by Luke Greiner

November 2023

The Retail Trade industry has long been a cornerstone of economic activity in Central Minnesota, serving as both a reflection of local consumer trends and a significant source of employment for the region. Retail stores, both big and small, have thrived in the heart of the state for decades, providing a diverse array of goods and services to residents and shoppers from outside the region.

Retail Trade employers in Central Minnesota have experienced a myriad of challenges and opportunities over the past few years while relying on retail workers to rise to the occasion. The Retail Trade industry at large has undergone significant transformations, including the advent of e-commerce and shifts in consumer preferences, while the labor market dynamics within Central Minnesota present their own distinct set of circumstances.

Central Minnesota's retail labor landscape is marked by its blend of urban and rural areas, with vastly different retail environments for both consumers and the workers employed by retailers. Counties like Pine and Wright have Retail Trade employment that is at least 1.5 times more concentrated than it is for the state overall, while Renville County has one of the lowest concentrations in Minnesota.

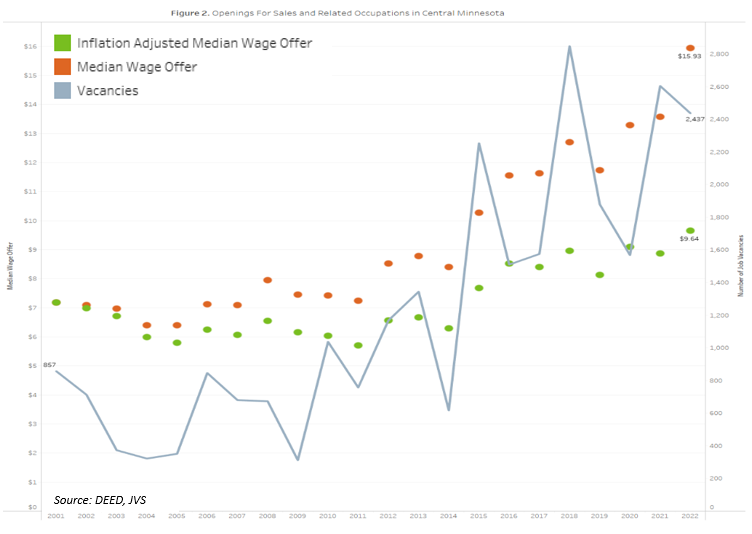

Employment levels in Retail Trade are, of course, dependent upon employers being able to turn job openings into job hires, a challenge that has become more acute since 2020. Recruitment and retention have become a substantial concern for retail employers in Central Minnesota. In a region where the labor market can be as dynamic as the ever-changing seasons, finding and keeping skilled and committed workers is no small feat.

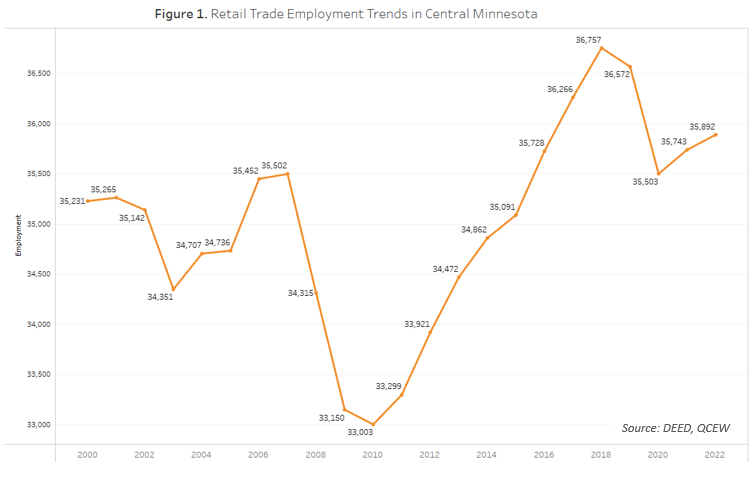

After experiencing massive declines in employment from layoffs during the Great Recession from 2008 to 2010, the industry recovered employment levels by 2016 and continued adding jobs until 2019 when employment fell slightly. But the worst was yet to come, as the COVID-19 pandemic caused an abrupt end to the longest economic expansion in U.S. history in 2020. Retail Trade employment in Central Minnesota dropped by 1,069 jobs, a 3% decline. Despite the economic volatility in 2020, Retail Trade in Central Minnesota did relatively well during the Pandemic Recession, especially compared to the overall regional economy, which declined by 5.4% and in comparison to statewide Retail Trade employment, which fell by 5.7%.

Meanwhile, job vacancies for Retail Trade workers in Central Minnesota have been at historically high levels for the past few years, highlighted by 3,300 openings in 2022, the second highest number on record. Sluggish employment coupled with record numbers of job openings illustrates how the tight labor market is preventing retailers from expanding and recovering employment levels. If Central Minnesota retailers filled every opening they posted, employment in the sector would climb to nearly 39,000 jobs, which would be well above the previous employment peak in 2018 (see Figure 1).

More than half of all jobs at Retail Trade establishments are held by Sales and Related workers, including occupations such as Retail Salespersons and Cashiers, which are typically filled by entry level workers gaining their first experience in the labor market. Entry level positions combined with high seasonality in the industry drive up turnover rates and create a constant need for workers to fill openings.

