by Shawn Herhusky and Carson Gorecki

June 2021

One of the most talked about issues of the pandemic recovery is employers' inability to find workers. The most recent Minnesota Department of Employment and Economic Development (DEED) Job Vacancy Survey showed a return to the pre-pandemic job openings level. Data from job banks and employer websites show that there are near record numbers of jobs available. Despite this high demand for workers, the unemployment rate remains higher than prior to the onset of the pandemic.

General wisdom would suggest that more unemployed workers equals more potential candidates for open positions employers are looking to fill. However, the typical understanding may not apply to our current labor market where more than simple supply and demand are at play. In our work as DEED's Labor Market Analyst and Workforce Strategy Consultant for Northeast Minnesota, we are hearing from many companies that they are not receiving the same number and quality of applications they were receiving prior to the pandemic. This is happening as many employers are hoping to hire more employees to meet growing demand.

Employers are reaching out to CareerForce for assistance in filling open positions and at DEED we are calling Minnesotans who are receiving Unemployment Insurance to make sure they know about opportunities. Some employers have even gone back to putting up posters in windows and signs on street corners to fill positions, especially those that are typically high demand and low wage. During our research for this article, we recently attended a drive-through job fair held in the parking lot of the Duluth Entertainment and Convention Center for open positions in the hospitality industry. Over 100 people drove up to learn more about the opportunities in this industry, but those 100 job seekers are nowhere near the number needed to fill the open positions in this industry in Northeast Minnesota alone.

It is clear that there is a lack of alignment of job seekers with the right interests, skills, scheduling availability and other requirements with the types of openings that employers need to hire for now. All professionals who work in workforce development – either in business, education, or government – are struggling to rebalance this equation as we move through pandemic economic recovery.

Just like a disruption in supply chains and consumer demand meant that consumers couldn't find necessary goods (like toilet paper or lumber) at some points during the pandemic, there has been a disturbance in the talent pipeline as well.

