by Erik White and Cameron Macht

June 2020

The coronavirus pandemic that spread across the nation and state in March and April of 2020 put a halt to the longest running economic expansion in recent history. Statewide, more than 660,000 workers had filed applications for Unemployment Insurance (UI) in Minnesota from March 16 to May 16, with specific demographics, geographies and industries more affected than others. To put the recent economic events into context, DEED has provided a set of articles explaining the impact in each region.

Because of its high reliance on employment in sectors like leisure and hospitality, retail trade, and personal care services, Northwest Minnesota predictably saw the fastest initial increase in Unemployment Insurance (UI) claims of the six planning regions in the state due to COVID-19 pandemic response measures. Impacts varied greatly depending upon workers' age, race, location, and industry. However, it's important to note that after seeing the fastest increase in UI applications, Northwest experienced the fastest drop of the six regions from week to week through mid-May.

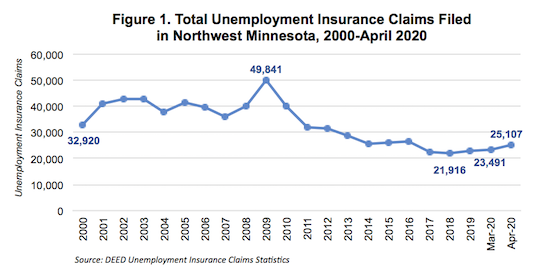

In the first month of COVID-19 response, from March 16 to the week ending April 14, nearly 40,000 workers in the region filed UI claims – that's 13.4% of the total regional labor force. In sum, 23,491 claims were filed in March and another 25,107 claims in April. These are historically high numbers – for comparison the 26-county region had a total of 22,820 UI claims in the entire year of 2019. In fact, the number of UI claims in April 2020 alone outpaced the yearly total in each of the past three years – 2017, 2018, and 2019. Combined, the claims for March and April nearly matched the total claims filed in for all of 2009 – the apex of the Great Recession (see Figure 1).

Following the fastest initial surge of UI claims of the six regions in the state as measured by percent increase week over week, Northwest Minnesota saw a faster decline in initial claims than other regions of the state through mid-May. This is mostly due to big declines in UI applications made by retail sales workers, production workers, food and beverage serving workers and construction trade workers. After seeing the fastest increase in UI applications in March, in May Northwest experienced the fastest decrease as measured by percent decline from the previous week (Table 1).

Table 1. Number of Unemployment Insurance Applications, Northwest Minnesota

| Week Ending | 3/21/2020 | 3/28/2020 | 4/4/2020 | 4/11/2020 | 4/18/2020 | 4/25/2020 | 5/2/2020 | 5/9/2020 | 5/16/2020 |

|---|---|---|---|---|---|---|---|---|---|

| Northwest | 8,766 | 10,204 | 10,030 | 8,108 | 5,915 | 3,585 | 2,993 | 2,252 | 1,974 |

| Source: DEED Unemployment Insurance Claim Statistics | |||||||||

As the initial response to COVID-19 transitions into a reopening and recovery phase, it is important to consider the populations that have been disproportionately impacted by the economic shocks due to this pandemic. Workers in the industries most directly impacted – including leisure and hospitality, arts, entertainment, and recreation, health care and social assistance, and retail trade – make up a large share of the claims filed so far.

Among communities of color, American Indian and Alaska Natives have suffered a disproportionately large impact in the region. American Indians account for 3.1% of workers in the region, but have filed 5.0% of total claims through May 16. For comparison, white people made up 93.2% of the labor force in the region, but they accounted for just 85.2% of UI applications. This indicates a much higher rate of layoffs among American Indians than white workers in the region. This is likely due to the fact that American Indians comprise 7.9% of the workforce in the hard-hit leisure and hospitality industry, including 56.4% of total employment in the gambling industries subsector.

Overall, Northwest Minnesota's workforce is not very racially diverse, and the number of UI applications filed by workers from other races reflects that. Less than 1% of workers in the region are Black or African American, though they have filed 1.4% of UI claims through May 16. Workers who are Hispanic or Latino comprise 2.6% of the labor force but have filed 2.9% of UI applications, while Asian or Other Pacific Islanders accounted for about 1% of both the workforce and claims filed (see Table 2). The adverse employment impacts on People of Color could deepen the economic disparities already present in the region.

