by Tim O'Neill

June 2022

As we enter the summer of 2022, labor markets throughout the state of Minnesota continue to navigate through uncharted territory. This includes the Seven-County Twin Cities Metro Area. After experiencing severe employment loss and record high unemployment rates in 2020, the region is now adjusting to record low unemployment and a severe need for workers. This article will analyze these changes in the Metro Area's labor market, focusing on labor force and industry trends, hiring demand, and what the region can expect for employment growth through the next decade.

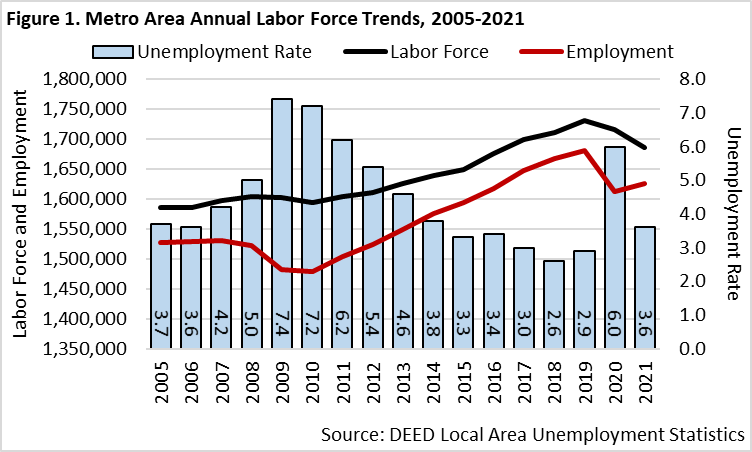

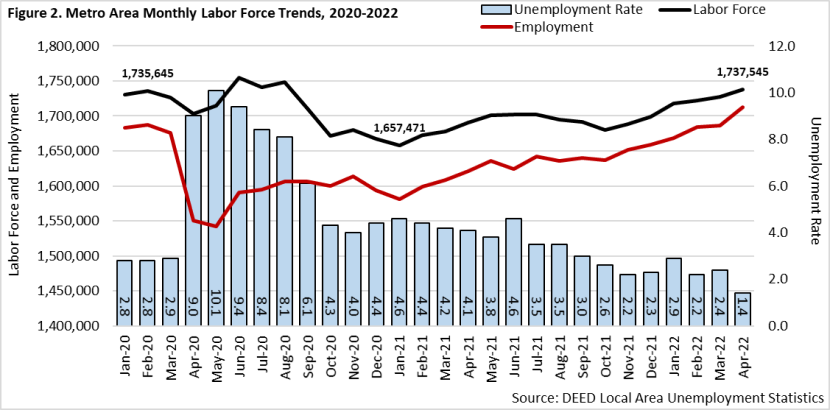

After experiencing dramatic shifts during 2020, the Seven-County Metro Area's labor force began to recover throughout 2021. As an annual average, the region's unemployment rate jumped from 2.9% in 2019 to 6.0% in 2020 before falling back to 3.6% in 2021 (Figure 1). These rates represented approximately 50,400 unemployed persons in 2019, 103,400 unemployed persons in 2020, and back down to 60,400 unemployed persons in 2021. On a monthly basis, the Metro Area's unemployment rate spiked to 10.1% in May of 2020 before steadily declining to 2.3% by December of 2021. The unemployment rate has continued to drop through the spring months of 2022, hitting an unbelievable low of 1.4% in April (Figure 2). These monthly trends in unemployment represented a drop from approximately 172,300 unemployed persons in May 2020 to 39,700 unemployed persons in December 2021 to just 24,600 unemployed persons in April 2022. Within two years, the Metro Area went from the highest number of unemployed persons on record to the lowest number on record.

In terms of employment, the Metro Area reached an annual high of 1,681,105 employed workers in 2019 before the COVID-19 pandemic. This declined by 3.5% (-69,123 employed persons) across 2020, before increasing by 0.9% (+14,422 employed persons) through 2021. Like unemployment, employment trends have been more volatile on a monthly basis during the past few years than in years prior. Total employment in the region dropped by 8.6% (-145,008 employed persons) between February 2020 and May 2020, before increasing by 7.6% (+116,918 employed persons) between May 2020 and December 2021. Employment continued to grow in the region by 3.2% (+53,904 employed persons) between December 2021 and April 2022. The region's total count of 1,712,894 employed workers in April 2022 is more than 25,800 persons more than the pre-pandemic high in February 2020.