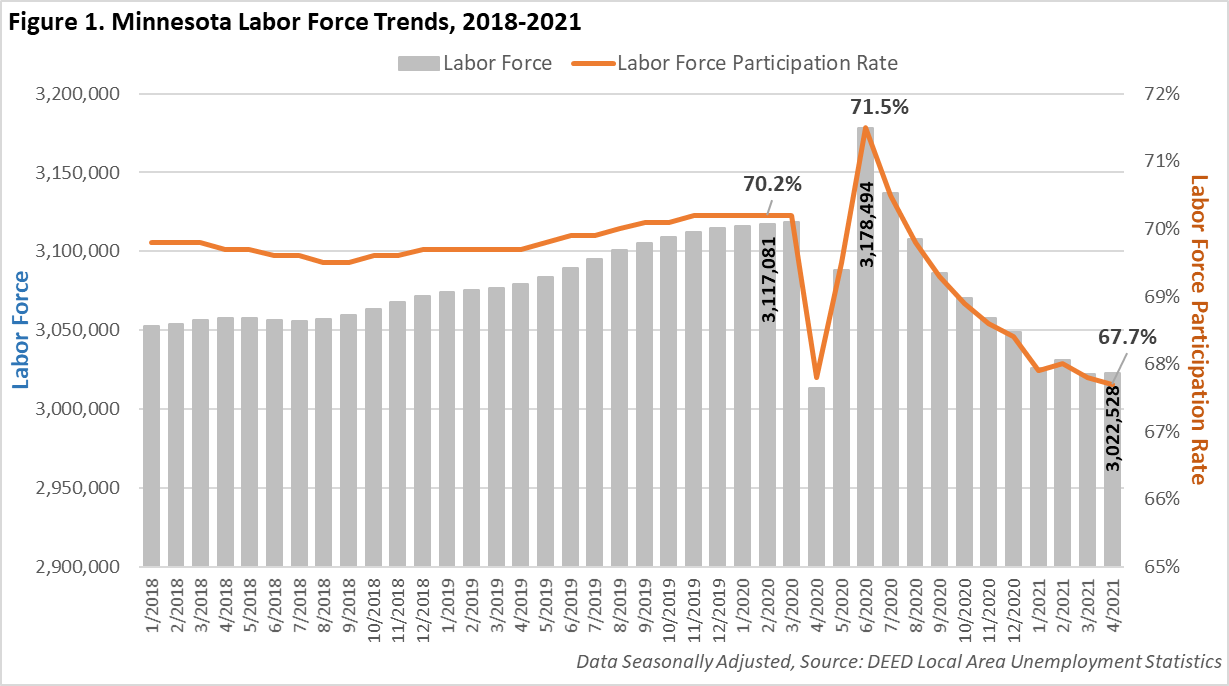

At the beginning of the pandemic, Minnesota's labor force shrank 3.3%, as nearly 105,000 workers stopped looking for work altogether. Even in April 2021, the labor force was still down almost 95,000 workers from a year previously. The current state labor force participation rate sits at 67.7%, compared to 70.2% last February (see Figure 1). Prior to 2020, the last time Minnesota's labor force participation rate was below 68% was 19791.

There are a variety of reasons why the labor force participation rate is down and hiring at this time is difficult. One is fear of contracting COVID-19, despite the widespread availability of vaccines. If a person is living at home with an older person or someone with a chronic medical condition, or themselves have such a condition, they might be concerned about working outside of the house, especially if the job involves onsite face-to-face interaction. Coronavirus concerns have likely had a big impact on labor force participation and willingness to work outside the home over the past 14 months, particularly prior to vaccine availability.

Another big reason is increased difficulty finding childcare, and the uncertainty of in-person schooling over the past 14 months. During the pandemic, many childcare providers had to shrink their programs to accommodate social distancing and/or have lost staff or have experienced temporary closures due to COVID-19 exposure. Many providers, especially smaller family providers, elected to close permanently despite grants and loan opportunities. In addition, parents have had to adapt to radically changing schedules and the need to supervise young children engaged in virtual learning.

Workers who are waiting to return to their previous job and are not interested in other work are another reason employers may have a harder time attracting applicants. Transitioning to a new career can be daunting and many workers still believe their layoff to be temporary, preferring to wait to go back to their old employer. According to research by DEED's Alessia Leibert, through 3rd quarter 2020, 59% of all Unemployment Insurance (UI) claimants laid off in March through June 2020 were recalled by the employer that laid them off.

Some people point to the continued enhanced UI benefit as another reason people are reluctant to look for and find work. It is important to note that research so far on the impact of enhanced and extended benefits on hiring difficulties has not established a definitive link with decreased employment. If the additional $300 plays any role in hiring difficulties, it is likely most relevant for those laid off from low-wage jobs. We work frequently with companies in the hospitality, retail, and food preparation industries and these employers are struggling to find talent to fill their positions as the economy recovers. In response, many Leisure & Hospitality employers have tried to entice job seekers with higher wages. In 2020 average weekly wages for all industries rose 7.6% from 2019, up from an increase of 2.7% in 2018-20192. In the 4th quarter of 2020 weekly wages for Leisure & Hospitality, Retail, and Other Services were up 7.2%, 12.3%, and 13.3% respectively over the year. Additionally, the median wage offer for open positions also increased 6.2% in the 4th quarter of 2020, buoyed by rises in lower-paying occupational groups such as Arts, Design, and Entertainment (+19.7%), Sales (+11.0%), and Personal Care and Service (+20.6%).

According to UI statistics, the majority of workers claiming UI benefits still plan to return to their former employer. Those receiving enhanced UI benefits know it is temporary, and will need to return to work at some point. Currently, the extra $300/week is set to expire in September. If the right offer came along, it is likely that many would prefer a stable, permanent job to temporary benefits. (See Where Are the Job Seekers? for more on workers' preferences and issues around returning to work.)

In addition to workers opting against job seeking for the variety of reasons cited above, there is also a mismatch between the opportunities that are available and the workers most likely to have lost employment during the pandemic. The largest numbers of Minnesotans who were laid off early in the pandemic worked in hospitality, retail, or food preparation. Many of the opportunities available during the first year of the pandemic required skills or formal certification – such as in health care or production – that these individuals may not possess. Leibert's research shows that inter-industry transfers were rare. Only 6% of UI claimants changed industries. Those that switched from Leisure & Hospitality were most likely to end up in other service industries with similar skill requirements such as Retail, rather than Manufacturing or Healthcare.

