by Nick Dobbins

July 2021

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.

| Industry | Jun-21 | May-21 | Apr-21 |

|---|---|---|---|

| Total Nonfarm | 2825.8 | 2826.4 | 2817.4 |

| Goods-Producing | 441.3 | 443.8 | 442.5 |

| Mining and Logging | 6.2 | 6.3 | 6.3 |

| Construction | 125.6 | 127.7 | 126.8 |

| Manufacturing | 309.5 | 309.8 | 309.4 |

| Service-Providing | 2384.5 | 2382.6 | 2374.9 |

| Trade, Transportation, and Utilities | 512.2 | 509.5 | 511.9 |

| Information | 40.3 | 39.9 | 40.1 |

| Financial Activities | 189 | 191.2 | 192.3 |

| Professional and Business Services | 368.8 | 367.6 | 364.8 |

| Educational and Health Services | 535.5 | 538 | 535.9 |

| Leisure and Hospitality | 225.3 | 225.8 | 219.4 |

| Other Services | 105 | 104.7 | 101.9 |

| Government | 408.4 | 405.9 | 408.6 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2021. | |||

Employment in Minnesota was flat in June on a seasonally adjusted basis, as the state lost 600 jobs or 0.0%. Service providers added 1,900 jobs (0.1%) but were countered by the loss of 2,500 jobs (0.6%) among goods producers.

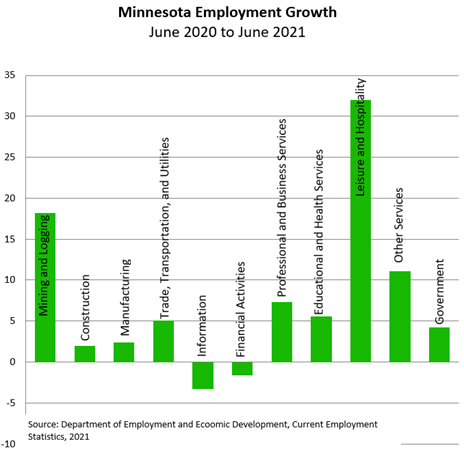

On an annual basis the state added 173,827 jobs (6.4%). Private sector employers added 157,070 jobs (6.8%) while government employers added 16,757 jobs (4.2%).

Employment in Mining and Logging was off by 100 (1.6%) over the month on a seasonally adjusted basis.

Over the year employment in Mining and Logging was up by 18.2% or 1,007 jobs. It was the second-largest proportional annual growth of any supersector in Minnesota after Leisure and Hospitality. Part of the large over-the-year growth happened because this supersector felt the effects of the pandemic slightly later than the larger labor market, with its lowest over-the-year growth rate coming in June of 2020 instead of April.

Construction employment was off by 2,100 (1.6%) in June. This followed three consecutive months of seasonally adjusted employment growth for the supersector.

On an annual basis employment in Construction was up 2% or 2,724 jobs. Every component sector added jobs, with the most growth coming in Construction of Buildings (up 3.9% or 1,118 jobs).

Employment in Manufacturing was down by 300 (0.1%) over-the-month in June. Non-Durable Goods Manufacturers shed 700 jobs (0.6%) while Durable Goods Manufacturers added 400 (0.2%).

Manufacturing employers added 7,485 jobs or 2.4% over the year. Growth was shared between the major components, as Non-Durable Goods Manufacturers added 3,685 jobs (3.4%), while their counterparts in Durable Goods Manufacturing added 3,800 jobs or (1.9%).

Trade, Transportation, and Utilities employment was up by 2,700 (0.5%) over the month in June. It was the largest real job growth of any supersector in the state. Transportation, Warehousing, and Utilities drove the growth, adding 2,200 jobs (2.1%), and Wholesale Trade added 1,400 jobs (1.1%), while Retail Trade employers shed 900 jobs (0.3%), the second consecutive monthly employment decline for the sector.

