View: Home | Data Tool | About | Findings | Future Hiring | Methodology | LMI Help

Minnesota's Job Vacancy Survey asks employers to report their plans to maintain or change current employment levels over the six months following the second through the fourth quarter of 2022. Of employers surveyed that responded:

A diffusion index over 50 percent indicates that employers plan to add employment overall, while a diffusion index under 50 percent indicates employers plan to decrease employment. At 63.0%, the diffusion index indicates that overall employers plan to add jobs over the next 6 months, down slightly (-3.5%) from fourth quarter 2021.

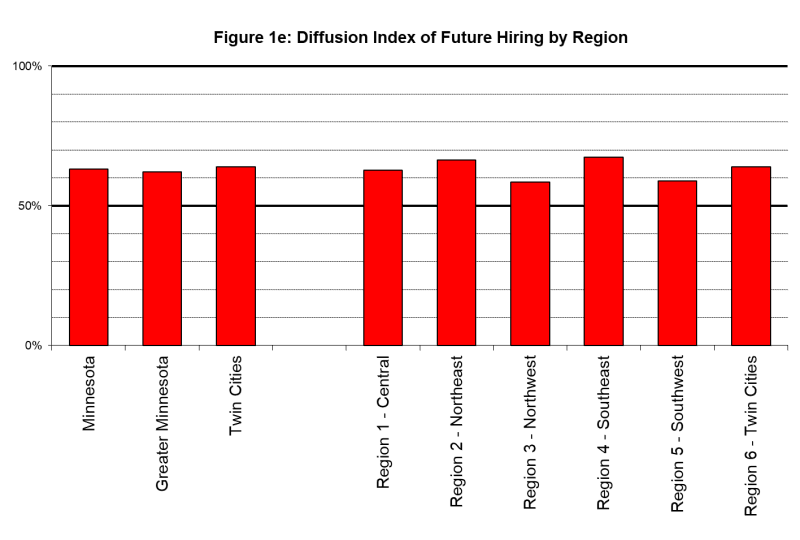

The Twin Cities index was 63.9% and the Greater Minnesota index is 62.2%, meaning that employers anticipate employment increases across the state. However, the diffusion index dropped nearly 7.0% in the Twin Cities but went up about 0.5% in Greater Minnesota from the fourth quarter of 2021. Moreover, all regions have an index score well above 50 percent, with the most optimism shown in Southeast and Northeast Minnesota. While the percent of employers that are expecting to increase employment is dropping, every region also saw a decrease in the percent of employers who were expecting to decrease employment.

Table 1: Future Hiring by Region, Second Quarter 2022

| Area | Increase Employment | Employment Constant | Decrease Employment | Diffusion Index |

|---|---|---|---|---|

| Minnesota | 30.6% | 64.9% | 4.5% | 63.0% |

| Greater Minnesota | 29.3% | 65.8% | 5.0% | 62.2% |

| Twin Cities | 31.9% | 64.1% | 4.1% | 63.9% |

| Region 1 - Central | 30.7% | 64.1% | 5.2% | 62.7% |

| Region 2 - Northeast | 36.2% | 60.4% | 3.5% | 66.4% |

| Region 3 - Northwest | 22.4% | 72.2% | 5.3% | 58.6% |

| Region 4 - Southeast | 39.4% | 55.8% | 4.8% | 67.3% |

| Region 5 - Southwest | 23.3% | 71.4% | 5.3% | 59.0% |

| Region 6 - Twin Cities | 31.9% | 64.1% | 4.1% | 63.9% |

Table 1 shows employer hiring plans by region.1 These can be translated into a diffusion index as in Figure 1.

