by Cameron Macht

March 2022

After two long years dealing with COVID-19, employment in Minnesota is expected to continue to recover in both the short-term and the long-term, according to new projections from DEED. This includes a period of recovery to get back to pre-pandemic employment levels, followed by continued economic expansion as businesses resume previous growth patterns. DEED's Employment Outlook shows that the state is projected to add about 170,000 jobs from 2020 through 2030, a 5.7% increase. At that rate, the state would have just over 3,145,000 jobs by 2030.

This round of projections is boosted by the on-going recapturing of jobs that were lost at the outset of the pandemic; but once those jobs are recovered, new growth will likely remain constrained by the lack of enough new workers to fill all the jobs that employers could – or would like to – add. This is a familiar issue, as the state has been dealing with tight labor markets and slowing labor force growth for years.

While highlighted in the past, the potential for workforce shortages became more apparent during the pandemic, as more than 100,000 workers dropped out of Minnesota's labor force over the course of 2020, and many of them didn't return to the labor force even while employers were posting a record number of job vacancies in 2021. We believe that many of these workers are likely to come back into the labor force over time, with the state projected to add about 86,000 additional workers over the next decade. However, that assumption relies on an increase in workers in the oldest age groups even as the back end of the Baby Boom generation reaches traditional retirement age. If retirement patterns truly changed due to the pandemic and remain accelerated, labor force growth may be even slower (see Table 1).

Table 1. Minnesota Labor Force Projections, 2023-2033

| Minnesota | 2023 Labor Force Projection | 2033 Labor Force Projection | 2023-2033 Change | |

|---|---|---|---|---|

| Numeric | Percent | |||

| 16 to 19 years | 159,058 | 160,866 | +1,808 | +1.1% |

| 20 to 24 years | 304,450 | 316,734 | +12,284 | +4.0% |

| 25 to 44 years | 1,372,158 | 1,417,966 | +45,808 | +3.3% |

| 45 to 54 years | 571,436 | 661,299 | +89,864 | +15.7% |

| 55 to 64 years | 524,342 | 443,208 | -81,134 | -15.5% |

| 65 to 74 years | 167,645 | 172,651 | +5,006 | +3.0% |

| 75 years & over | 29,343 | 41,861 | +12,518 | +42.7% |

| Total Labor Force | 3,128,431 | 3,214,584 | +86,153 | +2.8% |

| Source: calculated from Minnesota State Demographic Center population projections and labor force participation rates by age group from American Community Survey estimates | ||||

Unfortunately, much uncertainty remains in the economy, the labor force, and the world, but our outlook is still positive and pointed toward recovery. Despite the unknowns, we expect that our state will continue to see strong recovery and job growth in the future. To that end, our 10-year projections are designed to provide details on employment prospects in various industries and occupations. These projections of future job growth are widely used in career guidance, in planning education and training programs, and in workforce development efforts in both the private and public sectors.

Minnesota's employment outlook relies on national industry and occupational projections produced by the Bureau of Labor Statistics (BLS). Along with most other states, Minnesota customizes these national projections to reflect state-specific industrial, occupational, demographic, and labor market trends and characteristics. Historical employment trends for 290 industries in Minnesota were compared to corresponding national industry employment trends using statistical techniques and then projections were created and analyzed through Projections Management software.

The size and speed of the employment declines triggered by the COVID-19 pandemic recession from February to April 2020 were unprecedented. After suffering the loss of more than 295,000 jobs from the first to the second quarter of 2020, Minnesota employers then regained about 170,000 jobs by the fourth quarter of last year. However, the annual average across all four quarters – which is the starting point for our projections – was down nearly 195,000 jobs compared to 2019 and was also down almost 175,000 jobs from the starting point for our 2018 projections. More job growth has occurred in 2021, but we are still not back to pre-pandemic levels (see Table 2).

