by Tim O'Neill

June 2024

Entering the summer months of 2024, the Seven-County Twin Cities Metro Area continues to witness a labor market in constant motion. With brand new labor force statistics, industry statistics, and hiring demand data, we can get a unique look at this motion over the months and years. The data allows us to see how the Metro Area's labor market fits into Minnesota's labor market, and how it has differed over time. Looking into the data, we can begin to understand how the region has recovered from the Pandemic Recession and where challenges persist.

According to Local Area Unemployment Statistics (LAUS), the Metro Area's labor force reached an annual average of around 1,728,500 workers in 2023. The labor force includes all persons 16 years of age and older, living within a specified geographic area who are either employed or unemployed but who were available for work and made a specific effort to find work in the last four weeks. Additionally, unemployed persons include new entrants to the labor force, re-entrants, job losers and job leavers. The number includes many more people than just those who have filed claims for unemployment insurance. In sum, the labor force size is a count of persons, not jobs, and is available by location of residence and not by location of work.

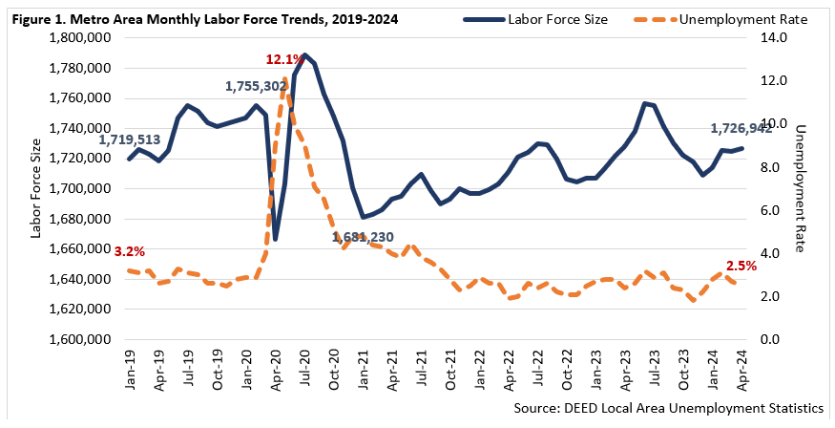

The labor force size across Minnesota, including within the Metro Area, has been closely watched over the past years and decades. Much of this analysis is due to an aging population and labor force, as well as the lingering impacts of COVID-19. After seeing steady growth for decades, between February 2020 and April 2020, the Metro Area's labor force plummeted by 88,900 people (-5.1%). Then with some fluctuation, the labor force was able to recover 14,800 people (+0.9%) through January 2021.

Since that time, between January 2021 and April 2024, the region's labor force expanded by a further 45,700 people (+2.7%). While recent growth has been encouraging, there's no escaping the fact that the Metro Area's labor force is still down by nearly 28,400 persons since February 2020, immediately pre-pandemic (see Figure 1).

This loss isn't unique to the Metro Area. Between February 2020 and April 2024, Minnesota's labor force is still down nearly 34,100 persons (-1.1%). Recent articles and analysis point to several reasons why the state's labor force has yet to match or exceed pre-COVID levels, including slower population growth rates, declines in labor force participation rates for older workers, and an aging population. Higher household incomes and more widespread access to retirement accounts in Minnesota compared to neighboring states is also a likely factor leading to increased retirements for Minnesota workers.

Longer term, the Metro Area's labor force has grown by 6.2% between 2013 and 2023. This is equivalent to just over 101,500 additional workers in a ten-year period. Despite declines during the pandemic, more recent annual trends also showcase encouraging growth. Between 2022 and 2023, the Metro Area's labor force expanded by 0.9%. This was equivalent to nearly 15,800 people. The region's seven counties all experienced labor force growth during this period, led by Hennepin County's additional 6,400 workers. Scott County and Carver County witnessed the smallest but fastest labor force growth between 2022 and 2023, each expanding by 1.1% (Table 1).

