by Mark Schultz

June 2022

As Southeast Minnesota's economy emerges from the pandemic period, the labor market is getting back to normal. Unfortunately for employers, what has become normal in the region is a tight labor market where job openings outnumber available workers. The most recent data available shows that the jobseeker-per-vacancy ratio in Southeast has dropped to 0.3-to-1, the lowest it's ever been in the region, meaning that for every 10 job openings there are only three unemployed jobseekers. This ratio in the Southeast region is tied with the Twin Cities Metro and Southwest for the lowest among the six planning regions in the state.

Data show that job growth has occurred as the region recovers, but the number of job vacancies was higher than ever in 2021. This means Southeast is poised to grow even more if it can find more workers and get them placed in available jobs. The region is also projected to see a large number of new jobs and job openings in the upcoming years, which will require even more workers.

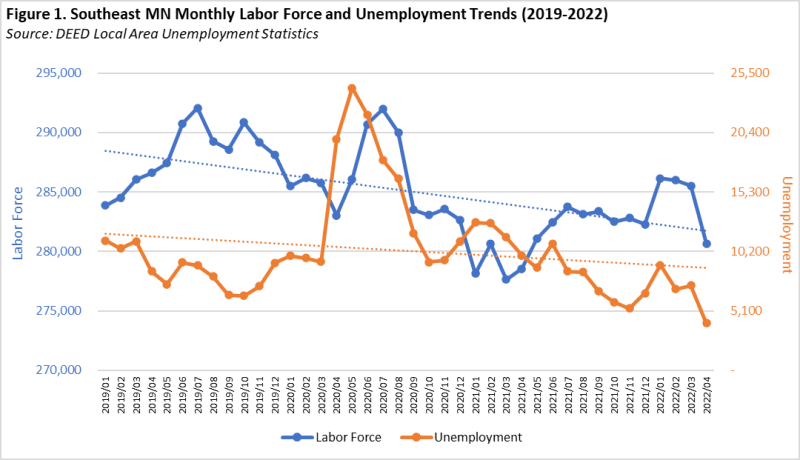

While the region's labor force and unemployed worker numbers were impacted by COVID-19, the region's labor market has, for the most part, been getting tighter over time as well, as is evidenced by labor force and unemployment data from DEED's Local Area Unemployment Statistics.

Despite the COVID-driven peaks in both the labor force and unemployment counts, both measures saw overall declines from January 2019 to April 2022, with the labor force dropping by about 3,200 participants, or 1.1%, while the number of unemployed persons decreased by 63.7% (see Figure 1). This dramatic decline in available workers is creating challenges for employers who want to fill open jobs.

Up until the pandemic, there had been an increasing share of jobs held by workers aged 55 years and over during the last decade. According to Quarterly Employment Demographics from DEED, the percent of jobs held by workers in the oldest age bracket (65 and over) increased from 4.0% in 2011 to 5.6% in second quarter 2021, while the share of jobs held by those 55 to 64 increased from 15.2% to 17.9% during this time frame. It is likely that older workers, especially Baby Boomers, are leaving the labor force in higher numbers due to retirements and there have not been enough workers in younger age groups to take their places. For example, the percent of jobs held by 20- to 24-year-olds declined over the last decade, dropping from 10.8% in the second quarter of 2011 to 9.3% in 2021.

| Table 1. Southeast Minnesota Labor Force Projections, 2023-2033 | ||||

|---|---|---|---|---|

| - | 2023 Labor Force Projection | 2033 Labor Force Projection | 2023-2033 Change | |

| Numeric | Percent | |||

| 16 to 19 years | 15,873 | 15,020 | -854 | -5.4% |

| 20 to 24 years | 28,200 | 27,774 | -426 | -1.5% |

| 25 to 44 years | 113,467 | 115,590 | 2,124 | 1.9% |

| 45 to 54 years | 49,409 | 54,818 | 5,409 | 10.9% |

| 55 to 64 years | 48,422 | 38,869 | -9,553 | -19.7% |

| 65 to 74 years | 16,833 | 16,699 | -134 | -0.8% |

| 75 years & over | 3,175 | 4,254 | 1,079 | 34.0% |

| Total Labor Force | 275,379 | 273,024 | -2,355 | -0.9% |

| Source: calculated from Minnesota State Demographic Center population projections and 2016-2020 American Community Survey 5-Year Estimates | ||||