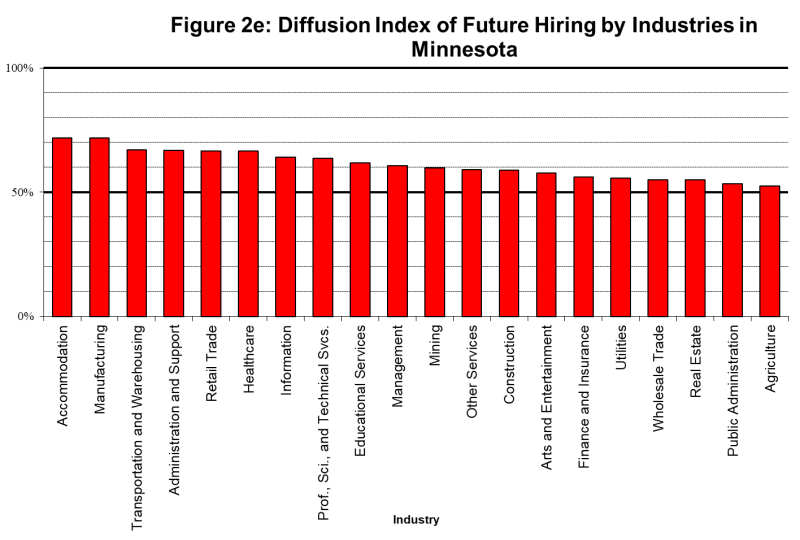

Table 2 below provides a breakdown of employer hiring expectations by industry while Figure 2 is a graph of the diffusion index of future employment expansion or contraction by industry. As employment bounces back, employers in the following industries are the most optimistic about adding jobs during the next six months: Manufacturing, Accommodation & Food Services, Transportation & Warehousing, Administrative Support & Waste Management Services, Health Care & Social Assistance, and Retail Trade.

Every industry in the state has a diffusion index above 50 percent, meaning they all anticipate an increase in their employment levels in the next six months. Most industries saw a marked decrease in employers expecting to decrease employment, and an increase in the percent of employers expecting to hold employment constant. The two industries with the lowest positive diffusion index are Agriculture, Forestry, Fishing & Hunting and Public Administration, which have the highest percentage of employers expecting to decrease employment.

Table 2. Future Hiring by Industries in Minnesota, Second Quarter 2022

| Industry | Increase Employment | Employment Constant | Decrease Employment | Diffusion Index |