Table 2. Minnesota Jobs by Quarter, 2018-2021

| Year | Qtr. 1 Jobs | Qtr. 2 Jobs | Qtr. 3 Jobs | Qtr. 4 Jobs | Annual Average |

|---|---|---|---|---|---|

| 2021 | 2,684,791 | 2,781,326 | 2,793,226 | N/A | N/A |

| 2020 | 2,856,066 | 2,560,820 | 2,683,944 | 2,729,737 | 2,707,642 |

| 2019 | 2,842,776 | 2,919,269 | 2,917,014 | 2,927,468 | 2,901,632 |

| 2018 | 2,825,050 | 2,893,888 | 2,897,339 | 2,911,737 | 2,882,004 |

| Source: DEED Quarterly Census of Employment & Wages | |||||

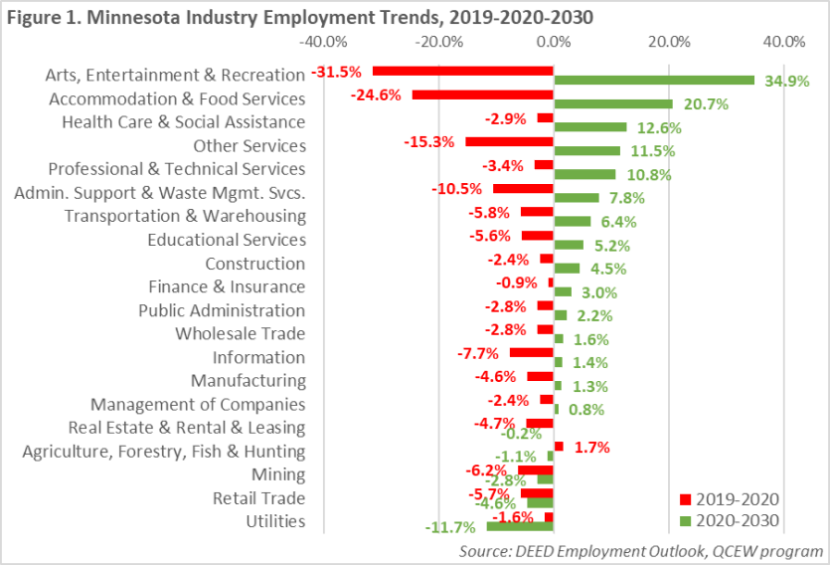

The most severe losses between 2019 and 2020 were concentrated in Leisure & Hospitality, Other Services, Education & Health Services, and Retail Trade, while industries like Finance & Insurance, Construction and Agriculture fared better and even added jobs over the year. Moving forward, Minnesota is expected to see job growth in 15 of the 20 main industries, with many seeing extensive recoveries and even a return to pre-pandemic growth patterns by 2030. Only five are forecasted to decline, while three industries that were projected to decline in the last round of projections (2018-2028) are now expected to gain jobs – including Other Services, Manufacturing, and Information (see Figure 1).

In contrast, some industries and occupations may have experienced long-term structural changes that will alter demand moving forward. As the BLS stated in a summary of their 2020-2030 projections, "for example, many computer-related occupations are expected to have elevated long-term demand, in part due to demands for telework computing infrastructure and IT security. Conversely, retail trade is projected to experience an amplification of its long-term decline, because brick-and-mortar retail is projected to lose employment to e-commerce as those spending habits from the pandemic persist long-term."

Employment projections include both wage and salary jobs at employer establishments as well as self-employment, with all jobs measured on an annual average basis. Wage and salary employment data include both full-time and part-time jobs, as tracked by DEED's Quarterly Census of Employment & Wages program. Self-employment is an estimate of workers who earned their primary income on their own. That means that many of the side or "gig" jobs held by workers are not included in projections employment, though those are certainly a changing part of the overall employment picture that cannot easily be tracked. The breakdown of baseline employment in 2020 was 6.4% self-employed compared to 93.6% wage and salary jobs.

Though job growth resumed in 2021, Figure 1 shows that all but one industry in Minnesota lost jobs in 2020, with the biggest decline recorded in Accommodation & Food Services, which sliced nearly -58,000 jobs. Six other industries cut between 13,000 and 17,000 jobs, led by the 31.5% decline suffered in Arts, Entertainment & Recreation, which was the largest percentage drop. Combined, those two industries were hit hardest by the pandemic, down nearly 75,000 jobs in 2020 compared to 2019; but are now projected to be the two fastest growing and the second and fourth largest growing industries through 2030, respectively (see Table 3).

