by Mustapha Hammida

December 2022

This article is the first in a series of three articles to help understand the properties of the distribution of hourly wages of Minnesota workers during the last six years – covering pre-, during, and post-pandemic recession years. It sets the stage by describing the distribution of hourly wages of Minnesota workers in the year before the COVID-19 pandemic hit. In particular, it offers - for the first time - a good illustration of the shape of such a distribution and its properties, including wage inequality. In addition, it highlights a special dataset critical in allowing for the comprehensive description of the distribution of hourly wages and for quantifying the impact of changes in the composition of employment on the distribution.

The second article, published in this issue and referenced below, analyzes how the Pandemic Recession affected the distribution of hourly wages of Minnesota workers and how the recent rise in inflation is influencing growth in hourly wages of workers. The final article in the series, forthcoming in the next issue of this publication, will address how indicative of "true" wage growth is the measure of aggregate average hourly wage growth in general and during the Pandemic Recession.

As the COVID-19 virus ravaged employment and disrupted many sectors of the economy, official statistics on aggregate wage growth showed surprisingly large spikes. Results from the establishment survey of the Bureau of Labor Statistics (BLS) indicate that the average hourly wage of private non-farm jobs in Minnesota grew by 2.6% between February and April 2020 and by 7.5% between April 2019 and April 2020. Nationally, these hourly wage growth rates were even more significant1: 4.5% between February and April 2020 and 8.1% between April 2019 and 2020. Many economists maintain that the changes in the composition of employment during the Pandemic Recession are behind these large growth rates.

The data for this study comes from the Unemployment Insurance Wage Detail Report (UIWDR). The UIWDR provides quarterly wages and hours worked2 for all employees of establishments covered under Minnesota Unemployment Insurance (UI) Law. This dataset possesses some desirable features for hourly wage analysis. First, it supplies the number of hours per job, an essential variable in constructing hourly wages. Second, all wages earned during the quarter are reported; no top coding3 is imposed on the reported wages. Third, it represents a near-universe of Minnesota jobs and workers. Excluded jobs represent the non-covered employment that includes the federal government, railroad workers, religious workers, elected government officials, and a few others. These last two properties are essential in determining the precise shape of the statistical distribution of wages.

Fourth, it is a job-based frame, which facilitates the creation of a worker-frame and the longitudinal linking at the worker and employer levels making it easy to study how wages change over time and in response to changes in employment structure. Finally, it is less susceptible to measurement errors common in surveys. However, the UIWDR has its own errors, and we implemented a set of procedures to identify and exclude records with suspect data4.

The wages of a job in the UIWDR represent wage earnings or compensation that is subject to UI taxes. Specifically, reported wages include salaries, wages, commissions, bonuses, vacation pay, holiday pay, and sick pay. Other types of compensation, such as health and retirement benefits, are not part of reported wages. Thus, the wages discussed in this study represent only wages, salaries, and other supplemental pay and not the total compensation package received by an employee. Over the last six years, BLS estimates show that wages and salaries were about 70% of the total compensation received by an average American civilian worker.

Data on hours represent the total number of paid hours worked at a job during the quarter. Reported hours include regular work hours, overtime hours, and hours for paid sick, vacation and holiday. In other words, hours represent paid hours related to a job and not just hours worked, which are commonly used in estimating labor productivity and labor cost. Moreover, no information is available in the UIWDR on the timing of paid hours worked during the quarter. Thus, the hourly wages reported in this article describe hourly wages received by workers during the entire quarter and not at a specific point in time5.

Although the UIWDR does not provide an actual hourly wage, deriving a measure of hourly wages from wages and hours reported in the UIWDR is easy. Put simply, for a particular job in the UIWDR the hourly wage is simply the ratio of the total wages paid to total paid hours worked during the quarter. Subsequently, the hourly wage earned by a particular worker is defined as the quotient of the total wages earned from all jobs held during the quarter divided by the total paid hours worked at all jobs held in the quarter6.

