by Carson Gorecki

June 2023

The economic recovery from the coronavirus pandemic in Northeast Minnesota continued through 2022 and into 2023 yet remains incomplete by many measures. As of 2022, the region had regained less than half of the jobs lost during the early days of the pandemic, likely due in large part to a lack of available workers. The number of people working or looking for work declined by 4,363 from 2020 into 2021, a decrease of -2.7%. About 1,330 (30.5%) people returned or joined the labor force by the end of 2022, but the labor force was still down 3,165 people from 2019. As of March 2023, the regional labor force was 500 workers smaller than a year previous, demonstrating a loss of the momentum that was present earlier in the recovery.

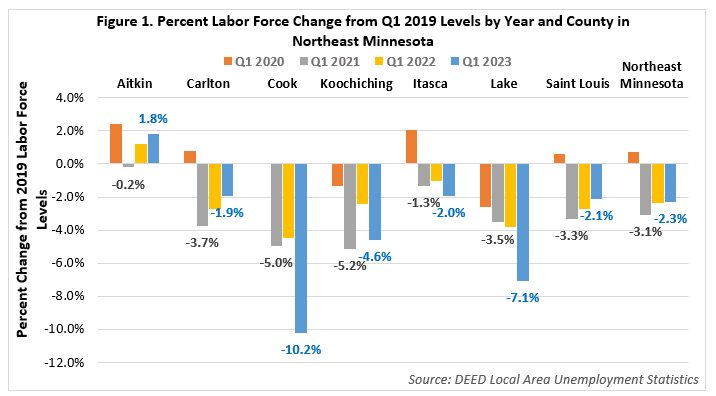

However, not every county in the region experienced the same trends of labor force decline since 2019. Aitkin County is unique as the local outlier, adding workers each of the past two years. For Carlton and St. Louis, the deficits have been slowly chipped away each year as people join or rejoin the labor force. Lake and Cook counties have seen recent accelerations in their labor force declines while Itasca and Koochiching have experienced more ups and downs over the last four years (see Figure 1). Cook County's workforce is the smallest of the seven counties, so a decline of 300 workers, like what occurred between 2019 and 2023, is felt much more acutely than the larger loss of 2,150 workers in St. Louis County.

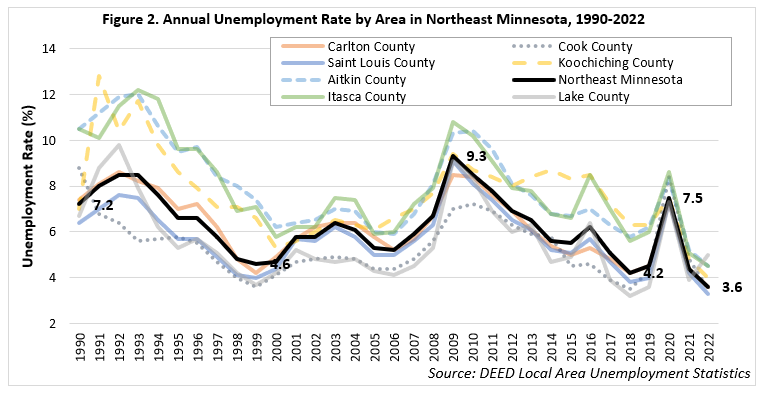

There are fewer people in the labor force than four years ago and the share of people looking for work (unemployed) has declined as well. As of March 2023, the regional unemployment rate was 4.2%. That monthly rate declined slightly from a year previous (4.5%). Recent local unemployment rates even hit historical lows. The 2.7% rate seen in October 2021 was the lowest ever recorded in Northeast Minnesota, and rates again dipped to 2.8% in the fall of 2022. The city of Duluth saw a 1.9% rate in April 2022 and Cook County's unemployment rate sat under 3% for five consecutive months last summer and fall, which is unprecedented.

The region's low unemployment rates are the continuation of a downward trend that began in 2009, interrupted for about a year by the pandemic. Following the Great Recession, the unemployment rate fell consistently from 2010 through 2018, at which time the region had the lowest annual rate (4.2%) reported to that point (see Figure 2). The average rate in the four years leading up to the pandemic was 5.0%, and the average rate over the last 12 months ending in March 2023 was 3.7%.

Another trend, in addition to the general decrease of unemployment rates across the region, was the tightening of the range of county unemployment rates. From 2014 to 2019, the average spread between the highest and lowest unemployment rates by county was 3.5 percentage points. That dropped by more than half to an average spread of 1.4 percentage points between 2020 and 2022, as workforce trends impacting unemployment were exhibited more universally across geography.

