by Dave Senf

July 2021

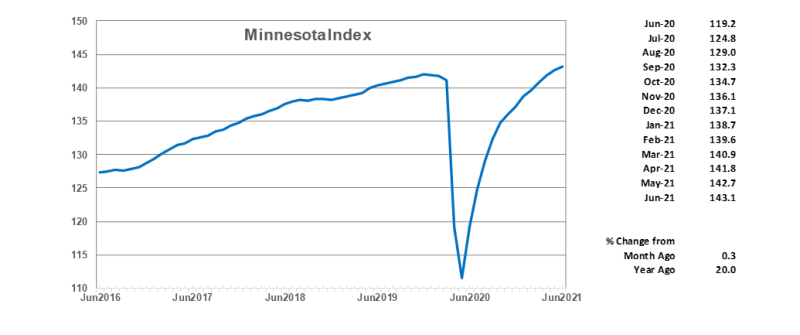

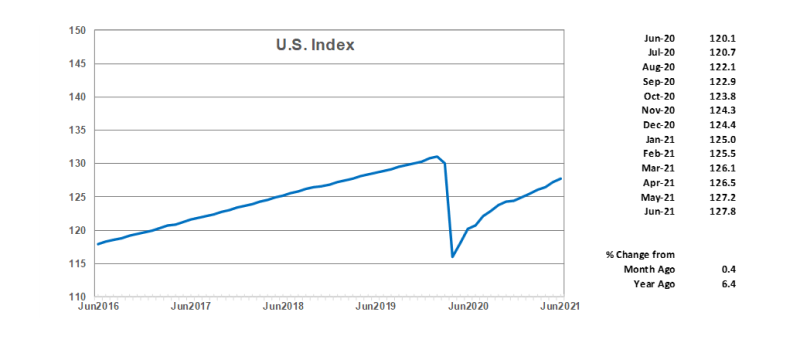

The Minnesota Index rose for the 13th consecutive month in June climbing 0.3 percent to 143.1, as the state's economy recovery from the pandemic recession continues. The index is a proxy for monthly GDP or economic activity, and June's level is 0.8 percent higher than the pre-pandemic peak reached in December 2019. The 6.5% U.S. second quarter GDP growth also showed that the U.S. economy had rebounded to above pre-pandemic level. The U.S. Index increased 0.4% in June which was just a tad above Minnesota's jump. June was the first month since last June in which the U.S. index advanced faster than Minnesota index.

The Minnesota Index, a coincident index, combines four state-level indicators to summarize current economic conditions in a single statistic which provides a proxy for monthly GDP. The four state-level variables in the coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index. The Minnesota Index, along with similar indices for all 50 states, is produced by the Philadelphia Federal Reserve Bank.

Minnesota was one of 16 states where the June 2021 index reading was above the February 2020 reading. Minnesota ranked 11th among the 16 states with a GDP, as measured by the indices, that was higher in June 2021 than last February. Utah (4.2%) and Idaho (3.7%) had the highest GDP growth over the period. Hawaii (-9.6%) and Connecticut (-9.0%) had the largest GDP shortfall compared to last February. June's readings for the surrounding states were higher in South Dakota (2.2%) and Wisconsin (0.1%) than last February but lower in Iowa (-1.7%) and North Dakota (-4.1%).

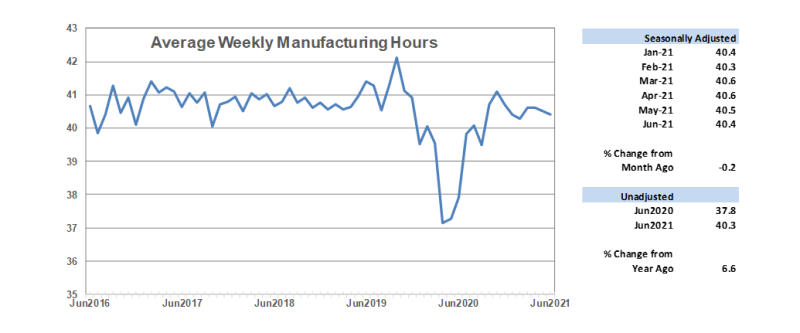

June's advance by the Minnesota Index was the smallest since the pandemic recovery began in June 2020. The advance was propelled solely by an increase in monthly real wage and salary disbursements as wage and salary employment and the unemployment rate were unchanged in June. Average weekly manufacturing hours inched down to 40.4 from 40.5 hours. Businesses are still experiencing problems with filling their job openings as the state's labor force remains significantly below pre-pandemic levels (2.7% below February 2020 level) but is gradually expanding as some sidelined workers trickle back into the labor force.

