by Oriane Casale and Nick Dobbins

June 2023

Minnesota's extremely tight labor market remains a central feature of the state's economic landscape. Employment growth slowed over the past year, down to 2.1% over the year in the first four months of 2023. At the same time, the unemployment rate, while remaining very low, landed at 2.8% in April 2023. The ratio of job openings to unemployed indicated a very tight labor market, with more than twice as many openings as job seekers. And while the labor force grew slightly since April 2022, growth remains low due to an aging workforce. Overall, Minnesota's labor market is very strong for workers but is creating a challenging environment for employers who are looking to hire.

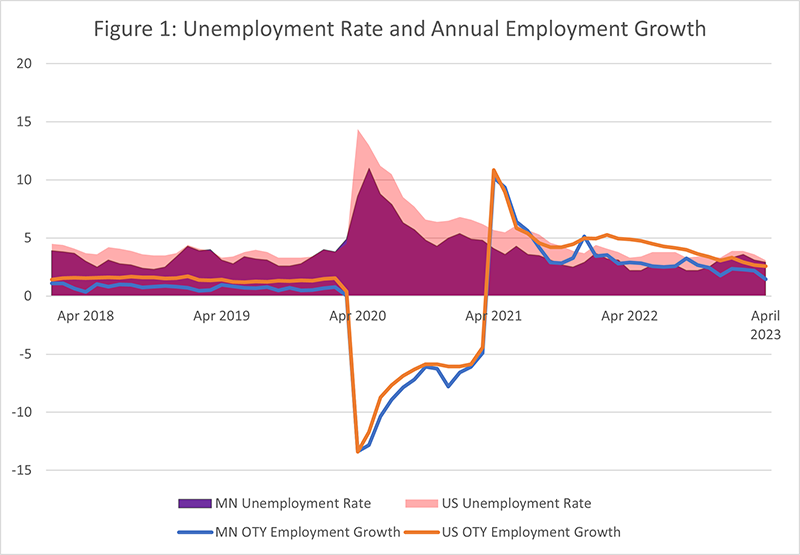

As Minnesota and the nation continue to put distance between a 2020 that was more tumultuous for the labor market than any year in recent memory, nonfarm employment growth has gradually become slower and more consistent. As Figure 1 shows, the onset of the COVID 19 pandemic in early 2020 brought the largest over-the-year (OTY) employment decline in Minnesota since we started tracking the data. April 2020 employment was down 13.4% from the previous year. While recovery from the early 2020 job loss was rapid in 2021, over-the-year growth has slowly ramped down in 2022 and early 2023.

At the peak of employment recovery in the first half of 2021, state employment averaged 4% OTY monthly growth. In the first half of 2022, monthly OTY growth averaged 3%. In the second half of 2022 that number was 2.5%, and for the first four months of 2023, it was down to 2.1%. OTY growth in Minnesota and the nation remains well above pre-pandemic levels. This suggests that while it has slowed significantly, recovery is still ongoing three years after the onset of the pandemic.

While employment growth has leveled out over the past two years in both Minnesota and the nation, the state fell behind national OTY growth in mid-2021. The gap between state and national job growth has remained relatively stable since then, with national OTY growth an average of 1.2 points higher than Minnesota's growth since August of 2021. This gap may be due to Minnesota finding its new long-term employment level sooner than the nation, or to a very tight labor market as indicated by the very low unemployment rate and high number of job vacancies, or a combination of both of these factors. Either way, Minnesota's tight labor market – which was tightening prior to the pandemic due to our aging workforce and retirement of a large number of Baby Boomers, who make up a bigger proportion of the population in Minnesota compared to the nation as a whole – is preventing employers from hiring all the workers they need, constraining job growth.

The difference between state and national growth is also apparent when looking at seasonally adjusted monthly employment. By this measure, Minnesota and the United States both reached their pre-pandemic employment highs in February of 2020, with Minnesota at 2,993,100 jobs, and the nation at 152,371,000. The U.S. passed that high in June 2022. By April 2023, national employment was at 155,673,000, 2.2% more than the pre-pandemic peak.