The hourly wages of individual workers are the foundation of the statistical distribution of hourly wages of Minnesota workers and its statistics. The next section describes the shape of the distribution of hourly wages of workers and determines the spread of hourly wages in the second quarter of 2019, one year before the Pandemic Recession. The wage distribution is in nominal terms, which expresses wages in current dollars (not adjusted for inflation).

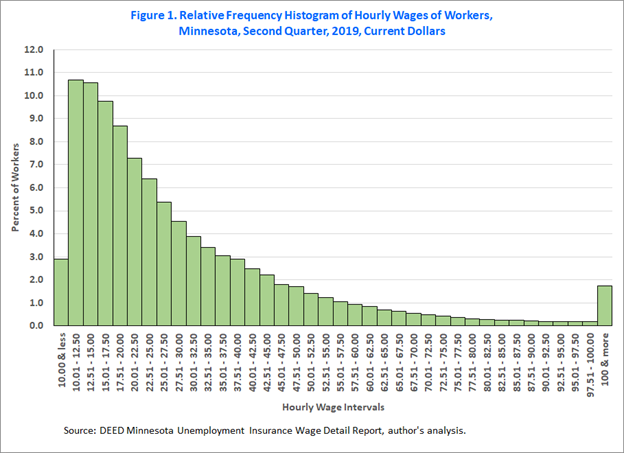

There are two standard techniques of graphically describing the distribution of a quantitative, random variable such as hourly wages. The first one is with an empirical probability distribution function (EPDF), or a relative frequency histogram7. Such a histogram is useful in depicting the shape of the hourly wage distribution and revealing its symmetry or lack of it. A histogram of hourly wages gives the percent (or probability) of workers earning hourly wages bounded in a specific interval.

Figure 1 presents the histogram of hourly wages of workers in second quarter 2019 by plotting hourly wage intervals on the horizontal axis and the percent of workers on the vertical axis. The base of each bar in the figure has a width of $2.50, except for the first and last bars. The height of each bar gives the relative frequency of workers that earn an hourly wage contained in the wage interval that forms the base of the bar. For example, the two highest bars indicate that 10.7% of workers were making between $10.01 and $12.50 and 10.6% of workers were making between $12.51 and $15.00. As the histogram is related to an EPDF, the percentage points of all the bars sum to 100%.