It looks like these conditions will persist in the region for a while as evidenced by labor force projections created by combining data from the Minnesota State Demographic Center and labor force participation rates from the U.S. Census Bureau's American Community Survey 2016-2020 5-year estimates. Projections for 2023-2033 show that the region is anticipated to lose 2,355 labor force participants for a drop of 0.9% during this time frame, largely fueled by a dip of over 9,500 55 to 64-year-olds (see Table 1).

| Table 2. Southeast Minnesota Labor Force Projections by County | ||||

|---|---|---|---|---|

| County | 2023 Labor Force Projection | 2033 Labor Force Projection | 2023-2033 Change | |

| Numeric | Percent | |||

| Dodge | 11,968 | 12,044 | +75 | +0.6% |

| Fillmore | 10,756 | 10,384 | -372 | -3.5% |

| Freeborn | 14,963 | 13,827 | -1,136 | -7.6% |

| Goodhue | 24,756 | 23,773 | -984 | -4.0% |

| Houston | 9,850 | 8,947 | -903 | -9.2% |

| Mower | 19,721 | 19,541 | -180 | -0.9% |

| Olmsted | 89,546 | 94,399 | +4,853 | +5.4% |

| Rice | 34,775 | 34,505 | -270 | -0.8% |

| Steele | 19,321 | 18,647 | -675 | -3.5% |

| Wabasha | 11,179 | 10,316 | -863 | -7.7% |

| Winona | 28,568 | 26,709 | -1,860 | -6.5% |

| Southeast | 275,379 | 273,024 | -2,355 | -0.9% |

| Source: calculated from Minnesota State Demographic Center population projections and 2016-2020 American Community Survey 5-Year Estimates | ||||

At the county level, all but two counties in the region are projected to see declines in labor force numbers from 2023 to 2033. The highest real reductions are anticipated to be in Winona (-1,860) and Freeborn County (-1,136), while the largest proportional decreases are expected in Houston (-9.2%), Wabasha (-7.7%) and Freeborn County (-7.6%) (see Table 2).

Of the two counties that are projected to see labor force growth, Olmsted is the front-runner with an expected gain of over 4,800 labor force participants. This is not terribly surprising given that it is home to the fast-growing city of Rochester and many more job opportunities than the remaining counties in the region. Not only are there more employment opportunities in Olmsted County, thus increasing its appeal to jobseekers, but there is likely a more diverse range of opportunities for workers of all ages, educational attainment, and experience levels.

That is not to say that there are few opportunities in the other counties in the region, just that the sheer number of employment opportunities is lower than what is seen in Olmsted County. In addition, Dodge County is projected to see a much smaller increase of only 75 additional workers. As the labor market continues to tighten in the upcoming years, many employers may continue to struggle to fill their job openings unless new or alternative sources of labor emerge, they make internal changes to their production and business processes or their job requirements, or embrace new technology to fill gaps left by a dwindling labor force.

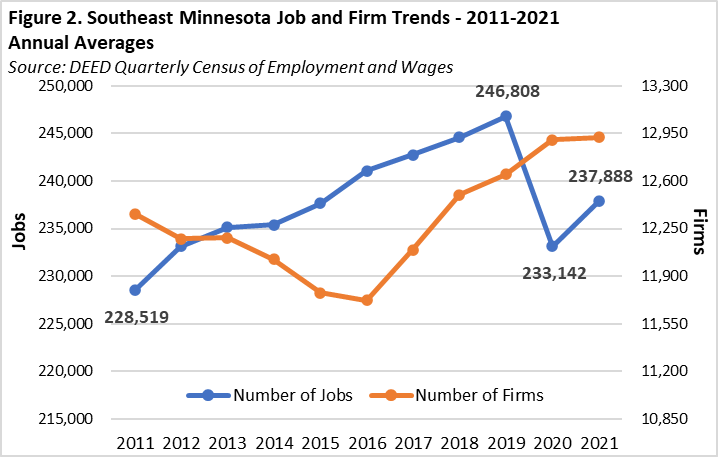

Southeast Minnesota saw a large loss in jobs when the pandemic first hit: a decline of 13,666 jobs from 2019 to 2020, a drop of 5.5%. The following year the region regained some of those lost jobs after experiencing an increase of 2%, yielding a jump of 4,746 jobs from 2020 to 2021.