These shifting employment and unemployment trends have had a dramatic impact on the Metro Area's labor force. After hitting a pre-pandemic peak of 1,735,645 available workers in February 2020, the region's labor force fell by 4.5% (-78,174 persons) through January 2021. The labor force then increased by 4.8% (+80,074 persons) through April 2022. Though up by less than 2,000 people, the Metro Area's labor force is now above pre-pandemic levels with 1,737,545 workers.

As an annual average in 2021, the Seven-County Metro Area had 87,459 establishments supplying 1,679,191 covered jobs. Total annual payroll for the region equaled $124.9 billion, with the average annual industry wage equal to $74,360. Health Care & Social Assistance is the Metro Area's largest-employing industry sector with 277,432 covered jobs at 12,331 establishments. Manufacturing is the second largest-employing industry with 168,113 covered jobs at 3,994 establishments. Retail Trade comes in as the Metro Area's third largest-employing industry with 154,985 covered jobs at 8,296 establishments. Altogether, Health Care & Social Assistance, Manufacturing, and Retail Trade account for over one-third (35.8%) of the Metro Area's total employment. Other large-employing industry sectors with over 100,000 jobs in the region include Educational Services; Professional, Scientific & Technical Services; Accommodation & Food Services; and Finance & Insurance (Table 1).

| Table 1. Seven-County Metro Area Industry Statistics, 2021 Annual Average Sorted by Number of Jobs | |||||

|---|---|---|---|---|---|

| Industry | Number of Establishments | Number of Jobs | Share of MN Jobs | Total Payroll ($1,000s) | Avg. Annual Wage |

| Total, All Industries | 87,459 | 1,679,191 | 100.0% | $124,866,504 | $74,360 |

| Health Care & Social Assistance | 12,331 | 277,432 | 16.5% | $16,388,587 | $59,020 |

| Manufacturing | 3,994 | 168,113 | 10.0% | $14,383,422 | $85,488 |

| Retail Trade | 8,296 | 154,985 | 9.2% | $6,015,410 | $38,792 |

| Educational Services | 2,286 | 128,310 | 7.6% | $7,829,972 | $60,892 |

| Professional, Scientific, & Technical Services | 11,214 | 122,469 | 7.3% | $13,836,600 | $112,892 |

| Accommodation & Food Services | 6,147 | 111,979 | 6.7% | $2,875,355 | $25,480 |

| Finance & Insurance | 4,859 | 111,966 | 6.7% | $14,680,019 | $130,936 |

| Administrative & Support Services | 4,412 | 89,750 | 5.3% | $4,510,774 | $50,128 |

| Management of Companies | 927 | 76,939 | 4.6% | $11,105,250 | $144,352 |

| Construction | 6,771 | 75,774 | 4.5% | $6,347,674 | $83,720 |

| Wholesale Trade | 4,993 | 75,511 | 4.5% | $7,497,084 | $99,216 |

| Transportation & Warehousing | 2,027 | 70,593 | 4.2% | $4,479,454 | $63,336 |

| Public Administration | 803 | 70,315 | 4.2% | $5,228,803 | $74,360 |

| Other Services | 10,110 | 50,895 | 3.0% | $2,265,381 | $44,460 |

| Information | 1,815 | 30,561 | 1.8% | $3,149,047 | $103,012 |

| Arts, Entertainment, & Recreation | 1,734 | 27,182 | 1.6% | $1,431,204 | $52,832 |

| Real Estate & Rental & Leasing | 4,308 | 26,317 | 1.6% | $1,802,738 | $68,432 |

| Utilities | 105 | 6,246 | 0.4% | $808,665 | $129,688 |

| Agriculture, Forestry, Fishing & Hunting | 291 | 3,327 | 0.2% | $139,056 | $41,860 |

| Mining | 38 | 524 | 0.0% | $92,009 | $173,472 |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | |||||

In comparison to the rest of the state, wages are high in the Metro Area, with the highest averages across all industries in Mining ($173,472); Management of Companies ($144,352); Finance & Insurance ($130,936); Utilities ($129,688); Professional, Scientific & Technical Services ($112,892); Information ($103,012); Wholesale Trade ($99,216); Manufacturing ($85,488); and Construction ($83,720).