Table 3. Minnesota Industry Employment Statistics, 2020-2030

| Industry | Estimated Employment 2020 | Projected Employment 2030 | Percent Change 2020-2030 | Numeric Change 2020-2030 |

|---|---|---|---|---|

| Total, All Industries | 2,975,300 | 3,145,200 | +5.7% | +169,900 |

| Health Care & Social Assistance | 473,914 | 533,729 | +12.6% | +59,815 |

| Accommodation & Food Services | 172,515 | 208,244 | +20.7% | +35,729 |

| Professional & Technical Services | 154,228 | 170,931 | +10.8% | +16,703 |

| Arts, Entertainment & Recreation | 39,891 | 53,804 | +34.9% | +13,913 |

| Other Services | 106,083 | 118,291 | +11.5% | +12,208 |

| Educational Services | 229,788 | 241,644 | +5.2% | +11,856 |

| Administrative Support & Waste Mgmt. Svcs. | 120,228 | 129,573 | +7.8% | +9,345 |

| Transportation & Warehousing | 103,467 | 110,041 | +6.4% | +6,574 |

| Construction | 123,927 | 129,479 | +4.5% | +5,552 |

| Finance & Insurance | 159,797 | 164,617 | +3.0% | +4,820 |

| Manufacturing | 309,108 | 313,098 | +1.3% | +3,990 |

| Public Administration | 184,485 | 188,472 | +2.2% | +3,987 |

| Wholesale Trade | 124,780 | 126,800 | +1.6% | +2,020 |

| Management of Companies | 86,958 | 87,685 | +0.8% | +727 |

| Information | 43,138 | 43,734 | +1.4% | +596 |

| Real Estate & Rental & Leasing | 33,760 | 33,693 | -0.2% | -67 |

| Mining | 5,474 | 5,318 | -2.8% | -156 |

| Agriculture, Forestry, Fishing & Hunting | 24,004 | 23,750 | -1.1% | -254 |

| Utilities | 11,898 | 10,501 | -11.7% | -1,397 |

| Retail Trade | 276,316 | 263,653 | -4.6% | -12,663 |

| Source: DEED 2020-2030 Employment Outlook | ||||

However, even if it were to add nearly 36,000 jobs from 2020 to 2030 as projected, Accommodation & Food Services would still not be back to pre-pandemic employment levels. Many jobs in this industry had been hard to fill for years even prior to the pandemic, and became even more so coming out of it, and are also at long-term risk of automation. Restaurants are projected to regain almost 26,000 jobs over the next 10 years, while Accommodation is expected to add about 4,200 jobs.

While those subsectors may not get back to pre-pandemic peaks, the Arts, Entertainment & Recreation industry would narrowly eclipse the previous high hit in 2019 with nearly 54,000 jobs by 2030. This is due to a rebound in areas like Amusement Parks & Arcades (+117%), Performing Arts & Sports Promoters (+86%), Performing Arts Companies (+56%), Spectator Sports (+50%), Museums, Parks & Historical Sites (+44%), and Gambling Industries (+20.5%). But perhaps most importantly, the state is expected to see more than 6,300 jobs return in Other Amusement & Recreation Industries, which includes Gyms & Fitness & Recreational Sports Centers, Golf Courses & Country Clubs, Bowling Centers, Skiing Facilities, and All Other Amusement & Recreation Industries.

The return of demand for Leisure & Hospitality services following the pandemic seems reasonable and may even occur more quickly depending on when and if the pandemic reaches an endemic phase. That would also allow our health care system to prepare and adapt for the challenges created by the virus. On that note, the Health Care and Social Assistance industry is expected to again lead Minnesota's economy over the next decade, projected to add nearly 60,000 jobs through 2030. That would be well above the pre-pandemic peak around 500,000 jobs and make it the third fastest growing industry overall (see Table 3).

However, there are structural shifts occurring in the health care system that differ from past projections. The next decade is likely to feature rapid growth in Social Assistance – primarily Individual & Family Services, which includes Child & Youth Services, Services for the Elderly & Persons with Disabilities, and Social Service, Welfare, Rehabilitation, & Drug Addiction & Substance Abuse Counseling – along with the more traditional growth in Ambulatory Health Care Services, Hospitals, and Nursing & Residential Care Facilities. But while we forecast rapid growth at Community Care Facilities for the Elderly and Residential Mental Health Facilities, there is continued decline projected for Nursing Care Facilities, which have struggled with retention and recruitment of workers throughout the pandemic.

