by Mustapha Hammida

September 2021

This study extends the analysis of monthly business employment dynamics utilized in the first article of this series to investigate how the COVID-19 recession impacted Minnesota firms of different size classes during March and April 2020. During that time frame, 410,736 jobs were lost and 10,492 businesses were closed. The number of job-creating businesses shrunk while the number of job-destroying businesses skyrocketed, with significant differences in levels and rates across industries, and this study shows, by firm size class. Five size classes are considered: very small: 1 to 4 employees, small: 5 to 9 employees, medium: 10 to 49 employees, large: 50 to 249 employees, and very large: 250 or more employees.

This study examines data from the second quarter of 2020 as COVID-19 hit and employment fell leading to the pandemic recession. The key findings of this study are:

First, the impact of the recession on net employment change was most severe in medium firms, severe in small firms, moderate in large and very small firms, and mild in very large firms. The popular narrative seemed to focus on the smallest businesses, which certainly saw declines, but medium-sized employers with 10 to 49 employees were hit hardest.

Second, medium firms were hit hardest at both job creation by their expanding establishments as well as job destruction by their contracting establishments.

Third, job creation by opening establishments dropped the most at very small firms, while job destruction by closing establishments increased the most at small firms.

Lastly, the impact of the recession on net establishment change was most severe in very small firms and mildest in very large firms.

These findings highlight the strong and prevalent differences by firm-size in the recession's impact on both employment and establishments as measured by business employment dynamics.

Firms and establishments are dominated by very small firms, while employment is dominated by very large firms

| Size classes used in the study: |

|---|

| Very Small: 1 to 4 employees |

| Small: 5 to 9 employees |

| Medium: 10 to 49 employees |

| Large 50 to 249 employees |

| Very Large: 250 employees or more |

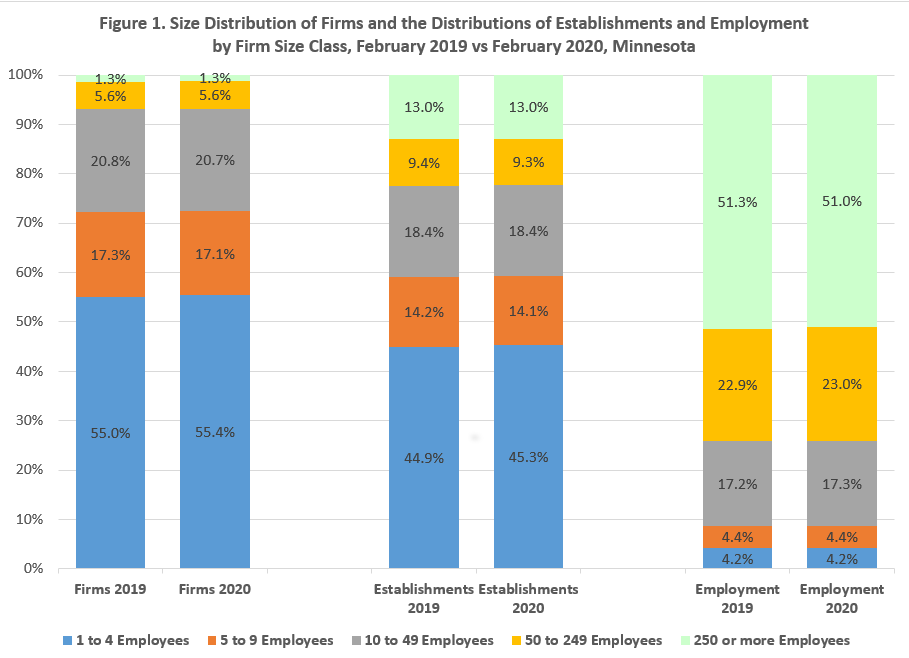

Before we analyze how the COVID-19 recession affected firms by size class, it is important to understand how firms and their establishments and employment are distributed by firm size class. In February 2020, before COVID-19 hit, 55% of firms were very small, less than five employees, while only 1.3% were very large, with more than 250 employees. Firms are made up of establishments, or physical locations, and again the very small size class dominates the distribution of establishments, accounting for 45%. Very large firms often have multiple physical locations, even within one state. In Minnesota, these very large firms account for 13% of all establishments. About three-fourths of establishments had less than 50 employees, distributed among medium establishments (39%) and small (18%) and very small establishments (18%). Interestingly, only 8% of very large firms are also very large establishments – having more than 250 employees on site.

