by Carson Gorecki

July 2022

The pandemic left a mark on almost every corner of the economy. In Northeast Minnesota nearly 11,800 jobs were lost between 2019 and 2020. As of the end of 2021, regional employment remained down 6,800 from 2019 levels. Job losses were spread across most industries. From 2019 to 2021 every sector in Northeast Minnesota lost jobs except for one. The lone sector to add jobs over the last two years was the Professional, Scientific, and Technical Services sector. With 4,719 jobs the Professional, Scientific, and Technical Services sector accounted for 3.5% of regional employment in 2021. Total employment was up 361 jobs (8.3%) from 2019 levels. While the sector actually lost eight jobs between 2019 and 2020, that represented the smallest absolute and relative loss (0.2%) among all 20 sectors.

Even within other regions that experienced relatively smaller total jobs losses, the respective Professional, Scientific, and Technical Services sectors did not fare as well as in Northeast Minnesota. From 2019 to 2021 only Southeast Minnesota also experienced gains in the sector, while the sector statewide lost over 1,300 jobs. The Twin Cities Metro alone saw a decline of 3,500 Professional, Scientific, and Technical Services jobs. The unique performance of the Professional, Scientific, and Technical Services sector warrants a closer look. Is there some characteristic or trend that positioned it better to weather the pandemic economy?

