by Carson Gorecki

January 2024

Housing affordability and accessibility have been identified as priorities throughout the state. It is no different for communities in Northeast Minnesota. The shortage of housing options acts as a governor on the growth of a place and limits the ability to keep current and attract new residents. This is especially relevant for local leaders and businesses who are simultaneously trying to navigate a workforce shortage. Often, rural areas like Cook County can feel these shortages more acutely. Even if a local employer is able to recruit a new potential employee from elsewhere, they are then left at the mercy of the current housing market. If the local housing options do not meet the recruits' needs, they will simply not take the job, leaving employers frustrated at a situation largely out of their control. This spotlight will examine Northeast Minnesota's housing characteristics and trends and their relationship with the regional labor market.

The hypothetical situation described above is typically applied to positions that require advanced education and pay high wages like physicians or engineers, which are less common and therefor justify larger geographic recruitment areas. According to the U.S. Census Bureau's Current Population Survey, 16% of those that moved in the U.S. in 2022 did so for employment-related reasons1. That share was higher for movers with higher incomes. Drilling down a bit more, if the reason for moving was to look for work or to be closer to work, the distribution by income is much more equal. All workers across the wage spectrum need housing, and the lack of affordable housing impacts local labor markets' ability to operate effectively.

Despite the bourgeoning trend of remote work, a physical workplace remains the norm for most jobs. As such, housing in reasonable proximity to one's job is still very important for the majority of workers. As of 2022, more than 75% of workers in Northeast Minnesota lived within a 30-minute commute to their workplace and 8.5% worked at home.2 The share working at home in the region was about five percentage points lower than the statewide average (13.6%). Given these data represent five-year averages, the current share working from home is likely to be higher, but still not nearly enough to replace the traditional physical commute as the primary workforce pattern. Housing within a reasonable distance of workers' employers is crucial. Even accounting for those working from home, 82.3% of Northeast Minnesota workers had an average commute time of under 45 minutes, and 50.1% traveled fewer than 20 minutes.

As of 2022, there were 180,051 housing units in Northeast Minnesota, 137,850 (77%) of which were considered occupied (see Table 1). For a population of 326,000 this amounts to an average household size of 2.3 individuals. The number of total units has declined over time. Since 2017, the number of units in the region fell by about 5,400 or 2.9%. Over the same period the population of the region remained effectively constant, increasing demand on existing units. The decline of units is largely attributable to the drop of vacant units which fell 3,700 or 8.1%. By tenure, owner-occupied units grew slightly while the number of renter-occupied units fell by just over 5%. Most residents live in owner-occupied housing (75.6%), but rentals account for about a fourth of all units. Northeast Minnesota has a slightly higher owner-occupied rate than the rest of the state (72.3%).

| Table 1. Housing Characteristics, 2022 | |||||||

|---|---|---|---|---|---|---|---|

| Units | Northeast Minnesota | Minnesota | Household Size | Northeast Minnesota | |||

