by Amanda Blaschko

December 2024

Minnesota's outdoor recreation economy thrives throughout the year, with winter activities significantly contributing to the state's success. From snowmobiling and cross-country skiing to ice fishing across the state's countless lakes, winter recreation has become an essential part of Minnesota's outdoor offerings. This four-season approach to outdoor recreation, with substantial winter impacts, helps Minnesota maintain a more consistent year-round tourism economy compared to states that rely primarily on warm-weather activities. Winter recreation serves as a vital economic driver, transforming what could be a seasonal lull into a thriving period of tourism and outdoor activity for residents and visitors.

According to data from the Bureau of Economic Analysis, snow activities contributed $238 million to Minnesota's economy in 2023 (Table 1), showing remarkable growth of $126 million since 2019. While outdoor recreation like activities at amusement parks and related to festivals and sporting events and other travel and tourism saw significant declines during the first year of the pandemic, snow activities actually increased in value from 2019 to 2020, demonstrating Minnesotans' enthusiasm for winter recreation even during challenging times. Even when people couldn't get together, they could at least still get outside!

Looking just at snow activities, the majority of this economic impact - $174 million - came from pastimes like snowmobiling, cross-country skiing, dog sledding and winter fat biking, showcasing the state's diverse winter recreation opportunities beyond traditional downhill sports. Likewise, Minnesota's ski resorts and slopes generated $63.6 million through skiing and snowboarding, as people took advantage of the state's varied terrain and snowy conditions.

But winter recreation's economic impact in Minnesota extends far beyond traditional snow sports, reaching into multiple sectors of the state's outdoor recreation economy. While activities like skiing and snowmobiling are explicitly classified as winter recreation, many other outdoor pursuits continue through Minnesota's cold months, contributing significantly to the economy. Ice fishing serves as a prime example, utilizing Minnesota's vast network of 11,800 lakes. This activity generates economic value not just through direct spending on fishing equipment, ice houses and licenses, but also through ripple effects in the hospitality sector. Winter recreationists support local economies by staying at resorts, dining at restaurants and shopping at local businesses.

The cold season also drives considerable retail spending as Minnesotans and visitors purchase specialized winter gear ranging from ice fishing equipment and hunting supplies to skis, snowboards, and cold weather apparel. This diverse winter recreation ecosystem creates economic value across multiple categories in the Bureau of Economic Analysis data, including contributing to total year-round lodging revenues of $939 million, shopping at $446 million, and specialized apparel and accessories at $1.4 billion dollars, demonstrating how recreation's influence plays a part in many sectors of Minnesota's economy.

The Bureau of Economic Analysis divides outdoor recreation into three main categories, with supporting activities emerging as the largest contributor at $5.6 billion in 2023. This category, which includes construction, transportation and tourism, encompasses economic activity across all seasons. Transportation generates $1.9 billion in value annually as visitors access recreation sites throughout the year. During the winter months, this includes families driving to skiing destinations and out-of-state visitors flying in for winter sports vacations, while summer sees travelers heading to lakes and campgrounds.

Travel and tourism activities contribute almost $3.8 billion through year-round spending at restaurants and lodging facilities, with winter destinations like ski resorts and ice fishing lakes providing essential economic support during what might otherwise be a slower season for owners. Minnesota's natural winter conditions create distinct seasonal opportunities, with resorts and lodges benefiting from visitors seeking both summer activities like boating, and winter pursuits like cross-country skiing and snowmobiling contributing to year-round employment and economic stability.

| Table 1. Major Outdoor Recreation Activities, 2019-2023 | ||||||

|---|---|---|---|---|---|---|

| Outdoor Activity | 2019* | 2023* | 2019-2020 | 2019-2023 | ||

| Numeric Change* | Percent Change | Numeric Change* | Percent Change | |||

| Total outdoor recreation activities | $9,852,778 | $13,540,058 | -$1,716,827 | -17.4% | $3,687,280 | 37.4% |

| Total core outdoor recreation activities | $5,579,223 | $7,918,846 | $96,014 | 1.7% | $2,339,623 | 41.9% |

| Conventional outdoor recreation activities | $3,731,571 | $5,194,265 | $313,426 | 8.4% | $1,462,694 | 39.2% |

| Bicycling | $57,627 | $83,452 | $15,372 | 26.7% | $25,825 | 44.8% |

| Boating/fishing | $896,595 | $1,142,249 | $195,288 | 21.8% | $245,654 | 27.4% |