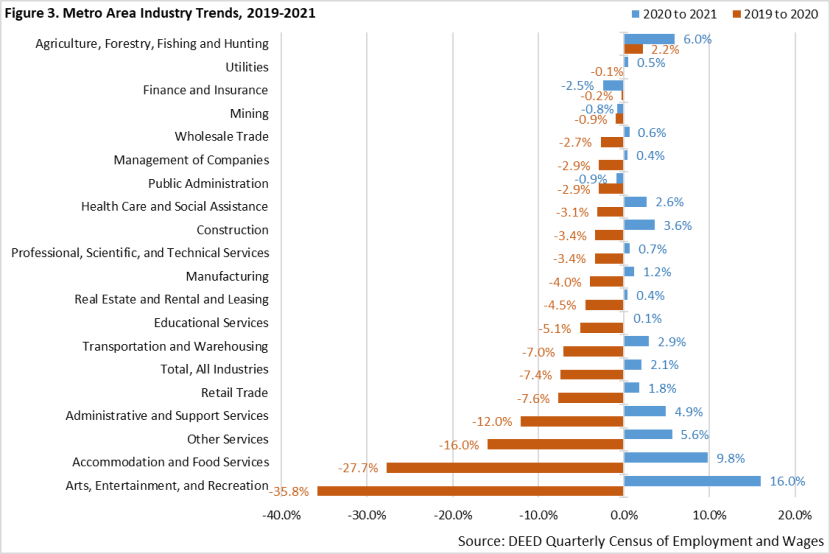

The COVID-19 pandemic significantly affected industry employment in the Metro Area. Between 2019 and 2020, the region's total employment dropped by 7.4%, equivalent to 131,155 fewer jobs. Losses were especially significant over that period for Accommodation & Food Services (-39,080 jobs); Arts, Entertainment & Recreation (-13,090 jobs); Retail Trade (-12,581 jobs); Administrative & Support Services (-11,714 jobs); Other Services (-9,158 jobs); and Health Care & Social Assistance (-8,658 jobs). In terms of percentage employment change between 2019 and 2020, Arts, Entertainment & Recreation; Accommodation & Food Services; Other Services; and Administrative & Support Services experienced the sharpest losses (Figure 3). Employment losses between 2019 and 2020 were less severe for Agriculture, Forestry, Fishing, and Hunting; Mining; Utilities; Finance and Insurance; and Real Estate, Rental, and Leasing.

Then in the past year, the Metro Area's total employment increased by 2.1%. This was equivalent to 33,907 additional jobs. Those industries hit hardest by COVID in the previous year experienced the most employment growth between 2020 and 2021. This included Accommodation & Food Services (+9,965 jobs); Health Care & Social Assistance (+7,143 jobs); Administrative & Support Services (+4,179 jobs); Arts, Entertainment & Recreation (+3,745 jobs); Retail Trade (+2,748 jobs); and Other Services (+2,708 jobs). Other industries experiencing robust job growth between 2020 and 2021 included Construction (+2,615 jobs), Transportation & Warehousing (+1,988 jobs), and Manufacturing (+1,941 jobs). Employment losses were experienced in Finance & Insurance, Public Administration, and Mining.

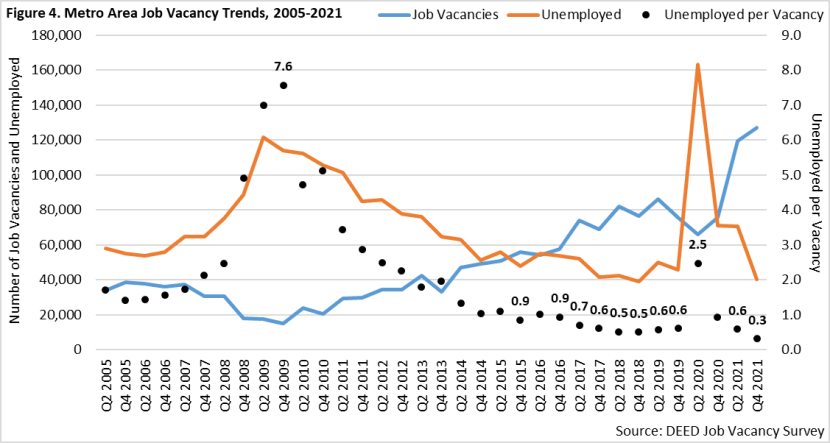

Despite major shifts in the Metro Area's labor force and industry employment over the course of 2020 and 2021, hiring demand remained strong. In fact, while vacancies understandably dipped through the second quarter of 2020, they bounced back past 75,700 vacancies during the fourth quarter of that year. Job vacancies then proceeded to spike upwards to over 119,500 during the second quarter of 2021 and to nearly 127,000 during the fourth quarter of that year. This represents the most job vacancies on record in the Metro Area, and by a wide margin.

