by Dave Senf

June 2020

Even though Minnesota’s economy began gradually reopening in May, the hope of containing the COVID-19 pandemic quickly and experiencing a steep but short economic slump followed by a fast recovery has faded. Instead, the COVID-19 threat remains and policies and personal habits to live with the threat, such as social distancing, must continue until a proven vaccine or effective treatments are available. The cancellation of the Minnesota State Fair is just one example of countless ways the virus will affect the state’s economy and job market into the foreseeable future.

Minnesota, along with the rest of the world, took an unprecedented direct economic broadside from the efforts to control the spread of COVID-19. The state reached all-time highs for nonfarm and wage and salary employment in January 2020 (2,984,000 jobs) before large swaths of Minnesota’s economy were temporarily shut down beginning in mid-March to contain and slow the spread of COVID-19.

As a result of temporary business closures and the Stay at Home order put in place to slow the spread of COVID-19 and save lives, the state lost 13.2%, or roughly 395,000 total nonfarm wage and salary jobs between January and April.1 National employment plunged 14.0% through April as 21.4 million jobs disappeared.

Weekly seasonally adjusted Unemployment Insurance (UI) applications surged during the last three weeks in March, gradually slowing since early April while remaining much higher than normal. However, many workers have begun returning to their pre-pandemic positions as businesses are reopening. Preliminary employment estimates for May show the state added 27,500 private sector jobs, up 1.3%, during the month on a seasonally adjusted basis. Still, the downward spiral typical of a recession will continue over the next few months in many sectors, restraining the job bounce resulting as restrictions are lifted.

DEED has published one-year detailed sector employment forecasts quarterly since 2009, but the statistical models we typically utilize are impractical now for two reasons.2 First, the models run off average quarterly employment and 2nd quarter average employment will not be available until mid-July. Second, the models are not designed to deal with extreme economic swings, like the ones brought on by the COVID-19 outbreak.

Without our typical models, DEED instead developed 2nd quarter 2020 to 2nd quarter 2021 employment projections for Minnesota based on the forecasting work of IHS Markit, the economic consulting firm used by Minnesota Management and Budget (MMB) in their budgeting work. IHS Markit forecasts are based on large macroeconomic models that capture all the forward and backward industrial linkages that exist in the economy and the income and wealth relationships that drive consumer spending.

Some of the assumptions underlying IHS Markit’s May forecast are3:

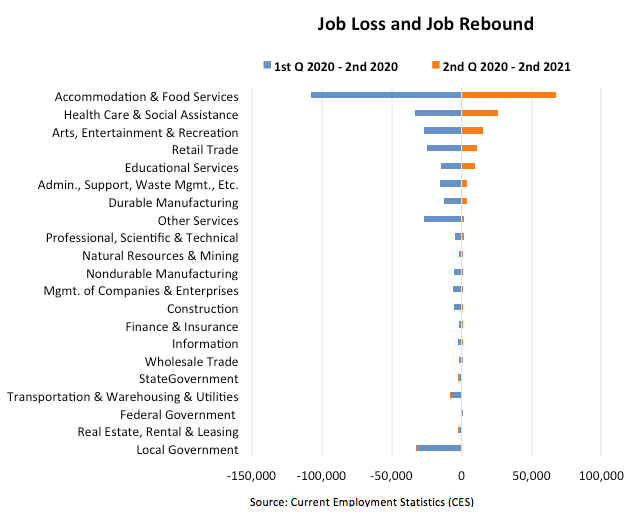

Based on the above assumptions, Minnesota is forecast to lose 11.3% of nonfarm wage and salary employment between the first and second quarters of 2020. Job layoffs are expected to tail off during early summer. During that same time frame, we expect hiring to ramp up. Job growth between the second quarters of 2020 and 2021 is expected to be 5.4% with the return of roughly 143,000 of the 334,000, or 43% of jobs lost during the second quarter (see Figure 1).

Job growth for the most part will be concentrated in sectors that were hardest hit by the shutdown, including healthcare and social assistance, accommodations and food services, and retail trade. But the rate of job rebound across sectors will be uneven as demand, social distancing (both mandatory and voluntary) and supply chain disruption impacts vary by sector. Sixteen of the 21 sectors are expected to see job growth between the second quarters of 2020 and 2021.

Spillover or secondary effects from the economic damage since mid-March will result in continuing job loss in five sectors over the next year.4 These sectors were originally less impacted but are now faced with revenue flows that are likely to remain below pre-pandemic levels for another year or so forcing staffing reductions to bring costs in line with revenue. Job losses in these sectors: real estate; rental and leasing; federal government; local government; state government; and transportation, warehousing and utilities, will be smaller relative to job cutbacks during the second quarter of 2020, but will delay the start of job rebounds in these sectors until later in 2021.

The uneven job rebound across sectors suggests that the job rebound across Minnesota’s race/ethnicity groups will also vary. Hard hit sectors such as accommodation and food services and arts and entertainment will initially rebound the quickest as restrictions are lifted, but then slow as demand remains below pre-pandemic level because customers remain nervous about face-to-face interaction. These are also industries with a higher share of workers who are Black, Indigenous and People of Color (BIPOC).

Overall, BIPOC people make up a higher share of the workforces of sectors that tend to have a high degree face-to-face interactions. Job rebound in these sectors are expected to take the longest to completely recover, which means that the job rebound for Minnesota’s BIPOC communities will lag behind the overall job recovery rate.

The saying that no two recessions are alike has never been truer than with this pandemic-induced recession. The usual uncertainties of the trajectory of the economy during any recession are further magnified by the unknown path of the virus over the next year. An uptick in COVID-19 cases as the state’s economy reopens during the summer or a second COVID-19 outbreak in the fall would alter the timing and path of the job market rebound.

The persistence of social distancing, both voluntary and mandated, is likely to prevent a quick rally from the sharp contraction endured over the last few months, especially in industries with close customer contact like hospitality, restaurant and entertainment. Demand for services such as non-emergency medical care, as well as many personal services, such as hair care, may also be curtailed below pre-pandemic levels as some people remain nervous about being in close contact with service providers.

Despite the unknowns, Minnesota’s jobs market will start to improve in the second half of this year. The rebound, after an initial spurt, will be a lengthy process and may last for several years.

1Minnesota’s job loss from January to April ranked as the 27th highest percent loss among the states with Michigan recording the steepest decline, 23.9%, and Wyoming the lowest drop with 8.4% job reduction.

2The most recent job forecast was for 4thQ 2020 to 4thQ 2021, but it is now completely out-of-date given the direction of the economy since the onset of the pandemic.

3The IHS Markit forecast utilized here is their most likely scenario which they judge to have a 45% chance of turning out right. Their optimist forecast (20% chance) expects GDP to contract 5.2% in 2020 and grows 5.1% in 2021. Their pessimistic forecast (35% chance) has 2020 GDP diving 14.9%, the recession lasting through the third quarter of 2020, and GDP growth in 2021 of 5.2%.

4Federal government employment in Minnesota is expected to shrink between the second quarters of 2020 and 2021 as the Census related uptick winds down later in 2020.