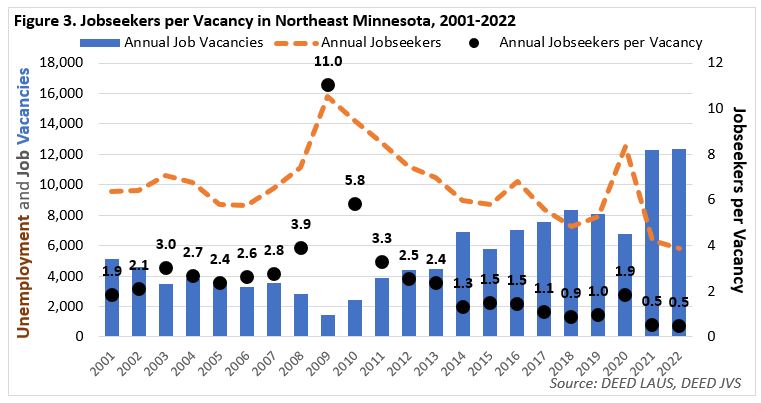

Job openings are a useful indicator of the demand for workers across the labor market. DEED's Job Vacancy Survey is a detailed source of job information in Minnesota by region for occupations and industries. As of last year, there were an estimated average of 12,388 job vacancies in Northeast Minnesota across all industries and occupations. Overall vacancies were up slightly (+0.6%) from 2021 into 2022, indicating continued high demand for workers across the region. That compared to a slight decline of openings statewide.

The relationship between the number of vacancies and the number of unemployed individuals provides a measure of labor market tightness. As unemployment fell and vacancies rose following the height of the pandemic, the labor market in Northeast Minnesota has tightened to record levels.

After almost doubling in 2020 due to the Pandemic Recession, the job seeker-to-job vacancy ratio fell to 0.5 the last two years, meaning that there were twice as many job openings as there were job seekers. The unemployment rate started to increase at the end of 2022 and into 2023, which should relieve at least some of the labor market tightness, but there is far to go until pre-pandemic job seeker-to-job vacancy ratios are reached again. In 2019, the ratio was about even, with one job seeker per every one job vacancy in the region (see Figure 3).

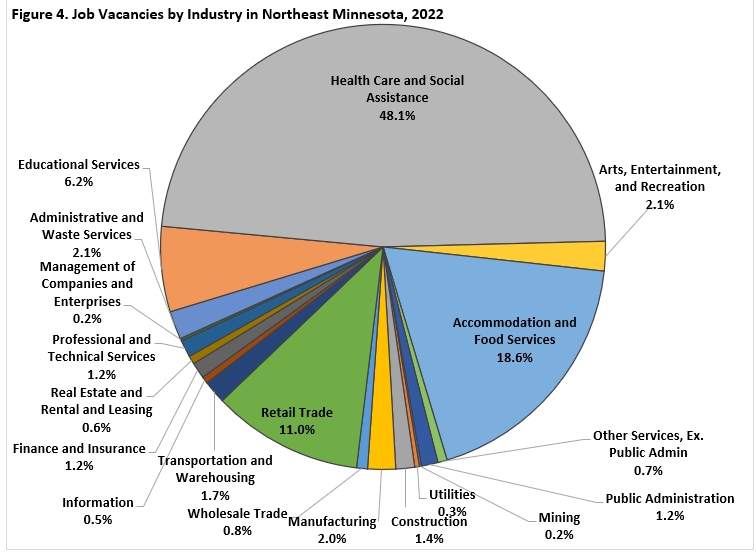

By a sizable margin, Health Care & Social Assistance was the industry sector with the largest number of vacancies, with just under 6,000 openings. That means that just under half of all vacancies in the region were for positions in Health Care & Social Assistance (see Figure 4). Accommodation & Food Services and Retail Trade were the sectors with the next largest numbers of vacancies, with 2,306 and 1,358 respectively. Including Educational Services, the top four sectors accounted for 83.9% of vacancies in the region, which is much more top-heavy than in the rest of the state.

The high concentration of vacancies in a few sectors is reflective of the high turnover often seen in lower-paying industries with more part-time or temporary positions such as Other Services, Retail Trade, Accommodation & Food Services, and Arts, Entertainment & Recreation, as well as the elevated longer-term demand for workers in sectors such as Health Care. While 29% of Health Care & Social Assistance vacancies in 2022 were part-time, more than half were part-time in Other Services, Educational Services, and Accommodation & Food Services.