While job vacancies climbed to record levels in 2021, unemployment continued to drop. During the second quarter of 2021, there were approximately 70,700 unemployed persons. This dropped to approximately 40,100 unemployed persons during the fourth quarter of 2021. Analyzed together, the Metro Area had about 0.6 unemployed persons per job vacancy during second quarter 2021 and about 0.3 unemployed persons per job vacancy during fourth quarter 2021. In other words, the Metro Area quickly reverted to very tight labor market conditions during 2021 (Figure 4).

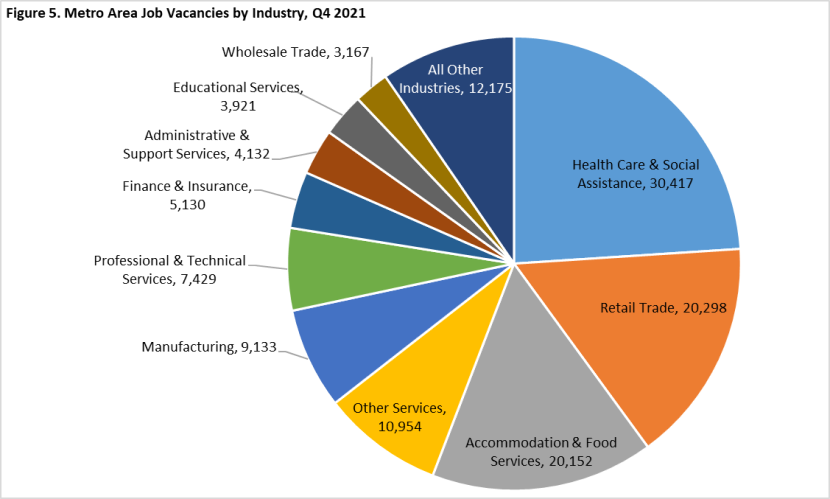

Health Care & Social Assistance led all industries in the Metro Area with over 30,400 job vacancies during the fourth quarter of 2021. In fact, this industry accounted for nearly one-quarter (24.0%) of the region's total job vacancies. Following Health Care & Social Assistance, both Retail Trade and Accommodation & Food Services had over 20,000 job vacancies. Altogether, these three industries accounted for over half (55.8%) of the Metro Area's total job vacancies (Figure 5). Overall, six major industry sectors set record highs for jobs vacancies in the Metro Area during fourth quarter 2021: Health Care & Social Assistance, Retail Trade, Other Services, Manufacturing, Professional & Technical Services, and Finance & Insurance.

As previously mentioned, the Metro Area's growth in job vacancies was significant during 2021. Increases were especially high for Health Care & Social Assistance, Accommodation & Food Services, and Retail Trade. Both Health Care & Social Assistance and Accommodation & Food Services had an increase of more than 13,000 job vacancies between the fourth quarters of 2020 and 2021. Retail Trade had an increase of more than 10,500 job vacancies during that period. Other industries witnessing significant increases in job vacancies between the fourth quarters of 2020 and 2021 include Other Services (+9,400 job vacancies over the year), Manufacturing (+2,600), Administrative & Support Services (+2,300), Finance & Insurance (+1,600), Transportation & Warehousing (+1,500), and Construction (+1,400).

Reflecting the recovery in Accommodation & Food Services, Health Care & Social Assistance, and Retail Trade, the top ten occupations with the most job vacancies in fourth quarter 2021 in the Metro Area included Fast Food & Counter Workers, Home Health & Personal Care Aides, First-Line Supervisors of Food Preparation & Serving Workers, First-Line Supervisors of Retail Sales Workers, Cashiers, Retail Salespersons, Registered Nurses, Secretaries & Administrative Assistants, Customer Service Representatives, and First-Line Supervisors of Transportation & Material Moving Workers.

Overall, these ten occupations accounted for nearly one third (32.3%) of the region's job vacancies. Other occupations with high job vacancy rates and over 1,000 job vacancies included Fast Food Cooks, Nurse Practitioners, Licensed Practical & Licensed Vocational Nurses, Light Truck Drivers, Food Preparation Workers, Waiters & Waitresses, Restaurant Cooks, and Market Research Analysts & Marketing Specialists.

For the record high 126,916 job vacancies in the Metro Area during fourth quarter 2021, the median wage offer was $19.27, also a record high. Just one-quarter (27%) of total vacancies were for part-time work, with 5% of total vacancies for temporary or seasonal work. By educational requirements, 34% of the region's total vacancies did not require any formal education, 29% required a high school diploma or equivalent, 9% required vocational training, 9% required an associate degree, 16% required a bachelor's degree, and 4% required an advanced degree. In sum, 55% of total job vacancies required one or more years of work experience, while 33% of total job vacancies required a certificate or license.

