by Dave Senf

December 2022

After expanding at the fastest annual rate in 37 years in 2021, the U.S. economy slowed noticeably during the first half of 2022 before picking up during the third quarter this year. The slowdown prompted some to declare that the U.S. economy had slipped into a recession. Slight GDP declines during the first two quarters of 2022 were behind the recession alarms, as the decline met the commonly held recession definition of at least two consecutive quarters of falling goods and services output.

Official recession calls, however, are made by an eight-member committee working at the private National Bureau of Economic Research (NBER). Before declaring that recession has occurred, the committee examines a range of economic indicators besides GDP including factory output, household income, inflation-adjusted retail sales, and job growth. As the committee states, "A recession is a significant decline in economic activity spread across the economy, normally visible in production, employment, and other indicators".1

Several of the other indicators, especially job growth, have been pointing towards an economy that has tapered off but hasn't, at least through the first three quarters of the year, lapsed into recession territory. U.S. unemployment dropped to 3.5% in September from 4.0% in January before inching up to 3.7% in October. Labor force growth has been strong, expanding 1.4% for the year through October. Over-the-year job growth has slowed from above 4% during the first half of the year recently but remains strong running above 3% over the last three months. Recessions are usually not associated with expanding job numbers.

Initial and continuing Unemployment Insurance (UI) claims, while up slightly from the beginning of the year, remain well below recessionary levels as layoff rates remain low. Labor demand, despite slipping 10% since peaking in March, continues to be elevated with 10.7 million job openings nationwide in September. That is 3.7 million or 50 percent higher than the 7.1 million monthly average for job openings in 2019. While the labor market tends to lag the rest of the economy, the current solid labor market conditions would need to deteriorate before a NBER-defined recession occurs.

The goal of the Federal Reserve as it attempts to tame inflation through ongoing federal funds rates hikes is to weaken the job market by moderating consumer and investment spending without throwing the economy into a recession. The Federal Reserve has increased fund rates five times over the last six months, including four consecutive 0.75 percent point hikes. More increases are expected over the next six months.

Curbing inflation without setting off a recession, known as "soft landings", are rare, although the Federal Reserve did manage to slow the economy between 1994-95 by doubling interest rates without unemployment spiking. The federal funds rate has risen at a much faster pace in 2022, climbing from near zero to 3.8 percent as of October.

Many economists currently believe that a soft landing is unlikely and that a recession is probable over the next 12 months given the Federal Reserve's firm commitment to hiking interest rates until inflation is tamed. How fast and high interest rates are pushed up will determine when and if a recession develops and the depth, diffusion and duration of the downturn.