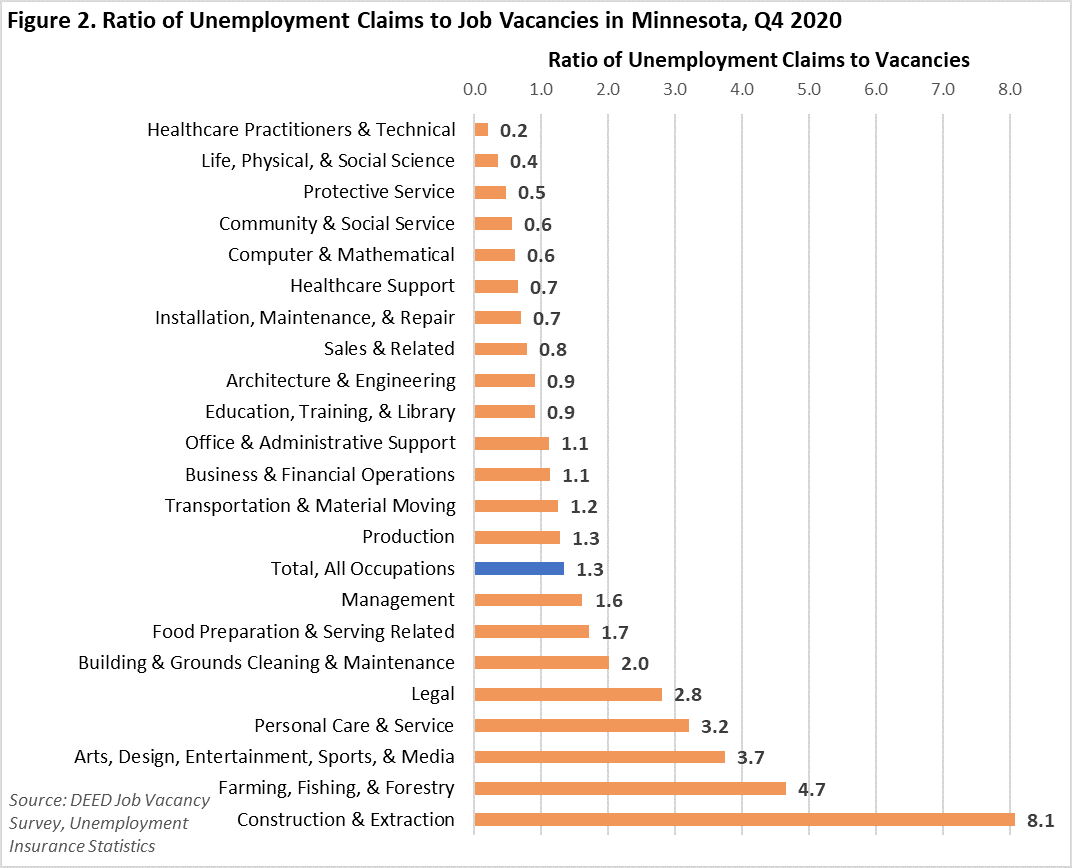

One way to measure this mismatch across occupations is to compare UI claims to demand for workers as measured by job vacancies during fourth quarter 2020 (most recent data). The occupational groups with the lowest ratios of UI claims to job vacancies were Healthcare Practitioners & Technical; Life, Physical, & Social Science; Protective Service, Community & Social Service, and Computer & Mathematical (see Figure 3). These occupational groups typically require higher levels of educational attainment or training and therefore are more difficult for workers to switch into.

In contrast, some of the highest ratios were in more seasonally-sensitive occupational groups such as Construction & Extraction and Farming, Fishing, & Forestry, but also in some of the areas that were hit hardest during the pandemic including Arts, Design, Entertainment, Sports & Media and Personal Care & Service. We know that employers are struggling to find candidates for Food Preparation & Serving Related occupations, but this shortage of candidates is in part masked by the theoretically sufficient supply of unemployed workers with applicable skills. There are reasons other than skills mismatches suppressing the supply of candidates for these jobs. Not all workforce shortages are created equal.