Table 2. Northwest Minnesota Unemployment Insurance Applicants by Race, Mar. 16-May 16

| Race | Cumulative UI Applications Through May 16 | Share of UI Applications | Total Labor Force | Share of Total Labor Force | UI Applications as a Share of Total Labor Force |

|---|---|---|---|---|---|

| White Alone | 45,892 | 85.2% | 266,966 | 93.2% | 17.2% |

| Black or African American | 773 | 1.4% | 2,711 | 0.9% | 28.5% |

| American Indian/Alaska Native | 2,709 | 5.0% | 8,841 | 3.1% | 30.6% |

| Asian or Pacific Islanders | 614 | 1.1% | 2,152 | 0.8% | 28.5% |

| Some Other Race and Two or More Races | 879 | 1.6% | 5,846 | 2.0% | 15.0% |

| Choose not to answer | 1,440 | 2.7% | N/A | N/A | N/A |

| Hispanic or Latino | 1,549 | 2.9% | 7,496 | 2.6% | 20.7% |

| Total | 53,847 | 100.0% | 286,516 | 100.0% | 18.8% |

| Source: DEED Unemployment Insurance Statistics, 2014-2018 American Community Survey 5-Year Estimates | |||||

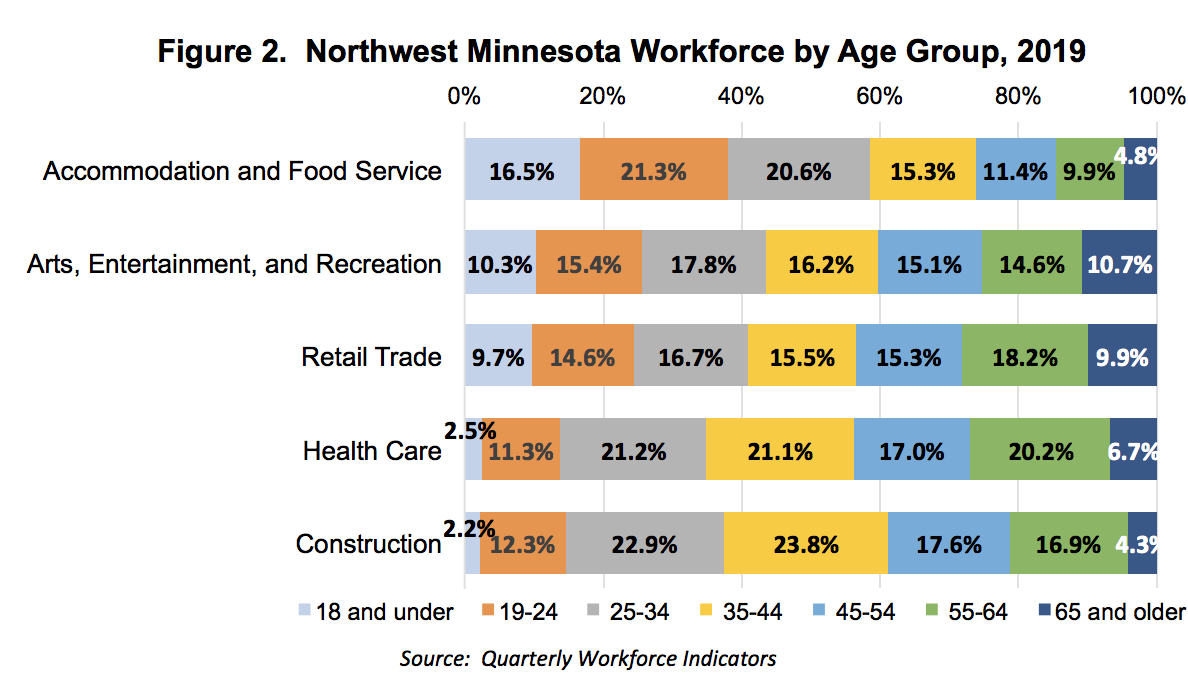

Considering the age makeup of the industries that were shut down by COVID-19, it shouldn't be a surprise that younger workers are more likely to be filing for UI. Most notably, 38% of workers in the accommodation and food services industry are under 25 years old, and another 20% of workers are 25 to 34 year olds. Likewise, the arts, entertainment, and recreation industry relies heavily on young workers with over 43.5% of its workforce under 35 years; while one quarter of retail trade workers are under 25 years.