| Number | Percent | Number | Percent | Total | Percent | ||

| Total housing units | 180,051 | 100.0% | 2,493,956 |

100.0% |

Owner-occupied | 104,170 | 75.6% |

| Occupied housing units | 137,850 | 76.6% | 2,256,126 |

90.5% |

Average household size, owner-occ. | 2.30 | - |

| Vacant housing units | 42,201 | 23.4% | 237,830 |

9.5% |

Renter-occupied | 33,680 | 24.4% |

| Homeowner vacancy rate | 0.8% | - | 0.6% |

- |

Average household size, renter-occ. | 1.95 | - |

| Rental vacancy rate | 4.4% | - | 4.8% |

- |

Total, occupied units | 137,850 | 100.0% |

| Source: 2018-2022 American Community Survey, 5-Year Estimates | |||||||

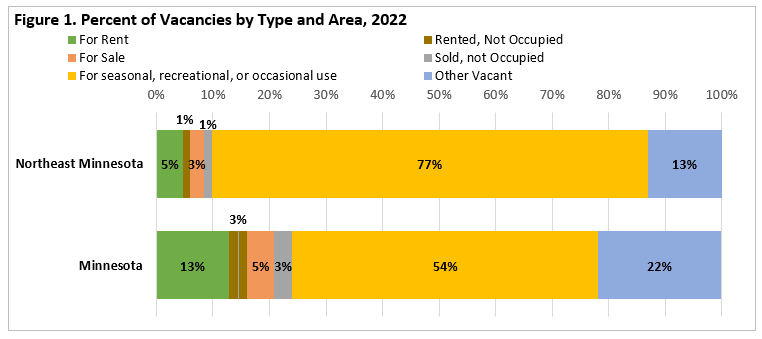

Compared to the rest of the state, Northeast Minnesota has a much higher share of vacant housing units. There are many reasons a housing unit may be considered vacant including being up for rent or sale, in between occupants, other vacancies3, for migrant workers, or for seasonal, recreational, or occasional use. This latter category makes up the bulk of vacant units in Northeast Minnesota (77%), unsurprising for an area that has a higher-than-average share of cabins and resorts (see Figure 1). While the statewide share of seasonal, recreational, or occasional use vacancies grew since 2011, it remained about the same in Northeast Minnesota. Over time, the total vacancy rate has declined as the housing market tightened, but more so for owner-occupied units than rented units. As of 2022, the owner vacancy rate was just under 1% while the rental rate was just under 5%.

Northeast Minnesota also has an older housing stock, meaning higher maintenance and remodeling costs. 40.6% of the housing units in the region were built before 1960, compared to 30% statewide. A crucial component of housing supply, especially in an area with an older than average housing stock, is the construction of new units.

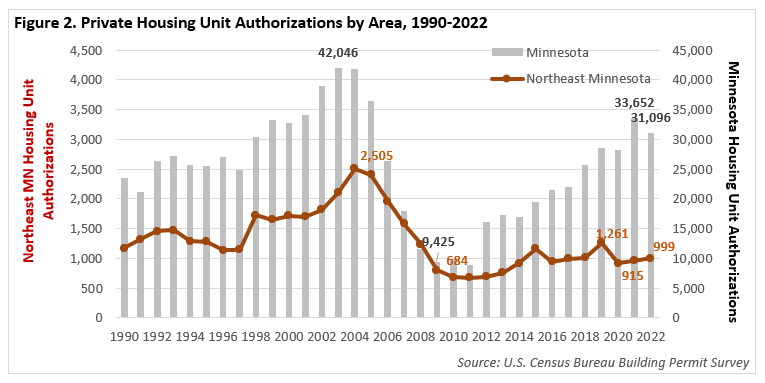

In the decade ending 2019, 8,839 housing units were built in the region4. That was less than half the number constructed the previous decade. From 2018 to 2022, Northeast Minnesota averaged just over 1,000 housing unit authorizations per year. That was up from the lows following the Great Recession housing bubble (847 avg. 2009-2017), but down 36% from the average annual authorizations from 1990-2008 (1,614) (see Figure 2). Most recently, the 999 authorizations in the region in 2022 were down 21% from 2019. By Comparison, statewide authorizations were up 9% from 2019 and slightly higher in recent years than the average pre-Great Recession levels.

The slow growth in the number of housing units in recent years can be tied to many challenges faced by the Construction sector including high costs of materials, labor shortages, and high interest rates. Interest rates for 30-year mortgages have moderated slightly but remained near 7% as of the end of 2023. Nationally, the growth of residential construction inputs slowed in 2023 after historically high growth the previous two years. Of particular relevance to the housing-workforce connection are the people responsible for producing homes, the Construction workforce.

The workforce and housing connection is not a one-way street where the accessibility and affordability of housing only constrains the number of workers available in a community. The reverse is also true. If there are not enough workers to build the demanded housing, the workforce will in turn constrain the supply of housing. The Construction sector, and more specifically the Residential Building Construction and Specialty Trade Contractors industries are, like most other industries, impacted by housing affordability and accessibility. However, unlike most other industries, these two Construction industries are directly responsible for increasing the supply of homes as well. For this reason, whether there are enough workers with the skills and expertise necessary to meet the high demand for housing is an important question to explore.

The latest job vacancy data from 2022 indicate lower demand for Construction workers compared to other sectors. The Construction sector had an estimated 169 openings in Northeast Minnesota at the beginning of 2022, with a job vacancy rate of 2.3%. Construction and Extraction occupations had a slightly higher vacancy rate of 3.2%, and the 162 vacancies for Construction Laborers equated to a much higher 16.2% vacancy rate.