However, unlike firm and establishment distributions, the distribution of employment is dominated by the relatively small group of very large firms, which accounts for over half of total employment. In contrast, very small firms comprise only 4% of total employment despite having around half of all establishments. Even combining very small and small firms together, these two size classes barely make up one-tenth of total employment, despite comprising 72% of all firms.

The recession transformed the firm size ordering of net employment change As COVID-19 arrived in Minnesota, it swiftly triggered unprecedented job losses reaching 375,477 net jobs lost from March and April of 2020, which stood in sharp contrast to the 35,259 net new jobs added a year earlier. All firm size classes participated in both net job creation in March and April 2019, as well as net job destruction in March and April 2020.

Medium size firms, which in March and April 2019 added a net of 14,374 jobs, eliminated a net of 105,174 jobs in March and April 2020, the second largest number of net jobs lost. On the other hand, the very large firms that added only 2,669 jobs in 2019, the lowest job growth of all firm size classes, saw their job elimination in March and April 2020 explode to 135,312 net jobs, the largest of all firm size classes. Finally, very small firms, with the second largest number of net jobs added in 2019 at 8,377, bore the lowest number of net jobs lost in 2020 at 9,631.

The COVID-19 recession impact on net employment change was very severe in medium firms, severe in small firms, moderate in large and very small firms, and mild in very large firms.

The "true" impact on net employment includes the net job losses that occurred in March and April 2020 as well as the loss of the potential job growth that would have occurred if COVID-19 never rolled in, totaling a loss of 410,736 jobs. In relative terms, about one-third of the total impact on net employment happened at the very large firms though they possess half of total employment. Moreover, by share of net employment loss due to the recession, the very large firms suffered the smallest blow (9%). This means that although very large firms had the largest count of net job loss at 137,981 jobs, the depth of the initial damage of COVID-19 to their employment was the least severe.

Surprisingly, medium firms, which dominate neither firm nor establishment nor employment distribution, were hit the hardest. Their COVID-19 recession impact on net employment change was 24% of total employment, the highest rate of all size classes. They lost 119,548 net jobs, which amounted to 29% of the total COVID-19 impact on net employment while they had only 17% of total state employment.

Finally, the very small firms sustained moderate COVID-19 recession impacts. In fact, they only accounted for 4% of the overall impact on net employment change, which is identical to their share of total employment. In other words, just as they contributed the smallest number of jobs of all size classes, they also contributed the smallest net loss of jobs (18,008 jobs). Likewise, this loss amounted to 15% of their employment, near the state's average rate of 14%.

The heterogeneous impact by firm size becomes even more pronounced as we break the net employment change into its four components. Basically, the net employment change captures the difference between expected job creation at expanding and opening establishments on one hand and job destruction at contracting and closing establishments on the other.

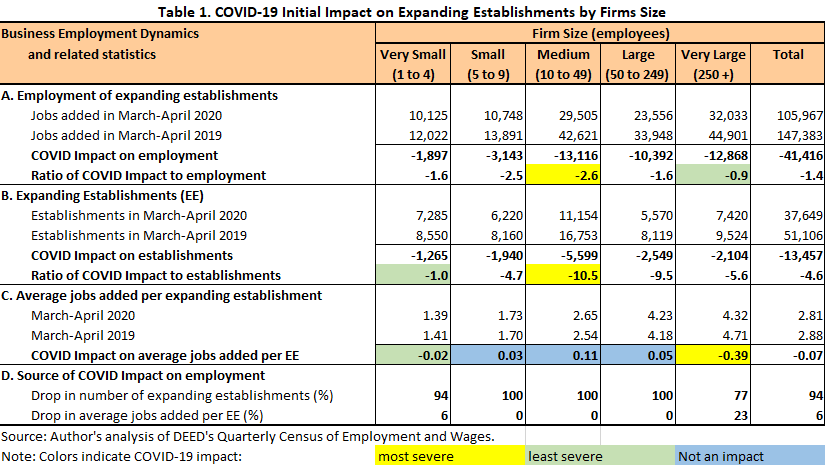

Jobs expected to be created by expanding establishments were reduced the most at medium firms.