| Table 1. Metro Area Labor Force Statistics, Annual 2023 Sorted by Labor Force Size | ||||

|---|---|---|---|---|

| Area | Labor Force Size | 2022 – 2023 Labor Force Change | Unemployment | Unemployment Rate |

| United States | 167,116,416 | +2,829,250 (+1.7%) | 6,079,916 | 3.6% |

| Minnesota | 3,099,922 | +22,422 (+0.7%) | 87,215 | 2.8% |

| Metro Area | 1,728,472 | +15,766 (+0.9%) | 44,877 | 2.6% |

| Hennepin County | 708,159 | +6,421 (+0.9%) | 18,281 | 2.6% |

| Ramsey County | 286,615 | +2,276 (+0.8%) | 7,705 | 2.7% |

| Dakota County | 243,607 | +2,302 (+1.0%) | 6,215 | 2.6% |

| Anoka County | 199,737 | +1,830 (+0.9%) | 5,511 | 2.8% |

| Washington County | 145,662 | +1,375 (+1.0%) | 3,552 | 2.4% |

| Scott County | 84,925 | +897 (+1.1%) | 2,151 | 2.5% |

| Carver County | 59,767 | +665 (+1.1%) | 1,462 | 2.4% |

| Source: DEED Local Area Unemployment Statistics | ||||

As previously mentioned, the labor force, in part, consists of those unemployed persons actively searching for work. Over 2023, the Metro Area had approximately 44,900 unemployed persons, which equated to an unemployment rate of 2.6%. This was slightly lower than the statewide unemployment rate of 2.8% and a full percentage point lower than the national annual rate of 3.6%. By county, unemployment ranged from 2.4% in Carver and Washington counties to 2.8% in Anoka County (Table 1).

On an annual average basis in 2023, the Twin Cities had 93,760 establishments supplying 1,754,325 covered jobs. This is according to DEED's Quarterly Census of Employment and Wages (QCEW). Total annual payroll for the region equaled $137.4 billion, with the average annual wage equal to $78,364. That was the highest of the six planning regions in the state.

Health Care & Social Assistance is the Metro Area's largest-employing industry sector with 291,689 covered jobs at 13,854 establishments. Manufacturing is the second largest with 175,817 covered jobs at 4,031 establishments, and Retail Trade ranks third with 154,854 covered jobs at 8,263 establishments. Altogether, those three industries account for over one-third (35.5%) of the Metro Area's total employment. Other large-employing industry sectors with over 100,000 jobs in the region include: Educational Services; Accommodation & Food Services; Professional, Scientific, & Technical Services; and Finance & Insurance (Table 2).

Management of Companies is the major industry sector with the highest average annual wage in the Metro Area, at $141,856. Other industries with significantly higher average annual wages include Finance & Insurance ($140,920); Mining ($135,356); Utilities ($134,056); Professional, Scientific & Technical Services ($121,680); Information ($112,944); and Wholesale Trade ($106,184). The industries with lower average annual wages include Accommodation & Food Services ($29,120); Retail Trade ($41,184); Agriculture ($43,992); and Other Services ($49,556).

| Table 2. Twin Cities Metro Area Industry Statistics, Annual 2023 Sorted by Number of Jobs | |||||

|---|---|---|---|---|---|

| Industry | Number of Establishment | Number of Jobs | Share of MN Jobs | Total Payroll ($1,000s) | Avg. Annual Wage |

| Total, All Industries | 93,760 | 1,754,325 | 60.4% | $137,438,190 | $78,364 |

| Health Care & Social Assistance | 13,854 | 291,689 | 57.0% | $18,810,573 | $64,428 |

| Manufacturing | 4,031 | 175,817 | 54.0% | $15,587,650 | $88,660 |

| Retail Trade | 8,263 | 154,854 | 54.6% | $6,381,791 | $41,184 |

| Educational Services | 2,415 | 134,138 | 58.3% | $8,632,091 | $64,168 |

| Accommodation & Food Services | 6,498 | 132,817 | 58.7% | $3,870,211 | $29,120 |

| Professional, Scientific, & Technical Services | 12,307 | 126,045 | 75.0% | $15,333,156 | $121,680 |

| Finance & Insurance | 5,087 | 103,848 | 73.8% | $14,641,763 | $140,920 |

| Administrative & Support Services | 4,622 | 88,559 | 68.0% | $4,776,070 | $53,924 |