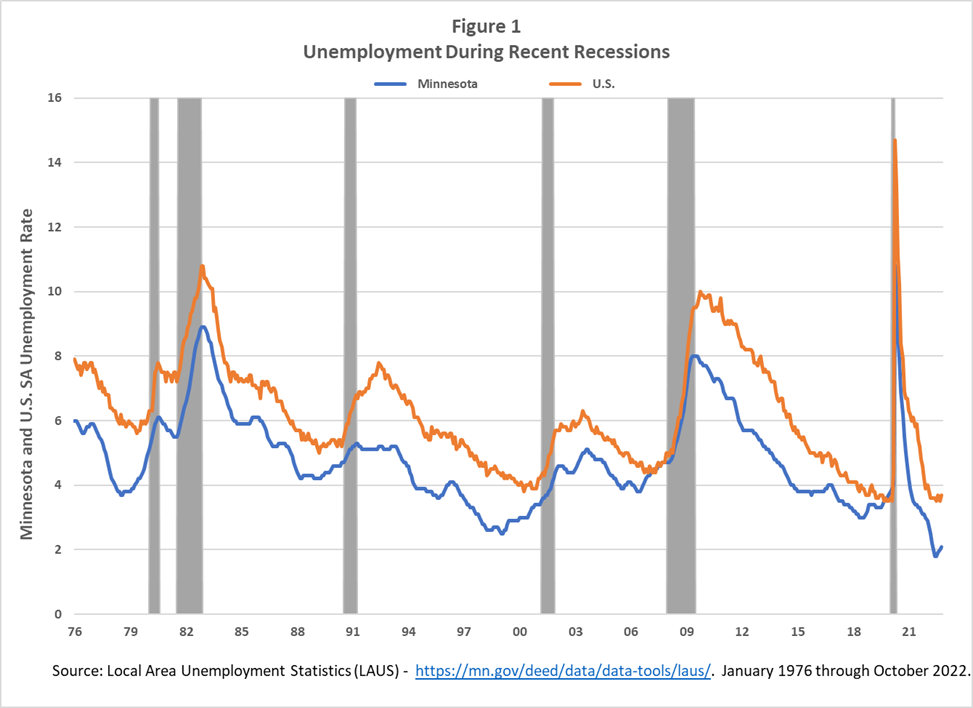

Figures 1 examines the depth and duration of the six most recent recessions by tracking monthly U.S. and Minnesota seasonally adjusted unemployment rates since 1976.2 U.S. unemployment rates have crept upwards a few months prior to recent recessions only half of the time. Minnesota's unemployment rate, on the other hand, appears to be a more reliable early recession indicator having climbed for several months before five out of the last six recessions. The only exception is prior to the 1981-82 recession. Minnesota's unemployment rate was even climbing during late 2019 before anybody had even heard of COVID-19.3

Minnesota's unemployment rate in October ticked up for the third straight month to 2.1% after having recorded a record low of 1.8% during June and July. Unlike nationally, Minnesota's labor force has expanded 1.5% during the year but has slipped over the last three months. Seasonally adjusted initial unemployment claims in the state, however, have been flat over recent months and are still hovering near record low levels. A steady rise in initial UI claims and climbing unemployment rates nationally and in Minnesota over the next few months would be confirmation that a recession has surfaced (see Figure 1).

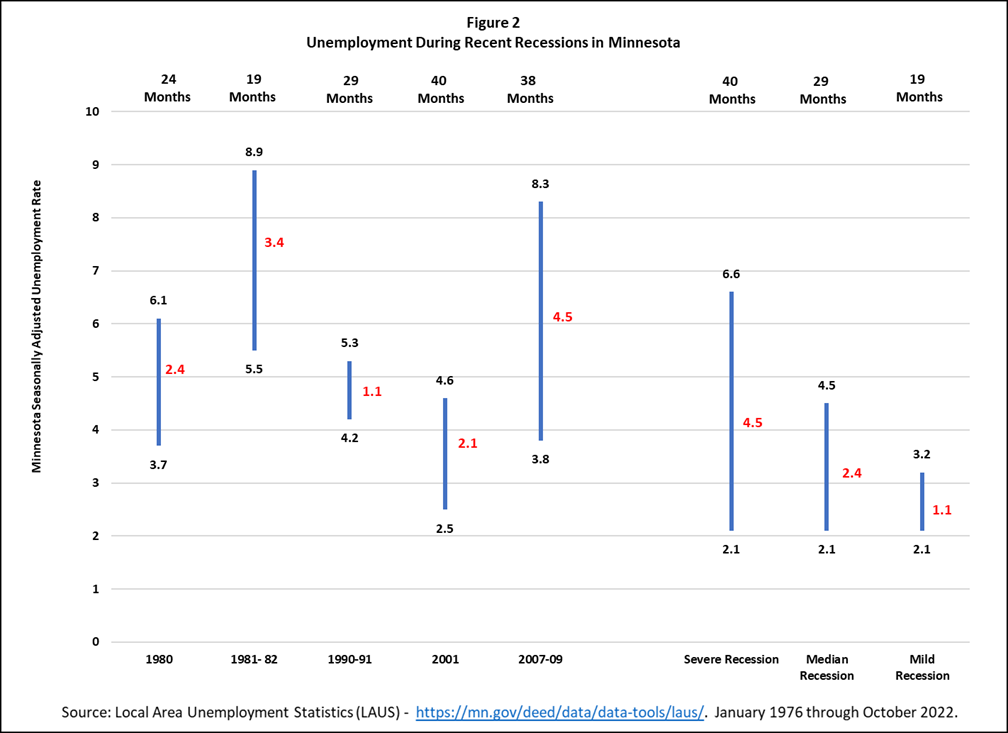

The pandemic recession stands out for its depth and duration as well as its COVID-19 origin. It tops recent recessions in depth when measured by the surge in unemployment and in shortest duration, lasting only two months. Due to its uniqueness, the surge of unemployment in 2020 means it is excluded from Figure 2, which summarizes the unemployment spikes associated with other recent recessions. The 1990-91 recession was relatively mild in Minnesota as the drop in employment was modest and the unemployment rate rose only 1.1% (from 4.2% to 5.3%), the smallest increase of recent recessions.4 The 2000 recession drove the state's unemployment rate from 2.5% to 4.6%, or a 2.1 percentage point increase. The 2.5% unemployment rate in early 1999 was the lowest rate on record until the recent run of sub-2.0% rates. The two most severe recessions for both Minnesota and the nation were the 1981-82 and 2007-09 recessions. Unemployment in Minnesota spiked by 3.4 and 4.2 percentage points during those recessions, respectively.