Other Services, another industry that was decimated during the pandemic, is expected to claw back to earlier job levels over time. This includes fast growth for the Hair, Nail, and Skin Care Services sector that had to react and reshape itself to new conditions during the pandemic. But the biggest bounce back in the industry is expected for Civic & Social Organizations, including veterans membership organizations, fraternal associations, lodges, or clubs, student and social clubs, and youth organizations, which are projected to add over 4,200 jobs, a 38.7% increase.

Professional, Scientific & Technical Services – most notably Computer Systems Design & Related Services and Management & Technical Consulting Services – are projected to benefit from the technological advancements and the shift to telework experienced throughout the pandemic. But every subsector in this industry from Accounting & Bookkeeping Services to Scientific Research & Development Services are projected to grow over the decade, creating new high-paying career opportunities in the state.

The same can not be said for every subsector in Manufacturing, though the industry overall is now projected to add another 3,990 jobs through 2030. At a more detailed level, projections show growth in the Food, Fabricated Metal Product, Electronic Instrument & Medical Device, Chemical & Pharmaceutical, Machinery, and Nonmetallic Mineral Product Manufacturing subsectors. Instead, the state is projecting continuing job losses in areas like Printing & Related Support Activities, Paper Manufacturing, Textile Product Mills & Apparel Manufacturing, and Computer & Electronic Product Manufacturing.

As consumer behaviors changed and online shopping became even more prevalent, Retail Trade lost nearly 17,000 jobs from 2019 to 2020. Though demand for workers in these brick-and-mortar settings has returned in the short-term, Retail is projected to lose more than 12,600 jobs over the decade, the most of any sector by nearly a factor of 10. Likewise, the fastest job decline is expected in Utilities, which had been seeing a slower but steady shift toward lower employment over the past decade even before the pandemic recession and will continue to cut jobs across the state.

Shifts in staffing patterns over the 2020-2030 period across industries are projected as part of the BLS national projections, with trends and analysis identifying which occupations within an industry are likely to be increasing or decreasing as a percent of total industrial employment. Staffing patterns for Minnesota industries are developed from estimates collected through the Occupational Employment & Wage Statistics (OEWS) program. Eighteen of 22 occupational groups are expected to experience employment growth over the next 10 years in Minnesota (see Table 4).

Table 4. Minnesota Occupational Employment Projections, 2020-2030

| Industry | Estimated Employment 2020 | Projected Employment 2030 | Percent Change 2020-2030 | Numeric Change 2020-2030 | Labor Force Exit Openings |

|---|---|---|---|---|---|

| Total, All Occupations | 2,975,300 | 3,145,200 | +5.7% | +169,900 | +1,299,528 |

| Healthcare Support | 165,026 | 195,744 | +18.6% | +30,718 | +110,552 |

| Food Preparation & Serving Related | 196,413 | 230,396 | +17.3% | +33,983 | +162,071 |

| Personal Care & Service | 85,350 | 97,909 | +14.7% | +12,559 | +57,296 |

| Computer & Mathematical | 103,199 | 115,793 | +12.2% | +12,594 | +22,665 |

| Community & Social Service | 65,252 | 72,662 | +11.4% | +7,410 | +23,361 |

| Education, Training, & Library | 164,751 | 178,355 | +8.3% | +13,604 | +70,050 |

| Arts, Design, Entertainment, Sports, & Media | 50,051 | 54,147 | +8.2% | +4,096 | +19,503 |

| Healthcare Practitioners & Technical | 192,413 | 207,998 | +8.1% | +15,585 | +50,559 |

| Legal | 22,327 | 23,964 | +7.3% | +1,637 | +6,339 |

| Transportation & Material Moving | 217,673 | 233,084 | +7.1% | +15,411 | +106,855 |

| Life, Physical, & Social Science | 28,259 | 30,029 | +6.3% | +1,770 | +5,840 |

| Business & Financial Operations | 194,738 | 206,660 | +6.1% | +11,922 | +52,881 |