The recession trimmed 13,116 from the number of jobs expected to be created at expanding establishments of medium firms, which have between 10 and 49 employees, representing 2.6% of their total employment. That was the highest rate of all firm size classes. The lowest rate was 0.9% at the very large firms, which lost 12,866 potential new jobs that would have been added in a more typical year. (Table 1 – Section A)

The number of expanding establishments of medium firms was also hit hardest by the COVID-19 recession.

The recession inflicted its most damage to the stock of expanding establishments at medium firms. They lost 5,599 establishments, or a third of their baseline stock of expanding establishments, which stood at 16,753 in March and April 2019. Moreover, these losses represent over one-tenth of all establishments of medium firms, a rate twice as large as that for all firms. In contrast, the very small firms experienced the least damage to their stock of expanding establishments, losing 1,265, which amounted to only 1% of their total establishments, well below the state average of 4.6%. (Table 1 – Section B)

The COVID-19 recession also reduced the job creation capacity of expanding establishments.

The recession caused a loss of 13,457 expanding establishments in the state, which amounted to about 5% of all establishments, and caused them a loss of 41,416 potential new jobs. This reduction in number of establishments, however, doesn't tell the whole story of how COVID-19 affected expanding businesses. In other words, we can't attach the 41,416 jobs lost at expanding establishments entirely to these 13,457 "would-be" expanding establishments that disappeared.

The recession also diminished the rate of jobs added per average expanding establishment. While an average expanding establishment added 2.88 jobs in March and April 2019, the rate slowed to 2.81 jobs a year later. This drop, although small, is responsible for 2,608 jobs and constitutes 6% of the 41,416 jobs lost by expanding establishments due to COVID-19. (See Table 1 – column "Total")

Job creation intensities changed very differently at the very small and the very large firms

The weakening of job creation was soft at the very small firms but hard at the very large firms. The number of jobs added at very small firms fell by an average expanding establishment from 1.41 to 1.39 jobs, a drop of 0.02 jobs. Combining all 7,285 expanding establishments that added jobs at this slower rate in March and April 2020 adds up to 6% of all jobs lost at expanding establishments of very small firms. The other 94% of job losses are attributed to the withdrawal of 1,265 expanding establishments and their ensuing loss of the potential to add 1.41 jobs each. (Table 1 – Sections C and D)

The situation is very different for very large firms. Their expanding establishments were only able to add 4.32 jobs per establishment immediately after COVID-19 hit, a drop of .39 jobs from their baseline level. This lower job creation rate experienced during March and April 2020 was responsible for 2,949 jobs lost, or 23% of the total loss of 12,868 jobs at expanding establishments of very large firms. The other 9,919 jobs or 77% of the total loss is attributed to the disappearance of 2,104 expanding establishments and consequently their potential average of 4.71 jobs created per establishment.

Finally, firms in the middle section of the firm size distribution that includes small, medium and large firms oddly escaped harm to the pace of job creation. Surprisingly, these firms saw a gain, on average, in the number of jobs created per expanding establishment. This gain in the rate of job creation is wonderful news for employment at these firms as a whole because it offered a cushion of jobs created that mitigated the effect of COVID-19 on the number of expanding establishments. Accordingly, we can attribute jobs lost by expanding establishments of small, medium, and large firms fully to the drop in their count of expanding establishments.

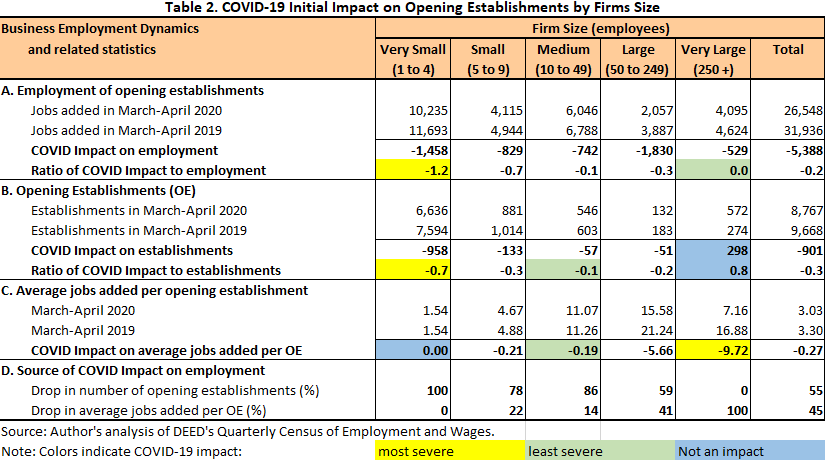

Jobs created by opening establishments of very small firms were hardest hit by the COVID-19 recession.

