by Anthony Schaffhauser

October 2022

As the economy recovers from the pandemic recession the two biggest economic topics are the tight labor market and inflation. While the tight labor market pulls wages up, inflation pulls down the purchasing power of those increased wages. Which is winning out, wage growth or inflation? Colleagues here at DEED conclude that for the entire state of Minnesota wage growth over the last three years is less than inflation based on Current Employment Statistics (CES) data. These data are survey-based and applicable for the U.S., states, and to a more limited extent, metropolitan statistical areas. CES data is fast, with each month's data released in the middle of the following month. However, we have Quarterly Census of Employment and Wages (QCEW) from unemployment insurance wage records that is available for all areas of Minnesota and is not hampered by survey error. That is well worth the four to six months wait.

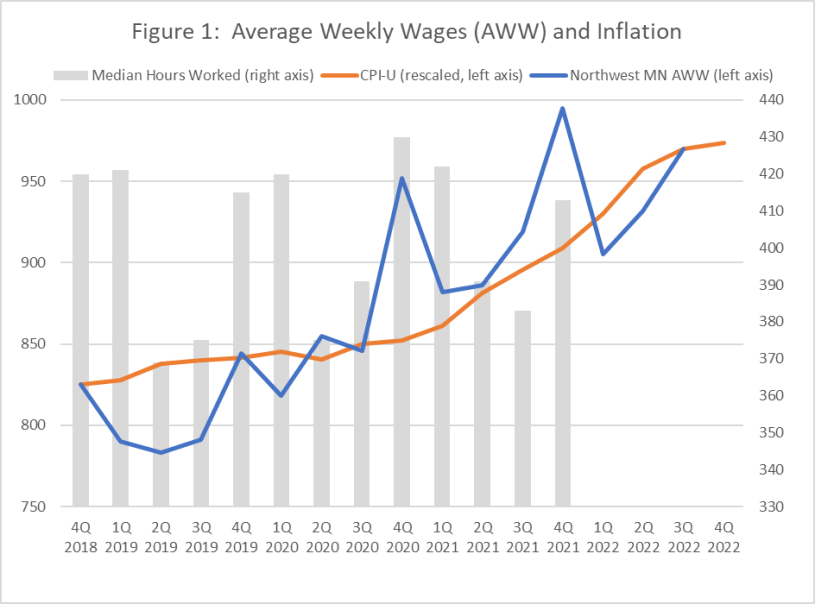

QCEW average weekly wages (AWW) are keeping up with inflation. To visualize this, I shift the consumer price index (CPI) up on the vertical axis of Figure 1 to start at the same level as AWW for fourth quarter 2018, showing the growth of each on the same scale.

The quarter-to-quarter variation in AWW is striking. Fourth quarter peaks reflect year-end bonuses and profit sharing. So, this is not an hourly wage. Instead, it is the average weekly paychecks of workers for the quarter. It tells us how average worker pay compares to inflation without regard to hours worked. Quarterly Employment Dynamics (QED) data shows that the bigger paychecks are not just from workers putting in more hours. The median hours worked varies quarter to quarter but does not consistently trend up. First and second quarter 2021 hours are higher than first and second quarter 2020, but third and fourth quarter 2021 are lower over the year.

Inflation (CPI) had an inflection point in First quarter 2021. From that point inflation advanced at a steeper slope. Inflation then slowed after second quarter 2022. The CPI peaked at 9.1% over the year in June 2022 and has steadily declined, ending 2022 at 6.5%. So, if wages have pulled harder than the relenting inflation through the last three months of 2022, wage growth will be winning this tug of war.

With the quarter-to-quarter variation in AWW, it helps see annual data. However, since the latest QCEW is third quarter, we can't use a calendar year. Hence, Table 1 has 12 months ending in September (fourth quarter through third quarter of the following year).

While a picture may be worth a thousand words, a more complete story is told with a table of numbers. The first chapter is the first two rows, labeled Inflation and Total, All Industries. This shows the same information in Figure 1 but reveals that wages in fact beat inflation over the three-year period by a bit over 6%. We have the same data statewide, and the three-year wage growth for Minnesota is 18.3% compared to 19.2% for the Northwest Region. Using the same data statewide and in Northwest Minnesota, both are beating inflation, with slightly greater gains in the Northwest.

