing. Annually the supersector added 2,518 jobs (1.4 percent). The driver of that growth was Finance and Insurance, which added 3,661 jobs or 2.5 percent. Real Estate and Rental and Leasing lost 1,143 jobs (3.2 percent).

Professional and Business Services employment was up by 800 (0.2 percent) in November. Professional, Scientific, and Technical Services added 700 jobs (0.4 percent), Administrative and Support and Waste Management and Remediation Services added 300 (0.2 percent), and Management of Companies and Enterprises lost 200 (0.2 percent). On the year the supersector lost 4,378 jobs (1.1 percent), with the losses primarily coming from the Administrative and Support and Waste Management and Remediation Services component sector (down 6,666 jobs or 4.9 percent).

Employment in Educational and Health Services was off by 1,500 (0.3 percent) in November, with declines in both component sectors. Educational Services lost 700 jobs (1 percent) while Health Care and Social Assistance lost 800 (0.2 percent). Over the year the supersector lost 5,631 jobs (1 percent). Over-the-year job growth has held at roughly the same level since September.

Leisure and Hospitality employment was up by 3,800 jobs (1.3 percent) in November. It was the continuation of an unusually strong run for the supersector, which added more than 2,000 jobs in every month since August. Arts, Entertainment, and Recreation was up by 2,000 (4.1 percent) while Accommodation and Food Services was up by 1,800 (0.8 percent). On the year Leisure and Hospitality added 16,113 jobs (6.2 percent) with growth in both component sectors. The supersector has shown over-the-year job growth consistently since April of 2018 and has had annual growth of greater than 1 percent for every month in 2019, with especially robust growth since early summer.

Employment in the Other Services supersector was up by 900 (0.8 percent) on the month. For the year the supersector added 1,569 jobs (1.4 percent), a sharp turnaround after posting a 0.5 percent over-the-year decline in October. November’s growth was shared between all three component sectors. Repair and Maintenance added 335 jobs (1.5 percent), Personal and Laundry Services added 215 (0.8 percent), and Religious, Grantmaking, Civic, Professional, and Similar Organizations added 1,019 (1.6 percent).

Government employment was mostly flat in November, up by 100 jobs or 0.0 percent. The only movement came at the Local Government level. Annually public sector employers added 1,460 jobs (0.3 percent), with growth at all three component levels. Federal employers added 412 jobs (1.3 percent), State employers added 451 (0.4 percent), and Local employment was up 597 (0.2 percent). Most of the growth came from the non-Educational Services side of the supersector, as education employment growth was largely flat.

| Industry | November 2019 | October 2019 | September 2019 |

|---|---|---|---|

| Total Nonfarm | 2,966.8 | 2,969.8 | 2,964.6 |

| Goods-Producing | 451.5 | 459.1 | 458.0 |

| Mining and Logging | 6.7 | 6.8 | 6.8 |

| Construction | 125.0 | 129.9 | 129.9 |

| Manufacturing | 319.8 | 322.4 | 321.3 |

| Service-Providing | 2,515.3 | 2,510.7 | 2,506.6 |

| Trade, Transportation, and Utilities | 537.3 | 537.0 | 535.2 |

| Information | 45.1 | 45.2 | 46.2 |

| Financial Activities | 187.1 | 186.8 | 187.9 |

| Professional and Business Services | 374.9 | 374.1 | 374.4 |

| Education and Health Services | 540.2 | 541.7 | 541.4 |

| Leisure and Hospitality | 291.0 | 287.2 | 282.1 |

| Other Services | 113.4 | 112.5 | 113.3 |

| Government | 426.3 | 426.2 | 426.1 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2019. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.