Despite this pandemic-fueled downtick in jobs, overall the region saw an increase in the number of jobs over the last decade according to DEED's Quarterly Census of Employment and Wages annual average data. Southeast gained almost 9,400 jobs from 2011 to 2021 for a bump of 4.1%. In addition to an overall increase in jobs, the number of establishments reporting employment, which actually saw an increase during the apex of the pandemic (2019-2020), also witnessed an increase over the last 10 years, rising by 564 or 4.6%. This was, however, likely due to many more firms reporting for the first time after they had to lay people off in order for them to receive Unemployment Insurance benefits (see Figure 2).

The top five employing industries – Health Care & Social Assistance, Manufacturing, Retail Trade, Educational Services, and Accommodation & Food Services – account for over two-thirds (69.2%) of the total jobs in the region. Comparatively, these four sectors make up only 54.2% of the total jobs statewide.

By far the largest industry in Southeast is Health Care & Social Assistance with over 66,000 jobs at over 1,750 employing firms, equaling over one-quarter (27.8%) of all jobs, compared to 17.8% of the total jobs statewide (see Table 2). Health Care & Social Assistance saw growth over the last year, with the number of jobs increasing by almost 970 from 2020 to 2021, a bump of 1.5%.

This sector is made up of four components, the largest being Ambulatory Health Care Services, which accounts for over half (33,216 jobs or 50.3%) of the jobs in the larger industry and which played a large part in the overall increase by regaining 831 jobs over the last year. The remaining three component sectors are Hospitals (15,355 jobs or 23.2%), which increased by just over 400 jobs over the last year, Nursing and Residential Care Facilities (10,978 jobs or 16.6%), which was the only sector to lose jobs (-453) since last year, and Social Assistance (6,537 jobs or 9.9%), which grew by 187 jobs since 2020.

Southeast is also a powerhouse when it comes to Manufacturing. This sector accounts for almost 36,000 jobs at 659 firms, or 15.1% of the total jobs in the region, which is the second highest concentration (after Southwest's 18.4%) of the six planning regions in the state and higher than the state as a whole (11.2%). This industry is made up of 18 component sectors, with over one-quarter (9,958 jobs or 27.7%) of regional jobs being in Food Manufacturing.

Other key Manufacturing sectors include Computer & Electronic Products (4,457 jobs or 12.4%), Machinery (4,156 jobs or 11.6%) and Fabricated Metal Product Manufacturing (3,999 jobs or 11.1%). Over the last year, wages in the Manufacturing industry sector increased by 3.1%, equaling an average annual increase of $2,028. Part of this is likely due to the fact that the median number of hours worked has increased from 496 in the second quarter of 2020 to 520 in the second quarter of 2021 according to the most recent Quarterly Employment Demographics data.

Taking the bronze medal is the Retail Trade industry, which accounts for 26,117 jobs, which is (11%) of the total jobs in the region. There are 12 component sectors that make up Retail Trade, with the largest being General Merchandise Stores with 5,430 jobs or 20.8%. Other notable sectors within Retail Trade in the region are Food & Beverage Stores (5,401 jobs or 20.7%), Gasoline Stations (3,687 jobs or 14.1%), Motor Vehicle & Parts Dealers (3,248 jobs or 12.4%) and Building Material & Garden Equipment & Supplies Dealers (2,803 jobs or 10.7%).

The Retail Trade industry saw an increase of 891 jobs (up 3.4%) over the last year, largely driven by the increases in three of the component sectors – General Merchandise Stores (up 360 jobs or up 6.6%), Food & Beverage Stores (up 126 jobs or up 2.3%) and Sporting Goods, Hobby, Book & Music Stores (up 107 jobs or up 10.5%, which was also the highest proportional gain of all the component sectors). On the other hand, two component sectors lost jobs on the year, including a decline of 27 jobs in Building Material & Garden Equipment & Supplies Dealers and 10 fewer jobs in Nonstore Retailers.

| Table 2. Southeast Industry Employment and Wage Statistics (2021 Annual Averages) | |||||

|---|---|---|---|---|---|

| Industry Title | Number of Jobs | Percent of Total Jobs | Number of Firms | Total Annual Payroll | Average Annual Wage |

| Total, All Industries | 237,888 | 100.0% | 12,922 | $13,999,081,555 | $58,812 |

| Health Care & Social Assistance | 66,087 | 27.8% | 1,753 | $5,076,041,983 | $76,804 |