Over the year Trade, Transportation, and Utilities employers added 25,105 jobs or 5.1%. Retail Trade added the most jobs overall, up by 14,729 or 5.5%. Transportation, Warehousing, and Utilities had the largest proportional gains, up 7.3% or 7,093 jobs. Wholesale Trade employment grew by 3,283 or 2.7%.

The Information supersector added 400 jobs (1%) in June, its first positive over-the-month growth since January.

On an annual basis Information employment remained down, off by 1,384 jobs or 3.3%. It was one of only two supersectors to post negative employment growth on the year, Financial Activities being the other.

Financial Activities employers lost 2,200 jobs (1.2%) in June. Both components lost jobs, with Finance and Insurance off by 1,700 (1.1%) and Real Estate and Rental and Leasing off by 500 (1.5%).

Over the year Financial Activities employers lost 3,040 jobs (1.6%), one of only two supersectors to post negative annual growth along with Information. The weak over-the-year growth is at least partially a product of the supersector's relative resilience during the onset of the pandemic, as June 2020 employment in Financial Activities was only down by 1.5% over the year, while overall employment was off by 10.5% at that time.

Employment in Professional and Business Services was up by 1,200 (0.3%) over the month in June. Two of the three component sectors lost jobs (Professional, Scientific, and Technical Services was off by 200, and Management of Companies and Enterprises was off 700), but positive growth of 1.7% (2,100 jobs) in Administrative and Support and Waste Management and Remediation Services kept the supersector in positive growth for the month.

On an annual basis employment in Professional and Business Services was up 7.3% or 25,394 jobs. All three published component sectors added jobs, but Administrative and Support and Waste Management and Remediation Services drove the growth, up 18,442 or 16.3 percent, in large part thanks to the addition of 10,975 jobs (26%) in the traditional bellwether industry of Employment Services.

Educational and Health Services employment was off by 2,500 (0.5%) over the month in June.

Educational Services lost 1,100 jobs (1.5%), and Health Care and Social Assistance lost 1,400 (0.3%).

Over the year Educational and Health Services added 28,197 jobs or 5.6%. Educational Services added 12,582 jobs or 22.5%, which may be slightly affected by differing academic calendars from year to year. Health Care and Social Assistance added 15,615 jobs or 3.5%, slightly down from May's 4.4% over-the-year growth.

Employment in Leisure and Hospitality was down by 500 (0.2%) in June. It was the first month of negative seasonally adjusted growth for the supersector since December of 2020. Accommodation and Food Services added jobs (up 2,000 or 1.1%) but Arts, Entertainment, and Recreation lost 2,500 jobs (6.1%).

On an annual basis the supersector added 61,007 jobs or 32%. While this is markedly lower than May's 58.6% over-the-year growth, it was still the highest proportional growth of any supersector in the state, from the disproportionally large impact the recent pandemic had on the Leisure and Hospitality industry group. Arts, Entertainment, and Recreation employment was up 59% (17,574 jobs) while Accommodation and Food Services employment was up 27% (43,433 jobs).

Employment in Other Services was up by 300 (0.3%) in June. It was the fourth consecutive month of seasonally adjusted growth for the supersector.

Over the year the supersector added 10,575 jobs or 11.1%. It was the third-largest proportional growth of any supersector in the state, although growth was down considerably from May's 31.8%.

Government employers added 2,500 jobs (0.6%) over the month in June. The increase was driven entirely by Local Government employers, who added 2,900 jobs or 1.1%. Employment at the other two levels of government was down by 0.3% in June, with Federal Employer shedding 100 jobs and State employers losing 300.

Employment in Government was up by 16,757 (4.2%) on an annual basis. Both Federal and State level employers lost jobs on the year (down 27 or 0.1% and 2,984 or 3.2%, respectively). Local Government employers, however, posted more than enough positive growth to obscure those losses, adding 19,768 jobs (7.3%) with growth among both the educational and non-educational components.