Northwest Minnesota total wages beat inflation by 4.1 percentage points in Year 1 (fourth quarter 2019 to third quarter 2020) and 5.4 percentage points in Year 2 (fourth quarter 2020 to third quarter 2021). However, after inflation accelerated in 2021, wages did not keep pace in Minnesota nor the Northwest. Note that Northwest Minnesota wage growth was 4.5% in Year 3 (fourth quarter 2021 through third quarter 2022) which was 3.4 percentage points lower than inflation. Minnesota did better in Year 3 with 5.5% wage growth, 2.4 percentage points below inflation. The Northwest had slightly higher wage growth than Minnesota in Year 1 with 5.5% compared to 5.3%. That slight advantage was compounded with the Northwest's whopping 8.4% wage growth in Year 2, compared to 6.5% for Minnesota statewide. The Northwest ended the three years with just under 1% faster wage growth than Minnesota statewide.

It is not surprising that wages could not keep up with the fast-accelerating inflation during Year 3. Prices of many things can go up quickly, but wages are stickier. Consequently, whether or not wages beat inflation depends on which period is considered. Nevertheless, this analysis shows that wages have grown more than inflation during the three-year pandemic recovery, both in Northwest Minnesota and Statewide.

| Table 1: Northwest Minnesota Average Weekly Wages by Industry Versus Inflation | ||||||||

|---|---|---|---|---|---|---|---|---|

| - | 12 Months Ending Third Quarter | Over-the-Year Change | 3-Year Change | |||||

| - | 2019 | 2020 | 2021 | 2022 | 2020

(Year 1) |

2021

(Year 2) |

2022

(Year 3) |

2019-2022 |

| Inflation (Twelve-Month Average CPI-U) | 254 | 258 | 267 | 288 | 1.4% | 3.3% | 7.9% | 13.1% |

| Total, All Industries | 797 | 841 | 910 | 951 | 5.5% | 8.2% | 4.5% | 19.2% |

| Health Care and Social Assistance | 869 | 896 | 965 | 1056 | 3.2% | 7.7% | 9.3% | 21.5% |

| Manufacturing | 1019 | 1079 | 1309 | 1237 | 5.8% | 21.4% | -5.5% | 21.4% |

| Educational Services | 828 | 893 | 921 | 936 | 7.8% | 3.2% | 1.6% | 13.0% |

| Construction | 1725 | 1756 | 1814 | 1904 | 1.8% | 3.3% | 4.9% | 10.4% |

| Retail Trade | 528 | 554 | 600 | 635 | 4.9% | 8.3% | 5.9% | 20.3% |

| Public Administration | 928 | 970 | 1013 | 1057 | 4.5% | 4.4% | 4.3% | 13.9% |

| Wholesale Trade | 1070 | 1099 | 1198 | 1259 | 2.7% | 9.0% | 5.1% | 17.6% |

| Accommodation and Food Services | 324 | 343 | 374 | 408 | 5.7% | 9.2% | 9.0% | 25.8% |

| Finance and Insurance | 1102 | 1161 | 1261 | 1381 | 5.4% | 8.6% | 9.6% | 25.4% |

| Transportation and Warehousing | 814 | 844 | 896 | 983 | 3.7% | 6.1% | 9.7% | 20.7% |

| Professional, Scientific, and Technical | 1029 | 1065 | 1120 | 1222 | 3.4% | 5.2% | 9.1% | 18.7% |

| Agriculture, Forestry, Fishing, and Hunting | 811 | 851 | 903 | 960 | 4.9% | 6.1% | 6.3% | 18.4% |

| Other Services | 443 | 494 | 525 | 546 | 11.3% | 6.4% | 4.0% | 23.1% |

| Admin. Support and Waste Mgt Services | 636 | 656 | 694 | 748 | 3.2% | 5.7% | 7.8% | 17.6% |

| Information | 893 | 964 | 1052 | 1118 | 7.9% | 9.2% | 6.2% | 25.1% |

| Utilities | 1009 | 1034 | 1120 | 1181 | 2.5% | 8.3% | 5.5% | 17.1% |

| Arts, Entertainment, and Recreation | 378 | 403 | 434 | 433 | 6.5% | 7.8% | -0.3% | 14.3% |

| Real Estate, Rental and Leasing | 650 | 711 | 774 | 842 | 9.3% | 8.9% | 8.7% | 29.4% |