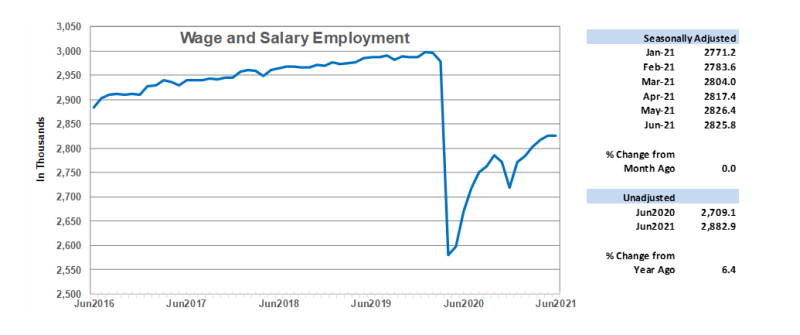

Adjusted Wage and Salary Employment was virtually unchanged in June as employment was 600 jobs short of May's total. This was the first month of job decline since last December when business restrictions were in place as COVID cases spiked. U.S. job growth in June was much stronger, climbing 0.6%, its fastest pace since last August. Minnesota's seasonally adjusted employment has grown 3.9% since December 2020 compared to the 2.3% nationwide increase. Minnesota's employers have added 106,200 jobs during the first half of the year despite struggling to fill their booming job openings. As of June, the state has recovered roughly 59% of the 416,000 jobs lost during the pandemic. Nationally 70% of the 22.4 million jobs lost across the nation last March and April had been recovered as of June.

Private sector employers cut 3,100 positions in June while the public sector added 2,500. Public payrolls were boosted by more jobs in local government education. Construction, Financial Activities, and Educational and Health Services all cut payrolls by more than 2,000. Strong job gains in Trade, Transportation, and Utilities, and in Professional Business Services offset some of the private sector job loss. Leisure and Hospitality, surprisingly, cut employment by 500 jobs. Problems with finding workers in this sector may explain the decline.

June's unadjusted over-the-year change was 6.4%, which was slightly stronger than the 5.8% national growth. Seasonally adjusted unemployment was flat in Minnesota at 4.0% in June while U.S. unemployment ticked up to 5.9% from 5.8%.

Minnesota's 6.4% over-the-year increase in unadjusted employment was the 16th highest. Nevada (10.1%) and New Jersey (10.1%) had the highest annual increases while Oklahoma (2.5%) and West Virginia (3.5%) had the lowest annual increases. South Dakota (5.8%) had the highest over-the-year rate jump among neighboring states with Wisconsin (5.3%), North Dakota (4.6%), and Iowa (4.4%) trailing.

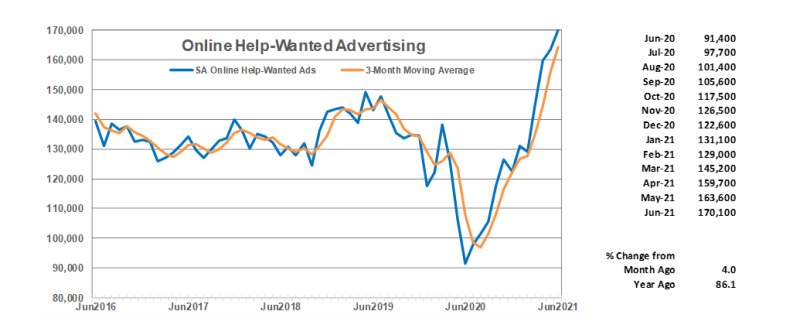

Online Help-Wanted Ads skyrocketed again in June climbing to another all-time high of 170,100. June's 4.0% rise in Minnesota was slightly higher than the U.S. 2.8% increase. Online Help-wanted ads by Minnesota employers in June were 61% above the average monthly level recorded over 16 years of data. Nationally online help-wanted ads were 71% higher than the historical monthly average. Job listings were up 100% from a year ago nationally and 86% in Minnesota. The state's share of U.S. online job postings was 2.2%, remaining slightly higher than the 2.0% share for national employment accounted for by Minnesota in June.

Minnesota's Purchasing Managers' Index (PMI) slipped slightly for the second month in a row to 73.7 in June but remains elevated by historical standards. June's reading was the sixth highest reading over 321 months of data. The reading suggest that Minnesota manufacturers expect expanding factory activity over the rest of the year.

The national ISM Manufacturing Index dipped to 60.6 from 61.2 while the Mid-America Business Index (nine states including Minnesota) inched up to 73.5 from 72.3. As has been the case over the last months, Minnesota manufacturers expect to see production expand at a faster rate compared to recent production than their counterparts in most other states.

Average weekly Manufacturing Hours dipped for the second month in a row in June, inching down to 40.4. The slight decline in the factory workweek is inconsistent with the strong PMI reading as expanding manufacturing activity is usually accompanied by an uptick in manufacturing hours. Manufacturers in the state, after having added workers during the previous three months, reduced their payroll numbers in June. As of June, manufacturing employment is 4.2% or 13,600 jobs below February 2020.

