by Dave Senf

December 2020

The pandemic-induced economic damage in Minnesota ranged from a record plunge in employment, a tidal wave of initial claims for unemployment benefits, skyrocketing unemployment rates, elevated business closures and robust personal income growth. That’s right, robust personal income growth during second quarter 2020 thanks to the extraordinary increase in federal government spending aimed at moderating the depth, diffusion, and duration of the COVID-19 caused recession. Now that many types of federal assistance related to the pandemic are slated to cease at the end of 2020, it is a good time to look at how this temporary emergency funding helped Minnesotans.

Four coronavirus bills were passed earlier this year providing funds to keep people afloat as the economy crashed and to support efforts to keep people at home to contain the coronavirus spread and provide time for health care systems to prepare with PPE, equipment and training. The fourth bill, the CARES (Coronavirus Aid, Relief, and Economic Security) Act was unparalleled in its scope and size providing more than $2 trillion in funds to combat the virus spread and prop up the battered economy. CARES Act spending in Minnesota boosted personal income by 7.9% in the second quarter or $6.7 billion, the second highest quarterly percent increase over the last 70 years.1 Without the federal spending splurge Minnesota’s personal income would have declined in the neighborhood of 4 to 5%.

Quarterly estimates of state personal income are seasonally adjusted and published at annual rates or levels. The Bureau of Economic Analysis (BEA) reported Minnesota’s 2020 second quarter personal income at $364.8 billion. That total is actually the tally of personal income received by Minnesotans during the second quarter seasonally adjusted and then multiplied by four to derive an annual level. BEA income data used here are converted back into quarterly estimates (by dividing annual rates by 4).

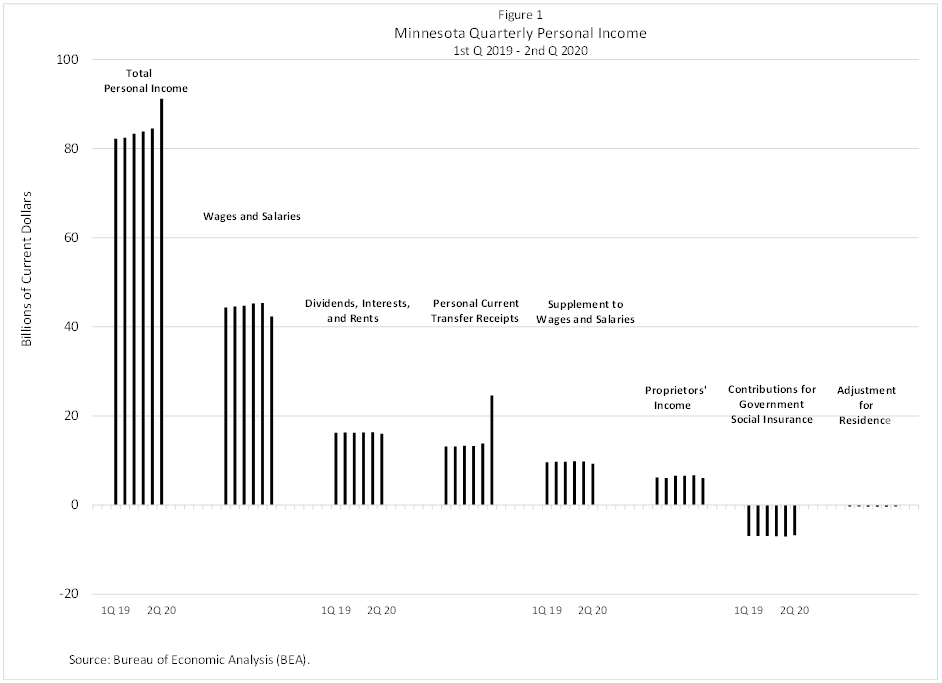

Under this approach, personal income surged from $84.5 billion to $91.2 billion between the first and second quarters. For comparison, the state’s average quarterly gain in personal income over the previous four quarters was 0.7% or $583 million. Despite massive job decline, reduced work hours and falling self-employment, personal income soared by more than 10 times the average rate of gain experienced during the previous four quarters. Per capita income in the state jumped by $4,600 in the second quarter to $69,360, which is two and a half times higher than the $1,800 average annual per capita increase experienced between 2011 and 2019.

