by Tim O'Neill

December 2017

With 8,810 establishments supplying nearly 167,200 jobs, Retail Trade in the Seven-County Metro Area is vital to the regional economy and labor market (see Table 1). Retail Trade is the third largest-employing industry in the Metro Area, behind only Health Care and Social Assistance and Manufacturing. If recent employment trends continue, there is the possibility that Retail Trade will overtake Manufacturing as the region's second largest employing industry in the not-too-distant future. Clearly, Retail Trade deserves a special spotlight article.

| Table 1. Retail Trade Employment in the Twin Cities Metro Region, Q2 2017 | ||||

|---|---|---|---|---|

| Area | Establishments | Employment | Percent of Area Employment | Average Annual Wage |

| Minnesota | 18,518 | 298,960 | 10.4% | $28,912 |

| Metro Region | 8,810 | 167,193 | 9.6% | $31,460 |

| Hennepin County | 4,033 | 78,414 | 8.6% | $33,904 |

| Ramsey County | 1,560 | 27,066 | 8.2% | $31,252 |

| Dakota County | 1,180 | 24,161 | 12.7% | $30,212 |

| Anoka County | 832 | 15,549 | 12.6% | $28,340 |

| Washington County | 690 | 13,295 | 15.7% | $25,844 |

| Scott County | 308 | 5,345 | 10.0% | $28,860 |

| Carver County | 207 | 3,362 | 8.6% | $26,624 |

| Source: MN DEED Quarterly Census of Employment and Wages (QCEW) | ||||

There's no doubt that Retail Trade is an important, large-employing industry sector. There's a lot to it, much more than one might realize at first glance. According to the Bureau of Labor Statistics (BLS), "The Retail Trade sector comprises establishments engaged in retailing merchandise, generally without transformation, and rendering services incidental to the sale of merchandise." Additionally, the sector comprises two main types of retailers: store and non-store:

Store retailers operate fixed point-of-sale locations, located and designed to attract a high volume of walk-in customers. In general, retail stores have extensive displays of merchandise and use mass-media advertising to attract customers. Store retailers serve the general public for personal or household consumption but may also serve businesses and institutional clients.

Non-store retailers, on the other hand, reach customers and market merchandise through other methods, such as infomercials, paper and electronic catalogs, door-to-door solicitation, in-home demonstration, selling from portable stalls, and through vending machines.1

Retail Trade accounts for 9.6 percent of total employment in the Metro Area. This sector and its 167,200 jobs can be broken down further, however. For example, nearly 32,000 retail jobs are found in General Merchandise Stores, of which about half are classified in Department Stores and the other half in Warehouse Clubs and Supercenters. Nearly 30,600 retail jobs are found in Food and Beverage Stores, which can be separated into Grocery Stores, Specialty Food Stores, and Beer, Wine, and Liquor Stores. Rounding out the top three-employing subsectors of Retail Trade, Motor Vehicle and Parts Dealers supplies nearly 18,300 jobs in the Metro Area. Nearly half (48.3 percent) of Retail Trade's employment is in General Merchandise Stores, Food and Beverage Stores, and Motor Vehicle and Parts Dealers. The other half of Retail Trade's employment in the Metro Area is scattered through nine other industry sectors, ranging from gasoline stations to sporting goods stores (see Table 2).

| Table 2. Retail Subsectors in the Twin Cities Metro Region | ||||

|---|---|---|---|---|

| Industry | Establishments | Employment | Percent of Total Employment | Average Annual Wage |

| Total, All Industries | 79,710 | 1,737,532 | 100.0% | $60,268 |

| Retail Trade | 8,810 | 167,193 | 9.6% | $31,460 |

| General Merchandise Stores | 464 | 31,940 | 19.1% | $24,388 |

| Food and Beverage Stores | 1,157 | 30,590 | 18.3% | $24,388 |

| Motor Vehicle and Parts Dealers | 823 | 18,289 | 10.9% | $50,076 |

| Building Material and Garden Equipment and Supplies Dealers | 440 | 14,799 | 8.9% | $31,512 |