| Protective Service | 46,767 | 49,561 | +6.0% | +2,794 | +21,676 |

| Building & Grounds Cleaning & Maintenance | 88,554 | 93,911 | +6.0% | +5,357 | +52,792 |

| Management | 225,287 | 237,754 | +5.5% | +12,467 | +67,446 |

| Architecture & Engineering | 55,462 | 58,392 | +5.3% | +2,930 | +13,817 |

| Construction & Extraction | 120,028 | 124,959 | +4.1% | +4,931 | +36,430 |

| Installation, Maintenance, & Repair | 105,222 | 109,437 | +4.0% | +4,215 | +33,714 |

| Production | 205,773 | 205,003 | -0.4% | -770 | +76,945 |

| Farming, Fishing, & Forestry | 16,818 | 16,596 | -1.3% | -222 | +6,965 |

| Sales & Related | 272,390 | 265,840 | -2.4% | -6,550 | +137,391 |

| Office & Administrative Support | 353,547 | 337,006 | -4.7% | -16,541 | +164,380 |

| Source: DEED 2020-2030 Employment Outlook | |||||

Occupational growth in Minnesota will be led by Healthcare Support, which is also the fastest growing occupational group at the national level. In sum, health care-related occupations account for 12 of the top 50 fastest growing jobs in the state, and demand for health care services will continue to drive projected employment growth.

Beyond that, more evidence of the importance of recovery from the recession show up in the detailed occupational projections. While Food Prep & Serving workers were projected to grow about 6% from 2018 to 2028, which would have been the 10th fastest (of the 22 groups) over that timeframe, they are now projected to grow 17.3% from 2020 to 2030, which is the second fastest growth rate.

This includes notable growth for Cooks, Fast Food & Counter Workers, Waiters & Waitresses, and Bartenders, all of whom were among the most likely to have filed an Unemployment Insurance claim in 2020 at the outset of the pandemic. However, it is important to note that the 2030 projected employment would still be less than the base number in 2018, reflecting the severity of the pandemic recession on Food Prep & Serving workers.

Likewise, Arts, Design, Entertainment & Media occupations were essentially expected to hold steady from 2018 to 2028 (+0.8%), but now are projected to grow more than 8%, fueled almost entirely by their expected post-pandemic recovery. Occupations including Costume Attendants, Ushers & Ticket Takers, Cooks, Choreographers, Gaming Dealers, Tour & Travel Guides, and Bartenders – jobs that have likely never been on a Top 10 list before – are now among the fastest-growing jobs in both the state and nation as demand returns in Arts, Entertainment & Recreation and Accommodation & Food Services (see Table 5).

Table 5. Top 25 Fastest Growing Jobs in Minnesota, 2020-2030 (minimum of 1,000 jobs)

| Industry | Estimated Employment 2020 | Projected Employment 2030 | Percent Change 2020-2030 | Numeric Change 2020-2030 |

|---|---|---|---|---|

| Ushers, Lobby Attendants & Ticket Takers | 1,538 | 2,423 | +57.5% | +885 |

| Cooks, Restaurant | 21,685 | 31,629 | +45.9% | +9,944 |

| Nurse Practitioners | 4,107 | 5,985 | +45.7% | +1,878 |

| Manicurists & Pedicurists | 2,965 | 4,024 | +35.7% | +1,059 |

| Gaming Dealers | 1,426 | 1,926 | +35.1% | +500 |

| Fitness Trainers & Aerobics Instructors | 4,950 | 6,633 | +34.0% | +1,683 |

| Statisticians | 943 | 1,258 | +33.4% | +315 |

| Gaming & Sports Book Writers and Runners | 1,409 | 1,869 | +32.6% | +460 |

| Tour & Travel Guides | 801 | 1,057 | +32.0% | +256 |

| Physician Assistants | 2,564 | 3,369 | +31.4% | +805 |

| Medical & Health Services Managers | 8,326 | 10,751 | +29.1% | +2,425 |

| Logisticians | 3,380 | 4,360 | +29.0% | +980 |

| Information Security Analysts | 2,532 | 3,267 | +29.0% | +735 |

| Massage Therapists | 2,910 | 3,728 | +28.1% | +818 |

| Bartenders | 14,149 | 18,000 | +27.2% | +3,851 |

| Speech-Language Pathologists | 2,950 | 3,720 | +26.1% | +770 |

| Amusement & Recreation Attendants | 6,453 | 8,119 | +25.8% | +1,666 |

| Computer Numerically Controlled Tool Programmers | 1,262 | 1,584 | +25.5% | +322 |