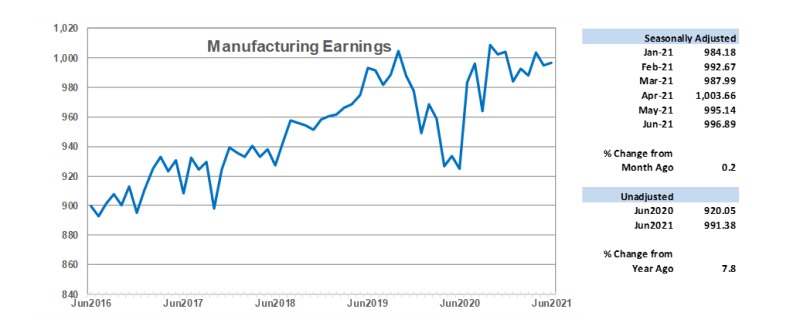

Seasonally adjusted average weekly Manufacturing Earnings, adjusted for inflation, inched up 0.2 % in June to $996.89. Factory paychecks are back to pre-pandemic levels, having bounced back from the pandemic recession months but have flattened out over the last six months. Unadjusted factory paychecks were up 2.3% from last year in real terms in Minnesota and 4.7% nationally.

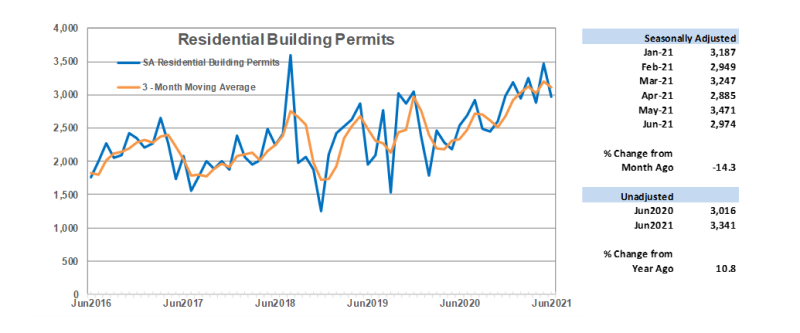

Adjusted Residential Building Permits, an early indicator of future home building activity, declined 14.3% in June to 2,974. That was the second lowest monthly total for the year but remain solid by historical standards. Home building permits have averaged 2,120 a month since 1970. Median home prices continue to set record highs each month as home-builders scramble to meet demand. Low mortgage rates and the swelling number of millennials reaching their peak age for first-time home buying have driven robust home demand. There are signs, however, that the home buying market is slowing up some as high home prices drive potential buyers out of the market.

Minnesota accounted for 2.2% of home building permits issued nationwide in June which tops the state's 1.7% share of U.S. population. Minnesota accounted for 1.7% of single-family permits but 2.8% of multiple-unit permits. Home-building permits over the first half of the year are 42% higher than last year, as the 2021 monthly average was 2,927 compared to 2,064 during the first six months of 2020.

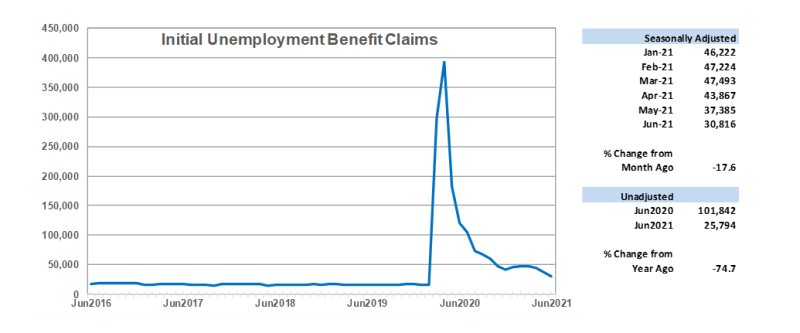

Adjusted Initial Claims for Unemployment Benefits (UB) declined for the third consecutive month sliding to 30,816. Unadjusted jobless claims were down 74.7% from last June but remain stubbornly higher than pre-pandemic levels. June's seasonally adjusted claims of 30,816 was 86% more than the 16,540 six-month average recorded during the six months prior to the pandemic recession. Businesses continue to adjust their workforces in response to shifting consumer demand brought on by the pandemic.

Note: All data except for Minnesota's PMI have been seasonally adjusted. See the feature article in the Minnesota Employment Review, June 2010, for more information on the Minnesota Index.

The Philadelphia Federal Reserve Bank, which produces the Minnesota Leading Index, has temporary suspended generation of state leading indices.