by Nick Dobbins

May 2020

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.

(Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.)

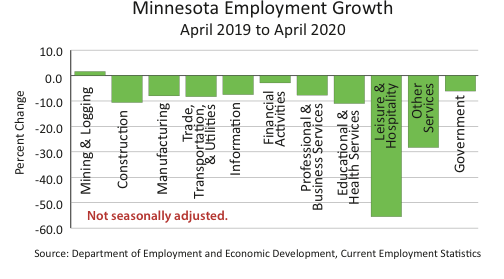

Employment in Minnesota plummeted in April as efforts to contain the COVID-19 pandemic first began appearing in earnest in labor market estimates. Overall the state lost 359,800 jobs (12.2 percent) on a seasonally-adjusted basis, with the losses concentrated more among service providers (down 325,300 or 13 percent) than goods producers (down 34,500 or 7.6 percent). The picture was much the same over the year, with the state shedding 387,894 jobs (13.1 percent), slightly better than the nationwide 13.2 percent decline. The private sector lost 361,673 jobs (14.3 percent), and government employers lost 26,221 (6.1 percent).

Mining and Logging was the only supersector not to lose jobs in April, up by 100 (1.5 percent) on a seasonally-adjusted basis. However, highly publicized layoffs in the supersector in the weeks following the April reference period suggest that estimates may show a significant decline next month. On an annual basis the supersector added 101 jobs (1.6 percent) and was the only supersector with positive over-the-year job growth.

Construction employment was off by 11,000 (8.8 percent) in April. As was the case with many supersectors, it was the worst over-the-month performance in the series’ history. On the year Construction employers lost 12,464 jobs (10.6 percent). Every component sector shed jobs, with the largest proportional decline coming in Specialty Trade Contractors (down 11.7 percent or 8,970 jobs).

Employment in Manufacturing was off by 23,600 (7.3 percent) in April. Durable Goods Manufacturing was down 17,000 (8.3 percent) while their counterparts in Nondurable Goods Manufacturing was off 6,600 (5.7 percent). Over the year manufacturing employers lost 25,635 jobs (8 percent). While dramatic, this does not represent the worst-ever over-the-year job loss in the supersector, as annual change caused by the Great Recession was regularly worse than 10 percent in 2009, and in fact averaged 10.6 percent on the year.

Trade, Transportation, and Utilities employment was off by 38,100 (7.2 percent) in April. This was both the worst month in the series’ history by a large margin, the next-worse being -2.4 percent in September of 1998, and somewhat better than most industry groups in the state. Over the year the supersector lost 43,711 jobs (8.3 percent). Most of the losses came in Retail Trade, where employment was off by 33,589 (11.6 percent), although all component sectors had negative annual growth.

Information employment was down by 1,900 (4.2 percent) in April. Over the year the supersector lost 3,524 jobs (7.5 percent). While dramatic, it was not the worst over-the-year job loss in the series’ history, which was a loss of 8.7 percent in July of 2003.

Financial Activities employment was down by 1.8 percent (3,500 jobs) in April, one of the better performances by any supersector in the state, as it was likely somewhat protected by the ability of many employees in the industry group to work remotely. Over the year the supersector lost 5,536 jobs (2.9 percent). More than half of those jobs came from Real Estate and Rental and Leasing, which shed 2,878 jobs (8.3 percent).

The Professional and Business Services supersector lost 25,700 jobs (6.8 percent) in April, with the bulk of those losses coming in Administrative and Support and Waste Management and Remediation Services (down 15,800 or 11.8 percent). Over the year, employment in the supersector was off by 7.7 percent (29,240 jobs). While all component sectors shed jobs, the losses remain concentrated in Administrative and Support and Waste Management and Remediation Services and more specifically in its component Employment Services, which was off by 16,084 (27.3 percent).

Educational and Health Services lost 53,700 jobs (9.9 percent) on a seasonally-adjusted basis in April, with both component sectors showing significant declines. Annually the supersector lost 60,826 jobs (11 percent). Educational Services lost 16,049 jobs (21.3 percent), with those losses concentrated in Colleges, Universities, and Professional Schools (down by 6,341 or 19.5 percent), while Elementary and Secondary Schools employment was off by 515 (2.1 percent). Declines were similarly unequal in the Health Care and Social Assistance sector, where Offices of Dentists lost 9,163 jobs (55.1 percent) and Social Assistance lost 15,868 (16 percent), while more immediately critical industries like Hospitals saw smaller declines (off 2,003 or 1.7 percent).

Leisure and Hospitality was the hardest-hit supersector by the early fallout from the pandemic. While dramatic declines in employment for the industry groups including restaurants, hotels, sporting events, and concert venues were not unexpected, the scale of the job losses were no less striking for it. Seasonally adjusted employment was down by 146,400, a loss of over half of the supersector’s jobs (54.4 percent) in a single month. Accommodation and Food Services employment was down 53.2 percent, while Arts, Entertainment, and Recreation was off 60 percent. Declines were no less extreme over the year, as the supersector lost 148,593 jobs (55.5 percent) from April 2019. Arts, Entertainment, and Recreation lost 27,138 jobs (61.4 percent), while Accommodation and Food Services lost 121,455 (54.5 percent). Full Service Restaurants fared the worst, losing 65,902 jobs or 73.5 percent on the year.

Other Services was the next hardest-hit supersector after Leisure and Hospitality. The supersector that includes hairdressers and other personal services lost 30,900 jobs (27.3 percent) on a seasonally-adjusted basis. On the year the supersector shed 32,245 jobs (28.3 percent). While every component sector saw large declines, the most extreme losses came in Personal and Laundry Services, which was off by 18,040 (63.2 percent). Religious, Grantmaking, Civic, Professional, and Similar Organizations lost 12,389 jobs (19.7 percent) over the year.

Government employers lost 25,100 jobs (5.9 percent) on the month in April. The losses were mostly concentrated in Local Government (off 24,500 or 8.3 percent). State Government lost 700 jobs (0.7 percent), and Federal employment was up by 100 (0.3 percent). Annually the public sector lost 26,221 jobs (6.1 percent). State employers lost 2,992 jobs (2.9 percent), entirely from the educational services component, and Local Government employers lost 23,763 (8.1 percent) with declines in both educational and non-educational services.

Minnesota Seasonally Adjusted Nonagricultural Wage and Salary Employment (Data In Thousands)| Industry | Apr-20 | Mar-20 | Feb-20 |

|---|---|---|---|

| Total Nonfarm | 2,590.0 | 2,949.8 | 2,977.6 |

| Goods-Producing | 418.9 | 453.4 | 455.2 |

| Mining and Logging | 6.7 | 6.6 | 6.6 |

| Construction | 114.1 | 125.1 | 125.5 |

| Manufacturing | 298.1 | 321.7 | 323.1 |

| Service-Providing | 2,171.1 | 2,496.4 | 2,522.4 |

| Trade, Transportation, and Utilities | 488.5 | 526.6 | 528.4 |

| Information | 43.4 | 45.3 | 45.7 |

| Financial Activities | 187.0 | 190.5 | 191.3 |

| Professional and Business Services | 355.0 | 380.7 | 383.5 |

| Educational and Health Services | 491.0 | 544.7 | 549.2 |

| Leisure and Hospitality | 122.8 | 269.2 | 280.4 |

| Other Services | 82.1 | 113.0 | 116.6 |

| Government | 401.3 | 426.4 | 427.3 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2020 | |||