In Figure 2, unemployment percentage point increases for each recession are shown in red. The numbers at the bottom and top of each blue line are unemployment rates when rates start to increase and when rates peak out and start to retreat. The months at the top of the figure report on how long the unemployment rates rose around the recessionary periods.

The 1980 and 1981-82 recessions are commonly referred to as the double-dip recessions and when combined, unemployment spiked from 3.7% to 8.9%, increasing 5.2 percentage points over 43 months. During the 2007-2009 recession, commonly called the Great Recession, unemployment rose 4.5 percentage points over a 38-month period.

The range of unemployment spikes experienced during recent recessions highlight that no two recessions are the same, while also providing a range for what may occur if a recession develops over the next year.

The right side of Figure 2 displays unemployment rate increases for three recession scenarios – mild, median, and severe recessions – based on the experience of recent recessions. Any recession that develops over the next year starts from a unique position of very low unemployment. The current low unemployment rate is a function of high labor demand as Minnesota's businesses bounce back from the pandemic, reduced labor force participation related to the pandemic, and most significantly a long-term flattening of labor force growth due to an aging population.

A mild recession scenario could develop over the next year if inflation retreats rapidly over the coming months with the Federal Reserve having to hike interest rates only a few more times. The economy stumbles into a recession but the decline in economic activity is moderate and short-lived, lasting for less than a year. Under this scenario, unemployment increases from 2023 into 2025 but the increase is gradual, creeping up from 2.1% to somewhere slightly above 3%. The most recent Federal Reserve forecast shows U.S. unemployment inching up to 4.4% in late 2023 from 3.5% in September under the assumptions that a recession is avoided, and GDP grows by 1.2% next year. From a historical perspective, unemployment in the low 3% neighborhood in Minnesota falls significantly below the 4.8% and 4.6% average and median rate over the last 46 years, since state unemployment rate started being tracked.

Future unemployment rates even during a recession are likely to be lower compared to the past simply because the job market will be consistently tighter in the future as the state's labor force barely expands over the next decade. The usual uptick in layoffs during downturns may be tempered as businesses hoard workers more so than in past recessions. Given the struggle that businesses have had in filling staffing openings over the last two years, they are likely to moderate their quick fire and rehire pattern practiced during previous recessions. Hiring will slow and job vacancies will shrink but unemployment numbers will likely swell less than during prior recessions due not only to businesses curtailing layoff rates, but also because of slower labor force growth. Slower labor force growth means that the flow of workers entering the labor force as unemployed will be lower.

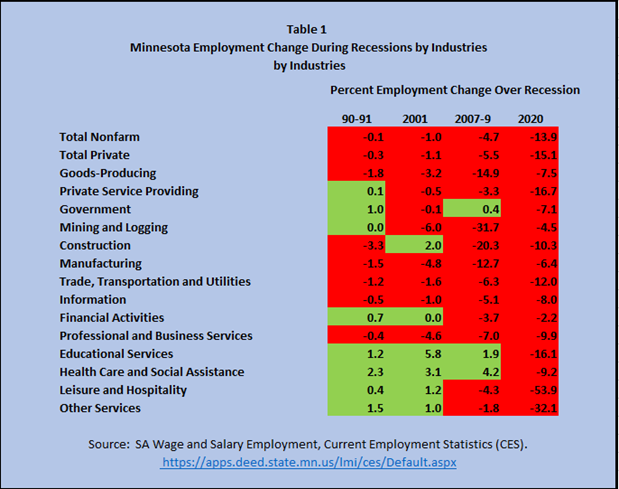

Construction and manufacturing employment usually decline the most during recessions, especially during recessions that follow rising interest rates (see Table 1). Home building activity slumps as mortgage rates climb, as does investment in commercial and industrial construction. Manufacturing production suffers as consumers cut back on durable goods purchases and as business spending on capital goods wanes. Mining, wholesale trade, and transportation employment usually also tend to decline more steeply than overall job losses.

On the other hand, education, health care and government workforces have held up during past downturns, escaping with minimal reductions or slowdown in job growth. That was the common pattern of job loss across industries during recessions until the pandemic recession.