| Canoeing/kayaking | $30,095 | $37,035 | $6,392 | 21.2% | $6,940 | 23.1% |

| Fishing (excludes boating) | $223,852 | $291,226 | -$14,780 | -6.6% | $67,374 | 30.1% |

| Sailing | $19,519 | $28,610 | -$2,799 | -14.3% | $9,091 | 46.6% |

| Other boating | $623,129 | $785,378 | $206,474 | 33.1% | $162,249 | 26.0% |

| Climbing/hiking/tent camping | $105,472 | $210,035 | $17,398 | 16.5% | $104,563 | 99.1% |

| Equestrian | $124,692 | $137,630 | $58,754 | 47.1% | $12,938 | 10.4% |

| Hunting/shooting/trapping | $334,679 | $554,761 | $52,076 | 15.6% | $220,082 | 65.8% |

| Hunting/trapping | $198,187 | $287,571 | $24,832 | 12.5% | $89,384 | 45.1% |

| Shooting (includes archery) | $136,491 | $267,189 | $27,246 | 20.0% | $130,698 | 95.8% |

| Motorcycling/ATVing | $218,035 | $457,194 | $40,292 | 18.5% | $239,159 | 109.7% |

| Recreational flying | $19,668 | $33,134 | $783 | 4.0% | $13,466 | 68.5% |

| RVing | $431,306 | $528,523 | $15,374 | 3.6% | $97,217 | 22.5% |

| Snow activities | $112,328 | $238,378 | $33,454 | 29.8% | $126,050 | 112.2% |

| Skiing/Snowboarding | $53,169 | $63,639 | -$15,303 | -28.8% | $10,470 | 19.7% |

| Other snow activities (includes snowmobiling) | $59,158 | $174,739 | $48,758 | 82.4% | $115,581 | 195.4% |

| Other conventional outdoor recreation activities | $279,420 | $419,565 | $44,630 | 16.0% | $140,145 | 50.2% |

| Other conventional air and land activities | $165,416 | $245,973 | -$1,858 | -1.1% | $80,557 | 48.7% |

| Other conventional water activities | $114,003 | $173,592 | $46,489 | 40.8% | $59,589 | 52.3% |

| Multi-use apparel and accessories (conventional) | $1,151,750 | $1,389,346 | -$159,995 | -13.9% | $237,596 | 20.6% |

| Other outdoor recreation | $1,847,652 | $2,724,581 | -$217,412 | -11.8% | $876,929 | 47.5% |

| Amusement parks/water parks | $166,195 | $197,164 | -$66,106 | -39.8% | $30,969 | 18.6% |

| Festivals/sporting events/concerts | $343,871 | $469,859 | -$128,734 | -37.4% | $125,988 | 36.6% |

| Field sports | $93,965 | $136,327 | -$1,276 | -1.4% | $42,362 | 45.1% |

| Game areas (includes golfing and tennis) | $430,023 | $627,404 | -$129,864 | -30.2% | $197,381 | 45.9% |

| Guided tours/outfitted travel | $224,431 | $343,676 | $35,229 | 15.7% | $119,245 | 53.1% |

| Air and land guided tours/outfitted travel | $89,146 | $109,745 | -$9,248 | -10.4% | $20,599 | 23.1% |

| Water guided tours/outfitted travel (i.e. charters) | $135,285 | $233,931 | $44,477 | 32.9% | $98,646 | 72.9% |

| Productive activities (includes gardening) | $248,213 | $533,505 | $100,879 | 40.6% | $285,292 | 114.9% |

| Other outdoor recreation activities | $255,983 | $326,716 | -$24,472 | -9.6% | $70,733 | 27.6% |

| Multi-use apparel and accessories (other) | $84,972 | $89,930 | -$3,070 | -3.6% | $4,958 | 5.8% |

| Supporting outdoor recreation | $4,273,555 | $5,621,212 | -$1,812,842 | -42.4% | $1,347,657 | 31.5% |

| Construction | $302,922 | $418,847 | -$40,802 | -13.5% | $115,925 | 38.3% |

| Local trips | $786,369 | $943,064 | -$439,873 | -55.9% | $156,695 | 19.9% |

| Travel and tourism | $2,758,528 | $3,770,537 | -$1,345,987 | -48.8% | $1,012,009 | 36.7% |

| Food and beverages | $339,070 | $439,298 | -$152,421 | -45.0% | $100,228 | 29.6% |

| Lodging | $664,411 | $938,863 | -$104,783 | -15.8% | $274,452 | 41.3% |

| Shopping and souvenirs | $447,679 | $445,687 | -$264,752 | -59.1% | -$1,992 | -0.4% |

| Transportation | $1,307,368 | $1,946,689 | -$824,031 | -63.0% | $639,321 | 48.9% |

| Government expenditures | $425,736 | $488,763 | $13,821 | 3.2% | $63,027 | 14.8% |

| Federal government | $27,156 | $30,183 | -$2,058 | -7.6% | $3,027 | 11.1% |

| State and local government | $398,580 | $458,580 | $15,879 | 4.0% | $60,000 | 15.1% |

| *Dollar amounts expressed in thousands | Source: Bureau of Economic Analysis | |||||

