by Nick Dobbins

January 2020

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.*

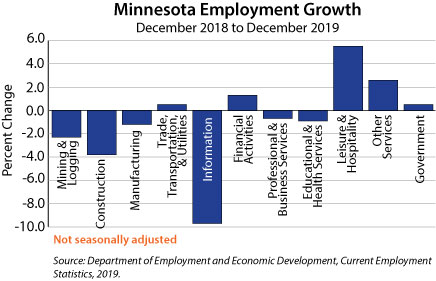

Minnesota employers added 200 jobs (0.0 percent) in December. Goods producers lost 1,500 jobs (0.3 percent) on the heels of November's 7,500-job decline, but service providers made up that loss with growth of 1,700 jobs (0.1 percent). Private sector employers lost 100 jobs (0.0 percent) while public sector employers added 300 (0.1 percent). On the year employers added 3,978 jobs (0.1 percent) with goods producers shedding 8,743 jobs (1.9 percent) while their service-providing counterparts added 12,721 (0.5 percent).

Mining and Logging employment was down by 100 (1.5 percent) in seasonally adjusted December employment. While small in real jobs, this was the largest proportional job loss of any supersector in the state. Over the year employment was down by 149 (2.3 percent).

Construction employment was down by 200 (0.2 percent) in December. The supersector has not added jobs since July. On the year Construction employment was down by 4,675 (3.8 percent). Over-the-year employment growth was negative in November and December, after posting strong growth for most of the year, peaking at 10.0 percent in April and never getting lower than October's 2.8 percent growth before dropping into the red in November, which may be a sign of stronger than usual employment in the supersector in the winter of 2018.

Employment in the Manufacturing supersector was down by 1,200 (0.4 percent) in December. Durable Goods manufacturers drove the declines as the component lost 1,400 jobs. Non-Durable Goods manufacturers added 200 jobs. Over the year employment in the supersector was off by 3,919 (1.2 percent). Durable Goods manufacturing was responsible for all of the annual job losses as well, down by 4,825 (2.4 percent) while their counterparts in Non-Durable Goods Manufacturing added 906 jobs (0.8 percent).

Trade, Transportation, and Utilities employers added 1,500 jobs (0.3 percent) in December with substantial gains in Retail Trade (up 2,300 or 0.8 percent) overcoming losses in Wholesale Trade and Trade, Transportation, and Utilities (down 100 or 0.1 percent and 700 or 0.7 percent, respectively). Retail Trade employers have added jobs in every month since June. Over the year Trade, Transportation, and Utilities added 2,752 jobs (0.5 percent). As was the case on the month, growth in Retail Trade (up 4,670 or 1.5 percent) overcame job losses in the other two component sectors.

Information employment was down by 500 (1.1 percent) in December. The supersector lost jobs in 10 of the 12 months of 2019 and was flat in April. On the year Information employers lost 4,816 jobs (9.7 percent). It was the largest proportional over-the-year job loss of any supersector in the state by a large margin. The next largest was 3.8 percent in Construction.

Employment in Financial Activities was off by 400 (0.2 percent) in December, with the loss of 500 jobs (0.3 percent) from Finance and Insurance erasing the gain of 100 jobs (0.3 percent) in Real Estate and Rental and Leasing. Over the year the supersector added 2,384 jobs (1.3 percent). Finance and Insurance added 3,206 jobs (2.1 percent), while Real Estate and Rental and Leasing employers lost 822 jobs (2.4 percent).

Employment in Professional and Business Services was mostly flat in December as employers cut 100 jobs (0.0 percent). Professional, Scientific, and Technical Services lost 1,000 jobs (0.6 percent), while Administrative and Support and Waste Management and Remediation Services added 700 (0.6 percent), and Management of Companies and Enterprises added 200 (0.2 percent). On the year the supersector lost 2,485 jobs (0.7 percent). Although employment was down on the year, it was also their strongest over-the-year job growth estimate since July. All three component sectors improved their growth over November estimates.

Educational and Health Services employment was down by 1,600 (0.3 percent) in December, with all of the declines coming from Health Care and Social Assistance (down 2,100 or 0.4 percent). It was the second straight month of losses for both the component and supersector. Annually Educational and Health Services employment was down by 4,671 (0.9 percent). Health Care and Social Assistance drove the declines, off by 5,544 (1.2 percent), while Educational Services added 883 jobs (1.3 percent).

Employment in Leisure and Hospitality was up by 1,200 (0.4 percent) in December on a seasonally adjusted basis. It was the fifth consecutive month of over-the-month job growth in the supersector. Accommodation and Food Services added 1,300 jobs (0.5 percent) while Arts, Entertainment, and Recreation lost 100 (0.2 percent). On the year the supersector added 14,579 jobs (5.5 percent). It was the largest proportional over-the-year job growth of any supersector in the state. Arts, Entertainment, and Recreation added 1,946 jobs (4.4 percent), and Accommodation and Food Service added 12,633 (5.8 percent).

The Other Services supersector added 1,300 jobs (1.1 percent) in December. It was the largest over-the-month increase in the state and the second consecutive month with greater than 1 percent job growth. Annually Other Services employers added 2,897 jobs (2.6 percent), with growth of more than 2 percent in all three component sectors.

Government employers added 300 jobs (0.1 percent) in December. All of that growth came at the State Government level (up 0.3 percent) as employment at both the Local and Federal levels was flat. Over the year Government employers added 2,081 jobs (0.5 percent), the best over-the-year performance of the calendar year for the supersector. There was growth in all three component sectors, with Federal employment up 382 (1.2 percent), State up 1,027 (1 percent), and Local up 672 (0.2 percent).

| Industry | Dec-19 | Nov-19 | Oct-19 |

|---|---|---|---|

| Total Nonfarm | 2,967.4 | 2,967.2 | 2,969.8 |

| Goods-Producing | 450.1 | 451.6 | 459.1 |

| Mining, Logging, and Construction | 131.6 | 131.9 | 136.7 |

| Construction | 125.1 | 125.3 | 129.9 |

| Manufacturing | 318.5 | 319.7 | 322.4 |

| Service-Providing | 2,517.3 | 2,515.6 | 2,510.7 |

| Trade, Transportation, and Utilities | 539.0 | 537.5 | 537.0 |

| Information | 44.2 | 44.7 | 45.2 |

| Financial Activities | 186.3 | 186.7 | 186.8 |

| Professional and Business Services | 374.4 | 374.5 | 374.1 |

| Educational and Health Services | 539.1 | 540.7 | 541.7 |

| Leisure and Hospitality | 292.5 | 291.3 | 287.2 |

| Other Services | 115.0 | 113.7 | 112.5 |

| Government | 426.8 | 426.5 | 426.2 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2019. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.