Table 1: Seasonally Adjusted Minnesota Employment

| Industry | February 2020 | April 2020 | April 2023 | % Change Feb to April 2020 | % Change Feb 2020 to April 2023 | Numeric Change Feb 2020 to Apr 2023 |

|---|---|---|---|---|---|---|

| Total Nonfarm | 2,993,100 | 2,577,100 | 2,978,100 | -13.9 | -0.5 | -15,000 |

| Total Private | 2,565,800 | 2,179,900 | 2,563,100 | -15.0 | -0.1 | -2,700 |

| Goods-Producing | 457,000 | 423,300 | 467,000 | -7.4 | 2.2 | 10,000 |

| Service-Providing | 2,536,100 | 2,153,800 | 2,511,100 | -15.1 | -1.0 | -25,000 |

| Private Service Providing | 2,108,800 | 1,756,600 | 2,096,100 | -16.7 | -0.6 | -12,700 |

| Mining & Logging | 6,600 | 6,400 | 6,700 | -3.0 | 1.5 | 100 |

| Construction | 128,000 | 115,400 | 134,400 | -9.8 | 5.0 | 6,400 |

| Manufacturing | 322,400 | 301,500 | 325,900 | -6.5 | 1.1 | 3,500 |

| Trade, Transportation & Utilities | 529,400 | 464,900 | 531,700 | -12.2 | 0.4 | 2,300 |

| Information | 46,000 | 42,300 | 46,500 | -8.0 | 1.1 | 500 |

| Financial Activities | 195,500 | 191,300 | 189,900 | -2.1 | -2.9 | -5,600 |

| Professional & Business Services | 383,000 | 344,500 | 387,700 | -10.1 | 1.2 | 4,700 |

| Education &Health Services | 563,000 | 506,900 | 561,200 | -10.0 | -0.3 | -1,800 |

| Leisure & Hospitality | 276,400 | 128,700 | 272,200 | -53.4 | -1.5 | -4,200 |

| Other Services | 115,500 | 78,000 | 106,900 | -32.5 | -7.4 | -8,600 |

| Government | 427,300 | 397,200 | 415,000 | -7.0 | -2.9 | -12,300 |

As Table 1 shows, in April 2023 Minnesota was slightly below pre-pandemic employment levels, lagging February 2020 by 0.5%. Earlier in 2023, Minnesota had briefly surpassed February 2020 level of total employment, but then slipped back slightly. However, this isn't the case for all supersectors, as some industry groups have long since exceeded their pre-pandemic highs, while others remain well below them. Construction employment topped its February 2020 level in January of 2021 and passed its pre-pandemic high of 132,000, set in 2006, in July of 2021. All goods-producing supersectors have exceeded pre-pandemic levels.

Service providers, however, remained behind their pre-pandemic employment. Three supersectors in particular were well below those levels, with Government off by 12,300 jobs (2.9%), Other Services off by 8,600 (7.4%), and Financial Activities off by 5,600 (2.9%). One large supersector, Leisure & Hospitality remains down just 1.5% – but that is still 4,300 workers fewer than immediately pre-pandemic. Some of these may be at least partially attributable to industries that were especially hard-hit by the pandemic.

For example, Other Services and Leisure & Hospitality had the largest declines of any supersector in the immediate aftermath of the pandemic, and both remained below pre-pandemic levels. However, Government and Financial Activities, two supersectors that were among the least affected by the immediate aftermath of the COVID outbreak, also remained below pre-pandemic employment. This suggests multiple dynamics could be contributing to the overall lag in employment.

Minnesota employers have continued adding jobs and are nearing overall pre-pandemic employment levels. The number of job vacancies (more details on this later in the article) in sectors that have not regained pre-pandemic employment levels is another sign that job growth in the state is constrained by lack of workers to fill open positions – despite the state's relatively high labor force participation rate at 68.1%, which remains more than 5 percentage points higher than the national labor force participation rate at 62.6%.