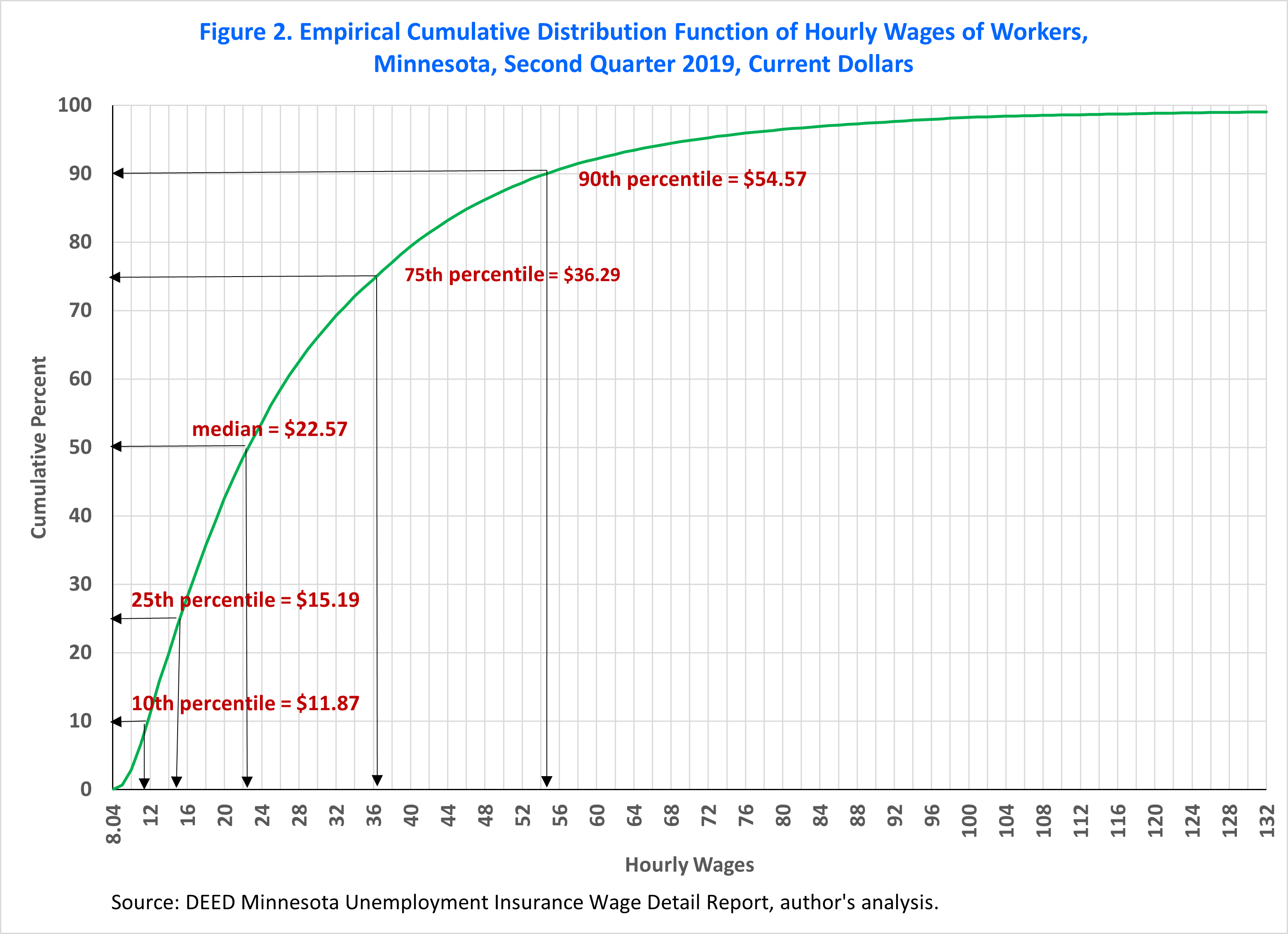

The second technique is to construct an empirical cumulative distribution function (ECDF), which gives the percent of workers earning less than or equal to a particular hourly wage rate8. This means that ECDF gives the distribution percentiles and shows how the slope of the distribution changes across different sections of the distribution, which is an indicator of wage spread, or wage inequality. An hourly wage pth percentile indicates the hourly wage level below which p percent of workers falls.

Figure 2 gives the ECDF of hourly wages of workers where the vertical axis gives the cumulative percentage (or probability) and the horizontal axis lists the hourly wages ordered from least to greatest. To preserve the sharpness of the curve, Figure 2 shows only the bottom 99% of the distribution; the support (horizontal axis) of the distribution extends to $132.00, however, the actual support extends much farther than that.

Figure 2 highlights five quantiles9: the bottom decile (or 10th percentile), top decile (or 90th percentile), and the three quartiles (25th, 50th, and 75th percentiles). The quartiles divide the distribution into four parts containing equal proportions of workers along the vertical axis. The median hourly wage was $22.57, the mid-point of worker compensation with half of workers earning less and the other half earned more. The other two quartiles identify that the middle half of workers earned hourly wages between $15.19 and $36.29. Looking at the tails of the distribution, the bottom decile shows that the bottom 10% of workers earned hourly wages less than $11.87 while the top decile shows that the top 10% of workers earned hourly wages higher than $54.5710.