| Construction | 7,121 | 80,018 | 56.0% | $7,338,998 | $91,832 |

| Wholesale Trade | 5,287 | 78,820 | 59.1% | $8,371,123 | $106,184 |

| Management of Companies | 1,035 | 77,570 | 86.7% | $11,000,111 | $141,856 |

| Transportation & Warehousing | 2,173 | 77,550 | 67.7% | $5,587,550 | $72,072 |

| Public Administration | 807 | 74,495 | 54.3% | $5,928,651 | $79,560 |

| Other Services | 11,436 | 55,509 | 61.5% | $2,750,482 | $49,556 |

| Arts, Entertainment, & Recreation | 1,879 | 34,429 | 66.3% | $1,898,837 | $55,380 |

| Information | 2,042 | 30,049 | 62.3% | $3,395,003 | $112,944 |

| Real Estate & Rental & Leasing | 4,447 | 27,000 | 76.2% | $1,973,863 | $73,164 |

| Utilities | 112 | 6,932 | 48.0% | $927,646 | $134,056 |

| Agriculture | 306 | 3,614 | 15.5% | $158,361 | $43,992 |

| Mining | 39 | 569 | 9.9% | $74,261 | $135,356 |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | |||||

DEED's QCEW data also zooms in on more detailed industry levels. At the 3-digit North American Industry Classification System (NAICS) level, the largest-employing industries in the Metro Area in 2023 include: Educational Services (134,138 jobs); Professional, Scientific & Technical Services (126,045 jobs); Food Services & Drinking Places (118,388 jobs); Ambulatory Health Care Services (91,575 jobs); Administrative & Support Services (84,465 jobs); Social Assistance (80,539 jobs); Management of Companies (77,570 jobs); Hospitals (66,539 jobs); Merchant Wholesalers, Durable Goods (53,184 jobs); and Nursing & Residential Care Facilities (53,034 jobs). These finer levels of industry analysis provide for a more complete understanding of what makes the Metro Area unique.

Overall, the Metro Area accounts for three-fifths (60.4%) of Minnesota's total employment. Along with analyzing those in-depth industries with high levels of employment in the region, we can also analyze industry concentrations. This type of analysis, using location quotients, points to those industries that are especially concentrated in the Metro Area. Over 20 detailed industry subsectors in the Metro Area have location quotients of 1.2 or more, while also providing more than 2,000 covered jobs. All these industries have more than 70.0% of their respective statewide employment right within the Metro Area (listed in order based on highest location quotient):

Altogether, these highly concentrated industries account for over 550,000 jobs in the Metro Area. Most of these industries are high-paying as well, with half of them paying out average wages of over $100,000.

| Table 3. Metro Area Industry Trends, Annual 2019 – 2023 Sorted by Number of Jobs | |||||

|---|---|---|---|---|---|

| Industry | Number of Jobs, 2023 | 2019 – 2023 Job Change | 2022 – 2023 Job Change | ||

| Numeric | Percent | Numeric | Percent | ||

| Total, All Industries | 1,754,325 | -22,114 | -1.2% | +24,269 | +1.4% |

| Health Care & Social Assistance | 291,689 | +12,742 | +4.6% | +12,183 | +4.4% |

| Manufacturing | 175,817 | +2,756 | +1.6% | +1,148 | +0.7% |

| Retail Trade | 154,854 | -9,964 | -6.0% | +1,035 | +0.7% |

| Educational Services | 134,138 | -1,018 | -0.8% | +2,722 | +2.1% |

| Accommodation & Food Services | 132,817 | -8,277 | -5.9% | +5,729 | +4.5% |

| Professional, Scientific, & Technical Services | 126,045 | +72 | +0.1% | -894 | -0.7% |

| Finance & Insurance | 103,848 | -11,228 | -9.8% | -2,713 | -2.5% |

| Administrative & Support Services | 88,559 | -8,726 | -9.0% | -4,635 | -5.0% |

| Construction | 80,018 | +4,305 | +5.7% | +1,706 | +2.2% |

| Wholesale Trade | 78,820 | +1,689 | +2.2% | +629 | +0.8% |

| Management of Companies | 77,570 | -1,338 | -1.7% | +1,535 | +2.0% |

| Transportation & Warehousing | 77,550 | +3,753 | +5.1% | +318 | +0.4% |

| Public Administration | 74,495 | +1,390 | +1.9% | +2,711 | +3.8% |

| Other Services | 55,509 | -1,836 | -3.2% | +1,936 | +3.6% |

| Arts, Entertainment, & Recreation | 34,429 | -2,098 | -5.7% | +1,514 | +4.6% |

| Information | 30,049 | -5,173 | -14.7% | -1,300 | -4.1% |

| Real Estate & Rental & Leasing | 27,000 | -448 | -1.6% | +129 | +0.5% |

| Utilities | 6,932 | +710 | +11.4% | +437 | +6.7% |

| Agriculture | 3,614 | +541 | +17.6% | +116 | +3.3% |

| Mining | 569 | +36 | +6.8% | -37 | -6.1% |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | |||||

