by Nick Dobbins

December 2017

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

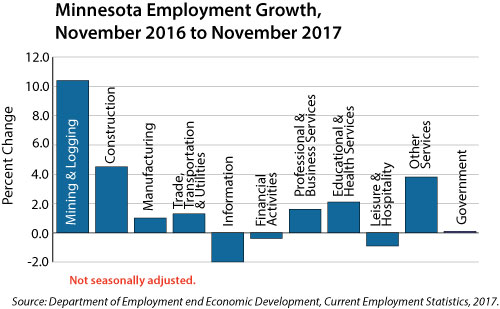

Minnesota lost 4,000 jobs (0.1 percent) in November on a seasonally adjusted basis. October preliminary estimates, which showed the loss of 4,500 jobs in the state, were revised to reflect losses of only 2,400 for that month. November’s losses were concentrated among service providers (off 5,200 or 0.2 percent) as goods producers added 1,200 jobs (0.3 percent). Both private and public sector employment shrank on the month. Annually the state added 34,566 jobs (1.2 percent). Goods producers showed larger proportionate growth at 2.1 percent (9,124 jobs), but the larger service providing segment of the economy added more total jobs, up 25,442 or 1 percent. Most of the annual growth was concentrated in the private sector, which was up by 33,988 or 1.4 percent. Government employers added just 578 jobs (0.1 percent) on the year.

Mining and Logging employment was up by 100 (1.4 percent) in November, with 7,100 total jobs. Employment in the supersector has remained somewhere between 6,900 and 7,100 in every month since March. Annually the supersector added 684 jobs (10.4 percent). This is an improvement on previous months, as annual growth had been generally declining since it hit 16.5 percent in February, the natural result of stabilizing employment after a tumultuous prior year.

Employment in the Construction supersector was up by 1,800 (1.5 percent) in November on a seasonally adjusted basis. The increase follows a nearly identical loss of 1,900 in October, suggesting that the supersector underwent its seasonal contraction slightly earlier this year, perhaps caused by weather conditions. Annually Construction employers added 5,384 jobs (4.5 percent). Specialty Trade Contractors spurred the growth, adding 5,292 jobs (6.8 percent). Heavy and Civil Engineering Construction chipped in 623 jobs (3.6 percent) while the third component, Building Construction, lost 531 jobs (2.1 percent).

Employment in the Manufacturing supersector was off by 700 (0.2 percent) in November. Non-Durable Goods Manufacturing employment remained flat at 118,900 jobs, while Durable Goods Manufacturers shed 700 (0.2 percent). Annually Manufacturing employment was up by 3,056 (1 percent), with both Durable (up 1,179, 0.9 percent) and Non-Durable (up 1,277, 1.1 percent) contributing to the growth. Food Manufacturing, a component sector of Non-Durable Goods, showed particularly strong growth, adding 2,058 jobs (4.4 percent) on the year.

Trade, Transportation, and Utilities employment was up by 2,300 (0.4 percent) in November. The Wholesale Trade sector led the surge, adding 2,000 jobs (1.5 percent). Retail Trade added 800 jobs of their own (up 0.3 percent), while Transportation, Warehousing, and Utilities lost 500 jobs (0.5 percent). Annually the supersector added 7,002 jobs (1.3 percent). Retail Trade employment was up by 5,775 (1.9 percent) over November of 2016, and Wholesale Trade was up 2,574 (1.9 percent). However, Transportation, Warehousing, and Utilities employment was off by 1,347 jobs (1.3 percent).

Employment in the Information supersector was off by 700 (1.4 percent) in November, on a seasonally adjusted basis. It was the second big decline for the industry group in the past three months, as it also shed 1,600 jobs (3.1 percent) in September. Annually Information employment was down by 1,027 (2 percent). Publishing Industries (Except Internet) lost 822 jobs (4.3 percent), and Telecommunications lost 202 jobs (1.7 percent).