Figures 1 and 2 show that the distribution of hourly wages of Minnesota workers exhibits many of the stylized facts of wage (as well as income or wealth) distributions11. First, the distribution is asymmetric with a sizeable portion of workers located in the left side of the distribution and few workers in the farthest right side of the distribution (Figure 1). For example, Figure 1 shows that the five bars on the farthest left side of the distribution that cover workers earning $20.00 or less represent more than two-fifths (42.6%) of workers. In addition, slightly over two-thirds of workers have hourly wages that are on the left of the mean hourly wage of $30.68 — the other measure of the middle of workers compensation. A symmetric distribution is centered at the mean with half of its observations to the left of the mean and the other half to the right of the mean.

Second, Figure 1 shows that the hourly wage distribution of workers has a long tail on its right side making it skewed to the right, also known as positively skewed. Such distributions are commonly characterized by having their mean greater than the median, which in turn is greater than the mode (most occurring hourly wage in the distribution). In the second quarter of 2019, the mean, median, and mode of hourly wages of Minnesota workers were $30.68, $22.57, and $12.00 respectively12. In symmetric distributions, all three statistics fall at the same value.

Third, the spread of hourly wages is not equal across different sections of the distribution. This can be seen easily from the differing slopes (which equal rise over run) of the ECDF over each of the four sections of the distribution with equal rises. Over a particular section of the ECDF, a steeper slope indicates a tighter range of hourly wages and, therefore, a small wage spread; this is the case over the first quarter section of the ECDF in Figure 2. However, a flatter slope indicates a large spread of hourly wages, as is the case over the last quarter section of the ECDF in Figure 2.

In addition to the simple visual assessment of inequality, or the dissimilar spread, across the distribution, numerical evaluation of wage inequality is possible by comparing percentiles across the two halves of the distribution. A ratio of two percentiles measures the relative spread of hourly wages located between that pair of percentiles. When the higher percentile is in the numerator of the ratio, the (unrealistic,) lowest possible value of the ratio is one indicating no spread, or that all workers between the two percentiles in the ratio have equal hourly wages. This means that small (large) values of ratios of percentiles are indicative of small (large) spread, or inequality, in hourly wages.

Comparing the median to the highest and lowest deciles describes the spread of hourly wages in the middle 80% region of the distribution. The ratio of the 90th percentile to the 50th percentile equals 2.4 while the ratio of the 50th percentile to the 10th percentile is only 1.9. In other words, a worker at the top ten percent of the distribution earns hourly wages that are 2.4 times those of a worker at the middle of the distribution. However, the hourly wages of this same middle-worker are only 1.9 times those of a worker at the bottom 10 percent of the distribution.

Another pair of percentile ratios to evaluate wage inequality contains the ratio of the 75th percentile to the 50th percentile and the ratio of the 50th percentile to the 25th percentile. These ratios evaluate the wage inequality of hourly wages within the middle half of the distribution. Even in this smaller region of the distribution, there are differences in the spread, though smaller than in the previous, larger region. In fact, the values of the ratio of the 75th percentile to the 50th percentile and of the ratio of the 50th percentile to the 25th percentile are 1.6 and 1.5, respectively.

Thus, these estimates confirm that there are differences in the spread of hourly wages between the bottom and the top halves of the hourly wage distribution; the spread in wages is larger over the top half of the distribution than over the bottom half14.

Furthermore, each of these two pairs of percentile ratios can be combined to form some standard measures of wage inequality. The first measure is the ratio of the 75th percentile to the 25th percentile that compares hourly wages of the top quarter of workers to the bottom quarter of workers. This ratio was 2.4 in second quarter 2019, indicating that hourly wages of workers making more than the 75th percentile were at least 2.4 times larger than those making less than the 25th percentile hourly wage. The second measure is the ratio of the 90th percentile to the 10th percentile, coming in at 4.6. This means that a worker at the 90th percentile of the distribution had an hourly wage equal to 4.6 times the one for a worker at the 10th percentile.