The $6.7 billion jump in personal income occurred despite wage and salary income tumbling by $3.0 billion, property income slipping ($331 million), wage and salary supplements dropping off ($486 million) and proprietors’ income (self-employed earnings) declining ($618 million). However, the pandemic-induced decline in these income sources were more than offset by the $10.7 billion boost in personal current transfer payments received by Minnesotans during the second quarter (see Figure 1).

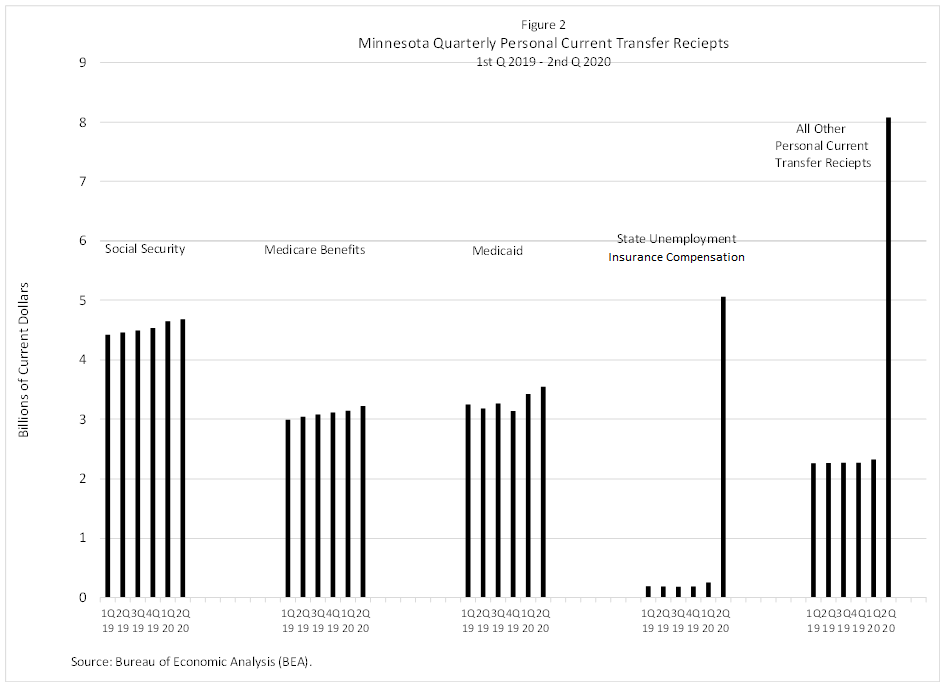

Personal current transfer receipts, as reported by the BEA, are benefits received by persons from federal, state and local governments and from business for which no current serves are performed. Some transfer payments, like Social Security, are received directly by individuals and spent at their discretion. Other transfer payments, like Medicare or Medicaid, are paid to the providers of health care services received by individuals. Usually the main sources of transfer receipts are Social Security, Medicare, Medicaid and various other federal programs (combined together in Figure 2 as All Other Personal Current Transfer Receipts).2 Transfer receipts accounted for 16.3% of personal income in Minnesota during first quarter 2020 before swelling to 27.0% in the second quarter.

As displayed in Figure 2 the elevated contribution of personal current transfer receipts to personal income can be traced to skyrocketing Unemployment Insurance (UI) compensation and all other transfer payments. All other transfer payments normally consist primarily of federally funded programs ranging from veterans’ pensions and disability benefits, Earned Income Tax Credit (EITC), Supplemental Security Income (SSI), Supplemental Nutrition Assistance Program (SNAP), education and training assistance programs to other income maintenance programs.

