by Cameron Macht

December 2019

UI claims activity is a barometer of economic change.

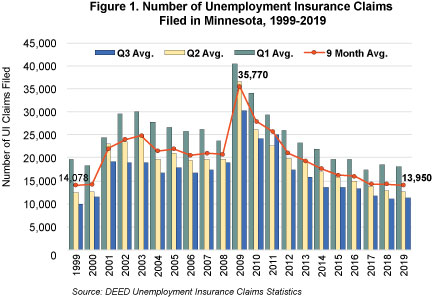

Unemployment Insurance claims remain near historic lows in Minnesota, suggesting that demand for workers – and the strength of the state’s economy – remains high. In fact, the average number of claims filed per month through the first three quarters of 2019 was the lowest reported in the past 20 years, just below the averages posted in 1999 and 2000 (Figure 1).

The Minnesota Unemployment Insurance (UI) Program provides short-term benefits through a temporary partial wage replacement to workers who have lost their jobs through no fault of their own. It is an economic stabilizer and stimulator in times of economic downturn and helps maintain an available skilled workforce for employers. The Department of Employment and Economic Development (DEED) supervises and administers the UI program, with benefits paid out from a fund that is supported by taxes on employers.1

Though not all laid-off workers file claims for benefits, and not all claims are filed by people permanently separated from their jobs, the number of initial claims being filed for unemployment benefits can be used as an indicator of labor market conditions since it provides a reliable and timely measure of layoff trends. To qualify for unemployment insurance benefits, applicants must:

As noted, not every unemployed worker applies for unemployment insurance benefits, meaning the UI statistics capture only one segment of all unemployed workers and labor market churn. Likewise, they capture only one-half of the net job change equation, with new hires also impacting labor market performance. Still, data from DEED’s Unemployment Insurance statistics can be used to help better understand current economic conditions. In general, when claims are low and falling, the economy is doing well; whereas when claims are high and rising, the economy is not.

With less than 200,000 total claims filed in each of the past two years (2017 and 2018) and even lower numbers posted through the first three quarters of 2019, unemployment insurance activity is down more than 10 percent compared to the previous low in 2016, and down more than 56 percent from the peak UI heights reported during the Great Recession in 2009. In sum, Minnesota is experiencing new record high levels of workers, jobs, and job vacancies, and historic lows in unemployment rates and UI claims (Figure 1).

In addition to analyzing total claims activity, UI statistics also provide demographic details on the occupation, industry, education level, race, origin, gender, and geographic location of claimants. This information provides insight into who and what the claims activity is affecting the most.

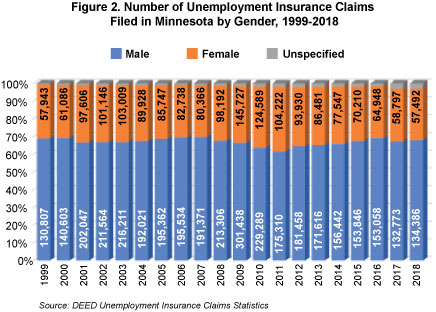

Just over two-thirds of UI claimants are male, a ratio that has stayed relatively consistent over time, ranging from a low of 61.4 percent of claims in 2011 to a high of 69.7 percent in 2007. Interestingly, while the number of claims filed was spiking during 2008, 2009, and 2010, the percentage of claims filed by men was actually declining (Figure 2).

One of the main reasons for the gender imbalance in UI claims filed is the industry of employment, with construction and manufacturing being two of the main sources of UI claims activity, accounting for just over 43 percent of total claims in 2018. According to DEED’s Quarterly Employment Demographics program, more than 70 percent of the manufacturing workforce and almost 90 percent of construction workers are male.