Similarly, the bulk of Construction (85%) and Educational Services (59%) openings were flagged as temporary or seasonal, largely reflecting the nature of work in the two sectors. By comparison, only 1% of Health Care & Social Assistance vacancies were considered temporary or seasonal. All Mining, Manufacturing, and Professional, Scientific & Technical Services vacancies were for full-time roles. Across all Northeast Minnesota vacancies, 34% were for part-time positions and 11% were for temporary or seasonal positions.

Over the year, Educational Services, Manufacturing, Health Care & Social Assistance, and Finance & Insurance saw the largest growth in openings. Other Services, Real Estate, Wholesale Trade, Public Administration, and Mining saw the largest declines in the number of vacancies. Of the 20 sectors, half saw openings increase, and half saw fewer openings. The three sectors accounting for the most vacancies (Health Care & Social Assistance, Accommodation & Food Services, and Retail Trade) were also the top three employing industries in the region, but while they represented 47% of filled jobs, they accounted for almost 78% of vacancies.

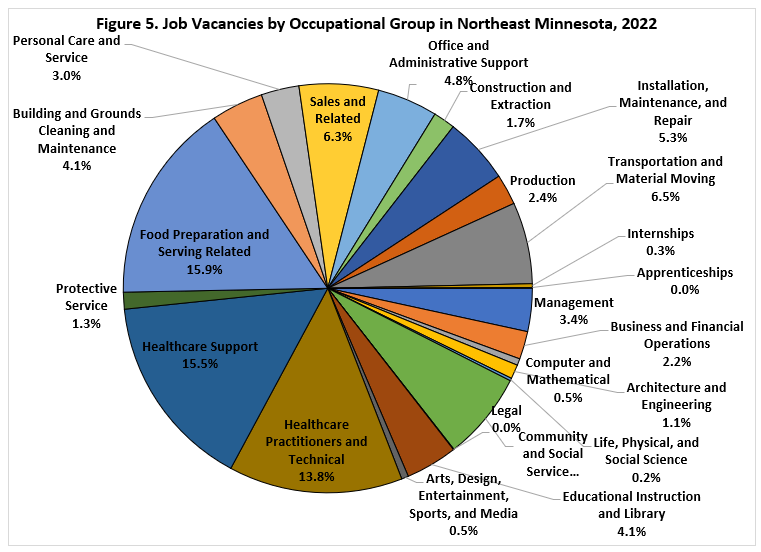

Broken down by occupation, job vacancies largely echoed that of the industries described above, with slightly more even distribution across more groups. Healthcare Practitioners & Technical and Healthcare Support occupations accounted for a combined 30% of vacancies, but Food Preparation & Serving Related openings were the highest for an individual group, tallying in at 1,974 (15.9%) (see Figure 5).

By individual occupation, the largest number of openings were for Mental Health Counselors (576), Registered Nurses (507), Waiters & Waitresses (489), Sales Representatives of Services (403), and Licensed Practical & Licensed Vocational Nurses (364). In the high number of openings, you can again see representation of some of those higher turnover occupations and industries such as Retail Trade and Accommodation & Food Services as well as Health Care.

Heightened demand for mental health professionals specifically arose as an emerging trend among job vacancies in the region. Along with Mental Health Counselors, RNs, and LPNs, Social & Human Service Assistants and Psychiatric Technicians also had more than 100 openings. The 16 estimated vacancies for Psychiatrists also equated to a vacancy rate above 54%, meaning that there were as many openings as there were employed Psychiatrists.

| Table 1. Year-over-year Percent Employment Change by Planning Region, 2019-2022 | |||