Figure 2 illustrates how wages have grown increasingly competitive as openings increased and employers across sectors continue to compete for a limited supply of labor. From 2021 to 2022 the median wage offer for Sales and Related positions grew by 17% to nearly $16. After adjusting for inflation, however, the impact of that wage growth was almost halved. Some retail employers have responded to inflation by offering cost-of-living adjustments or wage increases to retain and motivate their workforce. This isn't universal though, and the extent to which retail workers benefit from these initiatives varies.

As mentioned previously, retailers frequently rely on entry level workers to fill large numbers of openings. There are ample opportunities, however, for career growth beyond entry-level positions in the Retail Trade industry. These include roles in store management, visual merchandising, buying and merchandise planning, loss prevention and asset protection, human resources and training, e-commerce and online sales, corporate and regional positions, franchise ownership, and specialty roles. These positions demand diverse skill sets, ranging from management and design to analysis and digital marketing, and can lead to fulfilling and long-term careers within the retail sector.

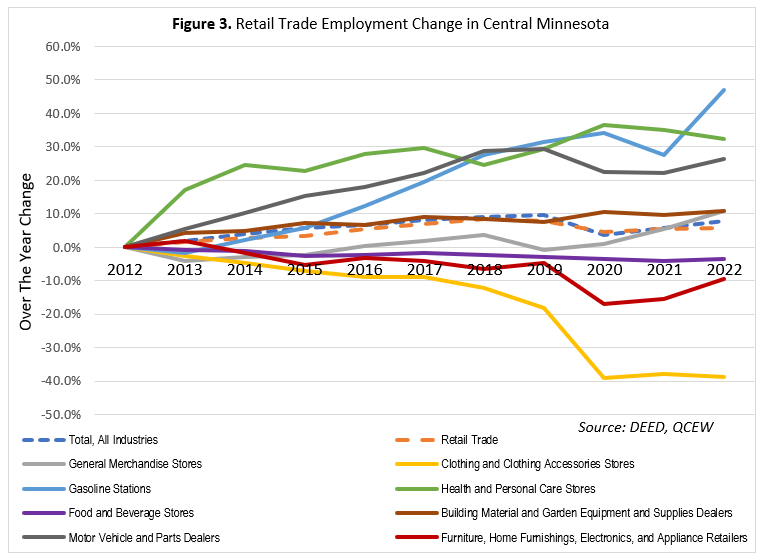

As shown in Figure 3, the overall Retail Trade sector has closely followed total employment growth in the region over the last decade, growing by 6% compared to 8% for the broader economy. At a more detailed level, the fastest growth has been at Gasoline Stations, which increased a whopping 47% over the period by gaining an additional 1,736 net new jobs. In sum, Gasoline Stations provided 5,427 jobs in 2022 or 15% of Retail Trade employment. These new jobs at Gasoline Stations accounted for 88% of employment growth in the entire Retail Trade sector, an interesting trend considering the variety of policies during the same period that were aimed at reducing reliance and demand of internal combustion engines and promote "green" vehicle technology.

Another fast-growing segment in the Retail Trade sector is Health and Personal Care Stores with 1,568 jobs. Growing 32% from 2012 to 2022 with 383 new jobs, this area experienced rapid growth but because of its relatively small size, only accounted for 19% of Retail Trade growth over the same period. Meanwhile the much larger Motor Vehicle and Parts Dealers subsector grew 26% yet added more than 1,140 jobs. The largest subsector is General Merchandise Stores, which had nearly 8,100 jobs in the region in 2022 after growing 11% over the decade. Building Material and Garden Equipment and Supplies Dealers had more than 3,600 jobs after adding 352 jobs since 2012, also an 11% increase.

Owing to shifting customer preferences, employment decline within Retail Trade has been focused in the following subsectors: Clothing and Clothing Accessories Stores, which is down 39% since 2012, as well as the Furniture, Home Furnishings, Electronics, and Appliance Retailers, where 10% of jobs were cut. Food and Beverage Stores maintained relatively stable employment without any major fluctuations but are still down by 4% over this period. Combined, these retailers have 1,329 fewer jobs than they did in 2012, offsetting much of the gains made elsewhere (Figure 3).

Consumer preferences in the Retail Trade industry are undergoing notable shifts, influenced by a combination of factors, including technological advancements and changing consumer preferences. One prominent trend is the growing popularity of e-commerce, where online shopping and home deliveries have become increasingly convenient for consumers. This change, accelerated by the COVID-19 pandemic, has prompted both traditional and online retailers to adapt by improving their digital platforms and creating versatile shopping experiences that blend the online and offline worlds. Unfortunately, this change can sometimes come at a cost as local brick and mortar retailers in certain segments pull back employment to compete against national or multinational corporations.

The Retail Trade industry has been undergoing a profound transformation. Rapid advancements in technology and evolving consumer preferences are reshaping the way retailers operate. From the rise of e-commerce to the demand for personalized shopping experiences, the changing nature of retail is both a challenge and an opportunity for businesses in Central Minnesota. As retailers adapt to these shifts, they are not only reshaping their business models but also redefining their role in the labor market. As retailers adapt to changing consumer preferences and a scarcity of labor, the need for their workers to be highly adaptable, technologically proficient, and capable of delivering exceptional customer experiences becomes increasingly paramount for success.