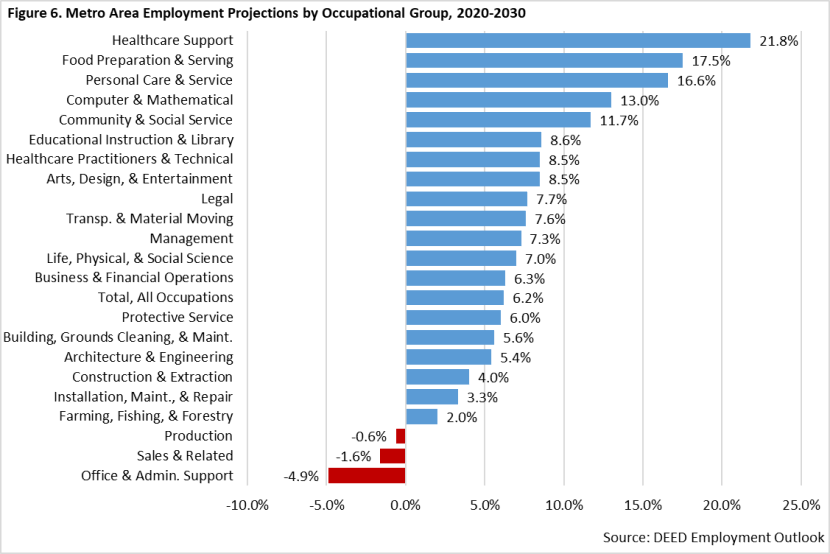

Looking forward, the Seven-County Metro Area's total employment is projected to grow by 6.2% between 2020 and 2030. This growth rate is equivalent to nearly 113,300 net new jobs. In addition, the region is anticipated to have over 773,300 openings from labor market exits. Labor market exit openings are those projected openings due to current workers leaving an occupation or exiting the labor market entirely, many of which are due to retirement. For reference, Minnesota's total employment is projected to grow by 5.7% between 2020 and 2030, which would equal 169,900 net new jobs, meaning the Twin Cities would account for two-thirds of the state's projected growth.

Healthcare Support occupations are projected to have the fastest employment growth in the Metro Area between 2020 and 2030, at 21.8% – more than three times as fast as the economy overall. This is equivalent to just over 21,000 projected net new jobs. Other major occupational groups projected to experience rapid growth include Food Preparation & Serving Related (+17.5%; +20,000 projected net new jobs), Personal Care & Service (+16.6%; +8,400), Computer & Mathematical (+13.0%; +11,500), and Community & Social Service occupations(+11.7%; +4,400).

Very few occupational groups are projected to see declining employment between 2020 and 2030 in the Metro Area, but there are potential job losses looming for Office & Administrative Support occupations (-4.9%; -11,300 net jobs), Sales & Related (-1.6%; -2,700), and Production occupations (-0.6%; -700) (Figure 6). Despite these projected net losses, these occupational groups are still projected to have tens of thousands of labor market exit openings through 2030. As such, there will still be high demand in these occupational groups to fill current and future job openings.

Specific occupations that are anticipated to have the most net new jobs between 2020 and 2030 in the Metro Area include Software Developers & Software Quality Assurance Analysts & Testers, Restaurant Cooks, Fast Food & Counter Workers, Waiters & Waitresses, Market Research Analysts & Marketing Specialists, Registered Nurses, Passenger Vehicle Drivers, General & Operations Managers, Bartenders, and Management Analysts.

Within 20 months during 2020 and 2021, the Seven-County Metro Area's unemployment rate shifted from 2.9% to 10.1% and back down to 2.6%. This rate continued to drop heading into 2022 and is now at historic lows. At the same time, job vacancies in the region have continued to climb to record levels. The demand for workers is high across nearly every industry sector and occupational group.

As the Metro Area's labor market continues to ebb and flow with recovery and expansion, employment barriers and disparities persist. In order to enable economic success for everyone, policies and action are needed to help address these barriers and disparities. Along these lines, career seekers, employment counselors, students, educators, non-profits, government agencies, and employers should continue to explore new and creative ways to connect and grow together.

The Metro Area is projected to continue leading the state in labor force and employment growth in the short-term and the long-term. If the region follows projected trends, it will soon have regained all the jobs lost during the COVID-19 pandemic and add even more as the economy pushes past pre-pandemic employment levels to reach new record heights.