| Manufacturing | 35,936 | 15.1% | 659 | $2,398,772,106 | $66,716 |

| Retail Trade | 26,117 | 11.0% | 1,595 | $838,504,874 | $32,084 |

| Educational Services | 18,756 | 7.9% | 263 | $965,405,276 | $51,532 |

| Accommodation & Food Services | 17,642 | 7.4% | 1,105 | $356,941,515 | $20,124 |

| Public Administration | 10,817 | 4.5% | 367 | $653,823,953 | $60,424 |

| Construction | 9,831 | 4.1% | 1,465 | $631,673,591 | $63,960 |

| Administrative Support & Waste Management | 8,255 | 3.5% | 514 | $400,334,511 | $48,464 |

| Transportation & Warehousing | 7,755 | 3.3% | 599 | $396,165,721 | $51,012 |

| Wholesale Trade | 6,458 | 2.7% | 486 | $479,674,631 | $74,100 |

| Other Services (except Public Administration) | 6,184 | 2.6% | 1,321 | $199,053,474 | $32,136 |

| Finance & Insurance | 4,279 | 1.8% | 679 | $322,892,851 | $75,452 |

| Management of Companies & Enterprises | 4,052 | 1.7% | 53 | $453,954,022 | $112,008 |

| Professional, Scientific, & Technical Services | 3,540 | 1.5% | 761 | $210,938,833 | $59,488 |

| Arts, Entertainment, & Recreation | 3,515 | 1.5% | 260 | $98,116,733 | $27,924 |

| Agriculture, Forestry, Fishing & Hunting | 3,245 | 1.4% | 391 | $129,618,399 | $39,884 |

| Information | 2,564 | 1.1% | 200 | $151,906,952 | $59,228 |

| Real Estate & Rental and Leasing | 1,372 | 0.6% | 384 | $58,370,680 | $42,484 |

| Utilities | 1,301 | 0.5% | 47 | $166,780,145 | $128,232 |

| Mining | 177 | 0.1% | 21 | $10,111,305 | $55,484 |

| Source: DEED Quarterly Census of Employment and Wages | |||||

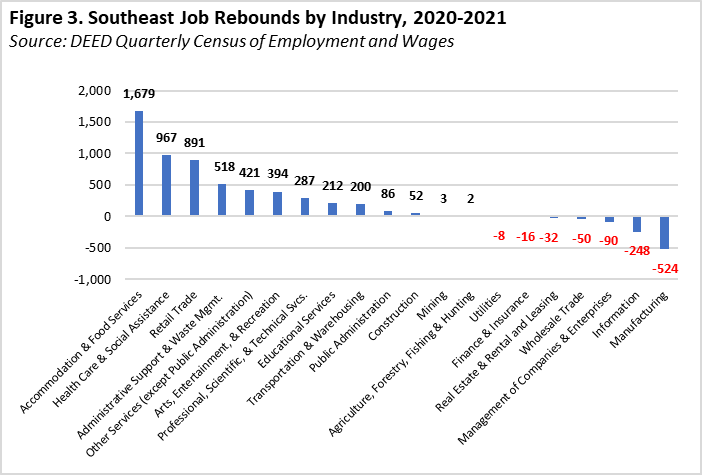

All but three of the 20 industry sectors in Southeast experienced a pandemic-induced loss of jobs from 2019 to 2020. However, over the last year, 13 of the 20 industry sectors in the region rebounded to some degree from those losses. The largest numeric increase was in Accommodation & Food Services which saw an additional 1,679 jobs from 2020 to 2021, most of which was the result of a bump of 1,520 jobs in the Food Services & Drinking Places component sector.

This was followed by solid over the year gains in Health Care & Social Assistance (up 967 jobs) and Retail Trade (up 891 jobs). Together, these three industry sectors accounted for almost three-quarters of the overall job gains in the region over the last year, likely due to the fact that these are the industries that lost some of the largest numbers of jobs due to the pandemic (see Figure 3).

On the other end of the spectrum, Manufacturing saw the largest decrease in jobs over the last year, losing over 500 jobs from 2020 to 2021. This decline was largely the result of losses in the Food Manufacturing and Computer & Electronic Product Manufacturing component sectors. Other sectors that experienced job loss over the last year include Information (down 248 jobs), Management of Companies (down 90 jobs), Wholesale Trade (down 50 jobs), Real Estate, Rental & Leasing (down 32 jobs), Finance & Insurance (down 16 jobs), and Utilities (down 8 jobs).