The all other categories of transfer receipts more than tripled in the second quarter as CARES Act-related spending reached Minnesota. CARES Act-related spending in the state boosted all other transfer payments from $2.3 billion during the first quarter to $8.1 billion in the second quarter. The $5.7 billion increase in all other transfer payments as well as roughly 70% of the $4.8 billion UI compensation surge was bankrolled by CARES Act spending (and spending authorized in the early three pandemic bills).

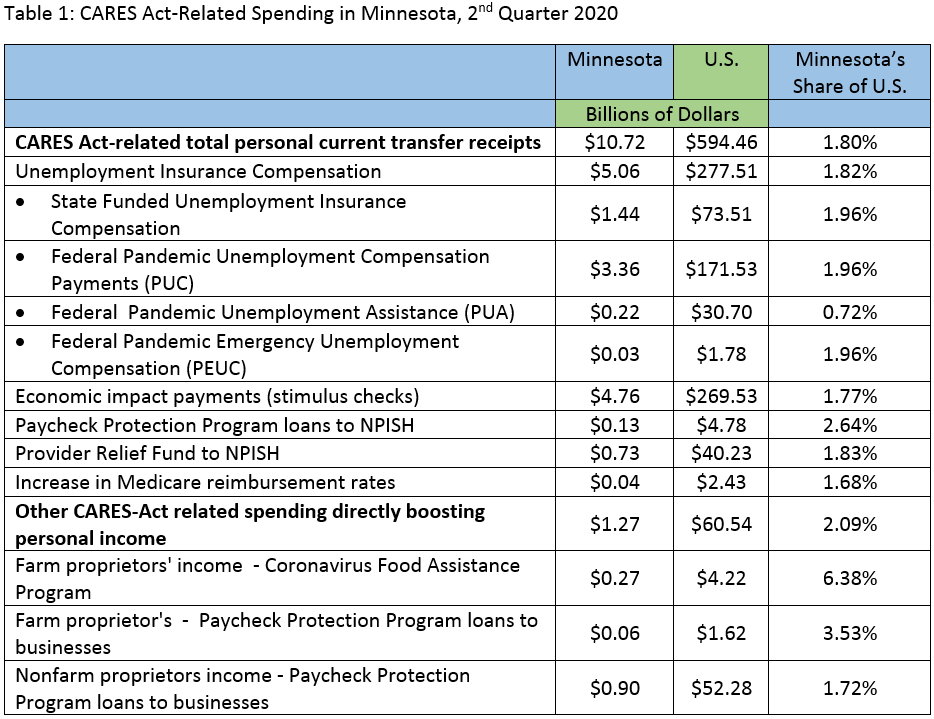

Table 1 connects Minnesota funding amounts from various CARES Act-related programs that you may have read or heard about in the media. Minnesotans who qualified for expanded UI benefits received just over $5 billion in unemployment checks during the second quarter. The expanded unemployment checks easily topped the estimated $3 billion decline in wages and salaries. Many unemployed workers received more in UI compensation than lost wages or salaries due to the weekly Pandemic Unemployment Compensation (PUC) payments of $600 on top of normal state UI checks. PUC was paid to unemployed workers from April 5 to July 31. An estimated $3.4 billion PUC funds were paid out to Minnesotans during the second quarter.

Regular state UI benefits compensation totaled $1.4 billion and was initially covered by the state’s UI trust fund. The trust fund ran out of money in July so the state, along with a growing list of other states, is now borrowing money from the federal government to cover state UI benefits.

The Pandemic Unemployment Assistance (PUA) program temporarily provides unemployment benefits to Minnesotans who are usually not eligible for benefits including the self-employed, independent contractors, and those with limited work history if they are unable to work for reasons related to COVID-19. The Pandemic Emergency Unemployment Compensation (PEUC) program provides an additional 13 weeks of unemployment benefits to workers who have exhausted all available regular and extended unemployment benefits. The PUA and PEUC programs together paid out about $250 million to Minnesota workers during the second quarter.

