by Chet Bodin

October 2017

Determining industry clusters in a regional economy has been an important tool of regional planners and policy makers for decades. Regional industry clusters show communities the nuance of their economies, identify trends, and may suggest how communities can adapt to them. In particular, the Blakely and Green-Leigh quadrant method (see Figure 1) clusters industry sectors by how well they withstand economic fluctuation. This method is unique in that it offers a matrix of sustainability, categorizing regional industries by their response to economic change over time.

Figure 1. Quadrant Analysis Method of Regional Industry Clusters

With this method regional industries are grouped into four quadrants - transforming, growing, emerging, and declining - based on both the current local concentration of employment and employment change from 2011-2016. The combined analysis of these two factors produces a unique look at industry clusters, rather than those produced by employment concentration alone. For example, despite a low concentration of jobs in Northwest Minnesota, Computer and Electronic Product Manufacturing has had significant, locally-driven employment gains since 2011, landing it in the 'emerging' quadrant cluster. Such analysis of economic change may provide insight into which industries are thriving and why in Northwest Minnesota.

According to the model an industry sector is either deemed locally 'competitive' or not by using shift-share analysis to separate statewide influence from regional employment changes. Industry sectors with positive regional shift-share land in both the 'growing' and 'emerging' quadrants, depending on their local concentration of jobs in 2016.

As noted, 'emerging' industries do not appear to be influential on the surface, but local trends are feeding growth and demand attention. These include sectors such as Management of Companies and Enterprises, Chemical Manufacturing, and Computer Systems Design and Related Services. Market forces, including innovative technology and practices, have made 'emerging' industries an important part of the economic future in Northwest Minnesota. In particular, workforce innovation improves the regional economy by supporting local workers who constantly develop their skillsets, thereby addressing the unique social and economic challenges communities face and improving economic sustainability.

Regional industries in the 'growing' quadrant cluster, on the other hand, are already established pillars of the regional economy, having led employment growth in Northwest Minnesota since at least 2011. Machinery Manufacturing in Northwest Minnesota exemplifies the combination of local job concentration and locally-driven growth that makes the regional economy unique and sustainable.

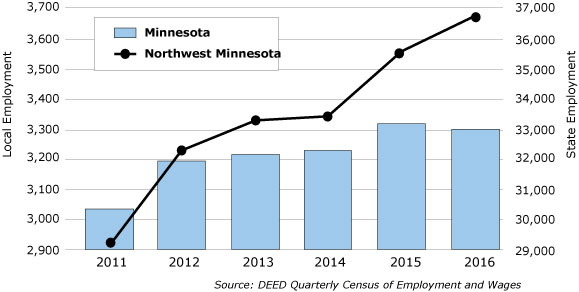

Figure 2 illustrates this trend. From 2011-2016 employment in Machinery Manufacturing grew by 25.8 percent in Northwest Minnesota, compared to 8.6 percent statewide. Had Machinery Manufacturing in Northwest Minnesota grown at the same rate as the state, it would have added approximately 252 jobs. Instead, the region added 754 jobs, signaling employment gains that are locally driven, as opposed to mere reflection of overall statewide trends.

In addition to being locally 'competitive', Machinery Manufacturing and other 'growing' industries in Northwest Minnesota have a location quotient above 1.0, meaning the ratio of jobs in these sectors are higher in the local economy than they are statewide. For example, although Machinery Manufacturing accounts for only 1.2 percent of total jobs in the state, the industry is responsible for 1.7 percent of jobs in Northwest Minnesota. As a result, 11.1 percent of Machinery Manufacturing jobs in Minnesota were in the Northwest planning region in 2016.

Figure 2. Machinery Manufacturing Employment Change, 2011-2016

Unfortunately, economic shifts also mean some industries become less relevant than in the past. For a variety of reasons, including changes in the available workforce, consumer habits, and other market forces, economic conditions in Northwest Minnesota have not been as suitable to some employers, leading to small gains compared to statewide industry growth or even regional employment loss. Either way, the regional shift is negative, signaling that some change may be required for these industries to regain a foothold in the region.