|---|---|---|---|---|

| Agriculture, Forestry, Fishing & Hunting | 15.1% | 74.7% | 10.2% | 52.5% |

| Mining | 23.0% | 73.7% | 3.3% | 59.8% |

| Utilities | 12.4% | 86.6% | 1.1% | 55.6% |

| Construction | 19.0% | 79.7% | 1.3% | 58.9% |

| Manufacturing | 47.1% | 49.3% | 3.5% | 71.8% |

| Wholesale Trade | 16.0% | 78.1% | 5.9% | 55.1% |

| Retail Trade | 38.5% | 56.4% | 5.2% | 66.6% |

| Transportation & Warehousing | 38.6% | 56.9% | 4.5% | 67.1% |

| Information | 30.9% | 66.2% | 2.9% | 64.0% |

| Finance & Insurance | 14.4% | 83.5% | 2.2% | 56.1% |

| Real Estate | 10.4% | 89.3% | 0.4% | 55.0% |

| Professional, Scientific & Technical Svcs. | 29.9% | 67.5% | 2.6% | 63.6% |

| Management of Companies | 24.5% | 72.3% | 3.2% | 60.6% |

| Administrative Support & Waste Management | 35.7% | 62.1% | 2.2% | 66.8% |

| Educational Services | 25.8% | 72.2% | 2.0% | 61.9% |

| Health Care & Social Assistance | 39.7% | 53.8% | 6.5% | 66.6% |

| Arts, Entertainment & Recreation | 25.0% | 65.6% | 9.4% | 57.8% |

| Accommodation & Food Services | 47.7% | 48.2% | 4.1% | 71.8% |

| Other Services | 20.0% | 77.9% | 2.0% | 59.0% |

| Public Administration | 31.8% | 43.1% | 25.1% | 53.4% |

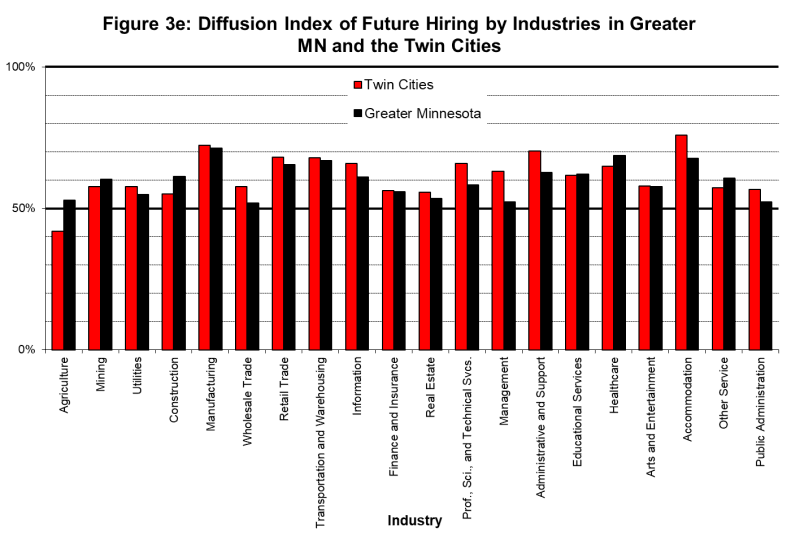

Figure 3 graphs the diffusion index of future employment expansion or contraction by industry in Greater Minnesota and the Twin Cities Metro Area.

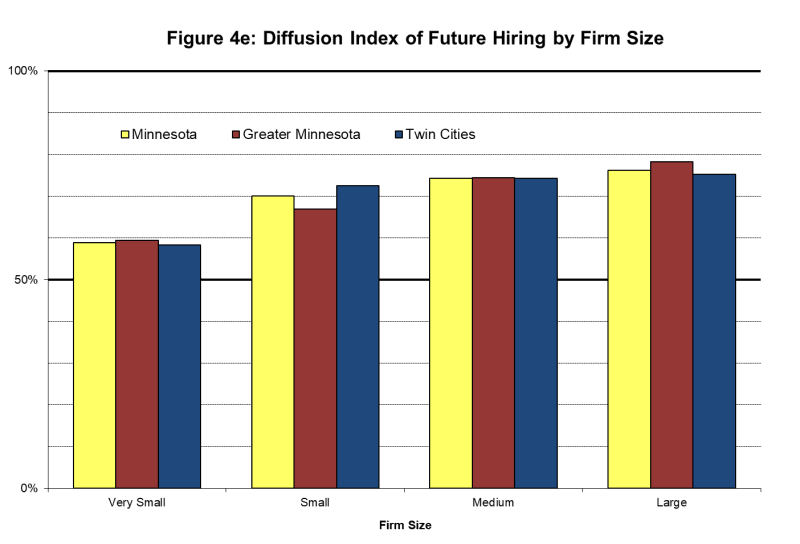

The following table presents hiring expectations by firm size for Minnesota, Greater Minnesota and the Twin Cities. During the six month period following fourth quarter 2021, large and medium size employers are most likely to anticipate an increase in their workforce while very small employers are least likely to anticipate an increase in their workforce.

Table 3. Future Hiring by Firm Size, Second Quarter 2022

| Area | Increase Employment | Employment Constant | Decrease Employment | Diffusion Index |

|---|---|---|---|---|

| Minnesota | ||||

| Very Small | 21.3% | 75.1% | 3.6% | 58.9% |

| Small | 47.0% | 46.1% | 7.0% | 70.0% |

| Medium | 52.2% | 44.3% | 3.5% | 74.3% |

| Large | 55.6% | 41.1% | 3.3% | 76.2% |

| Greater Minnesota | ||||

| Very Small | 22.8% | 73.3% | 4.0% | 59.4% |

| Small | 41.3% | 51.3% | 7.4% | 67.0% |

| Medium | 55.5% | 37.8% | 6.7% | 74.4% |

| Large | 59.8% | 36.9% | 3.3% | 78.3% |

| Twin Cities Metro | ||||

| Very Small | 19.9% | 76.9% | 3.2% | 58.3% |

| Small | 51.7% | 41.8% | 6.6% | 72.5% |

| Medium | 50.2% | 48.2% | 1.6% | 74.3% |

| Large | 53.6% | 43.1% | 3.3% | 75.2% |

1The diffusion index is constructed so that if all firms report that they expected to expand, the index would equal 100. If all report that they expect to contract, the index would be zero. If the percentage of firms that expect to expand just equaled the percentage of firms that expect to contract (regardless of the percentage expecting to remain constant), the index would equal 50. Thus, a value of 50 represents the threshold between expectations of contraction and expansion.