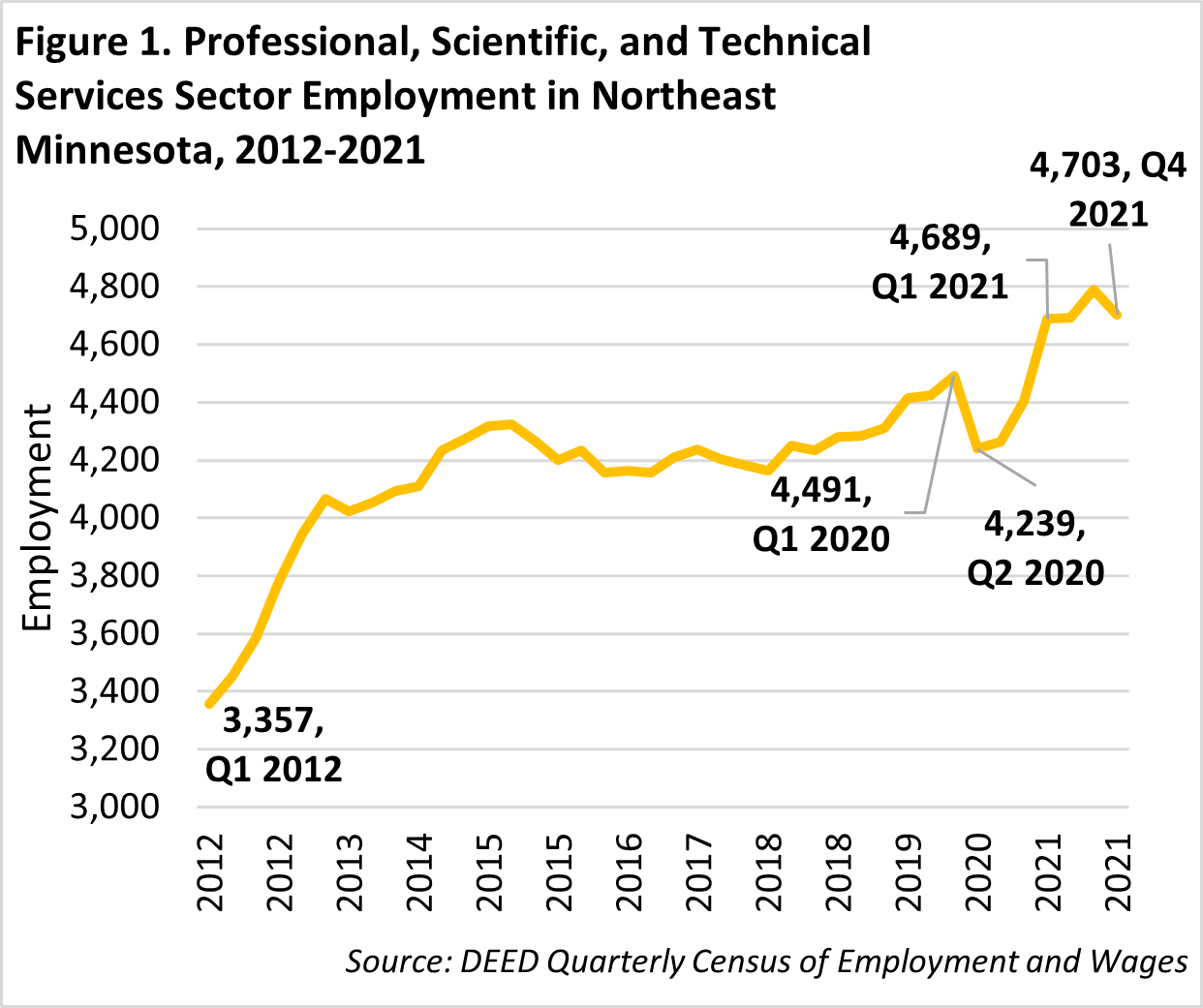

Strong employment growth in the Professional, Scientific, and Technical Services sector is not only a short term trend. From 2012 until before the onset of the pandemic, the sector grew by 814 jobs or 23% (see Figure 1). That growth trailed only the Twin Cities Metro over the period. When you include the subsequent two years, Northeast Minnesota jumps ahead of the pack in employment growth in the sector (see Table 1). While there was one quarter of decline in 2020, the pre-pandemic growth trajectory was regained three quarters later. As of the end of 2021, many other sectors had yet to return to pre-pandemic levels of employment.

| Table 1. Professional, Scientific, and Technical Services Employment Change by Selected Period and Area | |||||

|---|---|---|---|---|---|

| Area | 2019-2020 | 2020-2021 | 2019-2021 | 2012-2019 | 2012-2021 |

| Minnesota | -3.4% | 2.7% | -0.8% | 22.1% | 21.1% |

| Central Minnesota | -3.7% | 2.9% | -0.9% | 15.9% | 14.9% |

| Northeast Minnesota | -0.2% | 8.5% | 8.3% | 23.0% | 33.2% |

| Northwest Minnesota | -2.7% | 1.5% | -1.3% | +7.8% | 6.4% |

| Seven County Mpls-St Paul, MN | -3.4% | 0.7% | -2.8% | 23.7% | 20.2% |

| Southeast Minnesota | -3.7% | 8.8% | 4.9% | -10.1% | -5.7% |

| Southwest Minnesota | -6.6% | 1.3% | -5.3% | -1.8% | -7.0% |

| Source: DEED Quarterly Census of Employment & Wages | |||||

The Professional, Scientific, and Technical Services sector relies on the skills, knowledge, and expertise of employees to deliver services1. The emphasis on human capital is a feature that separates the sector from others. Additionally, Professional, Scientific, and Technical Services jobs pay much higher than the all-industry average. In 2021 the average annual wage was just under $72,000, nearly $20,000 greater than the regional average and the fourth highest among sectors. The three sectors with higher wages (Mining, Utilities, and Management) all had fewer employees.

The industries within the Professional, Scientific, and Technical Services sector provide a clearer picture of the types of activities performed by businesses. The sector includes legal, accounting, architectural, design, computing, research, and advertising services. The largest Professional, Scientific, and Technical Services industry by employment is Architectural, Engineering, and Related Services with just under a third of the sector's jobs. It is also the industry with the highest wage (see Table 2). The next largest industries are Computer Systems Design and Related Services (18.1% of jobs), Other Professional, Scientific, and Technical Services (13%), and Accounting, Tax Preparation, Bookkeeping, and Payroll Services (11.7%).

| Table 2. Industry Employment Statistics of the Professional, Scientific, and Technical Services Sector by Detailed Industry in Northeast Minnesota, 2021 | |||||

|---|---|---|---|---|---|

| Industry | 2021 Employment | 2021 Establishments | 2021 Average Annual Wage | 2019-2021 Employment Change | 2019-2021 Percent Employment Change |

| Total, All Industries | 134,564 | 8,930 | $52,221 | -9,119 | -6.3% |

| Professional, Scientific, and Technical Services | 4,719 | 557 | $71,825 | 361 | 8.3% |

| Legal Services | 475 | 100 | $59,475 | 17 | 3.6% |

| Accounting, Tax Preparation, Bookkeeping, and Payroll Services | 552 | 109 | $64,831 | 14 | 2.7% |

| Architectural, Engineering, and Related Services | 1,405 | 96 | $87,594 | 73 | 5.5% |

| Specialized Design Services | 28 | 16 | $34,723 | -4 | -12.6% |

| Computer Systems Design and Related Services | 854 | 54 | $79,339 | 115 | 15.5% |

| Management, Scientific, and Technical Consulting Services | 252 | 43 | $77,831 | 39 | 18.2% |