|---|---|---|---|

|

Region |

2019-2020 | 2020-2021 | 2021-2022 |

| Minnesota | -6.7% | +2.5% | +2.8% |

| Central Minnesota | -5.4% | +2.0% | +2.1% |

| Northeast Minnesota | -8.2% | +1.9% | +1.5% |

| Northwest Minnesota | -5.5% | +3.5% | +1.5% |

| Seven County Mpls-St Paul, MN | -7.4% | +2.1% | +2.8% |

| Southeast Minnesota | -5.5% | +2.1% | +0.8% |

| Southwest Minnesota | -5.3% | +1.0% | +1.6% |

| Source: DEED Quarterly Census of Employment and Wages | |||

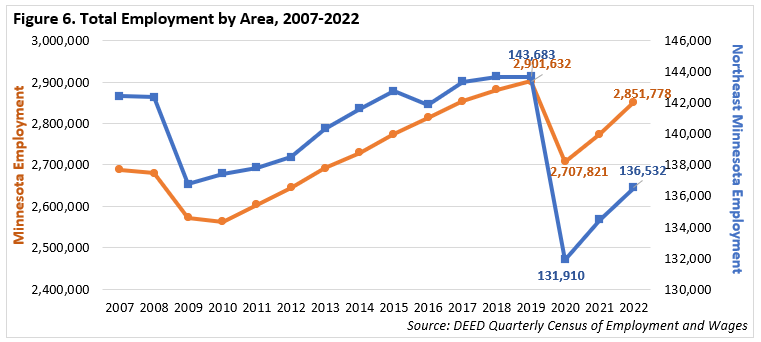

Northeast Minnesota remains about 7,200 jobs short of 2019 employment levels. Of the 11,800 jobs lost between 2019 and 2020, 4,600 or about 39% had been added back by the end of 2022 (see Figure 6). That is the lowest share among all six planning regions in the state. Northeast Minnesota lost relatively more employment, but also added jobs more slowly than the state average in each of the subsequent two years (see Table 1).

The larger percent employment declines and the smaller rebound relative to other areas of the state can be attributed, at least in part, to two major factors. First, as was discussed earlier in the article, the labor force decline in the region was larger than in other regions. Relatively more people stopped working or looking for work and have not returned to the labor force. An older than average population and lower than average population growth means that these workforce deficits are less easily overcome via the utilization of an extant workforce surplus. The other piece to the equation is that Northeast Minnesota had higher shares of those jobs that were most likely to be impacted or lost at the onset of the pandemic.

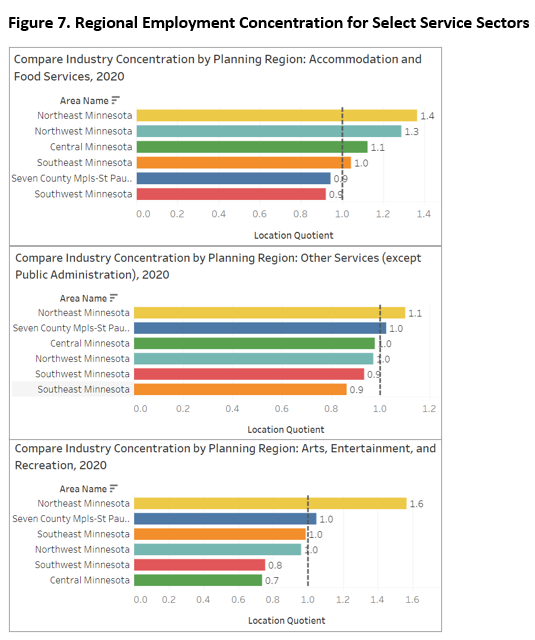

Northeast Minnesota had the highest concentration of Accommodation & Food Services, Arts, Entertainment, & Recreation, and Other Services employment in 2020 (see Figure 7). These three sectors saw the largest percent employment losses across the state from 2019 into 2020. In Northeast Minnesota in 2020, the employment losses in these three sectors ranged from -19.3% in Other Services to -25.6% for Arts, Entertainment & Recreation.

Following 2020, each sector added jobs back more quickly than others, accounting for three of the top four fastest growing over the subsequent two years. As a result, by 2022 the employment deficits of the three service sectors had shrunk, but remained larger than the regional average. Of the three service sectors, Accommodation & Food Services fared the best, recovering 68% of jobs lost initially. Arts, Entertainment, & Recreation and Other Services regained 55% and 42% respectively. Information continued its long-term trend of employment decline.

At the other end were the few sectors that gained jobs over the three years. Construction and Professional, Scientific, & Technical Services were the only two sectors that were up compared to 2019. The fastest growing sectors over the most recent period were Administrative Support & Waste Management Services (+11.9%), Accommodation & Food Services (+6.2%), and Other Services (+5.0%).

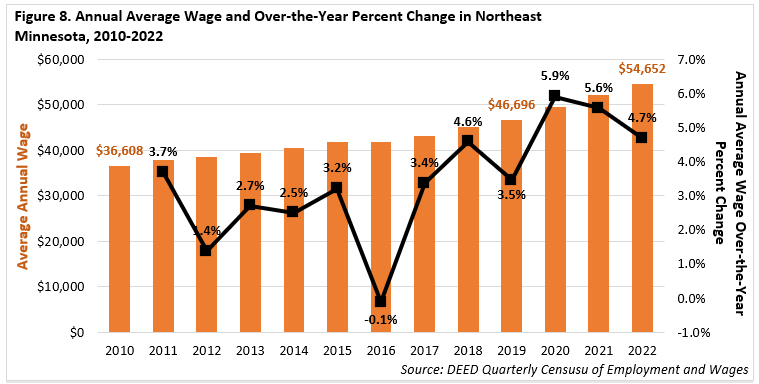

Rising wages (and inflation) were another big story of the last couple years. From 2019 to 2022, average annual wages for all jobs in Northeast Minnesota rose $7,956 or 17.0%. By comparison, the Consumer Price Index, a common measure of inflation, rose 14.5% over the same period. The last three years represented a noticeable acceleration of wage growth. From 2010-2019, which was largely the recovery from the Great Recession, the region saw average annual wage growth equal to 2.7%. From 2019 to 2022, wage growth doubled to an average annual increase of 5.4% (see Figure 8).