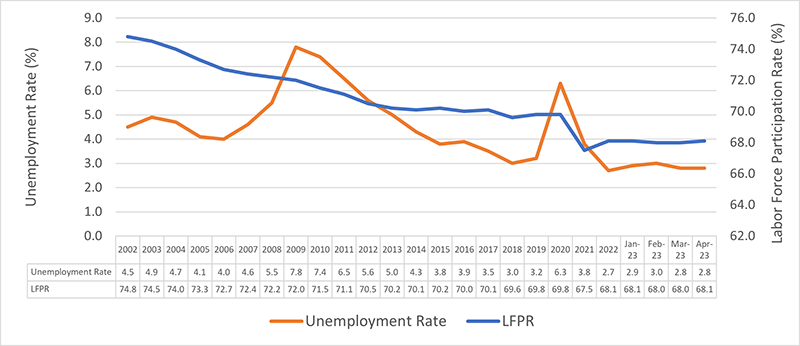

The unemployment rate fell as low as 2.3% in April 2022, but has since crept back up, landing at 2.8% in April 2023. While Minnesota unemployment peaked at 3.0% in October and November 2022 and again in February 2023, the U.S. hovered between 3.4% and 3.7% during the 12- month period from April 2022 to April 2023. At 2.8% in April 2023, Minnesota's rate ranked 16th lowest among states, tied with Colorado and Arkansas, coming in higher than our neighboring states of Iowa (2.7%), South Dakota (1.9%), North Dakota (2.1%), and Wisconsin (2.4%).

In this era of very tight labor markets, a 16th place ranking, tied with or behind neighboring states, puts Minnesota at an advantage for business attraction and retention compared to our neighbors, while still providing lots of opportunity for those in the job market. An unemployment rate below 3.5% indicates a very tight labor market, which is likely causing hiring challenging for many employers and constraining job growth in certain industries.

Figure 1: Unemployment and Labor Force Participation Rate (LFPR) Trends, Annual Average 2002 to 2022 and monthly in 2023, Local Area Unemployment Statistics (LAUS)

The high number of job openings tells the same story. Comparing the number of unemployed workers to the number of job openings from the Job Openings and Labor Turnover (JOLTS) survey produced monthly by the Bureau of Labor Statistics (BLS), Minnesota has 0.4 unemployed persons per job opening in March 2023 – or more than twice as many job openings as people who were actively seeking work. That points to a very tight labor market, where employers are still having difficulty filling open positions. That ratio ranks Minnesota 16th tightest in the nation, although this is less tight than in July 2022 when Minnesota had only 0.2 unemployed workers for every job opening, ranking our labor market tightest in the nation. Moreover, the number of job openings is down 25% from one year ago, reflecting somewhat diminished demand compared to March 2022, in line with the Federal Reserve's goal of a "soft landing" to tame inflation by cooling off the economy while avoiding a recession

The number of workers is up slightly from one year ago in Minnesota and nationwide. In Minnesota, the labor force grew by 15,711 workers or 0.5% over the year in April 2023, while the U.S. labor force grew by 1.6%. Despite Minnesota's labor force growth, the state's labor force participation rate (LFPR) bounced around between 68.0% and 68.3% during the 12-month period, landing at 68.1% in April, exactly where it was 12 months earlier. This put Minnesota's rate in 7th highest place among the states, above Wisconsin and South Dakota but below North Dakota and Iowa. The U.S. LFPR increased four-tenths of a percentage point to 62.6%.