| Scientific Research and Development Services | 351 | 8 | $76,921 | 23 | 7.0% |

| Advertising and Related Services | 188 | 27 | $59,436 | -7 | -3.7% |

| Other Professional, Scientific, and Technical Services | 612 | 106 | $42,081 | 94 | 18.2% |

| Source: MN DEED Quarterly Census of Employment and Wages | |||||

Compared to the statewide distribution of Professional, Scientific, and Technical Services employment, Northeast Minnesota has nearly twice the share of jobs in the Architectural, Engineering, and Related Services industry. Sector employment is also more concentrated in the Scientific Research and Development, and Other Professional, Scientific, and Technical Services, and Accounting, Tax Preparation, Bookkeeping, and Payroll Services industries. Conversely, the region has a significantly smaller share of Management, Scientific, and Technical Consulting Services, and Specialized Design Services employment. Computer Systems Design and Related Services is less concentrated but added the most jobs (115) from 2019-2021. Over the pandemic Other Professional, Scientific, and Technical Services also added nearly 100 jobs. In addition to those two industries, Management, Scientific, and Technical Consulting Services also saw employment growth above the sector average.

The specialized work done in the Professional, Scientific, and Technical Services sector is often achievable by small businesses or even individuals. The average number of employees per firm is under nine. Across all industries the number of employees per firm is just over 15. In addition to the over 540 Professional, Scientific, and Technical Services employer establishments in the region, there is also a significant number of non-employer firms. As of 2019 nearly 2,500 establishments in the sector had annual business receipts of more than $1,000, but no employees. These businesses generally referred to as independent contractors, made up a larger share (81%) of establishments in the Professional, Scientific, and Technical Services sector than the all-sector average (70.4%). The Professional, Scientific, and Technical Services sector accounts for 3.5% of total employment and 8.6% of non-employer firms. From 2014 the number of non-employer Professional, Scientific, and Technical Services firms grew 6.2% (145) whereas the total number of non-employers grew 1.9% (386)2.