Despite the relatively low number of vacancies in 2022, other measures indicated continued demand for Construction workers. Since 2019, regional Construction employers added 350 jobs (4.4%), making it the fastest growing of all sectors over that period5 (see Table 2). Residential Building Construction alone added 280 jobs, an increase of 32% which was the fastest among Construction industries. Much of the growth in Residential Building Construction occurred in the last year when 250 jobs were added. In addition to employment growth, there was also robust wage growth across much of the sector, but especially for workers in Residential Building Construction jobs. Since 2019 their wages grew the fastest of the Construction industries and almost twice as fast as the average of all industries. The recent strong wage growth, however, was not enough to dislodge it as the lowest-paying among Construction industries.

| Table 2. Construction Sector Employment and Wage Statistics, Q3 2019-Q3 2023 | ||||

|---|---|---|---|---|

| Sector/Industry | Employment | Percent Employment Growth 2019-2023 | Average Annual Wage | Percent Wage Growth 2019-2023 |

| Total, All Industries | 139,784 | -3.6% | $57,304 | 24.0% |

| Construction | 8,215 | 4.4% | $79,560 | 21.5% |

| Building Equipment Contractors | 1,810 | 13.0% | $78,260 | 12.6% |

| Highway, Street, and Bridge Construction | 1,382 | 2.7% | $100,828 | 17.7% |

| Residential Building Construction | 1,154 | 31.7% | $51,948 | 47.3% |

| Foundation, Structure, and Building Exterior Contractors | 1,075 | -6.5% | $67,860 | 31.4% |

| Nonresidential Building Construction | 1,041 | 15.9% | $103,480 | 39.6% |

| Other Specialty Trade Contractors | 884 | 0.3% | $68,952 | 24.2% |

| Utility System Construction | 360 | -26.2% | $101,088 | -1.5% |

| Building Finishing Contractors | 332 | -34.6% | $52,780 | -2.5% |

| Source: MN DEED Quarterly Census of Employment and Wages | ||||

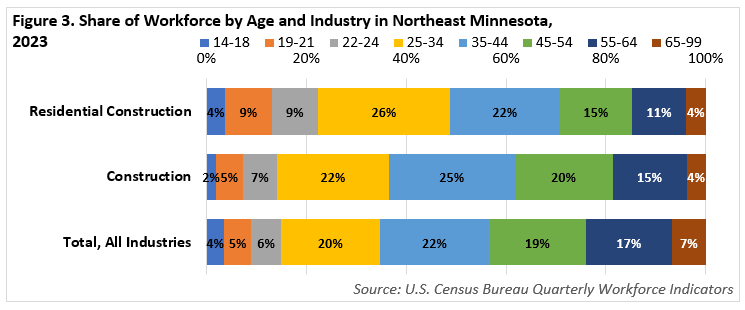

To meet the continued demand for housing, Residential Construction businesses will need a supply of workers with the appropriate training and skills. One concern common in the trades is the loss of knowledge and skills with the retirement of older, more experienced workers. On this point, the Residential Building Construction is better positioned than even other Construction industries. Nearly half (49%) of the Residential Construction Workforce is 34 years or younger, higher than the share for the Construction sector (37%) and the average of all industries (35%) (see Figure 3). At the other end of the age spectrum, only 15% of the Residential Building Construction workforce is 55 years or older, leaving it less exposed to imminent retirements. In fact, 66% of the employment growth in the industry since 2019 can be attributable to workers younger than 35. Assuming most of these young workers stay with the industry, it will be set up relatively well for the mid-to-long term.

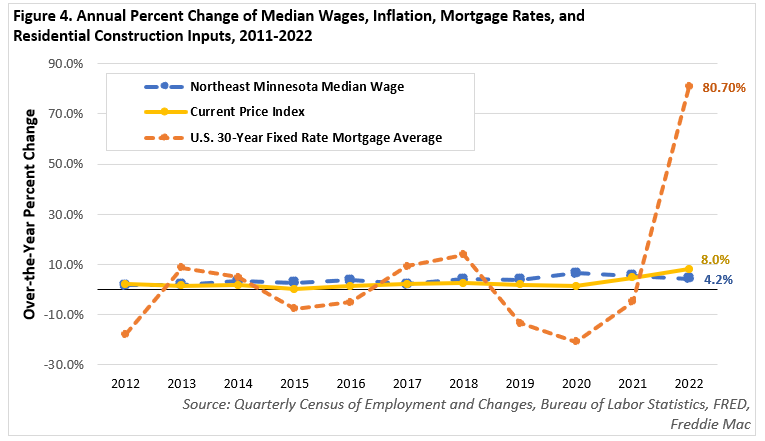

Even if housing is ample but unaffordable it is also effectively inaccessible to many who need it. Wages rose sharply over the last several years, but so has the cost of living, including the cost of housing. The median household income in Northeast Minnesota in 2022 was $66,575, up 29% from 2017. Over the same period the median rent rose 28% and the median home value was up 30%6. From 2020 to 2023, the median home sales price was up 32%7, and over the year into 2022 the 30-year fixed rate mortgage average was up 80% from historic lows. Over the same period the Consumer Price Index, a key measure of inflation, was up 8%, nearly double regional wage growth. (see Figure 4).