| Passenger Vehicle Drivers, exc. Bus Drivers | 17,498 | 21,777 | +24.5% | +4,279 |

| Operations Research Analysts | 3,101 | 3,855 | +24.3% | +754 |

| Home Health & Personal Care Aides | 107,496 | 133,419 | +24.1% | +25,923 |

| Nonfarm Animal Caretakers | 3,366 | 4,171 | +23.9% | +805 |

| Flight Attendants | 2,813 | 3,486 | +23.9% | +673 |

| Software Developers & Software Quality Assurance | 33,284 | 40,994 | +23.2% | +7,710 |

| Skincare Specialists | 854 | 1,051 | +23.1% | +197 |

| Source: DEED 2020-2030 Employment Outlook | ||||

Three-fourths of occupations with updated projections, 496 in all, are expected to experience employment growth over the next 10 years in Minnesota. This ranges from huge and common occupations such as Home Health and Personal Care Aides, Registered Nurses and Fast Food & Counter Workers to more rare but growing occupations like Occupational Therapy Aides, Statistical Assistants, Aircraft Cargo Handling Supervisors, and Pile-Driver Operators.

Eight occupations are expected to see no change in the number of employed workers. In general, these are small, specialized occupations (less than 1,000 combined positions in 2020) that are employed in industries that are expected to experience little employment change. The remaining 23% percent of occupations, 153 to be exact, are projected to decline. Over half (79) of those occupations, however, are projected to shrink by 5% or less, while the most extreme declines tend to be concentrated in Office & Administrative Support occupations including Switchboard Operators, Data Entry Keyers, Legal Secretaries, Order Clerks, and Executive Secretaries and Administrative Assistants.

As presented above, projected employment growth can be viewed from two perspectives – percent change and numeric change. Some occupations, which have relatively small numbers of workers in 2020, are projected to grow rapidly over the next 10 years but will add relatively few new jobs. Other occupations which start with a large number of workers in 2020 but are projected to grow slower than overall employment growth will still add large numbers of workers by 2030. The distinction between occupations with fast employment growth and occupations expected to add the most jobs is apparent when the 25 fastest growing occupations (Table 5) are compared to the 25 occupations expected to add the most jobs (Table 6). Just nine jobs make it onto both lists, as highlighted in bold.

Table 6. Top 25 Largest Growing Jobs in Minnesota, 2020-2030

| Industry | Estimated Employment 2020 | Projected Employment 2030 | Percent Change 2020-2030 | Numeric Change 2020-2030 |

|---|---|---|---|---|

| Total, All Occupations | 2,975,300 | 3,145,200 | +5.7% | +169,900 |

| Home Health & Personal Care Aides | 107,496 | 133,419 | +24.1% | +25,923 |

| Cooks, Restaurant | 21,685 | 31,629 | +45.9% | +9,944 |

| Fast Food & Counter Workers | 66,583 | 74,855 | +12.4% | +8,272 |

| Software Developers & Software Quality Assurance | 33,284 | 40,994 | +23.2% | +7,710 |

| Waiters & Waitresses | 31,369 | 36,813 | +17.4% | +5,444 |

| Registered Nurses | 71,782 | 76,538 | +6.6% | +4,756 |

| Passenger Vehicle Drivers, exc. Bus Drivers | 17,498 | 21,777 | +24.5% | +4,279 |

| Bartenders | 14,149 | 18,000 | +27.2% | +3,851 |

| Market Research Analysts & Marketing Specialists | 17,291 | 20,542 | +18.8% | +3,251 |

| General & Operations Managers | 41,540 | 44,400 | +6.9% | +2,860 |

| Teaching Assistants (Paraprofessionals) | 35,378 | 38,075 | +7.6% | +2,697 |

| Laborers & Freight, Stock, & Material Movers, Hand | 41,147 | 43,817 | +6.5% | +2,670 |