| Management of Companies | 1663 | 1744 | 1697 | 1932 | 4.8% | -2.7% | 13.9% | 16.2% |

| Mining | 1098 | 1121 | 1154 | 1204 | 2.1% | 3.0% | 4.3% | 9.7% |

| Source: DEED QCEW and US Bureau of Labor Statistics CPI | ||||||||

QCEW data reveals substantial differences in wage growth between industries. Table 1 lists the industry sectors in descending order by the size of the sector's total payrolls. That is, the higher the total wages paid, the higher on the list. The sectors at the top will have the most impact on the overall regional wage growth.

Health Care and Social Assistance accounts for nearly 19% of total regional payrolls. This sector exceeded average wage growth with 21.5% over the three years compared to 19.2% for all industries. On average, workers in this industry experienced increased purchasing power despite inflation. Furthermore, this sector handily beat inflation each year. Even clocking the fastest wage growth in Year 3, it beat the then surging inflation by the smallest margin of the three years. It is also notable that wage growth for Health Care and Social Assistance wages grew 4.2 percentage points faster in the Northwest than statewide. Table 2 displays the industries that had the largest differences in wage growth between Northwest and Minnesota statewide.

Manufacturing has slightly over 16% of total regional payrolls, and it also raised the average with very similar three-year wage growth to Health Care. Year 3 wage declines cancelled Year 1 growth. By far the most lucrative time for Manufacturing workers was in Year 2. As the pandemic precluded spending on many services, particularly Accommodation &and Food Services, goods purchases increased.

Manufacturing increased wages to attract and retain workers and paid overtime to meet this demand. However, after COVID-19 vaccines were available spending on services rebounded. This pattern contributed significantly to the region's Year 3 wage growth falling short of inflation. Accommodation and Food Services wage growth beat inflation by over 1% in Year 3, but average wages are 34% of those in Manufacturing. Table 2 shows both Manufacturing and Accommodation and Food Services had 5.1 percentage point faster wage growth compared to Minnesota over the three years.

Educational services nearly matched three-year inflation, but it declined in Year 2 and Year 3 when inflation increased. It is not surprising that educational services pay would not keep pace with surging inflation because wages are generally set by contract for one to two years. Furthermore, slowing wage growth could be caused by longer-tenured, higher-paid employees retiring. The 6.3% shortfall to inflation for this sector, which accounts for 9.7% of the region's payrolls, also contributes to the region's overall shortfall in wage growth verses inflation in Year 3.

| Table 2: Industries with the Largest Wage Growth Differences | |||

|---|---|---|---|

| Industry | 2019 to 2022 Wage Growth | Difference | |

| Northwest Minnesota | Minnesota | ||

| Health Care and Social Assistance | 21.5% | 17.4% | 4.2% |

| Manufacturing | 21.4% | 16.3% | 5.1% |

| Accommodation and Food Services | 25.8% | 20.8% | 5.1% |

| Finance and Insurance | 25.4% | 19.3% | 6.1% |

| Transportation and Warehousing | 20.7% | 14.1% | 6.7% |

| Admin. Support and Waste Mgmt | 17.6% | 27.2% | -9.7% |

| Arts, Entertainment, and Recreation | 14.3% | 23.7% | -9.3% |

| Real Estate, Rental and Leasing | 29.4% | 21.7% | 7.7% |

| Management of Companies | 16.2% | 11.3% | 4.8% |

| Mining | 9.7% | 24.5% | -14.8% |

| Source: DEED QCEW | |||

Construction wage growth also fell short of inflation overall, and that was from slow growth in Year 3. This is consistent with construction job growth tapering in that period. Again, spending shifted back to services. It is surprising to me that construction wages did not top inflation in Year 2 because construction employment grew substantially. However, this is consistent with the CES data on construction wages.

To summarize the industry story, seven of the eight largest wage-paying industries grew wages slower than inflation in Year 3. It is no wonder that total regional wage growth fell short. Six of the remaining 13 sectors beat inflation in Year 3. Also, all but three sectors beat inflation over the three years combined. Only three industries had significantly slower wage growth than statewide, while seven had wage growth more than 4% faster than statewide.