The Metro Area gained nearly 24,300 jobs between 2022 and 2023. The corresponding annual employment growth rate of 1.4% was slightly behind the statewide employment growth rate of 1.7% during that period. By industry, the biggest gains over the year were in Health Care & Social Assistance (+12,183 jobs), Accommodation & Food Services (+5,729 jobs) and Public Administration (+2,711 jobs). Large job gains were also experienced in: Other Services; Construction; Management of Companies; Arts, Entertainment, & Recreation; Manufacturing; and Retail Trade. Overall, 15 of 20 major industries in the Metro Area added jobs between 2022 and 2023. Employment losses were experienced in Administrative & Support Services; Finance & Insurance; Information; Professional, Scientific, & Technical Services; and Mining (Table 3).

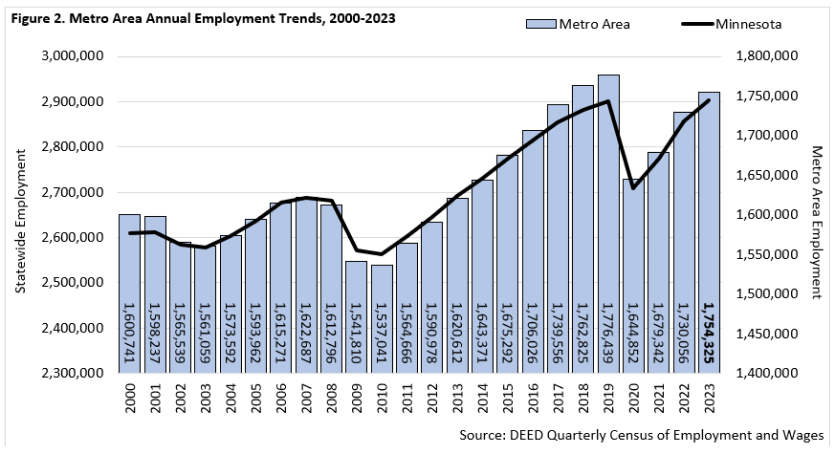

Even with the recent growth, the Metro Area is still down just over 22,100 jobs from 2019 to 2023. The corresponding employment decline of -1.2% was slightly behind the statewide employment growth rate of 0.1% during that period (Figure 2). Overall, 10 of 20 major industries are above their pre-COVID levels of employment. These industries include Health Care & Social Assistance, Construction, and Transportation & Warehousing. The industries experiencing the most significant declines during that period include Finance & Insurance, Retail Trade, Administrative & Support Services, Accommodation & Food Services and Information.

By county, employment growth rates between 2022 and 2023 were slightly higher for Scott (+2.6%) and Carver County (+2.1%) and slightly lower for Dakota (+1.1%) and Hennepin County (+1.2%). Between 2019 and 2023, employment growth rates were led by Scott (+10.6%), Washington (+5.9%), Anoka (+3.3%), and Carver County (+1.9%). Employment losses during that period were experienced for Ramsey (-3.3%), Hennepin (-2.5%), and Dakota County (-2.0%).

Along with those employment trends by industry and geography, we can also analyze demographic shifts in the Metro Area's labor market over time. Utilizing the Census Bureau's Quarterly Workforce Indicators (QWI) program, data reveals the region's aging and diversifying labor force. For example, between the second quarters of 2019 and 2023, the number of Metro Area jobs held by workers 65 years of age and older increased by 15.6%, even while total employment in the region declined by 1.3% during that period.

Meanwhile, where the number of jobs held by workers reporting as white declined by 3.3% between the second quarters of 2019 and 2023, all other race and ethnic groups witnessed growth. The number of jobs held by workers reporting Hispanic or Latino origin surged by 15.7%, compared to a 12.2% jump for workers reporting Two or More Races, a 6.7% increase for Black or African Americans, a 6.2% rise for workers reporting as Asian or Other Pacific Islander, and the number of jobs held by workers reporting as American Indian or Alaska Native increased by 5.9%.