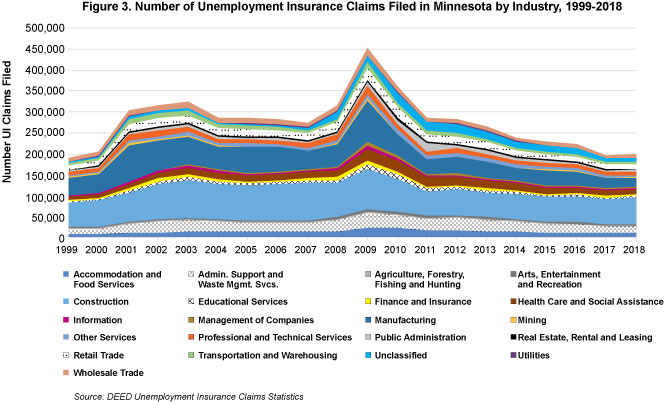

The seasonal nature of construction employment in Minnesota makes it the largest contributor to UI activity each year, accounting for almost one-third of total claims in 2018. Claims filed by construction workers are always highest from November through January, compared to low levels from June to August. Manufacturing also has minor seasonal spikes in the winter and dips in the summer, but the annual counts actually see more variation. During the Great Recession, manufacturing comprised 22 percent of total claims filed in 2009, but dropped to just 11 percent of total claims in 2018.

Other industries that produce a lot of UI claims each year include administrative support and waste management services, health care and social assistance, retail trade, and accommodation and food services. Encouragingly, 19 of Minnesota’s 20 industry sectors saw a decline in the number of UI claims filed over the past five years, with manufacturing seeing a particularly notable decrease to a record low of just 21,735 claims in 2018 (Figure 3).

The only exception was the construction industry, which saw an increase in claims over the past five years. However, the buildup in construction UI claims might actually be good news as well, since it relates to the fact that construction employment overall has been rising steadily. According to data from DEED’s Quarterly Census of Employment and Wages program, construction firms have built up their payrolls by more than 10 percent over the past five years, and more workers means more seasonal layoffs.

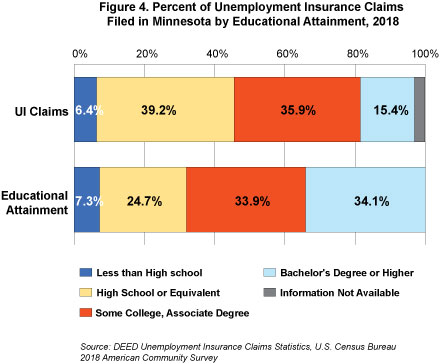

Perhaps not surprisingly, the largest number of UI claims are filed by workers with a high school diploma, followed closely by people with some college or an associate degree. Combined, those two groups accounted for just over 75 percent of total claims filed in 2018, while just 15 percent were filed by people with a bachelor’s degree or higher. That matches closely the educational attainment of the state’s working age population – according to the Census Bureau, about 59 percent of people aged 18 and over had a high school diploma, some college, or an associate degree, while 34 percent had a bachelor’s degree or higher in 2018 (Figure 4).

Even though the number of claims filed in 2009 was more than double the number filed in 2018, the percentage of claims filed by workers in each educational attainment category was nearly identical – 76 percent had a high school diploma, some college, or an associate degree; and 15 percent had a bachelor’s degree or higher.

Charts displaying unemployment rates by educational attainment clearly show that post-secondary training provides some insulation from recessionary periods and creates a stronger attachment to the labor force. However, DEED data also show that in the year leading up to the recessions in both 2001 and 2009, the number of UI claims filed by workers with post-secondary education increased much faster than for workers with a high school diploma or less. From 2000 to 2001, the number of claims filed by workers with post-secondary education jumped nearly 70 percent, compared to a 37 percent increase for workers with a high school diploma or less. Similarly, the number of claims filed by workers with post-secondary education climbed 55 percent from 2008 to 2009, compared to a 33 percent increase for workers with a high school diploma or less. This reflects the spread of layoffs and UI claims into industries that employ more workers with higher educational attainment, and also provides a stark reminder than no one is immune to the effects of a recession.

As the state’s population continues growing older, the age of workers filing UI claims has also skewed upward over time. The percentage of claims filed by workers aged 50 and over has climbed more than 5 percentage points over the past decade, while the percentage of claims filed by workers under 30 years of age fell by 5 percent. In simpler terms, younger workers accounted for one in every five claims filed in 2018, compared to one in every four claims 10 years earlier. In contrast, older workers now comprise 32 percent of total claims, a share that has been steadily swelling each year. The oldest workers have seen the biggest increases (Table 1).

| Table 1. Percent of UI Claims Filed in Minnesota by Age, 2009-2018 | ||

|---|---|---|

| - | 2009 | 2018 |

| Under age 22 | 4.3% | 3.0% |

| Age 22 to 29 | 21.1% | 17.4% |

| Age 30 to 39 | 22.5% | 24.6% |

| Age 40 to 49 | 23.8% | 19.9% |

| Age 50 to 59 | 20.4% | 21.6% |

| Age 60 to 64 | 4.5% | 7.1% |

| Age 65 & over | 1.7% | 3.1% |

| Info. Not Available | 1.7% | 3.4% |

| Source: DEED Unemployment Insurance Claims Statistics | ||

UI Claims statistics started providing data on race and origin in 2001, adding another dimension to the available demographic characteristics. In 2018, just over 78 percent of all UI claimants in Minnesota were white, with 6.7 percent filed by black or African Americans, and 4.6 percent of claimants reporting Hispanic or Latino ethnicity.