| First-Line Supervisors of Food Prep & Serving Workers | 14,789 | 17,416 | +17.8% | +2,627 |

| Janitors & Cleaners | 42,824 | 45,348 | +5.9% | +2,524 |

| Financial Managers | 16,009 | 18,487 | +15.5% | +2,478 |

| Medical & Health Services Managers | 8,326 | 10,751 | +29.1% | +2,425 |

| Management Analysts | 20,543 | 22,816 | +11.1% | +2,273 |

| Hairdressers, Hairstylists, & Cosmetologists | 12,062 | 14,116 | +17.0% | +2,054 |

| Nurse Practitioners | 4,107 | 5,985 | +45.7% | +1,878 |

| Substance Abuse, Behavioral & Mental Health Counselors | 8,127 | 9,987 | +22.9% | +1,860 |

| Preschool Teachers, Except Special Education | 9,719 | 11,579 | +19.1% | +1,860 |

| Self-Enrichment Education Teachers | 9,649 | 11,415 | +18.3% | +1,766 |

| Project Management & Business Operations Specialists | 32,809 | 34,527 | +5.2% | +1,718 |

| Fitness Trainers & Aerobics Instructors | 4,950 | 6,633 | +34.0% | +1,683 |

| Amusement & Recreation Attendants | 6,453 | 8,119 | +25.8% | +1,666 |

| Source: DEED 2020-2030 Employment Outlook | ||||

Job prospects tend to be better in occupations that are growing, but new jobs created by growth are only a fraction of the total number of future openings across occupations. The opportunity to get a job in a particular occupation also depends on how many workers are leaving the occupation and how many other job seekers are considering the same career. Though we've mostly focused on recovery and growth thus far, projections data show that job openings created by workers leaving the labor force or transferring to a different occupation will far exceed openings generated by employment growth.

As shown in Table 4, the number of new jobs created is expected to be around 170,000 jobs over the course of the decade, while the number of jobs that will become open due to labor market exits is close to 1.3 million! For example, many of the more than 217,500 people currently working in Transportation & Material Moving occupations in 2020 will still be working in those jobs in 2030, but many others will have retired or transferred to another occupation over the next ten years, thereby creating labor market exit and occupational transfer openings for new workers. While we are projecting a gain of more than 15,000 new Transportation & Material Moving jobs by 2030, we may also need more than 106,000 workers to fill existing jobs that become available due to retirements or other labor force changes.

On that note, the largest number of labor market exit openings are actually projected for Office & Administrative Support occupations, which are projected to see the largest decline – but will still offer nearly 165,000 job openings for interested job seekers. Likewise, the state will have significant demand for replacement openings in Food Prep & Serving, Sales & Related, Healthcare Support, Transportation & Material Moving, Production, Management, and Education, Training & Library occupations. Even in the fast growing Computer & Mathematical occupations group, labor force exits account for two-thirds of total openings; and average over 88% of total openings across all occupations.

In sum, Minnesota's total employment is projected to climb 5.7% over the 2020-2030 period, compared to projected U.S. employment growth of 7.7% over the same time period. Minnesota's employment growth trailed the U.S. pace during the previous 10 years and will most likely continue to lag behind national growth rates unless the labor force is able to grow more than currently projected. Unfortunately, Minnesota's job growth is still projected to be constrained by our tight labor market unless there is significant expansion of the number of available workers in the state with the right skills.

The state is expected to add nearly 170,000 new jobs over the decade, and may also have up to 1.3 million labor market exit openings, creating a multitude of opportunities for workers in Minnesota. Fifteen of the 20 main industries are expected to see job growth or recovery during that time frame, again led by Health Care & Social Assistance but also boosted by recovery in Leisure & Hospitality and Other Services. Likewise, most occupational groups and occupations are expected to see job gains, but even more will have demand due to replacement openings.

However, the long-term impacts of the COVID-19 pandemic have altered Minnesota's economy and labor market through changes in demand for goods and services, technological innovations and productivity advances, and shifts in business practices. These changes will alter the mix of occupations that employers will be looking to fill over the next 10 years, with the projections presented here starting to account for the pandemic-related changes that have occurred in the short run and may continue over the long run.