by Cameron Macht

December 2021

Through the first 10 months of 2021, Minnesota employers added just over 190,000 jobs back onto their payrolls, climbing back above 2.9 million jobs in October. Though the state is still below pre-pandemic employment levels, this is an encouraging sign of continuing recovery from the COVID-19 recession in 2020. Minnesota's job gains are outpacing the U.S. growth rate so far this year, but much like the past five years, the state's labor market tightness has constrained even faster economic growth.

From the end of the Great Recession in early 2010 until March of 2020, the state's economy continued to reach new employment peaks each year in the longest-running economic expansion on record. However, the state's steady – but slowing – labor force growth constrained even more potential job growth. If we had more workers, we could have filled more jobs.

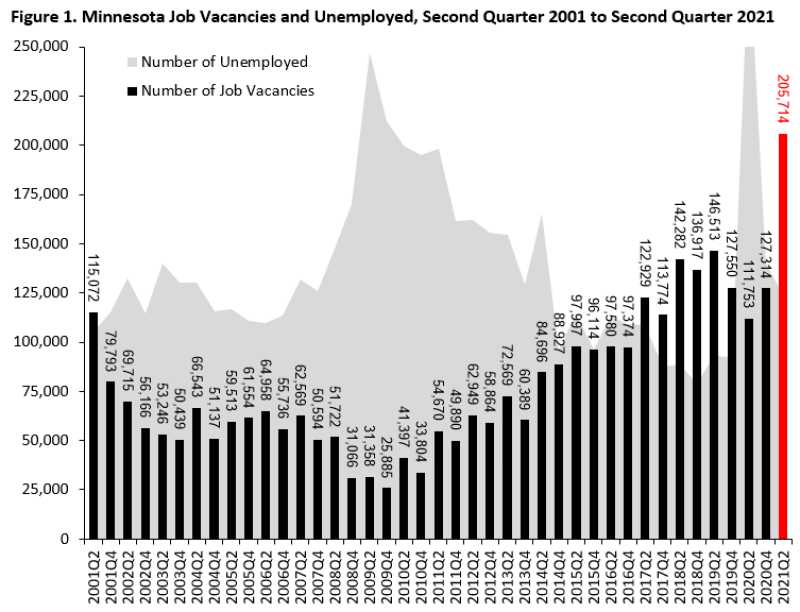

In fact, DEED's semiannual Job Vacancy Survey has revealed a progressively increasing number of vacancies each year since 2010 as employers struggled to find workers for available jobs. This trend continued all the way up to the start of the pandemic – and is even more pronounced coming out of the pandemic recession. With the state's labor force currently still down about 85,000 workers compared to February 2020, Minnesota employers posted a record high 205,700 job vacancies in the second quarter of 2021. That number was up nearly 95,000 vacancies compared to last summer, during the outset of the pandemic, and broke the previous record from the second quarter of 2019, prior to the pandemic, by almost 60,000 vacancies (see Figure 1).

After reporting a low of just over 25,000 vacancies at the low point of the Great Recession in the fourth quarter of 2009, employers began to increase hiring demand in spurts over the next 10 years. Employers averaged just over 54,000 vacancies per year from 2010 to 2013; which then nearly doubled to almost 94,000 vacancies between 2014 and 2016; and then climbed another 40,000 to an average of more than 131,600 vacancies from 2017 to 2019.

The state set new record highs each year in the second quarter of 2017, 2018, and 2019 before dropping to 111,750 vacancies in the second quarter of 2020 as the state and national economy reacted to the COVID-19 pandemic. The drop in vacancies did not last long, however, with fourth quarter 2020 vacancies immediately returning to pre-pandemic levels. This rebound in hiring demand was unprecedented based on data from past recessions. In fact, it took five full years - until the second quarter of 2012 - to get back to 2007 vacancy levels coming out of the Great Recession.