Job loss during the pandemic recession, due to various efforts to control the spread of the COVID-19 virus, landed much harder on service-providing workers than on goods-producing workers. Private service-providing employment plunged 16.7% compared to a 7.5% drop off in goods-producing employment.

Based on current data, the industry distribution of job loss during the next recession will probably look similar to the 1990-91 distribution, with construction and manufacturing jobs taking the biggest hits. Worker shortages will ease over the next recession but not to the extent seen during past recessions. Again, this might alter the historical firing and rehiring cycle during the next recession for some industries.

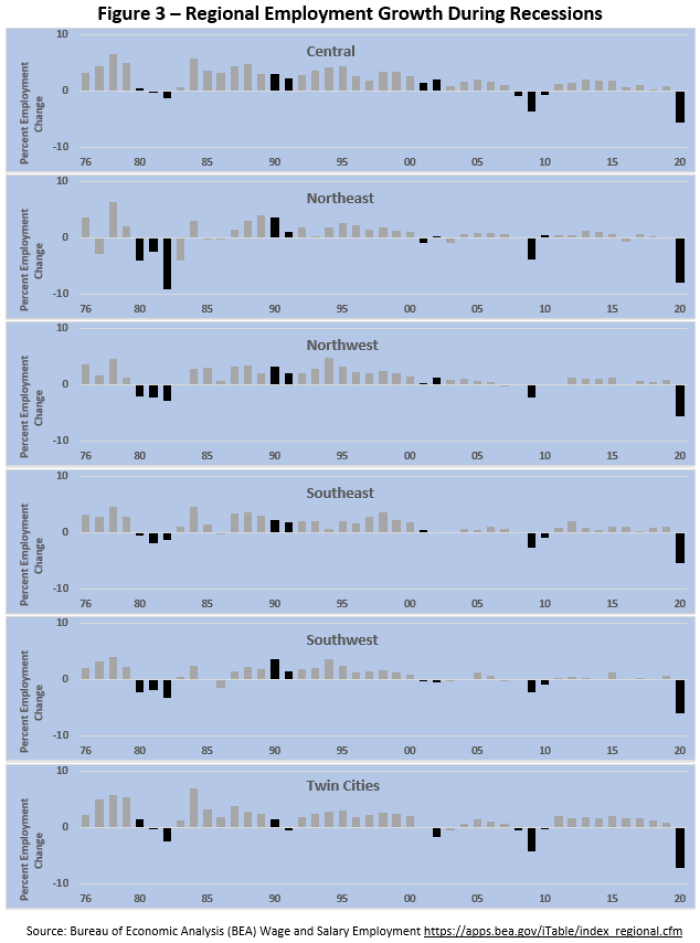

Minnesota regions, just like industries, have experienced varying impacts during past recessions. Most of the variation in regional impacts from downturns can be traced to the industrial mix of regions. For example, the double dip recessions of the early 1980s produced steep job loss in Northeast Minnesota (see Figure 3). The state's taconite industry along with the rest of the Midwest steel industry was devastated during the early 1980s. Job cuts during the 1990-91 recession were concentrated only in the Twin Cities. The Twin Cities also saw employment decline the most during the 2001 recession. Central Minnesota employment increased during both the 1990-91 and 2001 recessions, but didn't escape the 2007-09 recession.

Employment decline was widely shared across the state during the 2007-09 recession and during the pandemic recession. The takeaway here might be that during severe recessions like the 2007-2009 recession, employment decline occurs in all corners of the state, while centered in the Twin Cities during milder recessions.

During recessions, as layoffs increase and hiring slows, total wages and earnings of the state's workforce eventually shrink. Other income sources also tail off including corporate and small business profits. Expanded transfer payments such as unemployment benefits and other governmental aid programs designed to counter falling income during recessions have historically offset just a modest fraction of income loss. The same can't be said about the massive federal government aid response to the spread of COVID-19 and ensuing recession in 2020.