The remaining two BEA categories complete the economic picture: conventional activities, which include traditional outdoor pursuits ranging from summer boating to winter skiing and snowmobiling, produced $5.1 billion in value. Other outdoor recreation - including sporting events, concerts and gardening - added $2.7 billion to Minnesota's economy in 2023.

Minnesota's outdoor recreation economy, which includes activities across all four seasons, contributed $13.54 billion in value in 2023, or a 2.8% share of gross domestic product to the state's economy, notably higher than the national share of 2.3%. This figure represents the true economic impact after accounting for all costs of providing year-round recreational activities - from maintaining state parks and trails to supporting winter sports facilities and summer water recreation areas.

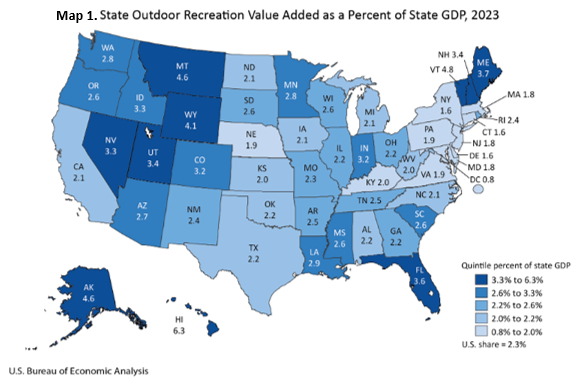

Since 2012, Minnesota has consistently outperformed its neighboring states in outdoor recreation value added to its economy. Most recently, Minnesota experienced growth of nearly $3.7 billion from 2019 to 2023, reflecting the state's rich natural resources and diverse recreational opportunities in every season. Wisconsin maintains a strong second position of the neighboring states, generating $11.24 billion in value added during 2023, well ahead of Iowa ($5.3 billion), South Dakota ($1.9 billion), and North Dakota ($1.6 billion), but still $2.3 billion behind Minnesota's leading contribution (see Map 1).

When looking at traditional outdoor activities, Minnesota's abundant lakes and waterways helped make boating and fishing the state's leading conventional outdoor recreation activity, generating $1.1 billion in 2023 and ranking 10th nationally. This value comes from diverse water activities including fishing licenses and equipment, boat rentals and sales and the growing popularity of paddle sports like canoeing and kayaking. Another significant contributor - hunting, shooting and trapping activities - generated $554.8 million through activities such as deer hunting, sport shooting, archery and related equipment sales, earning Minnesota the 7th spot nationally in this category. Our state also saw substantial economic activity from RVing, which added $528.5 million as Minnesotans and visitors purchased and rented RVs to explore the state's natural areas and campgrounds.

Minnesota's embrace of winter recreation generates value far beyond the $238 million in direct snow sports revenue through significant impacts in hospitality, retail and tourism sectors. As the leader among neighboring states in outdoor recreation with $13.54 billion in total economic value, Minnesota demonstrates how winter activities provide year-round stability for businesses and communities.

An analysis of Minnesota's industrial employment patterns reveals distinct seasonal variations when examined through coefficients of variation (CV) across quarterly data from 2019 to 2023. While the overall state economy shows moderate seasonal fluctuation with a CV of 2.27, certain industries display notably stronger seasonal patterns, particularly during winter months. The Fishing, Hunting and Trapping industry emerges as one of the most seasonally variable sectors, with employment peaking in the fourth quarter. This peak aligns with Minnesota's prime hunting season, when the state issues numerous licenses for both small game (including pheasants, cottontail rabbits and snowshoe hares) and big game like white-tailed deer. The fourth-quarter employment surge primarily represents workers in commercial trapping operations and hunting guide services, particularly during winter months when animal fur is thickest and most valuable.

