by Nick Dobbins

August 2019

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

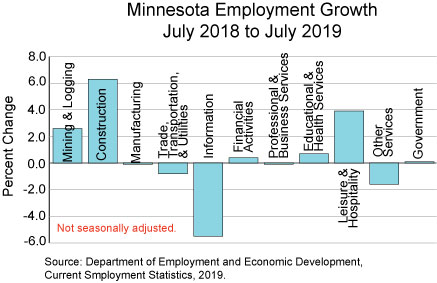

Employment in Minnesota was off by 1,300 (0.0 percent) in July on a seasonally-adjusted basis. The job losses came primarily from private services providers, who lost 3,300 jobs (0.2 percent). Goods producers added 1,600 jobs (0.3 percent) while public sector employers added 400 jobs (0.1 percent). On the year the state added 15,525 jobs (0.5 percent). Annual growth has been positive for five consecutive months since it dipped briefly into the red in February. Goods producers and services providers both added jobs over the year.

Employment in the Mining and Logging supersector was flat in July, holding steady at 6,800 jobs. It has not moved from that level since February, when it temporarily dropped to 6,700. Over the year employment in Mining and Logging is up.

Construction led all supersectors in both real and proportional seasonally adjusted growth in July, posting a gain of 1,200 jobs (1.2 percent). It was the supersector’s third consecutive month of job growth. Over the year Construction employers added 8,622 jobs (6.3 percent), the highest proportional job growth of any supersector. The annual growth was primarily concentrated in the Specialty Trade Contractors component sector, which added 9,206 jobs (10.6 percent). Construction of Buildings added 450 jobs (1.5 percent) while Heavy and Civil Engineering Construction lost 1,034 jobs (5 percent).

Job growth in the Manufacturing supersector was flat in July. Durable Goods manufacturers added 200 jobs (0.1 percent) while Non-Durable Goods manufacturers lost 200 (0.2 percent). On the year the supersector lost 255 jobs (0.1 percent), dipping back into negative job growth after briefly returning to positive growth in June. Durable Goods added 524 jobs (0.3 percent) while Non-Durable Goods lost 789 (0.7 percent).

Trade, Transportation, and Utilities employment was up by 200 (0.1 percent) in July. June’s preliminary estimates were revised downward from 534,100 to 532,700, turning a loss of 300 jobs into a loss of 1,700. July’s increase was driven by 800 new jobs (0.3 percent) in Retail Trade as the other two component sectors lost jobs. On the year the supersector lost 4,105 jobs (0.8 percent). Retail Trade lost 2,270 jobs (0.8 percent) on the year, and Transportation, Warehousing, and Utilities lost 2,153 (2 percent). The supersector has posted consistent over-the-year job losses in every month since December.

Employment in the Information supersector was down by 200 (0.4 percent) in July. The supersector has not seen positive over-the-month growth in any month in 2019. For the 12 months ending in July Information employers shed 2,735 jobs (5.5 percent). Telecommunications employment was off by 886 (7.2 percent).

The Financial Activities supersector held steady at 185,500 jobs in July. Finance and Insurance added 600 jobs (0.4 percent) while Real Estate and Rental and Leasing lost 600 (1.7 percent). Over the year the supersector added 664 jobs (0.4 percent). Finance and Insurance added 1,479 jobs (1 percent), but Real Estate and Rental and Leasing lost 815 (2.2 percent).

Employment in Professional and Business Services was mostly flat in July, off by 100 jobs (0.0 percent). Administrative and Support and Waste Management and Remediation Services lost 1,300 jobs (1 percent) while Professional, Scientific, and Technical Services added 900 jobs (0.5 percent), and Management of Companies and Enterprises added 300 (0.4 percent). Employment behaved similarly on an over-the-year basis, as relatively static estimates at the supersector level (down by 551 jobs or 0.1 percent) were the result of larger conflicting movements among component sectors. Professional, Scientific, and Technical Services added 3,792 jobs (2.3 percent), and Management of Companies and Enterprises added 637 (0.8 percent). Those gains were erased by the loss of 4,980 jobs (3.6 percent) in Administrative and Support and Waste Management and Remediation Services which was once again dragged down by declines in Employment Services which was off by 9,177 jobs (15.9 percent). This was the largest over-the-year loss in Employment Services since March of 2011.

Employers in Educational and Health Services added 1,000 jobs (0.2 percent) in July. It was the fourth straight month of job gains for the supersector. Educational Services employment was up by 900 (1.3 percent), and Health Care and Social Assistance was up 100 (0. 0 percent). On the year the supersector added 3,772 jobs (0.7 percent). Educational Services added 5,367 jobs (9.2 percent) while its counterpart, Health Care and Social Assistance, lost 1,595 (0.3 percent).

Leisure and Hospitality employment saw steep over-the-month declines in July as employers shed 3,000 jobs (1.1 percent), the largest monthly job loss in any supersector. Accommodation and Food Services was off by 2,000 jobs (0.9 percent), giving back all of the June increase while Arts, Entertainment, and Recreation lost 1,000 jobs (2.2 percent), its fourth consecutive month of declines. On the year the supersector added 11,302 jobs (3.9 percent), the largest real job increase of any supersector in the state. All of that growth came from Accommodation and Food Services (up 11,754 or 4.9 percent) as Arts, Entertainment, and Recreation was off by 452 (0.8 percent).

Employment in the Other Services supersector was down by 1,200 (1 percent) in July after adding 1,300 jobs in June. Annually the supersector lost 1,859 jobs (1.6 percent) with all three component sectors contributing to the job loss.

Government employers added 400 jobs (0.1 percent) in July, as State employers added 200 jobs (0.2 percent) while Federal and Local employers each added 100 (0.3 and 0.0 percent, respectively). Over the year Government employers added 487 jobs (0.1 percent). As was the case with the monthly estimates, all three levels of Government saw modest job growth.

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | Jul-19 | Jun-19 | May-19 |

| Total Nonfarm | 2,962.4 | 2,963.7 | 2,960.4 |

| Goods-Producing | 458.8 | 457.2 | 456.0 |

| Mining and Logging | 6.8 | 6.8 | 6.8 |

| Construction | 131.1 | 129.5 | 129.2 |

| Manufacturing | 320.9 | 320.9 | 320.0 |

| Service-Providing | 2,503.6 | 2,506.5 | 2,504.4 |

| Trade, Transportation, and Utilities | 532.9 | 532.7 | 534.4 |

| Information | 46.9 | 47.1 | 47.5 |

| Financial Activities | 185.5 | 185.5 | 184.2 |

| Professional and Business Services | 377.9 | 378.0 | 379.3 |

| Educational and Health Services | 544.3 | 543.3 | 541.8 |

| Leisure and Hospitality | 275.9 | 278.9 | 277.8 |

| Other Services | 113.8 | 115.0 | 113.7 |

| Government | 426.4 | 426.0 | 425.7 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2019. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.