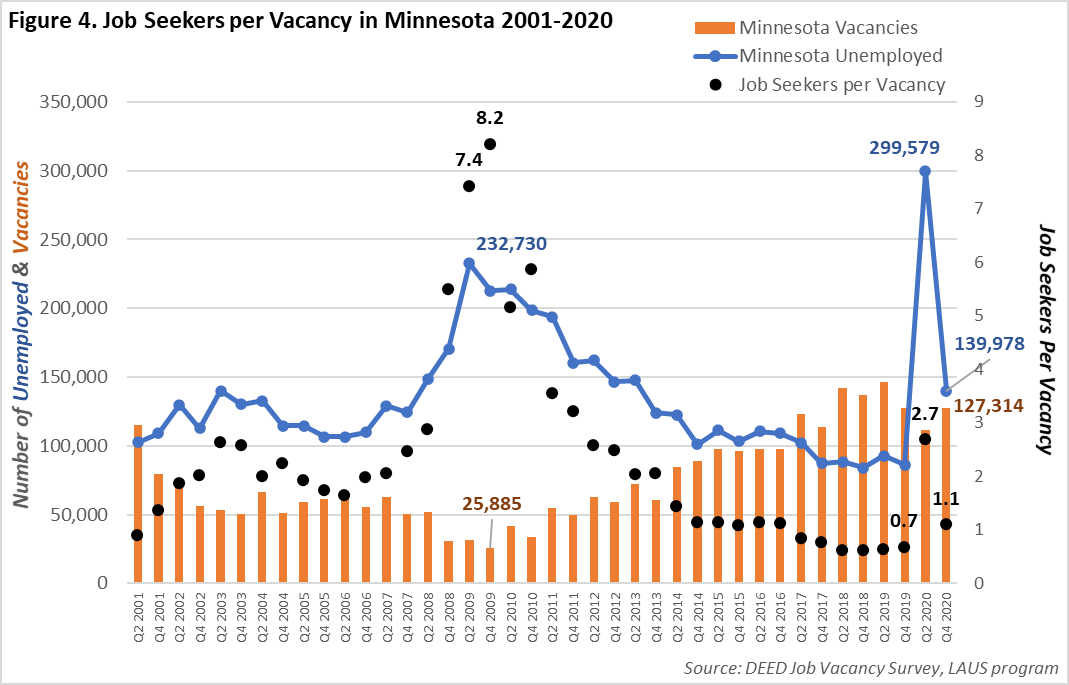

As of 4th quarter 2020, there were 127,314 job vacancies in Minnesota, equaling 4.5 vacancies per 100 jobs (see Figure 4). The number of vacancies was almost identical to the 2019 4th quarter total, indicating a return to high demand for workers, despite the impacts of the pandemic.

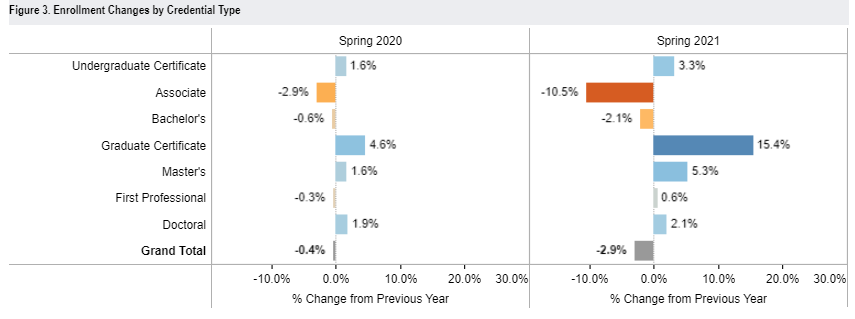

Pursuit of higher education does not seem to be a major factor in Minnesotans not looking for work now. Contrary to past recessionary trends, fewer workers are pursuing postsecondary education while laid off. According to the National Student Clearinghouse Research Center, enrollment in Minnesota postsecondary programs was 6% lower for the Spring 2021 term than a year previously. Nationwide, enrollment was down 10.5% for associate degree programs and down 2.1% for bachelor's degree programs, however pursuit of graduate certificate and degrees was up (see Figure 2). Of Minnesotans 18 and older with post-secondary education plans in fall 2021, nearly a third decided to completely cancel those plans3.

Source: National Student Clearinghouse Research Center

While people aren't turning away from the job market to pursue higher education and that could mean more available candidates now, in the longer term this could prove problematic for the talent pipeline. If enough people don't engage in education and training to earn the certifications needed for in-demand jobs, there could be a greater skilled worker shortage down the road.