Transit and Ground Passenger Transportation emerges as the second most seasonally variable industry in Minnesota, with a notably high coefficient of variation of 13.29 and peak employment in the fourth quarter. This industry, which encompasses transit systems such as chartered buses, school buses, interurban transportation and taxis, responds to significant seasonal demands driven by several factors unique to Minnesota's winter months. The employment surge aligns with increased transit needs during harsh winter weather, when many residents shift from personal vehicles or active transportation to public options. Additionally, the holiday season brings heightened demand for transportation services, from airport shuttles serving holiday travelers to chartered buses for seasonal events and shopping. School bus services, a substantial component of this sector, typically maintain full staffing during this quarter, contrasting with reduced summer schedules. This seasonal pattern demonstrates how Minnesota's climate and cultural patterns directly influence employment in transportation services.

The Forestry and Logging industry also demonstrates significant employment fluctuations, ranking as the third most seasonally variable industry with a coefficient of variation of 10.88. The industry, which according to the Bureau of Labor Statistics focuses specifically on timber growth and harvest operations with production cycles of 10 years or more (excluding shorter-cycle operations like Christmas tree production), demonstrates a clear seasonal employment pattern in Minnesota. The data shows employment peaks in the first quarter, reaching an average of 982 workers, before declining to its lowest point in the second quarter with an average of 762 workers. This winter employment peak reflects a crucial operational reality: approximately half of Minnesota's timber harvesting occurs during winter months when the ground is frozen enough to support logging machinery without causing soil erosion and rutting1. According to the U.S. Forest Service, this seasonal workforce variation has become even more critical as modern logging equipment has grown heavier, requiring greater depth of frozen ground to operate. The significant drop in employment during the second quarter coincides with the end of frozen ground conditions, when operations become more challenging.

The economic impact of Minnesota's winter recreation and supporting industries extends well beyond direct outdoor activities demonstrated by data from Bureau of Economic Analysis. In addition, data also reveal how winter activities support jobs, firms and wages in Minnesota looking at the Quarterly Census of Employment & Wages. In terms of year-round employment averages, there were over 320,000 jobs across 20,300 firms in recreation-related activities. These industries generated a total payroll of $10.9 billion in 2023, with some offering higher wages and seasonal stability and others offering lower wages, fewer hours and more seasonal variation (Table 2).

Among these industries, Food Services and Drinking Places had the most jobs with 194,513 jobs at 11,204 firms, and generated the highest total payroll at $4.8 billion. While restaurants and bars operate year-round, employment is typically highest in the second and third quarters of each year, dropping to lower levels in the first and fourth quarters. Still, they serve a vital role during Minnesota winter by supporting both tourism and local community needs. These establishments provide gathering spaces for residents seeking warmth and social connection during cold months, while serving visitors near ski resorts, snowmobile trails and winter festivities.

Amusement, Gambling and Recreation industries follows with 35,578 jobs and includes indoor recreation facilities that become particularly important during winter months when people seek entertainment options away from the cold. Accommodation provides around 30,000 jobs during winter months at hotels, resorts and lodges supporting winter tourism; but peaks with around 34,000 jobs in employment during the summer months.

Air Transportation had the highest average weekly wage at $2,208 – nearly $115,000 for a full-time, year-round worker – followed by Water Transportation at $2,040, notably exceeding the selected industries' average of $1,085. Despite having fewer jobs, Performing Arts, Spectator Sports and Related Industries generated the third highest total payroll of $1.2 billion in 2023.

| Table 2. Minnesota Industry Employment, 2023 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Industries | Number of Firms | Number of Jobs | Total Payroll | Avg. Weekly Wage | 2020-2023 (3 Year Trend) | 2018-2023 (5 Year Trend) | 2013-2023 (10 Year Trend) | |||

| Change in Jobs | Percent Change | Change in Jobs | Percent Change | Change in Jobs | Percent Change | |||||

| Total, All Industries | 208,074 | 2,906,616 | $207,847,571,567 | $1,375 | 198,795 | 7.3% | 24,612 | 0.9% | 214,446 | 8.0% |

| Fishing, Hunting & Trapping | 39 | 121 | $5,429,456 | $869 | 8 | 7.1% | 7 | 6.1% | -1 | -0.8% |

| Forestry & Logging | 217 | 859 | $50,068,568 | $1,119 | -40 | -4.4% | -85 | -9.0% | -65 | -7.0% |

| Sporting Goods, Hobby, Musical Instrument, Book, & Miscellaneous Retailers | 3,129 | 26,367 | $951,845,065 | $694 | N/A | N/A | N/A | N/A | N/A | N/A |