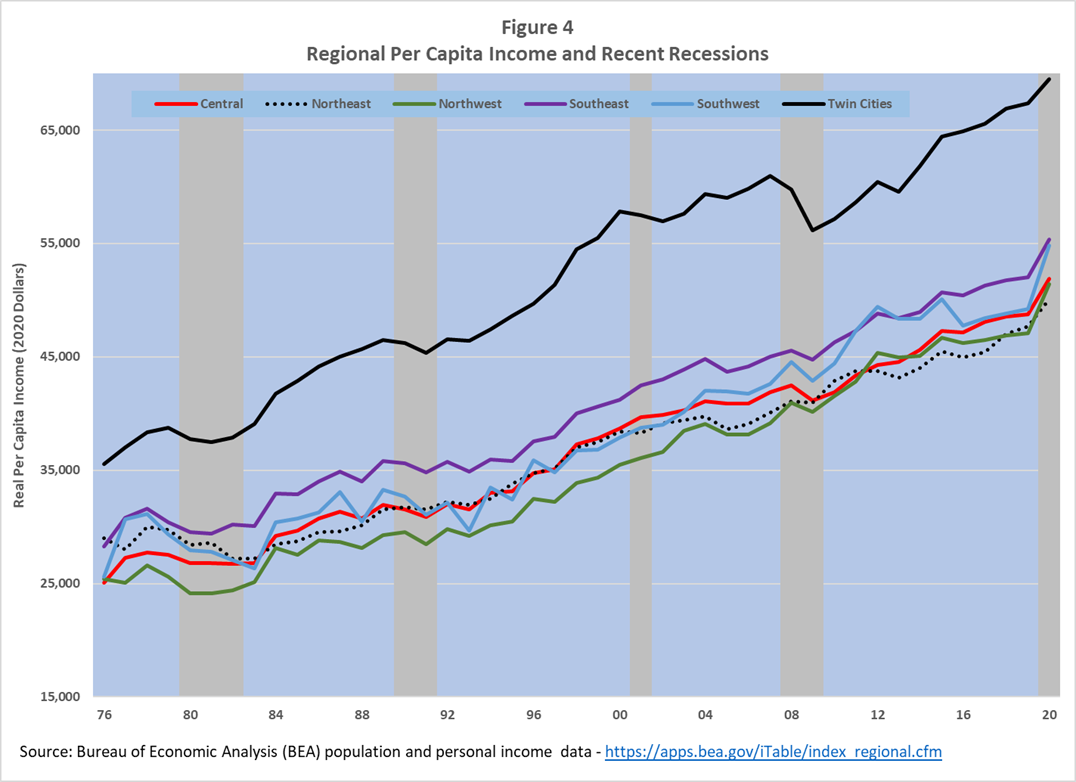

As COVID-19 spread across the nation, crippling a large share of the economy, the federal government responded with four acts allocating roughly $5 trillion in stimulus and aid spending, which boosted household income as well as business income. The end result was a quicker and stronger than anticipated recovery in 2020 and 2021, leading to spiking real per capita incomes across Minnesota (see Figure 4). Stimulus checks and enhanced unemployment benefits boosted income for many Minnesotans during 2020. Various business loan programs, such as the Paycheck Protection Program, improved the bottom line for many of the state's businesses in 2020.

As Figure 4 shows, real per capita income during previous recessions either declined or flattened out across all of Minnesotan's regions, except in 1990-91. As with job decline, most of the income loss caused by the 1990-91 recession was concentrated in the Twin Cities.

Uncertainty is high around how high the Federal Reserve will push up interest rates over the next year and how soon inflation will head downward as the economy cools in response to high interest rates. If the soft landing that the Federal Reserve is trying to achieve turns into a recession over the next 12 months, the mild recession in Figure 2 represents the next best scenario, with unemployment rising only slightly more than one percentage point in Minnesota. If inflation stays elevated and the Federal Reserve stays committed to hiking interest rates despite mounting pain, Minnesota's unemployment rate is likely to top 4% in 2024 as the recession deepens and lasts longer than hoped for.

View the latest Minnesota Budget and Economic Forecast from Minnesota Management and Budget, which projects a mild three-quarter recession beginning yet this year.

1More NBER recession dating information.

2The diffusion trait of a recession refers to how widespread the contraction is across industries and across regions and is not directly addressed in Figure 1.

3A caveat is required here since monthly unemployment rates are revised once a year in March. Thus, the Minnesota unemployment rates showed in Figure 1 are revised rates not real-time rates.

4Increases in Minnesota's unemployment rate around periods of recessions as presented in Figure 2 are measured from when rates first began to increase until peaking during recessional periods. Minnesota unemployment was 4.2 percent in early 1989 and gradually increased over the next two and a half years to 5.3 percent in early 1991. The gradual uptick in unemployment occurred over 29 months compared to the eight-month 1990-91 recession from July 1990 to March 1991.