Employment in the Financial Activities supersector was up by 500 (0.3 percent) in November. Real Estate and Rental and Leasing added 400 jobs (1.2 percent) while Finance and Insurance added 100 (0.1 percent). Annually the supersector lost 735 jobs (0.4 percent). Finance and Insurance showed decent growth, adding 1,255 jobs (0.9 percent), but Real Estate and Rental and Leasing continued to struggle (off by 1,990 or 5.8 percent). The component sector has been lagging since April, when over-the-year employment growth plummeted to -2.8 percent from March’s +0.2 percent.

Professional and Business Services employment was up by 1,800 (0.5 percent) in November. Likewise, October’s preliminary job losses were revised into a slight job bump for the month. November’s growth was driven by expansion in Administrative and Support and Waste Management and Remediation Services, which added 2,400 jobs (1.7 percent). Management of Companies and Enterprises lost 1,100 jobs (1.3 percent). Annually the supersector added 5,993 jobs (1.6 percent). A decline in Professional, Scientific, and Technical Services employment (off 3,032 or 1.9 percent) was offset by gains in the other two component sectors. Administrative and Support and Waste Management and Remediation Services employment was up by 7,646 (5.5 percent) on the back of Employment Services, which grew by 5,969 (9.3 percent). Management of Companies and Enterprises, the third component sector, added 1,379 jobs (1.7 percent).

Educational and Health Services employment was up slightly in November, adding 500 jobs (0.1 percent) over October. The previous month’s preliminary estimate was also revised up, from a loss of 2,400 to a loss of 1,600. November’s growth was concentrated in Educational Services, which added 700 jobs (1.1 percent). Employment in Health Care and Social Assistance was largely flat, down by 200 jobs (0.0 percent). Over the year the supersector added 11,435 jobs (2.1 percent). Health Care and Social Assistance employment was up by 14,556 (3.2 percent), spread among component sectors. Educational Services employment, on the other hand, declined on the year, off by 3,121 (4.3 percent).

Leisure and Hospitality continued its volatile seasonally-adjusted performance in November as it lost 7,500 jobs (2.8 percent). The supersector has now had both its largest increase and its largest decrease in 2017 (in June and November, respectively), suggesting that the seasonal effects that dominate the supersector may have shifted for the past year. Annually employment in the supersector was down slightly, off by 2,270 (0.9 percent). Arts, Entertainment, and Recreation was up by 1,114 (3.2 percent), but its growth was overshadowed by the loss of 3,384 jobs (1.6 percent) in Accommodation and Food Services.

Other Services employment was off sharply in November, losing 1,500 jobs (1.2 percent) from October estimates. However, October’s 400 jobs decrease was revised up to a 500 job increase (0.4 percent). Annually Other Services added 4,466 jobs (3.8 percent). Repair and Maintenance added 1,403 jobs (6.4 percent), while Religious, Grantmaking, Civic, Professional, and Similar Organizations added 2,580 (4 percent).

Government employers lost 600 jobs (0.1 percent) in November. Federal employers lost 500 jobs (1.5 percent), and State employers lost 100 (0.1 percent). Annually Government employment was largely flat, up by 548 (0.1 percent) since November 2016.

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | Nov-17 | Oct-17 | Sep-17 |

| Total Nonfarm | 2,949.1 | 2,953.1 | 2,955.5 |

| Goods-Producing | 450.0 | 448.8 | 450.3 |

| Mining, Logging, and Construction | 128.4 | 126.5 | 128.5 |

| Construction | 121.3 | 119.5 | 121.4 |

| Manufacturing | 321.6 | 322.3 | 321.8 |

| Service-Providing | 2,499.1 | 2,504.3 | 2,505.2 |

| Trade, Transportation and Utilities | 542.0 | 539.7 | 540.8 |

| Information | 49.4 | 50.1 | 49.8 |

| Financial Activities | 176.3 | 175.8 | 176.3 |

| Professional and Business Services | 381.0 | 379.2 | 379.0 |

| Educational and Health Services | 540.1 | 539.6 | 541.2 |

| Leisure and Hospitality | 260.2 | 267.7 | 266.9 |

| Other Services | 119.6 | 121.1 | 120.6 |

| Government | 430.5 | 431.1 | 430.6 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2017. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.