Some of the initial boost in average wages in 2020 was likely due to lower wage jobs being lost at higher rates. The three sectors to lose the largest share of jobs (Other Services ($32,552), Arts, Entertainment, & Recreation ($28,756), and Accommodation & Food Services ($21,268)) were also three of the four lowest paying as of 2020. As employment began to recover in most sectors, wage growth slowed slightly into 2021 and 2022. Leading wage growth were some of the highest paying sectors such as Mining and Finance & Insurance, which saw average annual wages grow by $38,300 and $13,300 respectively. Some of the lowest paying sectors also saw relatively large increases. Real Estate, Retail, and Accommodation & Food Services each saw average wages grow more than 20% (see Table 2). The slowest wage growth over three years occurred in Utilities, Information, and Agriculture, Forestry, Fishing, & Hunting.

| Table 2. Northeast Minnesota Industry Wage Statistics, 2019-2022 | ||||

|---|---|---|---|---|

|

Sector |

2022 Employment | Percent Employment Change 2019-2022 | 2022 Annual Average Wage | Percent Wage Change 2019-2022 |

| Mining | 3,985 | -5.5% | $127,348 | 30.4% |

| Utilities | 1,462 | -0.3% | $104,988 | 1.8% |

| Management of Companies & Enterprises | 730 | -3.2% | $100,100 | 16.6% |

| Finance & Insurance | 3,904 | -10.0% | $75,400 | 27.5% |

| Professional, Scientific, & Technical Services | 4,646 | 6.6% | $74,932 | 15.1% |

| Construction | 7,258 | 3.6% | $72,436 | 12.8% |

| Wholesale Trade | 2,883 | -3.4% | $70,044 | 12.0% |

| Manufacturing | 8,746 | -1.6% | $68,536 | 11.3% |

| Transportation & Warehousing | 3,790 | -10.1% | $60,892 | 13.5% |

| Health Care & Social Assistance | 32,249 | -6.8% | $60,892 | 17.8% |

| Public Administration | 10,712 | -4.0% | $60,788 | 13.4% |

| Total, All Industries | 136,532 | -5.0% | $54,808 | 17.4% |

| Educational Services | 11,400 | -4.0% | $51,844 | 11.5% |

| Information | 1,092 | -16.7% | $50,596 | 6.6% |

| Agriculture, Forestry, Fishing & Hunting | 536 | -7.4% | $42,640 | 6.8% |

| Real Estate and Rental & Leasing | 1,214 | -5.9% | $39,208 | 20.4% |

| Administrative Support & Waste Management | 3,198 | -6.9% | $35,100 | 15.6% |

| Retail Trade | 16,677 | -2.4% | $32,864 | 20.6% |

| Other Services (except Public Administration) | 4,569 | -11.2% | $32,552 | 13.0% |

| Arts, Entertainment, & Recreation | 3,334 | -11.6% | $28,756 | 17.4% |

| Accommodation & Food Services | 14,142 | -7.0% | $21,216 | 23.6% |

| Source: DEED Quarterly Census of Employment and Wages | ||||

The recovery of the labor market is ongoing in Northeast Minnesota. Depending on where you look it can either appear encouraging or concerning. The labor force remains depressed in many areas and has continued to shrink in recent months for counties like Cook, Lake, and Koochiching. On the other hand, unemployment remains lower than it was pre-pandemic as more people looking for work have been able to find it. Yet, job vacancies remain near historic highs, indicating that a substantial portion of employer demand for workers is unmet.

For those that are working, wages have on average increased faster than measures of prices since 2019. However, wage growth that was robust early in the recovery has begun to slow faster than inflation has been falling, diminishing the effect of earlier wage gains. Additionally, wage growth differed significantly from sector to sector.

Lastly, while some jobs have returned, more than half that were lost in 2020 were not yet recovered two years later, according to the Quarterly Census of Employment and Wages. Employment growth also varied depending by sector. Many measures at the regional level indicate a continued recovery, but a deeper dive shows a more complex picture of recent labor market trends.