by Nick Dobbins

December 2018

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

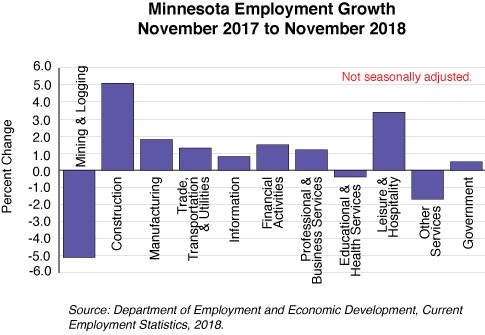

Employment in Minnesota was mostly flat in November as the state lost 800 jobs (0.0 percent) on a seasonally adjusted basis. October estimates were also adjusted downward from a gain of 3,400 to a gain of 2,500. November’s decline came from service providing industries (down 800, 0.0 percent) and was split evenly between the private and public sectors, both of which shed 400 jobs (0.0 and 0.1 percent, respectively). The relative stability of the overall employment level was largely mirrored in the component supersectors, many of which showed little or no movement on the month. Over the year the state added 33,360 jobs (1.1 percent). The private sector added 31,365 (1.2 percent) while the public sector added 2,095 (0.5 percent). Service providers added the most jobs (21,795 or 0.9 percent) but goods producers had the higher growth rate (2.6 percent or 11,665 jobs). Over-the-year growth in the state has declined slightly in every month since July when it hit its recent high point at 2.0 percent.

Mining and Logging employers shed 100 jobs (1.6 percent) in November to settle at 6,200. This represents the lowest employment estimate for the supersector since June of 2016. Annually Mining and Logging employers lost 340 jobs (5.1 percent). With October’s slight upward revision, the downturn now represents the largest over-the-year employment decline in the supersector since August of 2016.

Employment in Construction was flat in November, holding at 126,800 jobs. It marked the first time since March that the industry did not have seasonally adjusted over-the-month growth. Annually Construction employers added 6,196 jobs (5.1 percent). Specialty Trade Contractors added 5,274 jobs (6.7 percent), and Construction of Buildings was up by 1,178 (4.5 percent). The other published component sector, Heavy and Civil Engineering, was off by 256 (1.5 percent) on the year.

Employment in the Manufacturing supersector was up very slightly in November as employers added 100 jobs (0.0 percent). The gains, such as they were, came in Durable Goods Manufacturing (up 100, also 0.0 percent), as employment in Non-Durable Goods Manufacturing held at 118,800. Annually Manufacturing employers added 5,809 jobs (1.8 percent). The growth came primarily through Durable Goods Manufacturers, who added 5,362 jobs (2.7 percent), with gains spread across component industries. Non-Durable Goods Manufacturing added 447 jobs (0.4 percent).

Employment in Trade, Transportation, and Utilities was mostly flat, adding just 200 jobs (0.0 percent). Wholesale Trade employment was up by 500 (0.4 percent), Retail Trade was up 200 (0.1 percent), and Transportation, Warehousing, and Utilities was off by 500 (0.5 percent). Over the year the supersector added 7,378 jobs (1.3 percent). Growth was spread among the component sectors. Wholesale Trade added 1,383 jobs (1 percent) thanks primarily to Durable Goods Merchant Wholesalers. Retail Trade added 3,838 jobs (1.3 percent), with most of that growth coming in Food and Beverage stores (up 3,114, 5.5 percent). Transportation, Warehousing, and Utilities added 2,157 jobs (2 percent).

The Information supersector lost 100 jobs (0.2 percent) in November, although October’s estimate was revised upward from a gain of 100 to a gain of 300 jobs. Annually the supersector added 400 jobs (0.8 percent), although both published component sectors lost jobs.