Some industries with a negative regional shift-share remain stable because of their size and long-term presence in Northwest Minnesota. These 'transforming' industries are large sources of employment, but their regional employment change from 2011-2016 was negative or less than the state average. Given their relative size in Northwest Minnesota, the response of 'transforming' industries to economic change is important to the overall regional economy but, intentionally or not, their growth has slowed. In some cases employers may be simply adapting to labor market fluctuation and managing their employment levels accordingly. In other instances employment loss may be connected to a decrease in production or services rendered.

Overall, there are 19 industry subsectors in Northwest Minnesota with location quotients > 1.00 that had no locally-driven employment gains from 2011-2016 (see Table 1). At 4.95, Transportation Equipment Manufacturing had the highest regional location quotient of any three-digit NAICS sector in 2016. This amounts to a regional concentration of jobs five times that of the industry statewide. However, regional employment growth from 2011-2016 was only 1.9 percent - less than half the rate statewide. Transportation Equipment Manufacturing employment grew 4.4 percent statewide during the same period, signaling the industry has not been as competitive in Northwest Minnesota of late.

Table 1. 2016 Northwest Minnesota Industry Clusters, Quadrant Analysis Model

| TRANSFORMING (High LQ, Low Shift-Share) | LQ | Regional Shift | GROWING (High LQ, High Shift-Share) | LQ | Regional Shift | |

|---|---|---|---|---|---|---|

| Transportation Equipment Manufacturing | 4.97 | -85 | Hospitals | 1.19 | 595 | |

| Wood Product Manufacturing | 3.95 | -266 | Merchant Wholesalers, Durable Goods | 1.22 | 545 | |

| Support Activities Agriculture and Forestry | 3.05 | -96 | Machinery Manufacturing | 1.43 | 502 | |

| Gasoline Stations | 1.99 | -132 | Crop Production | 3.95 | 341 | |

| Heavy and Civil Engineering Construction | 1.97 | -431 | Primary Metal Manufacturing | 1.53 | 139 | |

| Building Material and Garden Supplies Dealers | 1.51 | -169 | Pipeline Transportation | 6.32 | 128 | |

| Elementary and Secondary Schools | 1.41 | -162 | Construction of Buildings | 1.27 | 118 | |

| Nursing and Residential Care Facilities | 1.38 | -933 | Animal Production and Aquaculture | 2.27 | 102 | |

| Motor Vehicle and Parts Dealers | 1.34 | -103 | Amusement, Gambling, and Recreation | 1.52 | 105 | |

| Food and Beverage Stores | 1.31 | -351 | Admin. of Environ. Quality Programs | 1.84 | 98 | |

| Merchant Wholesalers, Nondurable Goods | 1.30 | -63 | Accommodation | 2.18 | 93 | |

| Fabricated Metal Product Manufacturing | 1.19 | -49 | Religious, Civic and Professional Orgs | 1.18 | 91 | |

| Truck Transportation | 1.14 | -235 | Executive, Legislative and Other Gov. | 2.00 | 63 | |

| Telecommunications | 1.11 | -21 | General Merchandise Stores | 1.36 | 57 | |

| - | Textile Product Mills | 2.27 | 44 | |||

| National Security and International Affairs | 2.90 | 37 | ||||

| Forestry and Logging | 4.20 | 35 | ||||

| Nonmetallic Mineral Product Mfg. | 1.23 | 34 | ||||

| DECLINING (Low LQ, Low Shift-Share) | LQ | Regional Shift | EMERGING (Low LQ, High Shift-Share) | LQ | Regional Shift | |

| Apparel Manufacturing | 0.28 | -20 | Admin. and Support Services | 0.43 | 660 | |

| Real Estate | 0.56 | -27 | Mgmt. of Companies and Enterprises | 0.15 | 310 | |

| Clothing and Clothing Accessories Stores | 0.47 | -28 | Miscellaneous Manufacturing | 0.45 | 255 | |

| Other Professional, Scientific, and Tech Svcs. | 0.54 | -31 | Insurance Carriers and Related | 0.41 | 191 | |

| Warehousing and Storage | 0.19 | -36 | Securities, Financial Investments, and Related | 0.26 | 132 | |

| Publishing Industries (except Internet) | 0.49 | -37 | Computer Systems Design and Related Svcs. | 0.12 | 122 | |