The $3.6 billion expanded UI payments funded by the CARES Act was second in size to the stimulus checks sent out to Minnesotans by the federal government in the spring. BEA estimates that Minnesota households received $4.7 billion or 1.8% of checks sent out nationwide. Minnesota’s percent of U.S. population is 1.7% so the 1.8% of stimulus checks shows that Minnesotans got their fair share of the stimulus checks pie.

The BEA included other CARES Act-related spending as personal current transfer receipts that, when combined, totaled approximately $900 million during second quarter 2020. The Paycheck Protection Program (PPP) loans to NPISH (Non-profit Institutions Serving Households) is BEA’s estimate of the loan total to non-profits through the Paycheck Protection Program that will eventually be forgiven. The provider relief fund to NPISH is money sent to hospitals and healthcare providers on the frontlines of the coronavirus response. The increase in Medicare reimbursement rates served a similar purpose, that of increasing funds for hospital and healthcare providers treating COVID-19 patients.

Besides the $10.7 billion in increased personal current transfer receipts that boosted Minnesota personal income in the second quarter, some CARES Act-related spending boosted proprietors’ income. Farm proprietors’ income was increased through the Coronavirus Food Assistance Program and the Paycheck Protection Program (PPP). The Coronavirus Food Assistance Program provided direct relief to Minnesota farmers ($270 million) who faced price declines and additional market cost due to COVID-19. Some Minnesota farmers also participated in the PPP and received an estimated $60 million through that program.

Minnesota nonfarm proprietors also signed up for PPP loans. The BEA estimates that nonfarm proprietors’ income was increased by $900 million from participation in the program. The Proprietor’s income in Figure 1 was shown as deceasing by $618 million during the second quarter. In Table 1 the BEA estimates that, during the second quarter, farm and nonfarm proprietors in Minnesota received $960 million through participating in the Paycheck Protection Program. PPP funds to Minnesota proprietors (self-employed) reduced the decline in proprietors’ income from 23.6% to 9.2%.

How much did expanded federal pandemic-related spending aid Minnesota’s economy relative to the other states? One quick measure is to rank the percent increase in per capita income in the second quarter across states. Minnesota’s per capita income increased 7.7% in the second quarter, which was a tad higher than the 7.5% U.S. increase. Minnesota’s percent gain was the 22nd largest among the states.

Another quick measure of the impact of pandemic-related spending on Minnesota relative to other states is to compare the difference in the ratio of the change in personal income net of personal current transfer receipts (which is a proxy for economic loss) between the first and second quarter and the change in combined UI compensation and all other current personal transfer payments (proxy for CARES Act spending). Minnesota had the 26th largest ratio, at 2.6 compared to the U.S. ratio of 2.4. The ratio is a back-of-the-envelope comparison of pandemic-relief spending to pandemic-induced income decline in the second quarter.

The data analyzed here is macro level data that aggregates various sources of personal income, thus concealing household and individual income changes in the second quarter. Despite the 7.9% personal income increase in Minnesota, there are many households and individuals who experienced income decline during the period. Macro level data presents the aggregate picture but has nothing to say about changes in income distribution that have likely occurred during the pandemic.

Third quarter (July, August, and September) state personal income estimates won’t be released until mid-December. Advance estimates of U.S. third quarter personal income have nationwide personal income dropping 2.7% compared to the second quarter. U.S. wages and salary compensation and proprietors’ income increased in the third quarter as the economy continued to ramp up but at the same time federal pandemic relief spending began to tail off. Third quarter personal income changes in Minnesota will likely look similar to the advance U.S. personal income changes. Continued personal income growth in Minnesota and nationwide over the next six months will be a race between how fast the economy rebounds and the fading out of federal pandemic assistance, most of which is slated to expire at the end of 2020 unless another stimulus bill is passed.

1The highest percent increase in Minnesota quarterly personal income occurred during the first quarter of 1950 based on Bureau of Economic Analysis (BEA) state personal income estimates. State estimates of personal income are conceptually and statistically consistent with national estimates of personal income in the National Income and Products Accounts (NIPA).