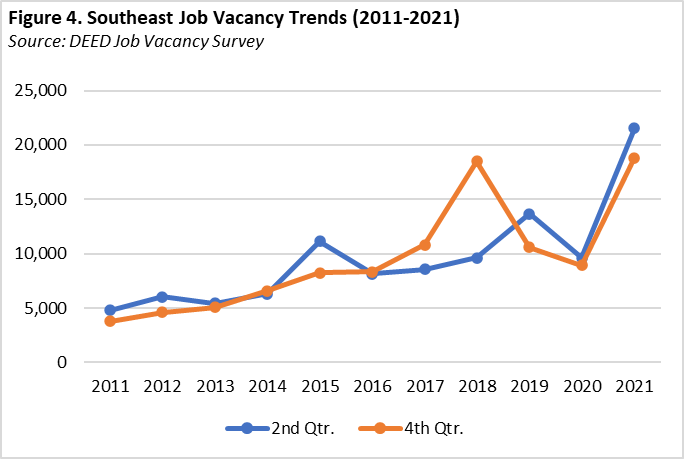

Overall, in the last decade the number of job vacancies across all occupations in Southeast has climbed rather steadily, although with a few hiccups along the way, culminating in the highest number of openings on record (21,510) in the second quarter of 2021. That number had decreased a bit in the most recent estimate for the fourth quarter of 2021 where the region had 18,827 vacancies, but that is still the second highest on record (see Figure 4).

In fact, from the second quarter of 2011 to the second quarter of 2021 the number of job openings increased by over 16,710 for a jump of almost 350%, while from the fourth quarter of 2011 to the fourth quarter of 2021 the number of vacancies increased by 15,045 job openings, a rise of almost 400%!

Among these vacancies, 29% were part-time (compared to 34% a year ago) while only 6% were temporary or seasonal (half of what it was in the fourth quarter of last year). And while postsecondary education was required for 30% of the openings (compared to 32% as of fourth quarter of last year), work experience was more sought after with 46% of the vacancies requiring one or more years of experience. In addition, half of these vacancies require a certificate or license, which was also the same as in the fourth quarter of last year.

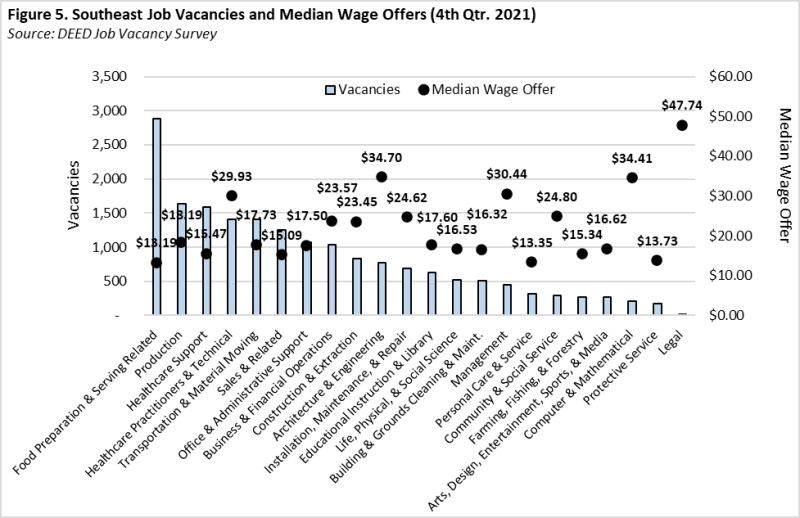

The largest number of vacancies were for Food Preparation & Serving Related occupations with almost 2,900 openings or 15.3% of the total openings in the region, which is over double what was seen in the fourth quarter of last year. Rounding out the top five are Production (1,635 vacancies or 8.7%), Healthcare Support (1,585 vacancies or 8.4%), Healthcare Practitioners & Technical (1,406 vacancies or 7.5%) and Transportation & Material Moving (1,403 vacancies or 7.5%). Combined, these top five occupational groups accounted for almost half (47.4%) of the total vacancies in the region.

Below is a comparison of the percent of total vacancies for Southeast's top five occupational groups compared to the same groups statewide:

The median wage offer across all occupational groups climbed to $17.39 per hour, which was higher than the hourly wage requirement for each adult in a typical family in the region to meet a basic needs cost of living standard, which sits at $16.53. This median wage offer is 5.5% higher than was seen last year and almost 60% higher than the median wage offer of 10 years ago, while ranking third highest of the six planning regions in the state behind Northwest and the Twin Cities Metro region.