| Sporting Goods, Hobby, Book, and Music Stores | 0.83 | -41 | Educational Support Services | 0.79 | 96 | |

| Computer and Electronic Product Mfg. | 0.25 | -42 | Chemical Manufacturing | 0.38 | 88 | |

| Support Activities for Transportation | 0.42 | -44 | Printing and Related Support Activities | 0.77 | 74 | |

| Other Schools and Instruction | 0.83 | -53 | Scientific Research and Development Svcs. | 0.60 | 52 | |

| Performing Arts, Spectator Sports, and Related | 0.53 | -72 | Couriers and Messengers | 0.66 | 51 | |

| Furniture and Home Furnishings Stores | 0.56 | -94 | Wholesale Electronic Markets | 0.29 | 39 | |

| Architectural, Engineering, and Related Svcs. | 0.42 | -102 | Specialized Design Services | 0.42 | 38 | |

| Internet Providers and Data Processing Svcs. | 0.05 | -119 | Plastics and Rubber Products Manufacturing | 0.72 | 34 | |

| Justice, Public Order and Safety Activities | 0.57 | -124 | Museums and Historical Sites | 0.45 | 23 | |

| Non-store Retailers | 0.79 | -142 | Natural Gas Distribution | 0.65 | 23 | |

| Advertising and Related Services | 0.59 | -158 | Waste Management and Remediation Svcs. | 0.91 | 22 | |

| Personal and Laundry Services | 0.61 | -195 | - | |||

| Accounting, Tax, Bookkeeping, and Payroll | 0.65 | -209 | ||||

| Mgmt. Scientific and Technical Consulting | 0.10 | -342 | ||||

| Furniture and Related Product Mfg. | 0.79 | -406 | ||||

| Specialty Trade Contractors | 0.86 | -588 | ||||

| Credit Intermediation and Related | 0.74 | -607 | ||||

There are still other industries in Northwest Minnesota that fall into the 'declining' quadrant. They also have a negative regional shift-share from 2011-2016, but with a location quotient < 1.00. Given the latter, these industries often represent many of the region's small businesses and entrepreneurs who are struggling to add workers. However, other industry data may illuminate some of the changes in these industries. For example, the negative shift-share in Specialty Trade Contractors looks to be a consequence of statewide growth rather than a regional slump. Over 16,000 jobs were added to Specialty Trade Contractors statewide, 635 in Northwest Minnesota. The region has not been able to leverage the statewide boon as much as other parts of the state, yet the regional growth rate of 14.5 percent still exceeded the regional and statewide growth rates for total jobs overall (see Table 2).

Table 2. Industry Employment Statistics, 2016

| - | 2011-2016 | ||||||

|---|---|---|---|---|---|---|---|

|

NAICS |

Geography |

Number

|

Number

|

Total Payroll |

Average Annual Wage |

Change

|

Percent Change |

| 000000 | State of Minnesota | 160,849 | 2,813,963 | $152,827,293,003 | $54,288 | 210,437 | 8.1% |

| 000023 | Construction | 15,412 | 122,771 | $7,752,034,483 | $63,024 | 24,167 | 24.5% |

| 000238 | Specialty Trade Contractors | 10,026 | 74,331 | $4,418,020,434 | $59,332 | 16,365 | 28.2% |

| 000000 | Northwest Minnesota | 16,134 | 219,267 | $8,333,043,701 | $33,960 | 11,052 | 5.3% |

| 000023 | Construction | 2,021 | 11,001 | $546,845,116 | $49,192 | 1,313 | 13.6% |

| 000238 | Specialty Trade Contractors | 1,170 | 4,954 | $210,381,019 | $42,224 | 629 | 14.5% |

| Source: DEED Quarterly Census of Employment & Wages (QCEW) | |||||||

There are many ways to cluster regional industries, but the quadrant method is unique in showing how Northwest Minnesota has been affected by economic change. In particular, it provides initial direction about how each industry is changing and how it might respond. From there it is up to communities, development professionals, and industry leaders to determine how best to leverage or counter the economic conditions in Northwest Minnesota and the state. Some tools, such as workforce development, are readily apparent and apply in nearly all situations. Others will require a closer look at industry dynamics to determine where and how to get involved.