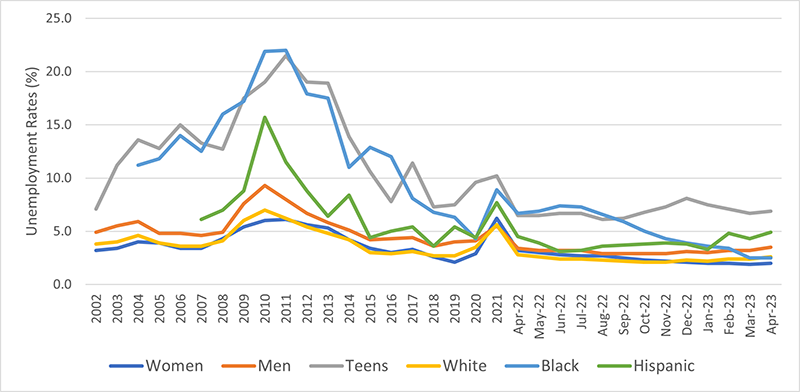

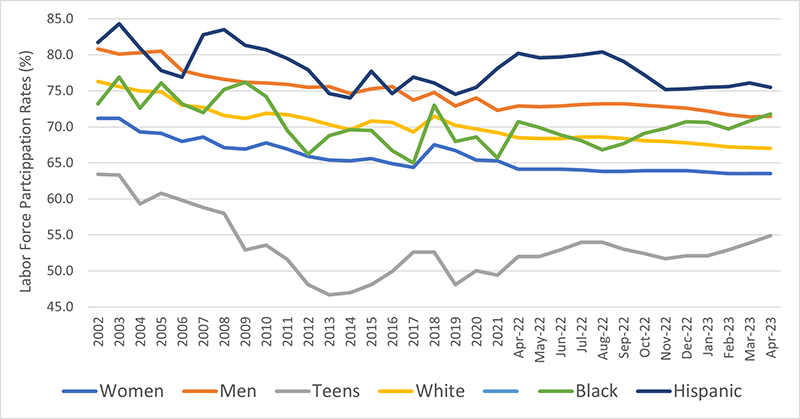

Breaking these numbers out by race, we find that Minnesota's white labor force has been shrinking over the 12-month period, down 5,500 workers, while Minnesota's Black (up 30,100 workers) and Hispanic (up 19,800 workers) labor forces have been growing1. The contraction of Minnesota's white labor force is a long-term trend, the result of an aging workforce. Labor force participation for this group is down 1.5 percentage points over the period.

As a result of these trends, Black labor force participation, which matched white labor force participation in April 2022 at 68.5%, now well surpasses it at 71.8% compared to 67% for white workers in April 2023. Hispanic labor force participation remains the leader at 75.5%.

Figure 2: Unemployment Rate Trends, 12-month moving averages from Current Population Survey Demecon data series

By gender, the number of employed women increased over the year in April while the number of employed men decreased. This pushed up the employment to population ratio for women by one-tenth of one percentage point to 62.2% while men saw a decline of one and half percentage points to 69%. This is in part the result of a declining unemployment rate for women over the year, down 1.2 percentage points to 2% and a very slight increase in men's unemployment, up one-tenth of a percentage point to 3.5% in April 2023.

Teen workers helped bolster employment over the past year. The number of teens in the labor force increased by 25,900 over the year in April, with an increase in their labor force participation rate, which ended the year at 54.9%, up 2.9 percentage points from April 2023. There were 23,500 more employed teens and 2,400 more unemployed teens in April 2023 than the year previous. With an unemployment rate of 6.9% in April 2023, employers still have opportunities to tap into the teen workforce this summer.

Figure 3: Labor Force Participation Rate Trends, 12-month moving averages from Current Population Survey Demecon data series

