by Amanda Rohrer

June 2024

Despite inflation falling from the peaks set in 2022, the current rate still surpasses the Federal Reserve's 2% target. Certain goods and services are experiencing continued price hikes, while others are holding steady but remain elevated compared to previous years. All of these increases are factored into the Minnesota Department of Employment & Economic Development's newly released Cost of Living study.

Mandated by Minnesota Statute 2013, Chapter 116J, section 013, the Cost of Living estimates are designed to provide a metric of the cost of basic needs – what it takes to make ends meet for an individual or family – in Minnesota. Each year the estimates are released for various family compositions and regions, using a variety of inputs from other agencies. Current inflationary pressures have had impacts on the Cost of Living inputs. While no methodological adjustments were made this year, there are some specific trends and their impacts on the numbers that are worth noting.

The biggest category in household budgets as estimated by the Cost of Living is housing. For that, our input is the Department of Housing and Urban Development's Fair Market Rents. Those are released annually by county, so they're used without any need to adjust geographically. In the aggregate, housing costs went up by 5.7%, but the Twin Cities metro area tended to have more moderate increases of about 4.5%.

When calculating state averages, county values are weighted by population, so the more populous metro area has a disproportionate impact. Outside the metro, increases in housing costs were much higher – mostly around 7% to 9% with 12 counties surpassing 10% increases over the year. The metro area continues to have much higher housing costs, but in percentage terms costs are increasing more slowly. Increases have been consistent through the years and larger in the last few.

In 2021 there were major tax cuts that reduced the tax burden for most Americans, particularly in the income brackets estimated by the Cost of Living calculation. These affected the numbers published last year because we incorporate taxes for the year in which they're paid. Although some adjustments were made to account for the one-time nature of those credits, there was still a substantial across-the-board reduction in cost of living as a result of taxes. For this year's calculation, those credits are no longer in place and the rate of taxes is on par with two years ago.

There were also cost of living increases in the last few years due to increased costs in other categories. Housing and transportation have trended up. Food in particular has seen unusually high increases three of the last four years. The base income from which taxes are calculated has increased, and as a result the taxes for which the hypothetical families in the calculation are responsible have also gone up.

This means that across the board the amount calculated for taxes is higher this year than last by quite a lot, but also that compared to even a few years ago it's moderately higher. However, it's important to point out that for the most part, that change (from years immediately prior to the data released in 2023) is due to the higher income required from other categories, rather than a higher rate of taxation.

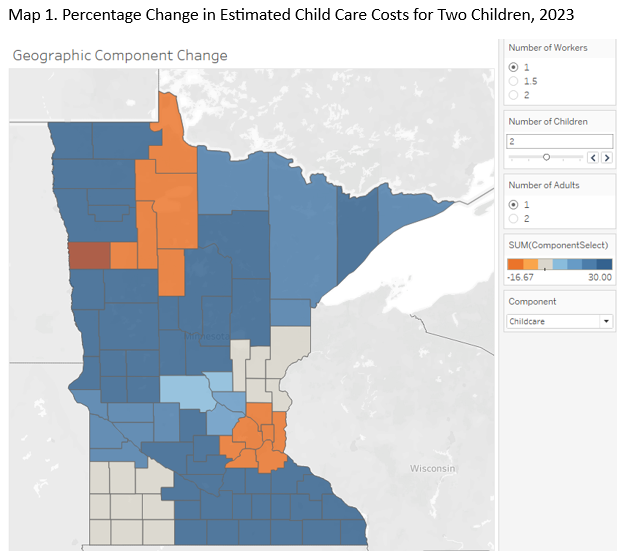

Child care costs come from Child Care Aware of Minnesota, which conducts a survey of providers every three years. They have just completed a new survey and have fresh responses. Their collection method has changed and as part of that we began aggregating responses to the Economic Development Region last year to better represent areas with small numbers of providers and longer average commutes. The combination of the new data and the larger areas of aggregation has resulted in some fluctuation in child care costs in our calculation.

In the map below, percentage change in estimated child care costs for households needing full-time care for two children is displayed. The orange areas saw cost declines, grey areas were essentially unchanged, and blue were increases. The Twin Cities metro is still by far the highest cost area for child care, but in our newer numbers the gap is closing.

Variable transportation costs are established by Vehicle Miles Traveled (VMT) by family size and number of workers from the National Household Travel Survey (NHTS), adjusted geographically by commute times by county from the American Community Survey. The NHTS is conducted every five years and this is the first post-pandemic update we've been able to incorporate.

The new survey results show substantial shifts in the base VMT numbers for required trips (i.e. health care, school, work, etc.). Regardless of household size, single worker households drove dramatically less in 2022 than 2017, while dual-income households drove slightly more.

The fixed costs went up by nearly 25%, while variable costs declined slightly, which softened this trend a little bit, but the effect was to increase the cost of transportation for two worker households and decrease it for single worker households.

It's worth noting that despite the increases in transportation costs this has precipitated, we're still estimating a lower cost for transportation than in the earliest years of the calculation. The recent increases are more challenging as other categories are a lot higher than they were then, but the estimated cost level is not unprecedented.

The latest Cost of Living study reveals persistent inflationary pressures affecting various aspects of daily expenses. Despite a decrease from peak inflation in 2022, goods and services are still being impacted in different ways. Housing costs, which constitute a significant portion of household budgets, experienced a 5.7% increase overall, with higher spikes outside the Twin Cities metro area. Tax adjustments following major cuts in 2021 influenced this year's calculations, resulting in higher overall tax burdens compared to previous years, notably affecting hypothetical families' income brackets.

Additionally, child care costs, based on fresh data from Child Care Aware of Minnesota, showed fluctuations due to methodological changes and geographic aggregations. While the Twin Cities metro remains the highest-cost area for child care, the gap is narrowing. Transportation costs, determined by VMT and adjusted for commute times, experienced shifts post-pandemic, with fixed costs rising by nearly 25%. Despite these increases, the overall transportation cost estimate remains lower than in earlier years, though recent spikes pose challenges amidst elevated costs in other categories, highlighting the ongoing complexities of assessing the cost of living in Minnesota.