Opening establishments at the very small firms experienced the deepest drop in their job creation at a rate of 1.2% of employment compared to 0.2% for all firms. The least affected firms were the very large firms that were able to add almost the same number of new jobs at their opening establishments and showed almost zero (0.04%) impact. (Table 2 – Section A)

Most of the reduction in the number of opening establishments was in very small firms.

Very small firms took most of the COVID-19 blow to the state's stock of opening establishments, suffering the highest rate of decline at 0.7% of all establishments, more than double the state average of 0.3%. Surprisingly, very large firms more than doubled their counts of opening establishments going from 274 establishments in March and April 2019 to 572 establishments a year later. (Table 2 – Section B)

Opening establishments of very small firms maintained their job creation power and escaped further damage to their employment.

The average number of jobs added per opening establishment of very small firms remained constant at 1.54 jobs during March and April of both 2019 and 2020, which is a boon given their sizable share in opening establishments. This means that jobs lost from opening establishments of very small firms can be attributed mainly to the reduction in the numbers of opening establishments. (Table 2 – Sections C and D)

In other firms, job creation capacity contracted faster as firm size increased from small to very large.

At small and medium firms, the rate of job creation by opening establishments shrank by only about 0.20 jobs. But as firm size increased, the deceleration in job creation capacity became massive. An average opening establishment lost 5.66 and 9.72 jobs from its baseline job creation ability at large and very large firms, respectively. Luckily for the very large firms the damage to employment from this high level of deceleration was softened by the increased numbers of opening establishments. Thus, all their 529 jobs lost from opening establishments can be fully attributed to the drop in their pace of job creation.

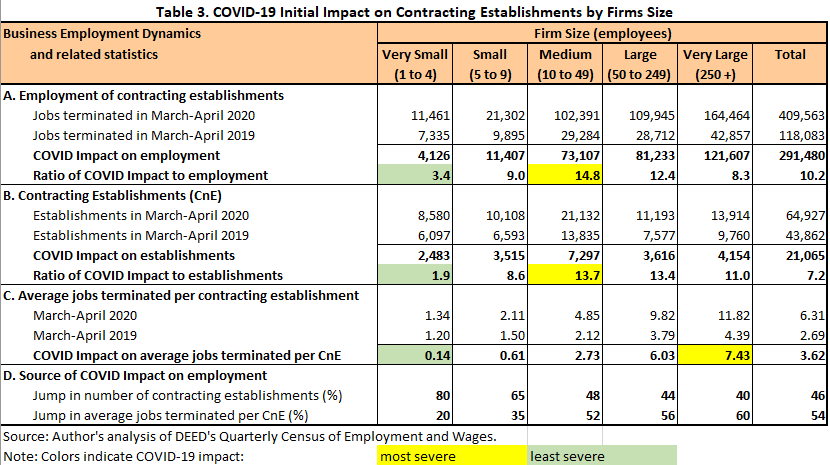

Job destruction at contracting establishments was hardest in medium firms and softest in very small firms.

Statewide, there was a jump in the number of jobs destroyed at contracting establishments, up by 291,480 jobs or 347% from March and April 2019 levels. Although the number of jobs terminated by contracting establishments increased in all firm size classes, firm size influenced the pace at which these establishments reduced their payrolls, with the fastest pace in medium firms. Indeed, this pace varied from a low of 3% at very small firms to a high of 15% at medium firms. (Table 3 – Section A)

The impact on the number of contracting establishments was strongest in medium firms and weakest in very small firms.

Immediately after COVID-19 hit, the universe of contracting establishments swelled to 64,927, increasing by 21,065 and affecting all firm size classes but with different forces. The pace of the increase in contracting establishments was slowest for very small firms, at 2%, and fastest for medium firms at 14%. (see Table 3 – Section B)

The COVID-19 recession not only increased the count of contracting establishments, but also job destruction capacity.

In March and April 2020 an average contracting establishment terminated 6.31 jobs, compared to a loss of 2.69 jobs in March and April 2019. In other words, contracting establishments cut jobs more than twice as fast during the recession as under normal circumstances. Breaking out the 291,480 jobs lost reveals that 132,879 jobs (46%) were lost at the additional contracting 21,065 establishments each terminating 6.31 jobs, and 158,601 jobs (54%) were lost at the 43,862 establishments that each suffered the additional 3.62 jobs cut above the rate of 2019. Thus, the impact on employment of contracting establishments was almost equally driven by the surges in the inventory of contracting establishments and in the rate of jobs terminated per average contracting establishment. (see Table 3 – column "Total")

Job destruction increased in contracting establishment at an increasing pace with firm size.