Another way to measure the affordability of housing is to compare typical housing costs with typical incomes. The U.S. Census Bureau publishes selected monthly owner costs as a percent of household income (SMOCAPI) and gross rent as a percent of household income (GRAPI). If housing costs or rent exceed 35% of a household's income, they are considered housing cost burdened or spending an unsustainable share of income on their housing, often at the expense of other basic needs. A recent report by the Minnesota Housing Partnership estimated that at a lower threshold of 30% of income, more than 590,500 Minnesotans were housing cost burdened. As of 2022, 17% of households that owned homes with mortgages and 41% of renters met these criteria in Northeast Minnesota, totaling over 22,500 households. Over the longer term, fewer Northeast Minnesota households are housing cost burdened. From 2012, the share of housing burdened owners fell 6.6%. nearly three times faster than the renter share (2.3%).

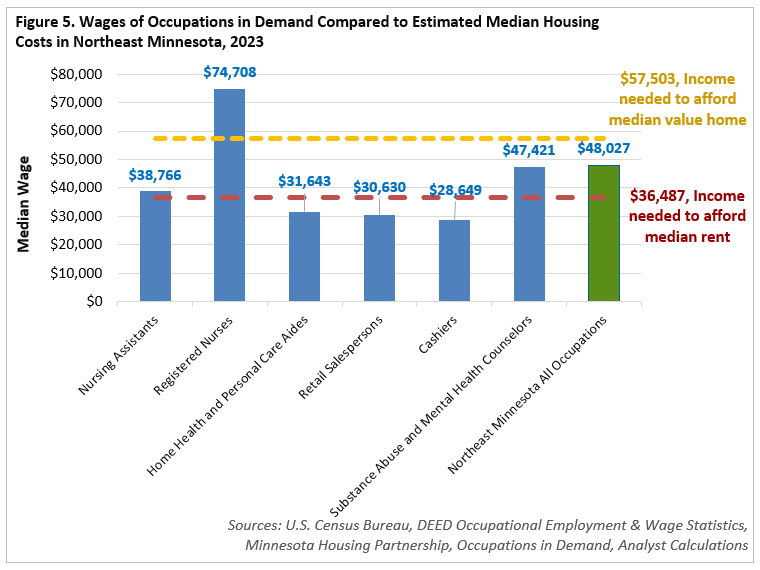

We can also compare the wages of occupations most in demand in the area to typical housing costs to see how they match up. For example, the median wage for all occupations in Northeast Minnesota in 2023 was just over $48,000. That wage was enough to cover the estimated $36,500 needed to afford the median rent, but below the $57,500 required to afford the median value home in the region (see Figure 5). More than 25% of positions pay below the income needed for the median rental. For some of the other most common occupations in demand, like Home Health Care and Personal Care Aides, Cashiers, and Retail Salespersons, the typical wage is not enough to cover the typical rent.

Myriad factors determine whether a community can provide adequate, affordable housing to meet its own unique needs, far too many to cover in this article. Yet, if we boil the issue down, the basic, shared need is simply more housing. Ida Rukavina, the Commissioner of Iron Range Resources and Rehabilitation describes both the region-wide need, but also one of the efforts being undertaken to address it: "One of the areas that our agency is committed to is housing, which is a large factor when measuring a region's economy and quality of life. The supply and choice of housing inventory in northeastern Minnesota is low, and the demand is high. The need for additional and more choices of housing impacts employers, employees, communities, and new and existing residents. To be part of the solution, we recently dedicated $5 million for a new housing grant program that is available for housing developments and projects that align with local priorities and regional employers' needs."

This quote is indicative of the region-wide interest in making meaningful change around the issue of housing. From the workforce perspective, employers have a keen desire to aid in the effort because most workers still live within a 20-minute drive of their workplaces and without adequate housing options, they lose a means to recruit talent. Housing and workforce will continue to be intricately connected in our region, impacting the supply and demand of each other. Through determined collaboration and renewed effort, however, Northeast Minnesota is working to bring more people home.

1Geographic Mobility: 2022, table 14

2U.S. Census American Community Survey 2018-2022 5-Year Estimates, Table S0801

3Other vacancies include foreclosure, personal/family reasons, needing or under repair, abandonment, and others not included above.

4U.S. Census Bureau American Community Survey 2018-2022, table DP04

5Q3 to Q3. Q3 is typically the highest quarter for construction employment, reflecting the seasonality of the sector.

6U.S. Census Bureau American Community Survey 2012-2017 and 2018-2022 5-year estimates, table DP04.

7Lake Superior Area Realtors. Statistics - Lake Superior