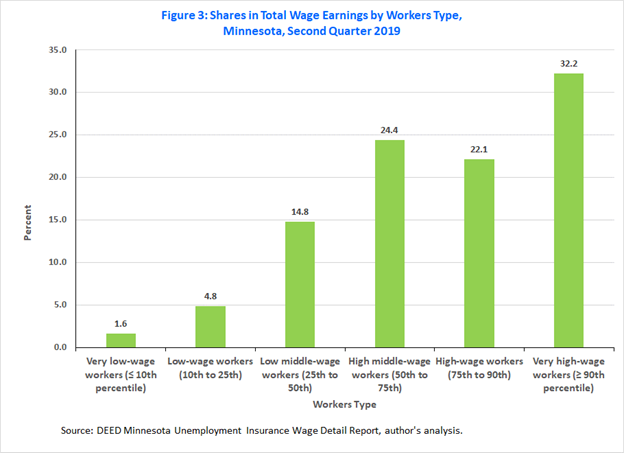

Finally, the Minnesota hourly wage distribution possesses another stylized fact not directly displayed in Figures 1 and 2. This fact states that the top percentiles of workers account for a disproportionately large share of wage earnings. In other words, wage earnings are unevenly distributed among groups of workers in the distribution and concentrated in the top section of the wage distribution.

Special quantiles are commonly used to break a distribution into groups to assess wage (or income) concentration. In this study, we use the 25th and 75th hourly wage percentiles to break the distribution into three major groups (low, middle, and high), and then we break each group into two parts using the 10th, 50th, and 90th percentiles. The resulting six groups are the very low-wage workers (≤ 10th), low-wage workers (10th to 25th), low middle-wage workers (25th to 50th), high middle-wage workers (50th to 75th), high-wage workers (75th to 90th), and very high-wage workers (≥ 90th).

Figure 3 depicts the share of each of these worker groups in total wage earnings. The top 10% of workers, or the very high-wage workers, accounted for close to one-third of total wage earnings in the second quarter of 2019. Furthermore, the top 25% of workers (high-wage and very high-wage workers) received over half of the total wage earnings. Stated differently, the share of the bottom 75% of workers in total wage earnings was only 45.6%. Comparatively, the bottom 25% of workers (very low-wage and low-wage workers) accounted only for about one-fifteenth (6.5%) of total wage earnings.

This article, the first in a three-article series, focused on the hourly wage distribution of Minnesota workers and its properties. The distribution is novel since it is based on the unique data from the Unemployment Insurance Wage Detail Reports. Having a clear understanding of the shape and properties of the distribution is necessary to grasp how COVID-19 affected the distribution and its statistics. The major finding in this article is that the Minnesota distribution of hourly wages possesses many of the stylized facts of wage (as well as income or wealth) distributions. Specifically, it is asymmetric, right-skewed, and unequal, where hourly wages are more concentrated in the top half of the distribution than in the bottom half.

Results on effects of COVID-19 on the wage distribution are presented in Minnesota Wage Distribution Analysis - Article Two: Distribution of Hourly Wages 2017-2022 and the Impact of Inflation.

1In addition to job statistics, workers' wage growth rate for the nation was also significantly large from another BLS survey, the household survey. The median usual weekly earnings of full-time wage and salary workers grew by 6.0% between the first and second quarters of 2020 and by 10.4% between the second quarters of 2019 and 2020.

2Minnesota is one of only a handful of states in the nation that have hours in the UIWDR.

3For confidentiality purposes, top coding of wages is common practice in survey data. Top coding establishes a cap on reported high wages; wages above the cap are re-set to the cap wage As a result, top coding has the adverse effects of underestimating hourly wages and their growth when wages above the cap wage increase over time.

4In addition to records with suspect data, the study imposes a floor on wages by excluding records with wages below the prevailing lowest minimum wage in the state and a ceiling on the number of jobs held by workers by excluding workers with more than four jobs in a quarter.