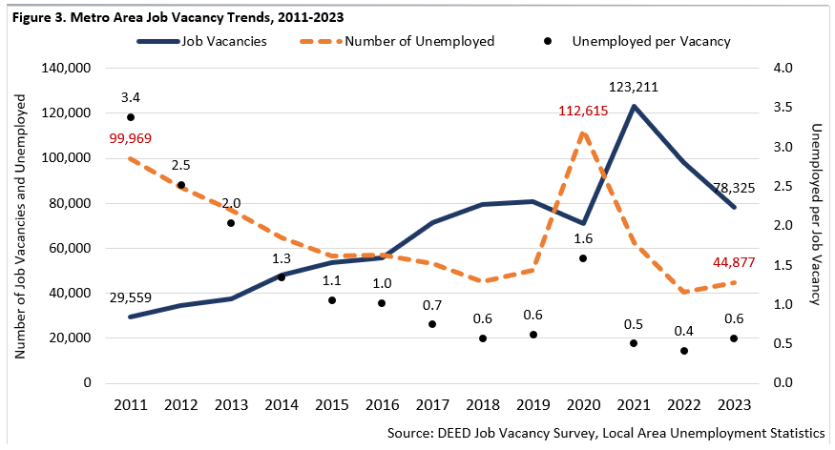

As the Metro Area's industry employment continues to recover the losses experienced during the COVID-19 recession, employers across the region are looking for workers to fill both new and replacement openings. According to DEED's Job Vacancy Survey (JVS), there were over 78,300 job vacancies in the Metro Area during 2023. This level of demand was down about 20%, or just over 20,000 job vacancies, from the historically high levels witnessed in 2022. Despite this drop in hiring demand over-the-year, job vacancies reported in 2023 are still higher than average and are similar to the rising levels of hiring demand experienced in the regional labor market pre-COVID. In fact, the more than 78,300 job vacancies reported by Metro Area employers in 2023 were the fifth highest number of average annual vacancies recorded since DEED's JVS data first became available in 2001.

While hiring demand lessened over the year, comparing Metro Area job vacancies to the number of unemployed persons reveals the continued tightness of the labor market. The 0.6 unemployed persons per job vacancy in 2023 matches the number of unemployed persons per job vacancy in 2018 and 2019, meaning there are still nearly two vacancies for every one unemployed job seeker (Figure 3).

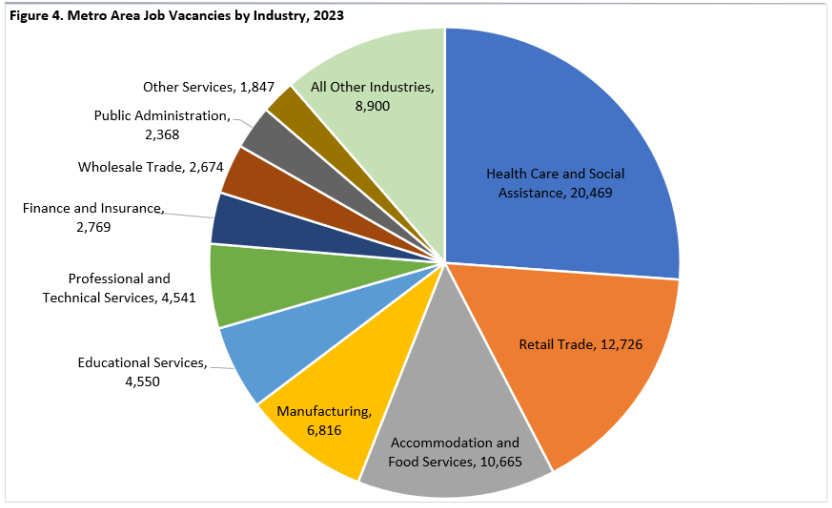

Health Care & Social Assistance led all industries in the Metro Area with nearly 20,500 job vacancies during 2023. In fact, this industry accounted for over one-quarter (26.1%) of the region's total job vacancies. Retail Trade and Accommodation & Food Services each had over 10,000 job vacancies during 2023. Altogether, these three industries accounted for well over half (56.0%) of the Metro Area's total job vacancies (Figure 4).