The largest numeric increase in wage offers was seen in Architecture & Engineering occupations, followed by Community & Social Service and Installation, Maintenance & Repair occupations, all of which increased by over $8 per hour. On the other hand, five occupational groups saw a decrease in median wage offers over the year with the largest, by far, being in Construction & Extraction, followed by a drop of just over $4 an hour in Arts, Design, Entertainment, Sports, & Media occupations (see Figure 5).

Median wage offers for the vacancies in these occupational groups saw substantial breadth, ranging from an hourly wage of $13.19 in Food Preparation & Serving Related to $47.74 for Legal occupations. In general, there were fewer openings that require higher educational and/or experience levels, which often leads to higher wages, and more openings for those with low wage offers. However there were some outliers such as was seen in Architecture & Engineering and Protective Service occupations.

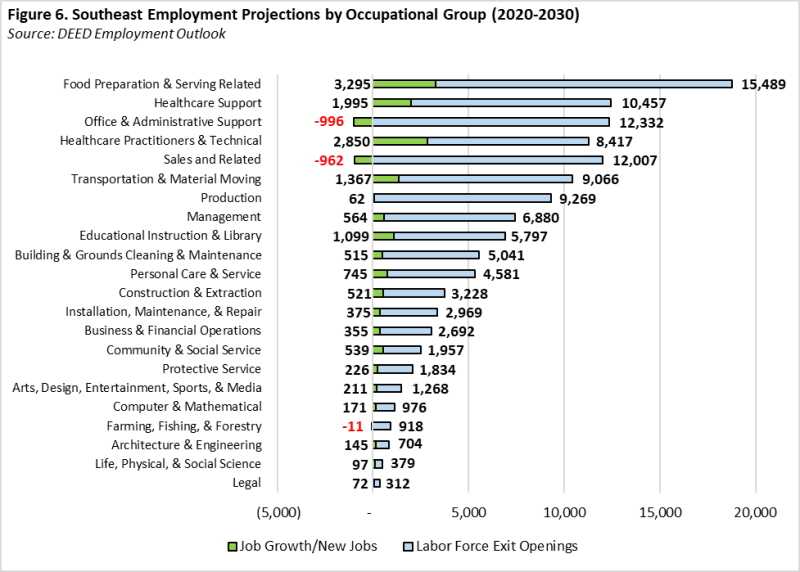

Despite the anticipated decline in labor force numbers mentioned earlier, the Southeast region is still projected to add jobs over the next decade. In addition, there will be demand from current jobs left vacant due to labor force exits (such as retirements) from 2020 to 2030.

Not every occupational group is projected to see job growth. As shown in Figure 6, there are three occupational groups that are anticipated to see job declines, with the largest losses seen in Office & Administrative Support (down 996) and Sales & Related occupations (down 962). Additionally, small declines are expected in Farming, Fishing & Forestry occupations.

On the other hand, the largest numeric job growth is forecasted in Food Preparation & Serving Related occupations, which is predicted to grow by almost 3,300 as those jobs return following the pandemic recession, and growth of 2,850 net new jobs for Healthcare Practitioners & Technical occupations. Together, just these two occupational groups account for 46.4% of the total job growth in the region.

On the other hand, every one of the 22 occupational groups in Southeast Minnesota is projected to see job openings due to labor market exits through 2030. Four of these occupational groups are expected to see over 10,000 replacement openings, including Food Preparation & Serving Related (up 15,489), Office & Administrative Support (up 12,332), Sales & Related (up 12,007) and Healthcare Support (up 10,457). These four occupational groups are projected to account for 43.1% of the labor force exit openings in the region.

Southeast Minnesota has seen some promising rebounds from the jobs lost during the pandemic, but still has more jobs to regain. Job growth is constrained by the tight labor market. Employers in the region reported the highest number of job vacancies ever seen on record in 2021 and we expect to see many more job openings in years to follow. The biggest challenge in the employment recovery so far is a labor force that has barely grown over the last couple of years and is projected to decline in upcoming years.

In light of this, employers in the region will likely continue to struggle to fill their job openings as the labor force continues to tighten. Employers may seek needed workers in underutilized sources of labor, such as groups that have a low labor force participation rate and/or a high unemployment rate, including previously incarcerated individuals and foreign-born workers.

Additionally, employers may benefit from investing in new technologies to help fill the gap left by a decreasing labor force. Overall, the region will have to continue to adapt to a changing labor market landscape in order to continue thriving.