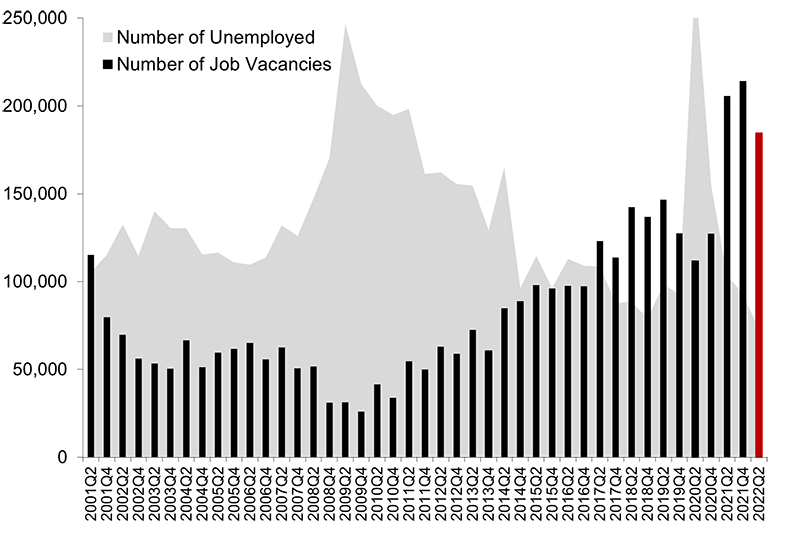

Minnesota's 2022 Job Vacancy Survey2, with findings for second quarter, indicates that employer demand for workers remained high across the state. Employers reported a total of 184,588 vacancies, down 10.3% from second quarter 2021 (see Figure 4), but still the third largest number of vacancies on record (going back to second quarter 2001) in Minnesota.

Figure 4: Minnesota Job Vacancies and Unemployed, Second Quarter 2001 to 2022

These 184,600 vacancies translate into a job vacancy rate of 6.9%, or 6.9 job openings for every 100 filled jobs in the state, down from 8.2% one year ago. Regionally, 98,330 or 53.3% of all job vacancies were located in the seven-county Twin Cities metro area, while the remaining 86,258 vacancies, or 46.7%, were located in Greater Minnesota during second quarter 2022. Compared to one year ago, the number of job vacancies decreased by 17.7% in the Twin Cities and remained nearly level in Greater Minnesota.

As in past years, the job vacancy rate was higher in Greater Minnesota (8.4%) than in the Twin Cities (6.0%), with both exhibiting extremely tight labor markets. Statewide as well as in both the Twin Cities and Greater Minnesota the ratio of unemployed persons to job vacancies is 0.4.

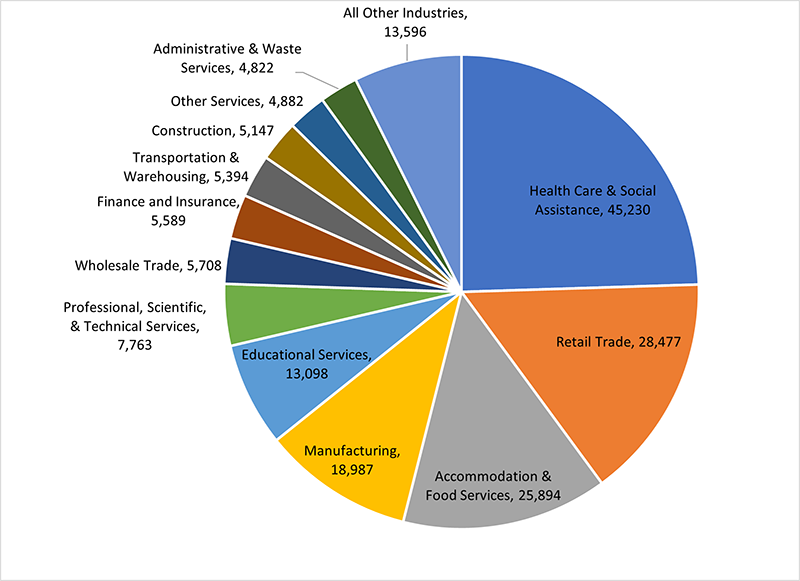

Statewide, the Health Care & Social Assistance industry had the most job vacancies with more than 45,000 openings, followed by Retail Trade with almost 28,500 vacancies, Accommodation & Food Services with almost 26,000 postings, and Manufacturing with almost 19,000 vacancies. Combined, those four industries accounted for two-thirds of the total openings in the state (see Figure 5).

As noted earlier, the statewide job vacancy rate was 6.9%. Four industries had a higher job vacancy rate: Accommodations & Food Services had the highest vacancy rate at 13.3% followed by Retail Trade at 10.2%, Agriculture, Forestry & Fishing at 9.9% and Health Care & Social Assistance at 9.2%.

Figure 5: Minnesota Job Vacancy Rates by Industry Sector, Second Quarter 2022

Eight industries saw an increase in the number of job vacancies over the year including Health Care & Social Assistance, Manufacturing, Educational Services, Agriculture, Forestry & Fishing, Real Estate & Rental & Leasing, Wholesale Trade, Finance & Insurance and Mining. The remainder saw decreases with the largest in Accommodation & Food Services, Retail Trade, Transportation & Warehousing, Arts, Entertainment & Recreation, Construction and Other Services.