The pandemic and related lower labor force participation rate along with shrinking unemployment numbers in Minnesota mean that employers need to cast a wider hiring net. This section explores some strategies that may help.

Finding talent exists on a continuum. On one end, when there is a lot of unemployed talent, as is typical during recessions, the advantage is to employers. For example, at the height of the Great Recession there were 8.2 job seekers for every opening (see Figure 4). In these conditions, employers can be more selective, and in the past have reacted by increasing the number of minimum and preferred qualifications.

At the other end of the continuum the labor force is extremely constricted. Just before the pandemic, the job seekers to vacancies ratio was as low as 0.6, meaning that there were nearly two vacancies per every job seeker – not enough available workers to fill all the open jobs. There is no reason to believe that after the current COVID-19 pandemic ends, conditions will not return to something similar to this level. In fact, as of the 4th quarter of 2020, the job seekers to vacancies ratio dropped back near one, as it was from 2014-2017.

Right now, there are still slightly more people unemployed than jobs available, but that relationship varies by type of job, rendering the dynamics of the labor market less intuitive or predictable. This means that recruitment needs to involve marketing and more proactive approaches to identify and reach prospective job seekers where they are.

Employers can develop an ideal candidate profile or persona by interviewing five to ten people you have hired who have become strong employees. Developing an ideal candidate persona will be very helpful to you in creating and targeting your outbound marketing.

Developing an ideal candidate persona is about identifying the characteristics such as personality type, values, interests or volunteer work to identify what interests, motivates and speaks to someone who is a good fit at your company. It's important to understand what a persona actually is to avoid bias based on race or ethnicity, gender, age or other demographic categories that have nothing to do with whether a person would make a great employee.

Find out what motivated those great employees you hired to apply and take a job at your organization and see if you can find a theme. What employment recruiting message worked best with them – what message would work even better?

With successful development of an ideal candidate persona you can develop better outreach messaging as well as better target your outreach to people who are more likely to be interested in working for you and of turning out to be a great employee.

For the purposes of this article, we will focus on the two basic options for engagement:

Inbound engagement is the more traditional recruitment method. Employers post their jobs on their website or job boards, and then wait for a response. Some employers may post a social media advertisement to entice applicants to apply. Once they get a response, they choose candidates to interview or repost the position to try to get more qualified applicants. It's a fairly passive process that works well enough if there is enough talent available and actively looking for work. However, if many workers are not actively looking for work, which reflects conditions similar to what we have now, this method may result in fewer applicants, frequent ghosting, and high turnover as employees are less connected with their employer and continue looking for better pay, hours or other working conditions.

Outbound engagement is more effective in times of low unemployment or in today's environment where individuals not currently employed may not be actively looking for work. This method is more active and time consuming for employers, but also has more potential for success. Some examples of outbound hiring activities could include:

Also see downloadable ideas for What Employers Can Do Now to recruit and hire employees.

We are currently in a paradoxical situation where employers see too few or unqualified candidates while unemployment remains relatively high. Much of this is attributable to the unique nature of this pandemic-induced recession. People are staying away from work for more reasons other than they are "not interested" or, as we presented in our previous article, not because they are content to sit around collecting UI checks. The reality is likely much more complicated and driven by individual or family needs.

While much of the focus during 2020 was – for good reason – on high unemployment, now the focus is shifting in many ways to high vacancies and hiring difficulties. Examining our relatively high unemployment that is occurring concurrent with high levels of job vacancies provides necessary context to accurately understand the unique challenges of the current labor market.

Many areas of the labor market remain tight despite the ongoing pandemic recession, upending historical recessionary trends. As confidence returns and pandemic-related barriers to work are overcome, workers who are not currently looking for work may opt to re-enter the labor force, increasing the pool of available workers and easing some of the hiring challenges that employers currently face. While it will be some time before we have a full picture of all the factors at play in our current job market, it is clear that our traditional understanding of labor supply and demand has been upended by the global public health crisis.

1DEED Local Area Unemployment Statistics

2DEED Quarterly Census of Employment and Wages

3U.S. Census Household Pulse Survey, Week 26 (3/3-3/15/21)