5Most official statistics on employment and wages are point-in time covering the pay period that includes the 12th of the month. These statistics may not coincide with the ones derived from the UIWDR because UIWDR captures employment that starts or ends outside of the reference period that is missed in the point-in-time statistics.

6This definition of hourly wages of workers is a weighted average of the hourly wages of jobs held where the hours worked across jobs form the weights, thus different from the simple average of hourly wages of jobs held.

7The relative frequency histogram is based on the actual observations and not on a theoretical density function. Although this study does not attempt to estimate the theoretical density function that gives rise to the Minnesota hourly wage distribution, the empirical histogram represents an estimate of the theoretical distribution.

8As such, the ECDF is a non-decreasing function. As wages increase from left to right on the horizontal axis, the probability or percent increases from bottom to top on the vertical axis. In addition, similar to the EPDF, the ECDF approximates the theoretical CDF. When both the theoretical PDF and CDF are identified, they are closely related.

9A quantile is a value (or wage) that divides the distribution in such a way that a particular proportion of observations are below the quantile. A set of quantiles are values (or wages) that divide the (wage) distribution into equal parts. More precisely, a group of q-quantile divides the distribution into q equal parts. For example, deciles are 10-quantiles and nine deciles divides the distribution into 10 parts. In a similar fashion, quartiles are 4-quantiles, and percentiles are 100-quantiles.

10Detailed statistics by the five quantiles for Minnesota are available only for jobs from the BLS Occupational Employment and Wage Statistics (OEWS). For comparison purposes, we also estimated the five quantiles for jobs using the UIWR. Below are statistics for jobs from the OEWS and UIWR. Given the difference in coverage and scope, both sets of statistics match well, in particular in the lower half of the distribution.

| Source | Coverage | Period | 10th | 25th | 50th | 75th | 90th | Average |

|---|---|---|---|---|---|---|---|---|

| OEWS | Survey | May 2019 | $11.41 | $14.48 | $21.21 | $32.60 | $48.48 | $26.87 |

| UIWR | Census | 2nd Quarter 2019 | $11.38 | $14.33 | $21.06 | $34.37 | $52.45 | $29.08 |

11See for example, the introduction in Theories of the Distribution of Earnings and the introduction in Skewed Wealth Distributions: Theory and Empirics.

12The ratio of the median-to-mean is 73.6%. For comparison purposes, using the OEWS statistics for jobs, the corresponding ratio is 78.9%. For the nation, the ratio of the median-to-mean of jobs was 74.4%. This indicates that, at least for jobs, the hourly wage distribution for Minnesota is less asymmetric, or less right-skewed, than the one for the U.S. as a whole. In addition, ranking all states based on this ratio from highest (less right-skewedness) to lowest (more right-skewedness), Minnesota was ranked 15th in May 2019.

The hourly wages of jobs for the U.S. in May 2019 were:

| Source | Coverage | Period | 10th | 25th | 50th | 75th | 90th | Average |

|---|---|---|---|---|---|---|---|---|

| OEWS | Survey | May 2019 | $10.35 | $13.02 | $19.14 | $30.88 | $48.57 | $25.72 |

13It is important to recognize that some wage (or income) inequality is a necessary and healthy outcome of a well-functioning free market system. Without wage inequality, agents in the economy would have no incentives to invest in education and training in order to improve their human capital and better their income.

14Using again the OEWS for May 2019 and comparing Minnesota to the nation, Minnesota has a similar spread of hourly wages of jobs in the bottom half of the distribution, and a lesser spread in the top half of the distribution. Ranking states from least to highest spread, Minnesota was, generally, among the top 20 states.

| Source | Region | Measure | 50th/10th | 50th/25th | 75th/50th | 90th/50th |

|---|---|---|---|---|---|---|

| OEWS | U.S. | Value | 1.85 | 1.47 | 1.61 | 2.54 |

| OEWS | MN | Value | 1.86 | 1.46 | 1.54 | 2.29 |

| OEWS | MN | Rank | 19th | 26th | 17th | 20th |