Other industries with a high share of job vacancies in the region include Manufacturing, Educational Services, Professional & Technical Services, Finance & Insurance and Wholesale Trade. It should be noted that the Metro Area accounted for over half (56.3%) of Minnesota's total job vacancies in 2023. Those industries with higher shares of job vacancies in the region included Finance & Insurance (86.9% of Minnesota's total job vacancies), Management of Companies (82.3%), Professional & Technical Services (79.9%), Real Estate & Rental & Leasing (66.6%), Information (64.5%) and Wholesale Trade (63.4%).

DEED's JVS data also reveals the occupational groups and specific occupations with the most hiring demand in the Metro Area. The major occupational groups with the most job vacancies in the region in 2023 included Food Preparation & Serving Related occupations, Sales & Related occupations, and Healthcare Practitioners & Technical occupations. Altogether, these three occupational groups accounted for over one-third (38.4%) of the region's total job vacancies. Other occupational groups with a high number of job vacancies included Healthcare Support, Office & Administrative Support, Business & Financial Operations, and Transportation & Material Moving occupations.

The specific occupations with the most job vacancies in 2023 included Retail Salespersons, Fast Food & Counter Workers, First-Line Supervisors of Food Preparation & Serving Workers, Personal Care Aides and Registered Nurses. For the total of all vacancies, the median hourly wage offer was $20.47 (Table 4). Of all vacancies, 27% were for part-time work, 5% were temporary or seasonal jobs, 50% required one or more years of work experience and 39% required some level of post-secondary education. Job seekers and employers can utilize the job vacancy data to look up these specific characteristics by industry, occupational group, and occupation.

| Table 4. Metro Area Occupational Demand, 2023 Sorted by Number of Job Vacancies | |||||

|---|---|---|---|---|---|

| SOC Code | Occupational Title | Number of Job Vacancies | Median Hourly Wage | Share Part-Time Work | Share Requiring Postsecondary Education |

| 000000 | Total, All Occupations | 78,325 | $20.47 | 27% | 39% |

| 412031 | Retail Salespersons | 4,025 | $15.64 | 46% | 4% |

| 353023 | Fast Food & Counter Workers | 3,443 | $14.35 | 52% | 0% |

| 351012 | First-Line Supervisors of Food Prep & Serving Workers | 2,820 | $18.42 | 6% | 2% |

| 311122 | Personal Care Aides | 2,592 | $16.76 | 36% | 3% |

| 291141 | Registered Nurses | 2,488 | $36.11 | 41% | 98% |

| 411011 | First-Line Supervisors of Retail Sales Workers | 1,696 | $19.41 | 18% | 9% |

| 412011 | Cashiers | 1,587 | $15.82 | 43% | 5% |

| 537065 | Stockers & Order Fillers | 1,442 | $16.08 | 49% | 9% |

| 311131 | Nursing Assistants | 1,432 | $18.13 | 51% | 31% |

| 434051 | Customer Service Representatives | 1,218 | $17.91 | 20% | 12% |

| 259045 | Teaching Assistants, Except Postsecondary | 950 | $18.16 | 55% | 26% |

| 132011 | Accountants & Auditors | 945 | $32.01 | 6% | 96% |

| 436013 | Medical Secretaries & Administrative Assistants | 936 | $19.96 | 47% | 34% |

| 911111 | Internships | 902 | $19.86 | 21% | 88% |

| 352021 | Food Preparation Workers | 870 | $16.98 | 35% | 0% |

| 151252 | Software Developers | 867 | $45.20 | 0% | 83% |

| 352014 | Cooks, Restaurant | 853 | $16.97 | 38% | 3% |

| 319092 | Medical Assistants | 815 | $19.15 | 16% | 53% |

| 292061 | Licensed Practical & Licensed Vocational Nurses | 800 | $25.93 | 30% | 98% |

| 499071 | Maintenance & Repair Workers, General | 776 | $20.94 | 8% | 14% |

| Source: DEED Job Vacancy Survey | |||||

The Twin Cities Metro Area continues to experience very tight labor market conditions. Throughout 2023 and the beginning months of 2024, unemployment remained low, even as more workers joined the labor force. And while hiring demand dipped between 2022 and 2023, vacancy levels remain high, especially in industries like Health Care & Social Assistance, Retail Trade, Accommodation & Food Services and Manufacturing. Analyzing these trends reveals a regional labor market in constant motion. This is especially true as the Metro Area continues to recover from the impacts of the Pandemic Recession, and as the labor market continues to witness rapidly shifting demographics.