Fortunately, claims activity has dropped significantly for every race group over the past 10 years. In fact, the 13,167 claims reported for black or African American workers and the 3,785 claims filed by Asian workers in 2018 was the lowest number reported since data became available in 2001, while the 2,588 claims posted for American Indians was the second lowest ever. The 9,042 claims filed by Hispanic or Latino workers was the fourth lowest since 2001. However, it is interesting to note that the drop in the number of claims was slower for all other race groups other than white, with the exception of a 68 percent decline for Asian workers (Table 2).

| Table 2. Number of UI Claims Filed in Minnesota by Race and Origin, 2009-2018 | |||||

|---|---|---|---|---|---|

| - | 2009 | 2018 | 2009-2018 | ||

| Claims | Percent | Claims | Percent | Change | |

| White | 376,117 | 82.9% | 154,502 | 78.1% | -58.9% |

| Black or African American | 25,312 | 5.6% | 13,167 | 6.7% | -48.0% |

| American Indian or Alaska Native | 4,563 | 1.0% | 2,588 | 1.3% | -43.3% |

| Asian | 11,917 | 2.6% | 3,785 | 1.9% | -68.2% |

| Native Hawaiian/Pacific Islander | 847 | 0.2% | 400 | 0.2% | -52.8% |

| Race Unknown | 34,982 | 7.7% | 23,281 | 11.8% | -33.4% |

| Total Claims | 453,738 | 100.0% | 197,723 | 100.0% | -56.4% |

| Hispanic or Latino | 14,775 | 3.3% | 9,042 | 4.6% | -38.8% |

| Source: DEED Unemployment Insurance Claims Statistics | |||||

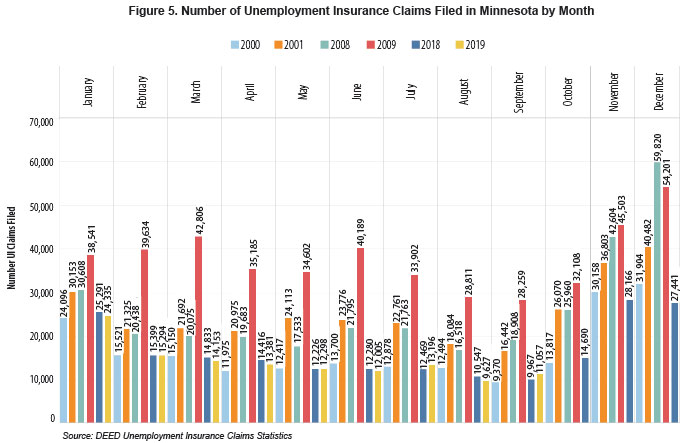

Historically low levels of unemployment insurance activity suggest that Minnesota's economy is strong and Minnesota's labor force continues to be in high demand. In the buildup to the 2001 and 2009 recessions, UI claims increased significantly in all nine months compared to the prior year, whereas claims filed were up year-over-year in only three of the first nine months of 2019, and in numbers that were barely perceptible (Figure 5).

Thankfully, the need for unemployment insurance is low across the board regardless of industry or demographic characteristic. Data show historically low levels of claims activity for whites, black or African Americans, American Indians, and Asians. Both young and old workers have benefited from the strong economy, though the percentage of claims filed by older workers is increasing as the state's population ages. Likewise, workers of all educational levels have seen lower layoff levels over the past 10 years.

Because they are produced monthly and are directly tied to the employment status of workers, UI claims statistics provide an immediate indicator of economic changes. If claims activity starts to rise, DEED can use this information to identify what age groups, gender, race, occupations, industries, or geographic locations are getting hit the hardest. Understanding UI is a benefit to us all.

1"About Unemployment Insurance." Minnesota Department of Employment and Economic Development.