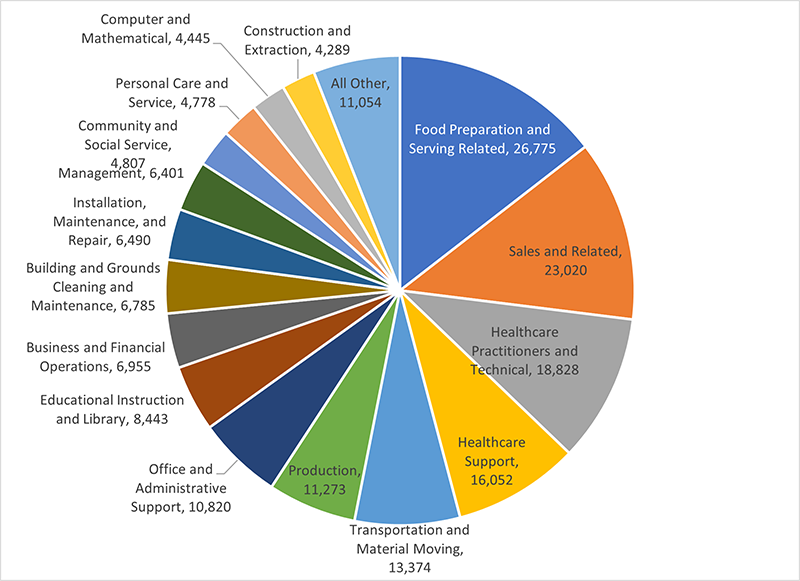

By occupational group, Food Preparation & Serving had the most job vacancies with nearly 27,000 postings and a vacancy rate of 13.5%, followed by Sales & Related, with 23,000 vacancies and a vacancy rate of 9.4%, Healthcare Practitioners & Technical, nearly 19,000 openings and a vacancy rate of 9.9%, Healthcare Support, with 16,000 openings and vacancy rate of 9.9% and Transportation & Material Moving, with 13,400 openings and a vacancy rate of 6.4% (see Figure 6).

Eight occupational groups saw an increase compared to second quarter 2021. Healthcare Practitioners & Technical, Production and Farming, Fishing & Forestry occupations saw the largest increases while Food Preparation & Serving, Sales & Related and Construction & Extraction saw the largest decreases.

Figure 6. Minnesota Job Vacancies by Occupational Sector, Second Quarter 2022

The specific occupations with the most job vacancies during second quarter 2022 were:

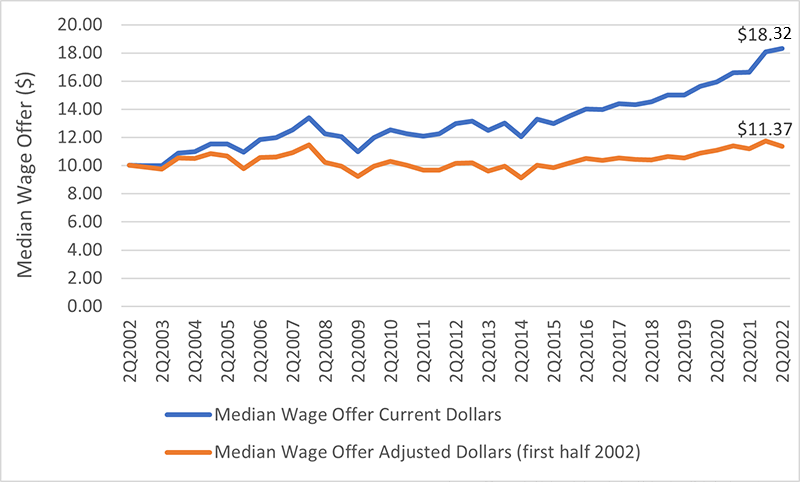

Median wage offers overall are up 10.2% from one year ago, rising from $16.64 to $18.32 per hour. In comparison, inflation, as measured by the Consumer Price Index, rose 8.3% during the first half of 2022 compared to the same period in 2021. Among the largest occupations, the median wage offer for Home Health & Personal Care Aides rose 12.5% to $15.14 per hour in 2022, for Retail Salespersons 13.6% to $14.36 per hour, for Registered Nurses 4.8% to $33.40 per hour, for Fast Food & Counter Workers 13.3% to $14.12 per hour and for Nursing Assistants 8.7% to $16.83 per hour.