| Clothing and Clothing Accessories Stores | 1,218 | 14,326 | 8.6% | $20,852 |

| Health and Personal Care Stores | 1,085 | 11,650 | 7.0% | $37,960 |

| Miscellaneous Store Retailers | 1,058 | 10,339 | 6.2% | $25,688 |

| Gasoline Stations | 754 | 8,501 | 5.1% | $22,932 |

| Sporting Goods, Hobby, Book, and Music Stores | 511 | 7,625 | 4.6% | $20,332 |

| Non-store Retailers | 486 | 7,028 | 4.2% | $68,952 |

| Furniture and Home Furnishings Stores | 441 | 6,384 | 3.8% | $37,804 |

| Electronics and Appliance Stores | 373 | 5,719 | 3.4% | $47,372 |

| Source: MN DEED Quarterly Census of Employment and Wages (QCEW) | ||||

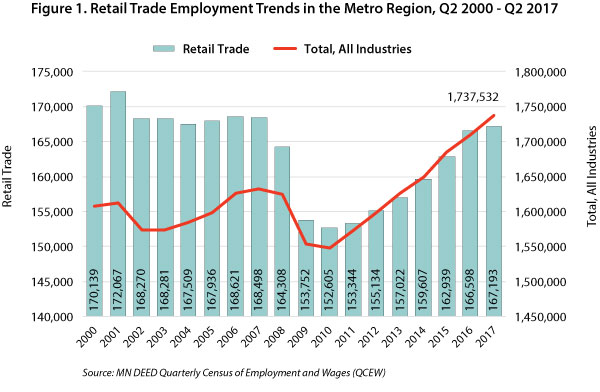

The phrase "in the black" is often used to describe companies that are profitable, while "in the red" is used to describe those that are falling behind. Loosely borrowing these terms to describe positive and negative employment trends would seem appropriate for Retail Trade. During the Great Recession the total economy was definitely in the red, contracting by 5.2 percent between the second quarters of 2007 and 2010. During that same period of time, Retail Trade shed nearly 16,000 jobs, contracting by 9.4 percent.

Since the nadir of the recession, the total economy is back in the black, expanding by 12.3 percent. As of the second quarter of 2017, the Metro Area is over 100,000 jobs (6.5 percent) above its pre-recessionary peak in 2007. Meanwhile, between the second quarters of 2010 and 2017, Retail Trade has added nearly 14,600 jobs, expanding by 9.6 percent. So while Retail Trade has certainly recovered from the depths of the Great Recession, it has just a bit to go to be "in the black." In other words, Retail Trade is about 0.8 percent or 1,300 jobs shy of its 2007 level of employment (see Figure 1).

Zooming back in on Retail Trade's subsectors reveals how the industry sector has restructured during the economic recovery. For instance, where the total of all Retail Trade employment increased by 9.6 percent between the second quarters of 2010 and 2017, employment in Health and Personal Care Stores shot up by 30.9 percent. Health and Personal Care Stores includes Pharmacies and Drug Stores; Cosmetics, Beauty Supplies, and Perfume Stores; Optical Goods Stores; and Food Supplement Stores. Other subsectors that witnessed rapid growth between the second quarters of 2010 and 2017 include Food and Beverage Stores (up 26.5 percent), Motor Vehicles and Parts Dealers (up 22.1 percent), and Furniture and Home Furnishings Stores (up 21.6 percent).

The phrases "in the black" or "in the red" are generally used to describe the previous accounting period, such as the previous fiscal year. When analyzing employment trends since the nadir of the Great Recession, eight of the 12 Retail Trade subsectors are in the black. Only General Merchandise Stores; Miscellaneous Store Retailers; Sporting Goods, Hobby, Book, and Music Stores; and Clothing and Clothing Accessories Stores are in the red.

Longer-term trends reveal a much different picture. Since the turn of the century, only two Retail Trade subsectors are currently at their highest points of employment: Health and Personal Care Stores and Food and Beverage Stores. Building Material, Garden Equipment, and Supplies Dealers almost joins that exclusive club, only 52 jobs below its peak employment in 2004. Through the past 17 years of available employment data, only two of 12 Retail Trade subsectors are in the black. Clearly, Retail Trade has transformed over the past 17 years, buffeted by new technologies, changing consumer preferences, entirely new generations of shoppers (Millennials and Generation Z), a Great Recession, and more.

Retail Trade is strongly linked to the success of the economy. When the Great Recession hit, many consumers looked to save money, reducing the demand for products sold, resulting in employment and business contractions. With economic recovery, consumers spend more of their disposable income, more retail workers are hired, and businesses expand.2 Yet new and emerging factors are also influencing the shape of Retail Trade. Online shopping is the largest of these factors. According to BLS, "the increase in online sales is expected to continue over the next decade, limiting the growth of the number of physical retail stores and moderating the demand for retail sales workers."3 For retail employers, keeping up with transforming technologies and changing consumer preferences is key. "Retail Trade is a dynamic industry that is always changing. Technology is reshaping how consumers shop. Retailers that resist the changes coming about will not survive. Those that embrace technology and let the consumer be in charge will thrive."4

Despite the impact of online sales and slowing Retail Trade employment growth, the need for workers remains high. According to DEED's latest Job Vacancy Survey (JVS) results, Retail Trade employers reported over 11,000 vacancies throughout the Metro Area. Such vacancies were up an incredible 60.9 percent over the year and now represent the most vacancies reported for Retail Trade since the survey began in 2001. The bulk of these vacancies are for Retail Salespersons, Cashiers, and First-Line Supervisors of Retail Sales Workers.

Despite the changing face of Retail Trade, it remains the Metro Area's third largest-employing industry sector, accounting for one in every 10 jobs. With tight labor market conditions persisting into 2018, employers remain on the look-out for qualified and motivated workers to fill current vacancies.

1"About the Retail Trade Sector." Industries at a Glance, Bureau of Labor Statistics, Dec. 13, 2017. Accessed Dec. 13, 2017.

2Rieley, Michael. "The Changing Face of Retail Trade." Career Outlook, Bureau of Labor Statistics, Dec. 2014. Accessed Dec. 13, 2017.

3"Occupational Outlook Handbook." Retail Sales Workers, Bureau of Labor Statistics, Oct. 24, 2017. Accessed Dec. 13, 2017.

4Loeb, Walter. "The Future of Retailing: The Technology Revolution is Now." Forbes, Aug. 9, 2016. Accessed Dec. 19, 2017.