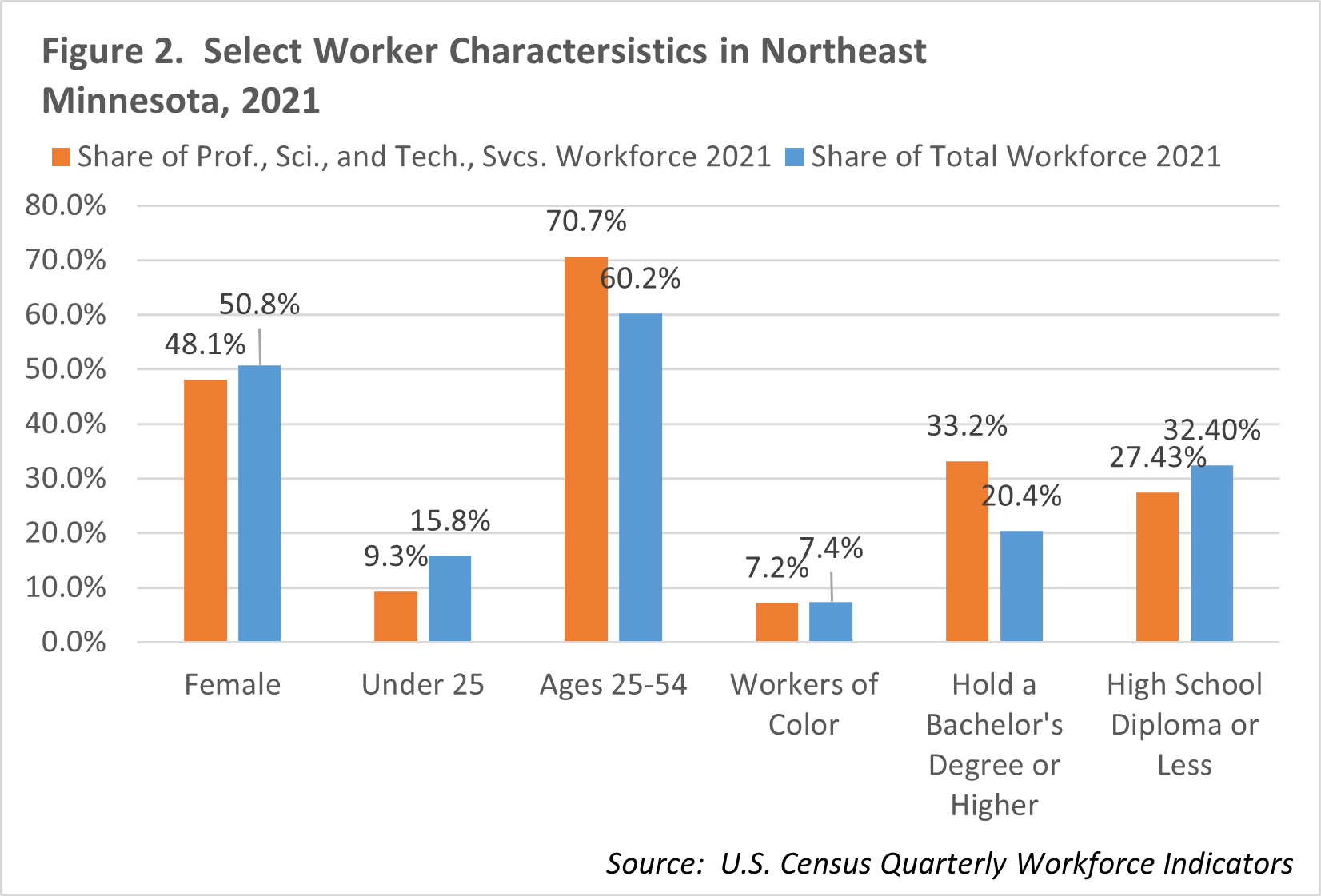

The Professional, Scientific, and Technical Services sector workforce matches the overall workforce on a couple of demographic measures but varies on many others. Just over 7% of Professional, Scientific, and Technical Services jobs are filled by workers of color, just as they are economy wide. 5.2% of Professional, Scientific, and Technical Services jobs are filled by workers 65 or older, slightly lower than the 5.8% of all jobs by older workers (see Figure 2). From there it is easier to discern the differences. A smaller share of the Professional, Scientific, and Technical Services workforce is female (48.1%) compared to the 50.8% of all jobs held by women. In both cases the share of female workers has declined recently, yet it has fallen further for Professional, Scientific, and Technical Services workers, down from 52.1% in 2011 (51.8% for all jobs). In 1995 nearly 60% of Professional, Scientific, and Technical Services employment was female. Among Professional, Scientific, and Technical Services industries, Legal Services has twice as many woman employees as men, and 75.9% of Other Professional, Scientific, and Technical Services workers are women. At the other end of the spectrum, the largest industry – Architectural, Engineering, and Design Related Services – is 73% male, and Computer Systems Design and Related Services is 70.3% male.

Over 70% of Professional, Scientific, and Technical Services workers are between the ages of 25 and 54, often considered the prime working years. A lower 60% of the total workforce is in the prime working age group. This means that a smaller share (9.3% compared to 15.8%) of the Professional, Scientific, and Technical Services sector's workforce is under age 25. Only 2.5% of workers are under the age of 22 compared to 9.7% of the entire workforce. The trend of fewer younger workers can largely be attributable to the higher-than-average educational requirements of jobs in the sector. Reflecting the typical educational requirements of jobs in the sector, nearly two out of three workers have some college experience or an associate degree (30.1%) or a bachelor's or advanced degree (33.2%). Just over 51% of workers in all industries have at least some college experience or more.

Separate from the educational attainment of current workers in the sector is the typical educational attainment of occupations or what is needed to obtain a particular job. Of all the occupations in the Professional, Scientific, and Technical Services sector, more than half (56%) have a typical educational requirement of a bachelor's degree or higher. Of the top 10 most common occupations in the sector, seven require postsecondary education, and six require at least a bachelor's degree (See Table 3).

| Table 3. Top Professional, Scientific, and Technical Services Occupations and Typical Educational Requirements, 2021 | ||

|---|---|---|

| Occupation | Share of Sector Employment | Typical Educational Requirements |

| Accountants and Auditors | 6.2% | Bachelor's Degree |

| Lawyers | 4.4% | Graduate Degree |

| Market Research Analysts and Marketing Specialists | 4.0% | Bachelor's Degree |

| Office Clerks, General | 3.9% | High School or Less |

| Civil Engineers | 3.7% | Bachelor's Degree |

| Mechanical Engineers | 3.6% | Bachelor's Degree |

| Software Developers & Software Quality Assurance Analysts & Testers | 3.4% | Bachelor's Degree |

| Paralegals and Legal Assistants | 2.9% | Associate Degree |

| Secretaries & Administrative Assistants, Except Legal, Medical, & Exec. | 2.9% | High School or Less |

| Tax Preparers | 2.7% | High School or Less |

| Source: MN DEED Educational Requirements, Occupational Staffing Patterns | ||

The historically high educational requirements of the Professional, Scientific, and Technical Services sector appear to be relaxing under the effects of the pandemic. The share and number of workers with a high school diploma or less is up from 25.9% in 2019 to 27.4% in 2021. The share of workers for which educational attainment was not available Because they were under 25 also increased over the pandemic. Each of these movements represented accelerations of trends that existed leading up to the pandemic.