Looking back 20 years, between second quarter 2002 and 2022 median wage offers in Minnesota have risen 83% from $10.01 per hour to $18.32 per hour 20 years later. After adjusting for inflation, wages have risen 13%, to $11.37 per hour in 2022 (see Figure 7). All of the sustained inflation-adjusted increase happened over the last seven years as the labor market tightened and employers began to respond with higher wage offers.

Figure 7: Current Dollar and Inflation Adjusted Median Wage Offers from 2002 to 2022

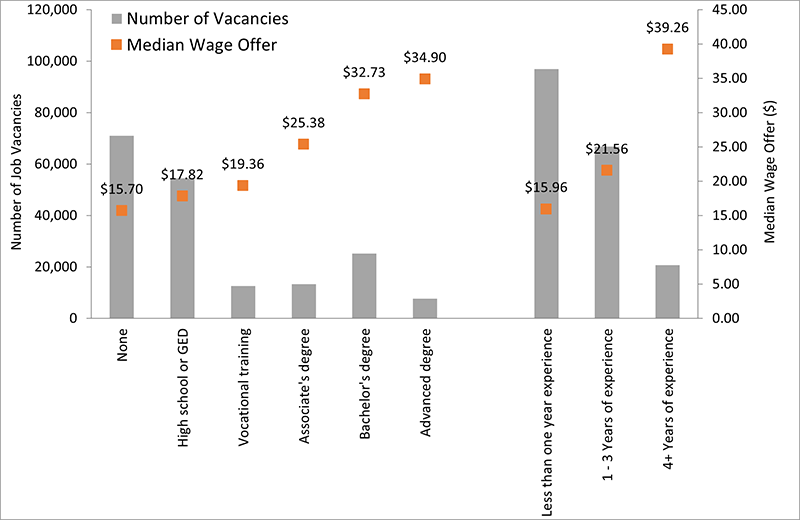

Thirty-two percent of all vacancies during second quarter 2022 require some level of post-secondary education or training beyond a high school diploma, showing no change from one year ago. The other two-thirds of vacancies require no education beyond a high school diploma or equivalent. Thirty-eight percent of all vacancies require a certificate or license. Preparation for certification or licensure ranges greatly, with some requiring formal education and others requiring on-the-job training. In terms of experience requirements, 47% require one or more years of work experience. As Figure 8 illustrates, wage offers are highly correlated with experience and education requirements.

Figure 8: Minnesota Job Vacancies by Education and Experience Required with Wage Offers, Second Quarter 2022

An aging workforce, especially among Minnesota's white population, which saw a declining labor force participation rate over the last year, is likely constraining job growth. On the positive side, labor force participation rates for Black, Hispanic, women and teen workers in Minnesota are high and growing. Minnesota's unemployment rate, hovering at or below 3.0%, is slightly higher than in neighboring states, making Minnesota a more attractive location for business attraction and retention, because of the greater availability of labor force. Moreover, recent strong growth in wage offers likely helped draw some workers into the labor market and eased hiring difficulties in some industries. The bottom line: While Minnesota's labor market remains tight and continues to constrain job growth in the state, similar to the situation in the years immediately before the pandemic, the worker shortage is easing as job growth slows and more people join Minnesota's labor force.

1These numbers are based on 12 month moving averages from the Current Population Survey's Demecon data. As a result they do not match the official monthly LAUS data.

2Information for the Minnesota Job Vacancy Survey is gathered through a survey of 6,225 firms stratified by 6 regions of the state, 20 industry sectors, and 4 size classes. The survey had a response rate of 80.1% in second quarter 2022. The survey will be published once a year from 2022 forward.