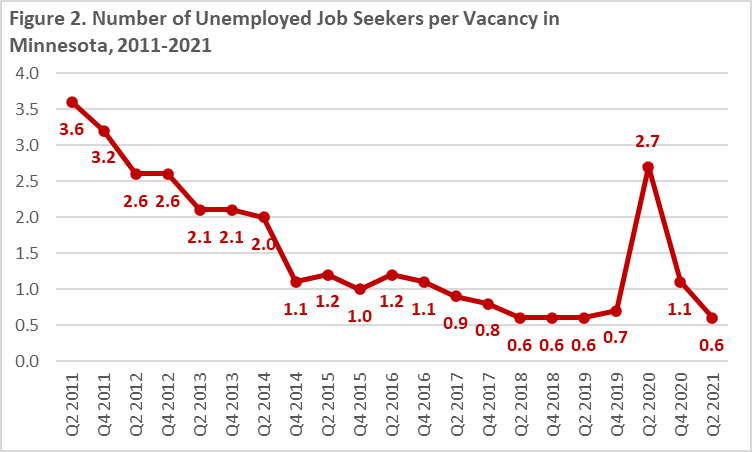

Job Vacancy Survey data show that from 2017 to 2019, the state had less than one available job seeker for each vacancy as hiring demand outpaced labor force growth. There was a short reversal during the second quarter of 2020 as unemployment spiked and employers paused hiring activity due to the coronavirus, then with more than 205,000 vacancies and less than 125,000 unemployed workers in the second quarter of 2021, there were again nearly twice as many open positions as available job seekers in Minnesota (Figure 2).

This unprecedented spike in postings translates into a job vacancy rate of 8.0%, or eight job openings per 100 filled jobs. This is the highest on record, and is double the 4.0% rate one year ago and also up from around 5.0% in 2018 and 2019. The job vacancy rate got as low as 1.0% in the fourth quarter of 2009, and had hovered between 1% and 3% from 2002 until 2014, when vacancies began outpacing worker availability. The current ratio suggests that the labor market is the tightest it's ever been, with employers in every industry finding it difficult to fill open positions.

As highlighted in bold in Table 1, 12 of 20 industries reported new record numbers of vacancies in the second quarter of 2021, reflecting intense demand for workers across the entire economic spectrum. Only two industries – Information and Public Administration – saw declines over the past year, though both were still relatively high in historic terms.

| Industry | Number of Job Vacancies | Job Vacancy Rate | Percent Part-Time | Requiring Post-Secondary Education | Requiring 1+ Years Experience | Median Wage Offer |

|---|---|---|---|---|---|---|

| Total, All Industries | 205,714 | 8.0% | 32% | 32% | 50% | $16.64 |

| Health Care & Social Assistance | 39,727 | 8.3% | 39% | 53% | 50% | $17.39 |

| Accommodation & Food Services | 37,363 | 20.2% | 47% | 3% | 33% | $13.31 |

| Retail Trade | 36,174 | 13.1% | 34% | 12% | 31% | $14.06 |

| Manufacturing | 14,621 | 4.8% | 3% | 34% | 50% | $19.23 |

| Transportation & Warehousing | 11,346 | 11.7% | 24% | 35% | 80% | $23.36 |

| Educational Services | 9,046 | 5.0% | 51% | 54% | 74% | $19.62 |

| Construction | 9,007 | 6.5% | 9% | 26% | 59% | $19.93 |

| Professional & Technical Services | 8,450 | 6.0% | 4% | 76% | 86% | $30.13 |

| Arts, Entertainment, & Recreation | 6,590 | 16.5% | 64% | 19% | 45% | $14.89 |

| Other Services | 6,336 | 8.7% | 27% | 50% | 52% | $19.46 |

| Wholesale Trade | 5,444 | 4.9% | 24% | 47% | 71% | $19.84 |

| Finance & Insurance | 5,360 | 3.8% | 6% | 69% | 91% | $37.36 |

| Administrative & Waste Services | 5,120 | 7.2% | 18% | 17% | 34% | $17.26 |

| Public Administration | 3,344 | 2.5% | 35% | 38% | 47% | $16.57 |

| Management of Companies | 2,687 | 3.2% | 13% | 67% | 89% | $25.21 |

| Real Estate & Rental & Leasing | 1,776 | 5.3% | 23% | 24% | 38% | $13.23 |

| Information | 1,701 | 4.0% | 10% | 55% | 76% | $21.88 |

| Agriculture, Forestry, Fish & Hunt | 1,125 | 4.7% | 28% | 13% | 45% | $14.55 |

| Utilities | 307 | 2.3% | 16% | 59% | 65% | $23.21 |

| Mining | 190 | 3.5% | 0% | 49% | 65% | $23.81 |

| Source: DEED Job Vacancy Survey, 2nd Qtr. 2021 | ||||||

Health Care & Social Assistance posted nearly 40,000 vacancies in the second quarter of 2021, an increase of nearly 16,000 in comparison to the previous year, and about 8,150 more vacancies than the previous high, posted in the fourth quarter of 2020. At that level, Health Care & Social Assistance accounted for nearly one-in-every-five vacancies in the state and remained the industry in highest demand.