We see that wage growth varied by industry. We can also examine how wage growth varied by age and sex, at least through 2021 which is the most recent data available. Table 3 has Quarterly Employment Demographics (QED) data showing that overall, as well as for workers of all ages and both sexes, median hourly wages beat inflation, both in Northwest Minnesota and Minnesota from 2019 to 2021.

| Table 3: Median Wages and Inflation | ||||||

|---|---|---|---|---|---|---|

| - | 2019 | 2020 | 2021 | 2019-2020 | 2020-2021 | 2019-2021 |

| Inflation (CPI-U) | 256 | 259 | 271 | 1.2% | 4.7% | 6.0% |

| Northwest Minnesota | Median Wage | Percent Change | ||||

| 19 and under | 11.00 | 11.74 | 12.66 | 6.7% | 7.8% | 15.1% |

| 20 to 24 years | 14.47 | 15.48 | 16.68 | 7.0% | 7.8% | 15.3% |

| 25 to 44 years | 19.75 | 21.35 | 22.61 | 8.1% | 5.9% | 14.5% |

| 45 to 54 years | 21.42 | 23.42 | 24.80 | 9.3% | 5.9% | 15.8% |

| 55 to 64 years | 20.24 | 21.88 | 22.89 | 8.1% | 4.6% | 13.1% |

| 65 years and over | 15.55 | 16.88 | 17.58 | 8.6% | 4.1% | 13.1% |

| Female | 16.82 | 18.30 | 19.20 | 8.8% | 4.9% | 14.1% |

| Male | 19.95 | 21.46 | 22.57 | 7.6% | 5.2% | 13.1% |

| Total, all | 17.71 | 19.28 | 20.15 | 8.9% | 4.5% | 13.8% |

| Minnesota | Median Wage | Percent Change | ||||

| 19 and under | 11.36 | 12.13 | 13.08 | 6.8% | 7.8% | 15.1% |

| 20 to 24 years | 15.00 | 16.01 | 17.16 | 6.7% | 7.2% | 14.4% |

| 25 to 44 years | 23.08 | 24.86 | 26.00 | 7.7% | 4.6% | 12.7% |

| 45 to 54 years | 26.63 | 28.74 | 29.98 | 7.9% | 4.3% | 12.6% |

| 55 to 64 years | 24.92 | 26.39 | 27.34 | 5.9% | 3.6% | 9.7% |

| 65 years and over | 17.16 | 18.68 | 19.53 | 8.9% | 4.6% | 13.8% |

| Female | 19.52 | 21.08 | 22.04 | 8.0% | 4.6% | 12.9% |

| Male | 23.19 | 25.00 | 26.00 | 7.8% | 4.0% | 12.1% |

| Total, all | 20.45 | 22.16 | 23.07 | 8.4% | 4.1% | 12.8% |

| Source: DEED Quarterly Employment Demographics | ||||||

While wage growth is more than inflation over the two years, inflation started to erode wage growth in 2021. Wage growth for all Northwest Minnesota jobs beat inflation by 7.7 percentage points in 2020 and fell behind by 0.2 percentage points in 2021. Minnesota wages grew less and lost 0.6 percentage points to inflation in 2021. Using calendar years rather than the 12 months ending third quarter in the tables above brings the highest inflation months of 2021 into the comparison and shows the bite to wages started in calendar year 2021.

Males had slightly faster wage growth in 2021 than females in the Northwest, but 1.2 percentage points slower growth in 2020. Wage growth in 2021 was highest for workers under age 25 both in Minnesota and the Northwest, but even these workers did not come out as far ahead as in 2020. Workers 55 and older saw the slowest wage growth in 2021. However, wage growth could have been reduced to some if many high earners retired. Overall, the hourly median wage data shows pervasive purchasing power erosion from inflation in 2021 compared to 2020.

While zero inflation with blazing wage growth would be great, the same hot economy that produced the inflation surge first brought significant real wage growth (above inflation) before inflation surged, and it brought record low unemployment that continues to be exceptionally low. The recovery from the pandemic recession has been relatively prosperous for many workers, especially compared to the Great Recession recovery. The economy bottomed in June 2009, but the slack labor market did not start to tighten appreciably until 2016.

That is not to ignore the hardships caused to many by the recent inflation surge. It is encouraging that inflation has been steadily slowing since June. The hope is that wage growth tapers more slowly than inflation. A lot of workers have purchasing power to regain.