In terms of race and ethnicity, the sector largely mirrors the rest of the regional workforce. Just under 93% of workers are white, just over 7% are workers of color. There is a smaller share of groups of color except for the share of workers that identify as Asian, which is more than twice the percentage (3.8%) of the total workforce (1.4%). Despite the small share of workers of color, the Professional, Scientific, and Technical Services workforce is diversifying. The number of workers of color has more than doubled in less than a decade. However, unlike the total workforce, in which workers of color have accounted for 86% of all jobs added in the last decade, Professional, Scientific, and Technical Services workers of color have represented only 15% of the jobs added in the last 10 years.

Professional, Scientific, and Technical Services job vacancies are actually down in the most recent period in Northeast Minnesota. The 63 openings recorded in Q4 2021 were the lowest since the first half of 2019 and less than half the 20-year series average. Statewide Professional, Scientific, and Technical Services vacancies, however, have tracked pretty closely to all industries. Perhaps counterintuitively, this could be another indication of the relative success for the sector locally. More vacancies and higher vacancy rates are usually a sign of higher demand for workers, which in pre-pandemic times could mean a strong and growing industry. But in the context of today's super tight labor market, lower vacancy levels could mean that the sector has enjoyed more success in hiring and retaining workers than others. Median wage offers in the Professional, Scientific, and Technical Services sector have grown significantly over the last two years, from the decade-low $16.75 in Q2 2020 up to $27.55 in Q4 2021. Rapidly rising wage offers could be a response to increased competition for talent for those jobs that need to be filled. They could also be a sign that lower wage openings have dropped in number.

| Table 4. Northeast Minnesota Projected Employment Growth by Sector, 2020-2030 | ||

|---|---|---|

| Sector | Projected Percent Employment Change | Projected Numeric Change |

| Agriculture., Forestry, Fishing and Hunting | 32.3% | 332 |

| Arts, Entertainment, and Recreation | 30.0% | 784 |

| Accommodation and Food Services | 20.5% | 2,400 |

| Other Services, Ex. Public Admin | 10.5% | 601 |

| Health Care and Social Assistance | 9.2% | 2,968 |

| Professional and Technical Services | 7.2% | 331 |

| Administrative and Waste Services | 6.1% | 179 |

| Information | 5.7% | 65 |

| Total, All Industries | 5.5% | 8,115 |

| Source: MN DEED Employment Outlook | ||

The Professional, Scientific, and Technical Services sector has performed well over the last several years, but what is its outlook for the period to come? The latest industry employment projections predict continued strong growth. The Professional, Scientific, and Technical Services sector is expected to grow 7.2% which would be about 331 new jobs in the region between 2020 and 2030 (see Table 4). The projected percent growth of the sector is above the all-sector average of 5.5%. Five sectors have higher projected employment growth: Agriculture, Forestry, Fishing, and Hunting is one of the smallest sectors in terms of employment, and three others (Arts, Entertainment, and Recreation, Accommodation and Food Services, and Other Services) have at least some projected growth attributable to ongoing recoveries. Driving the growth in the sector are the Computer Systems Design and Related Services (21.4%) and Other Professional & Technical Services (12.4%) which are expected to account for over three quarters of new job growth.

The Professional, Scientific, and Technical Services sector has thus far sailed through the pandemic period relatively unscathed. Part of its durability could be attributed to the many large construction and engineering projects taking place in the region over the past couple years. Large-scale projects such as the construction of the new Essentia Vision Northland facility and the rebuilding of the I-35/I-535 interchange in Duluth require a lot of work uniquely performed by Professional, Scientific, and Technical Services firms as does the lucrative Mining sector. Additionally, the technological emphasis of much of the work in the Professional, Scientific, and Technical sector may mean that more workers were able to transition to remote work or telework, both further insulating workers from pandemic-related effects as well as making the sector more appealing to those in search of increased workplace flexibility. Whatever the factors, Professional, Scientific, and Technical Services looks to build upon its recent success in the region with continued job growth in the future.