Construction and health care have an older workforce, but have also had less disruption to their industry due to the pandemic. The largest cohorts in both their workforces are between 25 and 44 years of age, with much smaller shares of teenagers and entry-level workers due to skill and education requirements (Figure 2).

Depending on each county's industry mix and dependence on employment in critical or non-critical sectors, the impact on the labor force has varied widely. For example, at just over 33%, Mahnomen County has the second highest percentage of its labor force that has filed an application for UI in the state, behind only Cook in Northeast Minnesota. Roseau ranks third in the state at 31.5%, followed closely by Cass at 28.3% and Crow Wing at just over 25%. The Northwest region has four of the top six counties in the state with the highest UI applications as a percent of labor force through May 16.

In contrast, Northwest was also home to five of the seven least-impacted counties in the state as measured by UI applications, including Clay, which at 7.5% was lowest in the state. Wilkin (8.0%), Traverse (8.2%), Kittson (8.5%), and Stevens (9.0%) all ranked near the bottom as well, showing relatively little impact from the pandemic-related shutdowns. Statewide, about 21.6% of the total labor force had applied for UI by May 16. Only seven of the 26 counties in the region have a higher percentage than the state, while the other 19 have lower percentages.

Table 3. UI Applications as a Percent of the Labor Force

| Geography | Economic Development Region | March 2020 Labor Force | Cumulative UI Applications thru 5/16 | UI Apps as a Percent of March 2020 Labor Force |

|---|---|---|---|---|

| Mahnomen Co. | Headwaters | 2,264 | 759 | 33.5% |

| Roseau Co. | Northwest | 7,728 | 2,434 | 31.5% |

| Cass Co. | North Central | 13,753 | 3,897 | 28.3% |

| Crow Wing Co. | North Central | 31,452 | 7,924 | 25.2% |

| Douglas Co. | West Central | 20,720 | 4,960 | 23.9% |

| Hubbard Co. | Headwaters | 9,638 | 2,132 | 22.1% |

| Clearwater Co. | Headwaters | 4,457 | 965 | 21.7% |

| Becker Co. | West Central | 18,232 | 3,889 | 21.3% |

| Wadena Co. | North Central | 5,978 | 1,238 | 20.7% |

| Lake of the Woods Co. | Headwaters | 2,527 | 518 | 20.5% |

| Morrison Co. | North Central | 17,230 | 3,445 | 20.0% |

| Beltrami Co. | Headwaters | 24,344 | 4,624 | 19.0% |

| Pennington Co. | Northwest | 8,603 | 1,489 | 17.3% |

| Otter Tail Co. | West Central | 30,805 | 4,831 | 15.7% |

| Polk Co. | Northwest | 16,333 | 2,531 | 15.5% |

| Grant Co. | West Central | 3,158 | 480 | 15.2% |

| Red Lake Co. | Northwest | 2,157 | 321 | 14.9% |

| Todd Co. | North Central | 13,363 | 1,930 | 14.4% |

| Pope Co. | West Central | 6,376 | 862 | 13.5% |

| Norman Co. | Northwest | 3,087 | 400 | 13.0% |

| Marshall Co. | Northwest | 5,235 | 635 | 12.1% |

| Stevens Co. | West Central | 5,166 | 464 | 9.0% |

| Kittson Co. | Northwest | 2,265 | 193 | 8.5% |

| Traverse Co. | West Central | 1,665 | 136 | 8.2% |

| Wilkin Co. | West Central | 3,304 | 263 | 8.0% |

| Clay Co. | West Central | 36,226 | 2,714 | 7.5% |

| Source: DEED Unemployment Insurance Statistics, Local Area Unemployment Statistics | ||||

While many of the effects of the COVID-19 pandemic won't be fully known or measured for a long time, current data shows that the initial impact was significant in the region. However, it varied greatly based on factors like age, race, location and industry mix. Northwest Minnesota has already started to see a receding wave after the initial surge of UI applications and DEED's Labor Market Information office will continue to track and analyze data as we move into recovery over the coming weeks and months.