Financial Activities employment was up by 200 (0.1 percent) in November. The growth came in Real Estate and Rental and Leasing, which added 200 jobs (0.6 percent) while its counterpart, Finance and Insurance, held at 146,600 jobs. On an over-the-year basis the supersector added 2,775 jobs (1.5 percent). Finance and Insurance employers added 1,723 jobs (1.2 percent) while Real Estate and Rental and Leasing added 1,052 (3 percent).

Employment in Professional and Business Services was up by 1,500 (0.4 percent) in November as all three component sectors added jobs. Professional, Scientific, and Technical Services was up 500 (0.3 percent), Management of Companies and Enterprises was up 100 (0.1 percent), and Administrative and Support and Waste Management and Remediation Services added 900 (0.7 percent). Over the year the supersector added 4,398 jobs (1.2 percent). Professional and Business Services added 3,830 jobs (2.4 percent), leading the way in total jobs added, while Management of Companies and Enterprises added 2,156 (2.7 percent). Administrative and Support and Waste Management and Remediation Services shed jobs on the year, off by 1,588 (1.1 percent) thanks to a loss of 1,536 (2.4 percent) in Employment Services.

Employment in Educational and Health Services was off by 2,700 jobs (0.5 percent) in November. It was by far the biggest movement, positive or negative, of any supersector. Educational Services shed 500 jobs (0.7 percent) while Health Care and Social Assistance employment was off by 2,200 (0.5 percent). Annually the supersector dipped into the red, off by 2,091 jobs (0.4 percent). This is the first time that this supersector has dipped into negative over-the-year growth since 1990 when records were first kept for this industry. Both component sectors were off on the year, with Educational Services off by 1,722 jobs (2.4 percent) and Health Care and Social Assistance off by 369 (0.1 percent).

Leisure and Hospitality employment was up by 1,500 (0.5 percent) in November. It was the largest proportional growth for any supersector in the state, driven entirely by Arts, Entertainment, and Recreation employment (up by 1,800 or 3.8 percent). Accommodation and Food Services, the much larger of the two components, shed 300 jobs (0.1 percent). On the year the supersector added 8,819 jobs (3.4 percent). Leisure and Hospitality added 1,887 jobs (4.6 percent), and Accommodation and Food Services added 6,932 (3.2 percent).

The Other Services supersector lost 1,000 jobs (0.9 percent) in November. It was the fourth consecutive month of over-the-month declines. Annually employers in Other Services lost 1,979 jobs (1.7 percent). Those declines came primarily among Religious, Grantmaking, Civic, Professional, and Similar Organizations which shed 2,091 jobs (3.2 percent).

Government employers shed 400 jobs (0.1 percent) in November, with each of the three levels of government contracting slightly. Annually Government employers added 2,095 jobs (0.5 percent). Local and State Governments added jobs (up 1,312 or 0.4 percent and 1,148 or 1.1 percent, respectively) while Federal employers in the state lost 365 jobs (1.1 percent) on the year.

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | Nov-18 | Oct-18 | Sep-18 |

| Total Nonfarm | 2,976.4 | 2,977.2 | 2,974.7 |

| Goods-Producing excl. Ag. | 457.7 | 457.7 | 456.7 |

| Mining and Logging | 6.2 | 6.3 | 6.4 |

| Construction | 126.8 | 126.8 | 125.5 |

| Manufacturing | 324.7 | 324.6 | 324.8 |

| Service-Providing | 2,518.7 | 2,519.5 | 2,518.0 |

| Trade, Transportation and Utilities | 545.1 | 544.9 | 543.8 |

| Information | 50.5 | 50.6 | 50.3 |

| Financial Activities | 182.2 | 182.0 | 181.5 |

| Professional and Business Services | 379.7 | 378.2 | 378.6 |

| Educational and Health | 538.1 | 540.8 | 540.7 |

| Leisure and Hospitality | 279.2 | 277.7 | 275.9 |

| Other Services (Private Only) | 113.7 | 114.7 | 115.5 |

| Government | 430.2 | 430.6 | 431.7 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2018. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.