The median wage offer for health care postings was $17.39, which was up $2.29 compared to the second quarter of 2020, suggesting extreme demand and legislative action is leading to higher wages. Still, many of the openings are for lower wage occupations including Personal and Home Care Aides, Nursing Assistants, and Medical Assistants, as well as culinary and janitorial openings. However, vacancies also reached new peaks for higher wage healthcare practitioner openings including Registered Nurses, Licensed Practical Nurses, Clinical Laboratory Technologists and Technicians, Therapists, and Physicians and Surgeons.

After seeing decreased demand in the summer of 2020 at the outset of the pandemic, Accommodation & Food Services came charging back in 2021 with a strong tourism season to try to satisfy pent-up consumer demand for food and travel. With 37,363 vacancies, which was an increase of 22,210 vacancies compared to 2020, the industry saw the largest over-the-year increase of any industry, a nearly 150% jump over the year.

With so many unfilled jobs, Accommodation & Food Services has the highest job vacancy rate of any industry, at 20.2% - which means there were 20 job openings for every 100 filled jobs. The next highest was Arts, Entertainment & Recreation, which had a job vacancy rate of 16.5%, but a much smaller number of vacancies total. After adding 4,871 vacancies compared to the fourth quarter of 2020; during the second surge last winter, that industry reported a record high of 6,590 vacancies this year.

Among the lowest paying sectors in the state, these two Leisure & Hospitality industries had been struggling to find workers for several years. At the occupation level, wage offers climbed more for Building & Grounds Cleaning & Maintenance, Supervisors, and Food Prep and Cooking occupations, but not as much for Waiters, Bartenders, and Maids and Housekeeping Cleaners. About two-thirds of openings in Arts, Entertainment & Recreation and less than half of postings in Accommodation & Food Services were part-time, and only about a third of openings offered healthcare benefits, though that was up in comparison to past years as employers compete for workers.

Retail Trade did not see the large decline in demand in 2020 as consumers still required basic needs like food and beverages, health and personal care, and building materials and supplies. Instead, Retail both added jobs over the year and posted more than 36,000 vacancies in 2021, which was a 62% increase. This was very different from the Great Recession, when Retail Trade saw nearly 5,000 fewer vacancies from 2006 to 2009 due to falling consumer confidence and reduced demand.

Like Leisure & Hospitality industries, Retail tends to offer lower wages, less healthcare benefits, and more part-time work, which makes it harder to attract new workers. Surprisingly, the median wage offer actually went down slightly in Retail, but that may reflect a shift back to higher demand and more postings for lower paying occupations including Cashiers and Retail Salespersons, which were muted last year. It may also reflect a more significant wage decline for First-line Supervisors of Retail Sales Workers. Retailers are offering more full-time work in order to attract new workers, and there was a slight increase in the percent of jobs offering healthcare benefits.

Manufacturing saw a quick rebound after a huge dip in the second quarter of 2020, producing 14,621 vacancies, a massive 347.5% increase over the year. In the Great Recession, manufacturing vacancies dropped for three years before coming back up; and didn't reach 7,000 vacancies until the second quarter of 2014 - four years into the recovery. The median wage offer increased exactly $1.00 over the year to $19.23, while work experience requirements went down to attract more and different workers, though 50% of manufacturing openings still require one or more years of experience.

The fastest over-the-year increase of any industry happened in Transportation & Warehousing, which racked up 11,346 vacancies, a 379% jump in comparison to the second quarter of 2020. It was also nearly double the previous high of just over 6,000 vacancies in 2018. This was an extreme swing considering the unexpected drop in the second quarter of 2020, despite rising demand for package delivery during the pandemic. However, last year's decline included a lot of bus companies, where demand was down due to schools and transit demand, and also included airlines. Demand for travel and school transportation returned this year.