Firms reduced their workforces with increasing rates as firm size increased. The rate of job destruction at an average contracting establishment increased by only 0.13 jobs (or 11%) at very small firms while it swelled by 7.43 jobs (or 169%) at very large firms.

The causes of the employment losses were from both a jump in the number of contracting establishments and a jump in the average number of jobs terminated compared to the same period in the previous year. As firm size increased, the extent of job destruction shifted from higher numbers of contracting establishments to higher rates of job destruction as shown in the last section of Table 3.

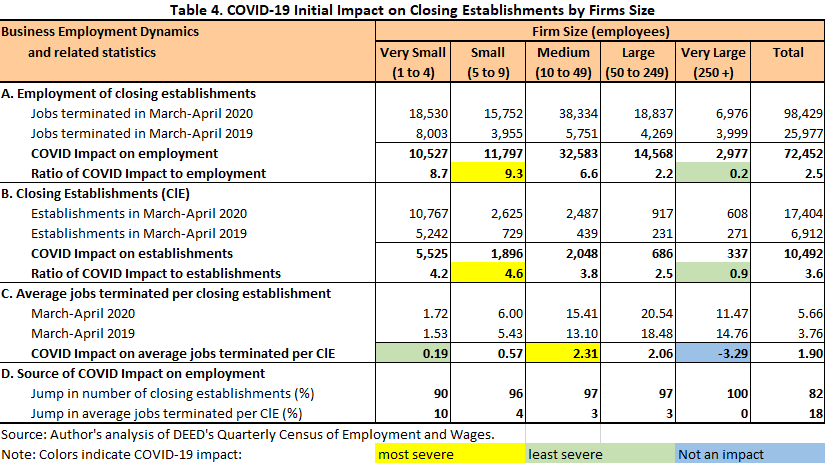

Job loss by closing establishments was greatest at very small and small firms.

Closing establishments shed 98,429 jobs in March and April 2020 compared to 25,977 jobs in March and April 2019, a nearly three-fold spike. By firm size, the ratio of COVID-19 impact on employment of closing establishments to employment decreases as firm size increases, falling from about one-tenth of a percent in the very small and small firms to only two-tenths of a percent in the very large firms. (see Table 4 – Section A)

Number of closing establishments of very small and small firms were hardest hit by COVID-19.

The count of closed establishments increased by 10,492, a factor of 1.52, or three times that of contracting establishments. More than half of these closures occurred at the very small firms, representing about 4.2% of all their establishments, the second highest rate of all firm size classes. Another one-fifth of the total closures were in small firms, closing establishments at 4.6% of these firms compared to 3.6% for all firms. On the other hand, very large firms were by far the least affected, with about 1% of establishments closing. (Table 4 – Section B)

Closing establishments of very large firms saw lowered job destruction despite COVID-19.

Not only did the very large firms suffer the mildest COVID-19 impact on the number of closing establishments and employment but they also saw a lower job destruction rate, down from 14.76 to 11.47 jobs in March and April of 2019 and 2020, respectively. Hence, all their job loss can be attributed fully to the jump in the number of closing establishments. (Table 4 – Sections C and D)