| Air Transportation | 162 | 13,797 | $1,579,668,166 | $2,208 | 1,825 | 15.2% | -558 | -3.9% | 555 | 4.2% |

| Water Transportation | 37 | 297 | $31,325,033 | $2,040 | -3 | -1.0% | -37 | -11.1% | 22 | 8.0% |

| Scenic & Sightseeing Transportation | 27 | 152 | $3,980,774 | $561 | 78 | 105.4% | 11 | 7.8% | 28 | 22.6% |

| Performing Arts, Spectator Sports, & Related Industries | 1,377 | 12,714 | $1,275,438,791 | $1,934 | 5,577 | 78.1% | 495 | 4.1% | 3,963 | 45.3% |

| Museums, Historical Sites, & Similar Institution | 266 | 3,747 | $166,593,137 | $856 | 749 | 25.0% | -212 | -5.4% | -625 | -14.3% |

| Amusement, Gambling, & Recreation Industries | 2,323 | 35,578 | $926,359,340 | $502 | 8,965 | 33.7% | -1,242 | -3.4% | -305 | -0.8% |

| Accommodation | 1,589 | 31,938 | $1,114,206,231 | $672 | 7,369 | 30.0% | -3,406 | -9.6% | -642 | -2.0% |

| Food Services & Drinking Places | 11,204 | 194,513 | $4,864,475,906 | $480 | 41,380 | 27.0% | -3,591 | -1.8% | 10,110 | 5.5% |

| Source: DEED Quarterly Census of Employment & Wages | ||||||||||

Employment trends across these industries show varying patterns of growth between 2013 and 2023. Of the four experience-based sectors that play essential roles during Minnesota winters, two showed overall growth while two faced declines over the decade, though all sectors gained employment in the past three years.

Performing Arts, Spectator Sports and Related Industries expanded significantly, growing 45.3% over the decade and adding 5,577 jobs (+78.1%) between 2020 and 2023. The sector also saw substantial growth in establishments, adding 428 firms (+45.1%) since 2013. Scenic and Sightseeing Transportation, which includes travel experiences like riverboat tours, sleigh rides and guided wilderness excursions rather than simple point-to-point transportation, also demonstrated strong growth with a decade-long expansion of 22.6%, including a notable increase of 105.4% (+78 jobs) between 2020 and 2023, while adding eight new firms (+42.1%) over the decade.

In contrast, Museums, Historical Sites and Similar Institutions and the Amusement, Gambling and Recreation sector experienced employment declines over the decade but showed recent growth. Museums saw a 14.3% decrease in jobs since 2013 but added 749 jobs (+25%) between 2020 and 2023, while growing their establishment count by 44 firms (+19.8%) over the decade. Similarly, while Amusement, Gambling and Recreation lost 305 jobs (-0.8%) over the decade, largely due to a 4,651 job decline in Gambling Industries, the sector added 8,965 jobs between 2020 and 2023. This sector also experienced growth in firms, adding 535 new firms (+29.9%) between 2013 and 2023. These sectors continue to provide important indoor and outdoor winter activities for both residents and visitors.

Traditional outdoor recreation sectors showed minimal employment changes over the past decade. While small, Fishing, Hunting and Trapping employment remained remarkably stable, losing just one job between 2013 and 2023, moving from 122 to 121 workers. The sector added eight jobs between 2020 and 2023, a 7.1% increase, demonstrating the continued importance of these winter activities in Minnesota. This sector has also seen steady growth in business establishments, adding eight firms (+25.8%) over the decade. Forestry and Logging experienced a gradual decline in employment, decreasing by 65 jobs over the decade, but added 27 firms (+14.2%) during this period.

The hospitality type industries, including Food Services and Drinking Places along with Accommodation, have shown strong employment growth and business expansion over the past decade. Food Services and Drinking Places added over 10,000 jobs (+5.5%) between 2013 and 2023, with a notable increase of 41,380 jobs (+27%) from 2020 to 2023. This sector also demonstrated growth in firms, adding 1,366 firms (+13.9%) over the decade. The Accommodation sector, which includes hotels and resorts, saw a slight employment decline of 642 jobs (-2.0%) over the decade but added 124 firms (+8.5%).

Lastly, transportation industries such as Air and Water Transportation show mixed employment trends over time. Air Transportation grew by 4.2% (+555 jobs) between 2013 and 2023, despite a 3.9% decline from 2018 to 2023. This sector also saw substantial growth in business establishments, adding 74 firms (+84.1%) over the decade. Water Transportation increased jobs by 8% (+22 jobs) since 2013 but experienced declines from 2018 to 2023 and 2020 to 2023. However, the sector continued to expand firms, adding six firms (+19.4%) between 2013 and 2023.