This has created huge demand for Transportation & Material Moving workers; especially since those jobs are also in demand in other industries, such as Manufacturing, Wholesale Trade, Retail Trade, and more. This includes about four times as many openings for Light Truck & Delivery Drivers, and about double the number of Heavy & Tractor-trailer Truck Drivers. Median wage offers jumped $3.36 over the year to $23.36, the fifth highest increase of all 20 industries.

As schools returned to in-person learning, Educational Services returned to record-high demand levels, posting 9,046 vacancies, which was up 42.5% compared to the second quarter of 2020. That was up 700 vacancies from the previous high in the second quarter of 2018, and included steady increases for Preschool, Elementary, Middle School, and High School teachers; Special Education teachers; and Substitute Teachers. However, the fastest increases were for Education Administrators, which more than doubled in vacancies over the year. Schools also reported big increases in demand for support staff including Speech-Language Pathologists; Educational, Guidance & Career Counselors; and Child, Family & School Social Workers.

Construction built up payrolls throughout the year with growth outpacing the national rate but could have grown faster. The 9,007 vacancies posted in Construction in the second quarter of 2021 was the highest on record, up from an average of about 7,000 vacancies per year over the past 5 years. More notably, this is up 1,167% compared to low point in 2009 during the Great Recession. Employers have been struggling to find new workers amongst a lost generation of blue collar workers – there were seven years of low vacancies in Construction from 2006 to 2012 leading into and coming out of the Great Recession, which kept people away from the industry.

Demand for white collar workers in Professional & Technical Services doubled over the past year up to 8,450 vacancies in the second quarter of 2021, primarily in Computer Systems Design, Management Consulting, Advertising & Public Relations; Accounting, Tax Preparation, Bookkeeping & Payroll Services; and Architectural & Engineering Services. These openings offer the second highest median wage among all 20 industries at $30.13, which was up $2.32 compared to 2020, but they also have strict requirements – 76% of vacancies require postsecondary education and 86% require one or more years of experience.

Likewise, 91% of the 5,360 vacancies in Finance & Insurance require one or more years of experience and 69% require postsecondary education, and consequently wage offers were the highest among all 20 industries at $37.36. Not only did the industry see a huge 205% increase in vacancies over the year, but Finance & Insurance also saw the biggest increase in wage offers in 2021.

Other Services, which includes Hair & Nail Salons, Auto Repair & Maintenance, and Civic & Social Organizations such as American Legions, YMCAs, and more, posted 6,336 vacancies in the second quarter of 2021, a strong recovery compared to 2020. Even more striking: that number is up more than 500% compared to the second quarter of 2010 during the Great Recession, when consumer demand dropped even more for these services. Instead, Other Services is up about 250 vacancies from the previous high in the second quarter of 2002, and up about 600 vacancies from recent high in the second quarter of 2018.

Demand for workers in the Management of Companies industry more than tripled over the year, to 2,687 vacancies, with a median wage offer of $25.21. Openings quadrupled in Agriculture, Forestry, Fishing and Hunting to 1,125 in 2021, making that the fourth highest number of vacancies ever recorded in that industry. Utilities also more than doubled and had median wage offers above $23 an hour, while Mining increased 67% and offered similarly high wages.

After setting a record high with 3,295 vacancies last year, Information postings were cut nearly in half with 1,701 vacancies in 2021. While that was down, it was still the fourth highest number of Information vacancies ever posted in the second quarter going all the way back to 2001. This sector includes Newspapers, Radio Stations, Telecommunications, and Software Publishers. Though the industry has seen long-term employment declines, hiring demand remains elevated.

Lastly, Public Administration, which includes city, county, state and federal government, posted 3,344 vacancies in the second quarter of 2021, which was just 5 fewer than in the second quarter of 2020. However, that was down more than 600 vacancies from its peak in the second quarter of 2019 and is the third lowest share of total job vacancies in the second quarter since 2001 – showing that hiring is much more robust in the private sector than the public sector.

The state's surge in job vacancies in the second quarter of 2021 shows that Minnesota's economy is rapidly recovering. Thousands of jobs are being added each month, but thousands more are still open and waiting for workers to fill them. Employers have responded by raising wages, increasing hours, offering benefits, and changing experience and education requirements. But the return to pre-pandemic labor market tightness, pinched even more by the nearly 85,000 workers who exited the labor force over the past year and half, is leading to unprecedented opportunities and challenges.