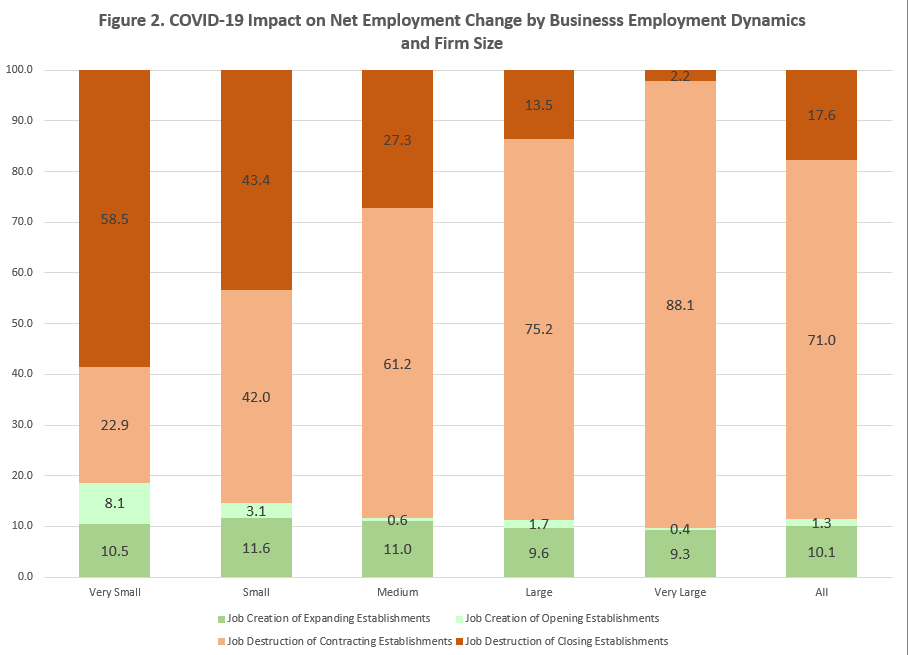

There is extraordinary firm-size heterogeneity in how the impact on net employment change evolved in each firm size class.

In this section we compare how recession impact on net employment change arose across firm size classes (see Figure 2). Each component exhibited strong firm-size variation in its contribution, except for job creation at expanding establishments, which experienced minor variations in their contribution that ranged from 9.3% to 11.6%.

First, the decline of jobs created at opening establishments contributed less than half of one percent to the recession's impact on net employment change in very large firms. By contrast, in the very small firms, the decline was approximately 10% of the COVID-19 impact on net employment change.

Second, the share of the impact on contracting establishments in total net employment change reveals differences between firms of different sizes. In fact, this share increases remarkably as firm size increases, starting at 23% for the very small firms and peaking at 88% for the very large firms. The very large firms were able to mostly reduce employment levels at their establishments, while smaller firms were forced to completely close.

Lastly, the share of the impact on closing establishments on net employment change decreases as firm size increases, falling from 59% in the very small firms to only 2% in the very large firms. This relationship is opposite to the one observed for contracting establishments and implies that as firm size shrinks the damage of COVID-19 to employment becomes more concentrated at closing establishments. Most of the damage to employment in the very small firms unfolded through closing establishments.

Net establishments change is the difference between opening and closing establishments

During March and April 2019, Minnesota added 2,756 new establishments (1%) to the total. As COVID-19 hit in March and April 2020, the state lost 8,637 total establishments (-3%). Thus, with the loss of establishments that should have been added, Minnesota lost 11,393 establishments, or approximately 4% of the total.

Firm size heterogeneity is as strong as discovered with net employment change. In fact, 57%(or 6,483 out of 11,393 establishments) of the impact on net establishments change evolved at the very small firms, much higher than their share in total establishments. In contrast, the very large firms only contributed three-tenths of one percent (or 39 out of 11,393 establishments), much lower than their share in total establishments.

This firm-size heterogeneity in COVID-19 recession impact on establishments can also be seen when we express the impact relative to the population of establishments in each firm size class. According to this metric, the impact increased in severity as firm size decreased. While it was only one-tenth of one percent for very large firms, it reached 5% for small and very small firms.

By component of net establishment change, very small firms were hit hardest while very large firms escaped with much less damage. In fact, over half (53%) of the 10,492 closed establishments were in the very small firms, compared to only 39 establishment closures at the very large firms (0.3%). In addition, very small firms suffered most of the reduction in opening establishments (958 out of 1,199 opening establishments lost, or 80%), while very large firms enjoyed an increase in their opening establishments despite the recession.

In conclusion, these results underscore that while average or overall measures are important to establish a general appreciation of how COVID-19 (or any other shock) impacted employment, understanding heterogeneity of impact by business size is important in gaining a clear picture of the real damage of the shock. The Business Employment Dynamics program uncovers the variation that is inherent in the economy and is missed in the standard measures, especially looking just at net employment change. Moreover, this variation is certainly driven by further heterogeneity in other factors such as industry, occupations and access to capital, among others.

The complete analysis is provided in a set of three in-depth research reports:

Assessing the Initial Impact of the COVID-19 Recession on Employment by Firm Size Class (2 of 3)

Assessing the Initial Impact of the COVID-19 Recession on Establishments by Firm Size Class (3 of 3)