Of the outdoor recreation-related industries listed in Table 2, average weekly wages increased substantially between 2013 and 2023, following the overall state trend where wages across all industries rose by $411 (42.6%). Every industry in Table 2 saw wage increases over this period. Fishing, Hunting and Trapping led the way at 134.2% growth to reach $869 weekly, while Air Transportation saw the largest dollar increase, rising $900 to reach $2,208 weekly. Traditionally lower wage sectors also experienced significant gains as Food Services and Drinking Places wages grew 69% to $480, while Accommodation wages rose 52.4% to $672.

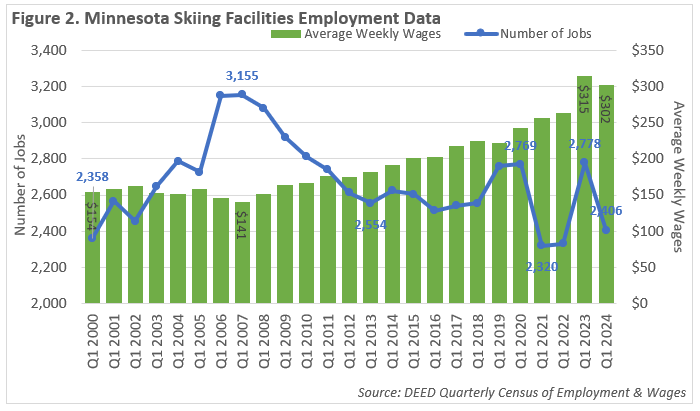

Among Minnesota's seasonally variable industries, the skiing facilities industry provides the most measurable data on winter recreational employment. As of Quarter 1 of 2024, the state's 23 skiing facilities provided 2,406 jobs and generated nearly $9.5 million in total payroll (see Table 3). This industry has demonstrated growth in establishments over the past decade, growing by 43.8%, an increase of seven firms. However, trends of jobs within the industry tells a different story, with jobs declining by -8.3% over the same period despite the increase in establishments. The most recent data shows a decrease of more than 370 jobs compared to Quarter 1 2023, though last year marked the highest employment level since 2010, so fluctuations are common (see Table 3 and Figure 2).

| Table 3. Minnesota Skiing Facilities Employment & Wage Trends, Qtr. 1 2024 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Skiing | Qtr. 1 2024 Data | Avg. Weekly Wage | Q1 2021-Q1 2024 (3 Year Trend) | Q1 2019-Q1 2024 (5 Year Trend) | Q1 2014-Q1 2024 (10 Year Trend) | |||||

| Number of Firms | Number of Jobs | Quarterly Payroll | Change in Jobs | Percent Change | Change in Jobs | Percent Change | Change in Jobs | Percent Change | ||

| Skiing Facilities | 23 | 2,406 | $9,468,887 | $302 | +86 | +3.7% | -353 | -12.8% | -219 | -8.3% |

| Source: DEED Quarterly Census of Employment & Wages | ||||||||||

Perhaps the most striking trend is the substantial wage growth within the industry. While employment has often seen a downhill trend, wage are on the up slope. Average weekly wages have risen dramatically, an increase of 17.5% over three years, 36% over five years, and 58.1% over the past decade. This consistent upward trend in wages, reaching $302 per week in Quarter 1 2024, may reflect two key factors: increasing competition for winter recreation workers driving higher wage offers, and potential increases in weekly hours worked. These wage increases suggest an industry actively adapting to labor market challenges while maintaining its role as a key contributor to Minnesota's winter economy. This adaptation becomes increasingly important as winter recreation businesses face what some northern Minnesota resort owners have called "natural disaster" conditions during poor seasons2.

Minnesota's outdoor recreation economy generated $13.54 billion in 2023, with winter activities both directly and indirectly supporting multiple sectors including hospitality, retail and tourism. Minnesota's diverse recreational opportunities, from summer boating and fishing to winter snowmobiling and skiing, help maintain steady employment and economic activity across all seasons, outperforming our neighboring states of Wisconsin, Iowa, South Dakota and North Dakota. While some seasonal industries have seen employment changes over time, growth in wages and firms shows the continued importance of year-round outdoor recreation to Minnesota's economy.

2Our Minnesota Climate – "Recreation, Tourism Threatened by Winter Warming